In about 24 hours, the “Bank Term Funding Programme”, the infamous #BTFP, will be history. There should not have been any surprise about this if it wasn’t for the fact the banking situation today is much worse than it was one year ago when the #BTFP was launched.

How dire the banking situation was became obvious months ago, but the #FED at that time warned they would not have extended the #BTFP and banks should hurry to strengthen their balance sheets and put aside enough reserves to deal with their losses. Of course, banks didn’t do anything of this either in Q3-23 or in Q4-23 because they knew mama #FED would never have the guts to risk a banking crisis starting, and potentially spreading like wildfire, across the world 2008 #GFC style. Personally speaking, I agreed with this stance which is why it was shocking to see the #FED (out of the blue) putting out a press release on the 24th of January to make it clear to everyone, including myself, that the #BTFP will end on the day it was always supposed to do so.

Press Release: “Federal Reserve Board announces the Bank Term Funding Program (BTFP) will cease making new loans as scheduled on March 11”

If you have doubts about how critical the #BTFP was to keep together the whole financial system, I suggest you read my previous analysis on the topic to help better understand what I am going to discuss next:

- THE BIG BANKS ARE ALREADY UTILIZING THE FED BTFP!

- 2024 THE YEAR WHEN “HIDE TILL MATURITY” ENDS

- WITHOUT THE FED BTFP, BANKS WILL NOW HAVE A HARDER TIME TO “HIDE TILL MATURITY” THEIR LOSSES

- DEAR JEROME BURNS, TODAY YOU MUST TELL THE WORLD WHAT COMES AFTER THE #BTFP…

So, not only is the #FED letting the #BTFP end soon, but this is also happening without an equivalent replacement in place. Yes, the Discount Window is available and banks should learn to use it, but what the #FED is apparently not understanding (or pretending not to) is that most of the banks cannot use it. Why?

- The high-quality collateral current market value is deeply below par (while, let’s not forget, the #BTFP allowed banks to borrow against collateral pretending it was worth much more than it truly was). As a result, they would not be able to access the same amount of liquidity through the Discount Window compared to the #BTFP, leaving a gap to be filled.

- Banks, in a never-ending rush to minimize their cost of capital and maximize their leverage and profits, began to aggressively re-hypothecate their (and often their clients’) assets to access liquidity after the GFC. Thanks to this they could build leverage without bloating their balance sheets and consequently triggering more capital requirements under Basel rules. How does re-hypothecation work? To keep things simple, when you “REPO” an asset you pledge $100 in collateral value to borrow, let’s say, $99. Using re-hypothecation instead, assuming $100 worth of collateral, this time you can borrow $150, $200,… theoretically up to any amount you wish. Of course, the more you borrow, the greater the leverage in your books the higher the chances a smaller worsening in market conditions will send your books straight to the morgue. Clearly, if banks stop re-hypothecating to use the discount window instead they will immediately face the threat of falling into a liquidity crisis (paradoxically).

- The primordial reason why banks are so reluctant to use the #FED discount window is that everyone else in the market will know the best quality assets they hold are being pledged as collateral to the #FED, leaving all other creditors hanging on worse quality, if not radioactive ☢, ones. This is why once a bank is caught using the Discount Window, all other lenders will try to pull their liquidity from them (ultimately accelerating its downfall).

So in 24 hours:

- Banks will not be able to use the #BTFP anymore

- The Discount Window isn’t a viable alternative to replace the #BTFP

- Since the banking crisis last year, not a single bank raised capital, but their balance sheet losses even increased.

- Banks that borrowed from the #BTFP will need to come up with $79bn to repay the #FED loans by the 4th of April.

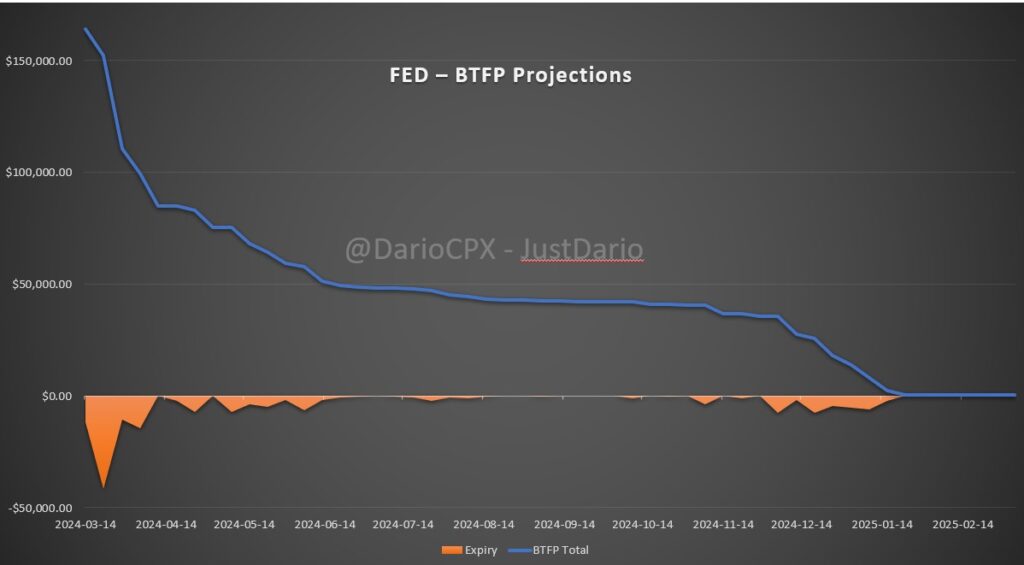

As you can see from this table I prepared, the biggest amount of #BTFP loans are expected to be repaid in the next 4 weeks:

- $11.9bn this week

- $41.7bn next week

- $10.7bn in 3 weeks

- $14.6bn in 4 weeks

“How the hell can they do that?” I imagine is the question you are now asking yourself and honestly speaking I don’t have an answer for you considering the situation is already so bad that banks started to implode with the #BTFP still in place. If it was hard to find $1bn for $NYCB to the point there wasn’t a better alternative than (locust) hedge funds, it doesn’t take a financial wizard to figure out the chances $79bn can be found in 4 weeks are realistically low. Why can’t banks just walk away from the #BTFP? Doesn’t the #FED have collateral against the money they borrowed if they do so?

Banks cannot simply walk away and not repay money borrowed from the #BTFP because that was made in the form of a “loan” and defaulting against it will trigger all cross-default clauses in every other borrowing facility available to them.

Yes, it’s an incredible mess without any visible escape route. This is why I am arguing the #FED is potentially starting a banking crisis today and, honestly speaking, I don’t think people at the #FED aren’t intelligent enough to see it coming which makes me wonder if perhaps they are willingly starting a banking crisis this time. Why would they do so? I have a long list of reasons in my mind, from economical to political, but maybe we will discuss them another day if by that time it won’t be clear already.