Even if blessed with superpowers, in particular, the one of printing infinite money, the Federal Reserve is ultimately a “Bank” and like every superhero has a weak spot like Kryptonite for Superman. Being a “Bank”, hence required to remain solvent, is paradoxically the #FED’s weakness.

Let me explain:

1 – For a bank to be solvent, the value of the assets needs to be greater than the value of its liabilities at all times, right?

2 – What happens when interest rates increase? The value of fixed-rate assets drops (the greater the duration, the bigger the loss), while those with a floating rate will not see a significant change in their principal value because their coupon will be adjusted instead.

3 – What about the value of the liabilities? Same as point 2.

Even if the #FED, by definition, cannot have a liquidity crisis, that doesn’t mean it is immune from insolvency. Wait, is the FED insolvent right now? Correct and I will show you why.

First of all, what are the #FED’s liabilities?

- Deposits of Depositary institutions (about 5,000 #US banks authorized)

- Federal Reserve notes (net of Federal Reserve Bank holdings)

- Reverse Repurchase Agreements [The now very famous “ #RRP”]

- Deposits of the US Treasury

- Foreign Official Deposits

- “Other” Deposits from selected government-sponsored enterprises (GSEs) and Designated Financial Market Utilities (DFMUs)

What is the one thing that all these items have in common? Their maturity is very short, hence an increase in rates will not decrease their nominal value.

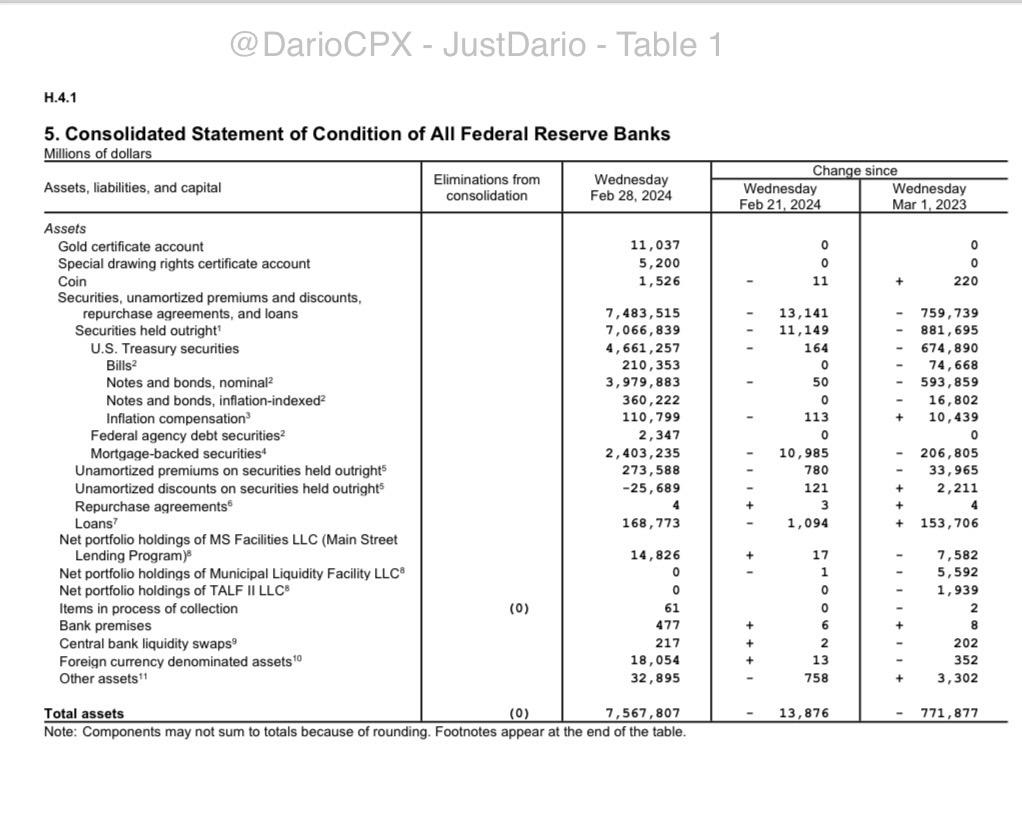

What about #FED’s assets instead? The full list is in the table below

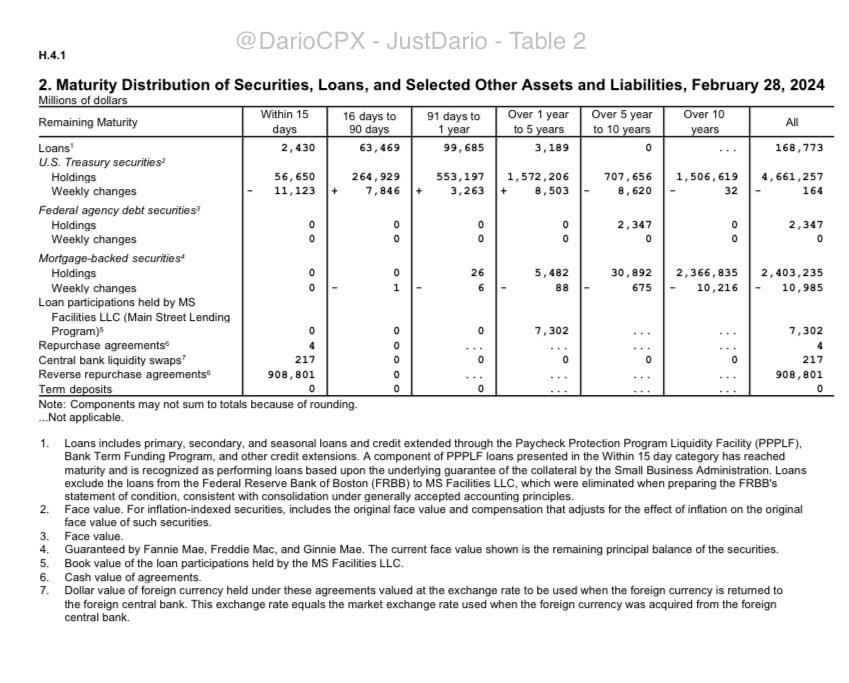

Now, differently from the liabilities, #FED’s assets are very sensitive to interest rates. Why? Because they have a very long duration. Please have a look at the second table here now, as you can see about 3.9 TRILLIONS of $USD alone have a maturity LONGER than 10 years.

Now let’s put all the pieces of the puzzle together, shall we?

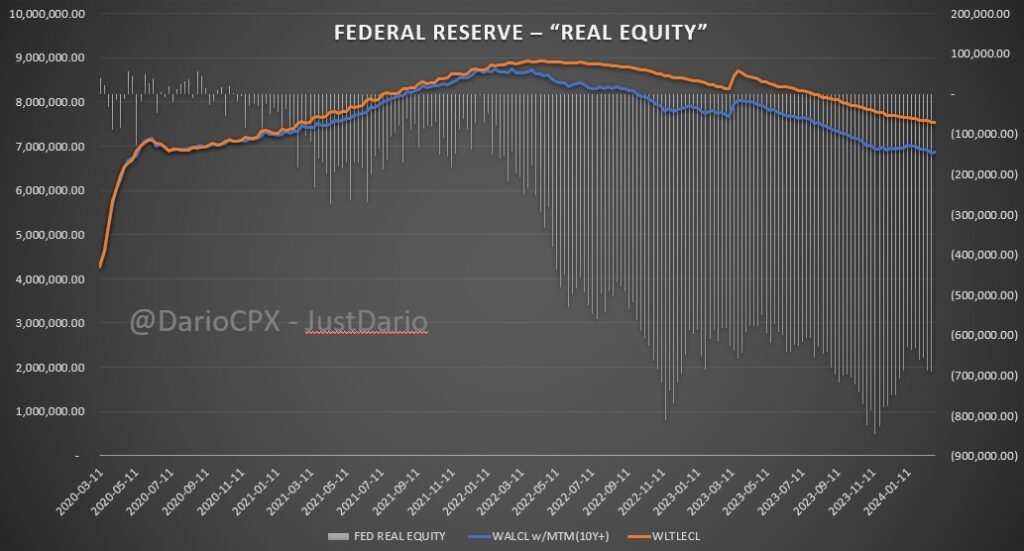

So if you simply deduct #FED Assets and Liabilities at face value, NOT SURPRISINGLY, the #FED is totally solvent as you can see in the chart, with assets of greater value than liabilities.

Now, what about we start applying (a conservative, otherwise the results will freak out people) Mark to Market to #FED’s Balance Sheet Assets currently held with a maturity above 10 Years using $TLT as a proxy? Please see the result in the last chart, mind-blowing, isn’t it? Only Marking to Market a portion of FED’s assets equivalent to ~50% of the total the “real” equity of the Federal Reserve BANK is 659bn$ NEGATIVE.

Now I am sure you would think that all this doesn’t matter whatsoever because no matter what the #FED can print itself out of whatever troubles, right? I am afraid there is a limit to a central bank’s superpower of printing infinite amounts of fiat currency. What’s the limit? People will stop trusting the currency as a store of value, hence they will accept it less and less to settle payments, likely demanding a higher premium for the goods sold to offset the loss of value they expect to face when they will use the currency earned from their commercial trade to purchase other goods themselves. Effectively the $USD will stop being a currency and become an IOU bill.

The risk hovering above all I just described can be summarized in one word: HYPERINFLATION.

Beware “Fiat Currency” isn’t an experiment tried for the first time in our modern times, but it has been tested many times throughout history in various forms, ending up in failure every single time. Guess what all those failures had in common? The beginning of the end was when governments started to simply print additional paper money, with zero intrinsic economic value left, to pay their out-of-control expenses, thinking they could get away with it forever.

All those economists who live the dream that countries can “inflate their debt away” are simply ignorant of history, why? Because as soon as creditors figure out your intention is to “rob” wealth from them, guess what are they going to do with your paper money? They are going to treat it as toilet paper, equivalent in value to repay the debts owed to them. #Argentina, a G20 country, is a great example in our modern times.

Wrapping all together:

1 – The #FED is insolvent.

2 – Once a central bank is insolvent, their “infinite money printing” superpower ceases to be effective because creditors know there is no “positive economic” value left to back that currency.

3 – Because the #FED cannot print fresh currency anymore, they cannot serve anymore as a lender of last resort, the consequence of resuming printing once you are insolvent is hyperinflation.

4 – To be effective again, the #FED requires a bailout to begin with and no, cutting rates won’t save themselves. Why? Because the longer part of the curve is controlled by the market not by the central banks (all they can do is “brainwash” the market to listen to them and behave according to their wish, the problem is people cannot be brainwashed forever). So how to bailout the #FED?

The answer is: the #US government needs to resume creating real wealth and not destroying it (and feel free to share your counter-argument here if you disagree). Once a government operation is run healthily, hence generating a surplus (not increasing your debt by 1 trillion $USD every 100 days), the accumulated real economic capital can then be used to strengthen the economy structure starting from the parts most in need (the #FED in this case).

However, what I describe above doesn’t happen overnight but it requires years, so ultimately the US government and its central bank are at a crossroad:

1 – Resume QE and buy a one-way ticket for all #US people to travel to “Weimarland” or;

2 – Pull the plug, go through a painful, but inevitable, clean up of the financial system (like #China figured out earlier than others) and save the future of incoming generations that will have the opportunity to rebuild better rather than dealing with the ever-growing mess left by the (greedy) generations that preceded them.

Personally, I don’t think any politician that runs for re-election every 4 years will ever have the courage to go for the second choice, as things stand now “Weimarland” is the most likely outcome in my opinion.