The #Nikkei just broke 40,000 and yet no one in #Japan is celebrating, literally speaking. Why? The purchasing power of $JPY literally fell through the floor in the past 30 years as a result of endless (and reckless) nonstop money printing.

As I wrote almost 5 months ago on X: “Someone somewhere has to pay a high price for #BOJ incompetence” (https://x.com/dariocpx/status/1717334125223538878?s=46&t=Hz7-qku8ZNVPw6L9nBJOZA). We are slowly moving towards that point, whether you like it or not, sorry 🤷🏻♂.

First of all, what’s holding back the $JPY from deeply and quickly depreciating to the value where it should trade against $USD like in the chart below?

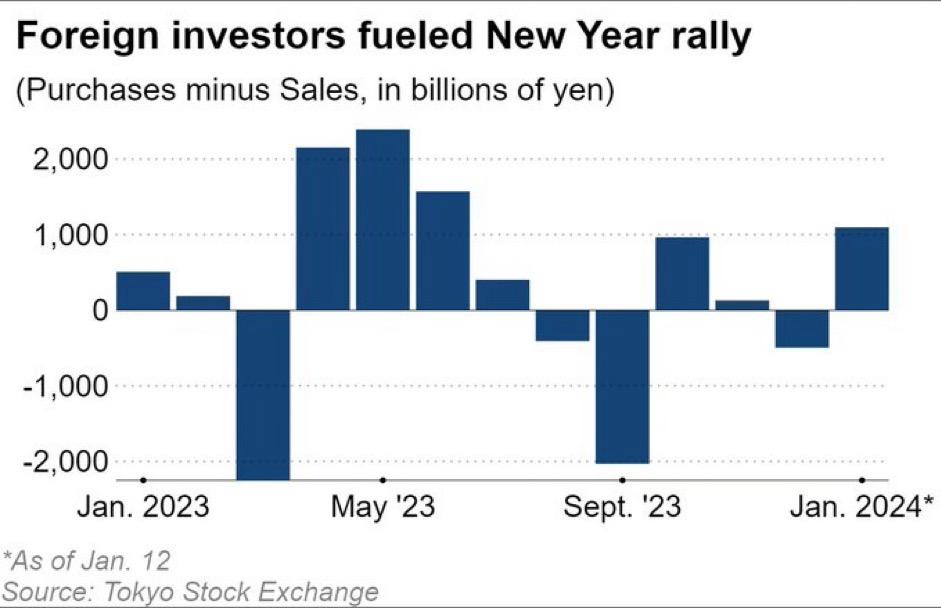

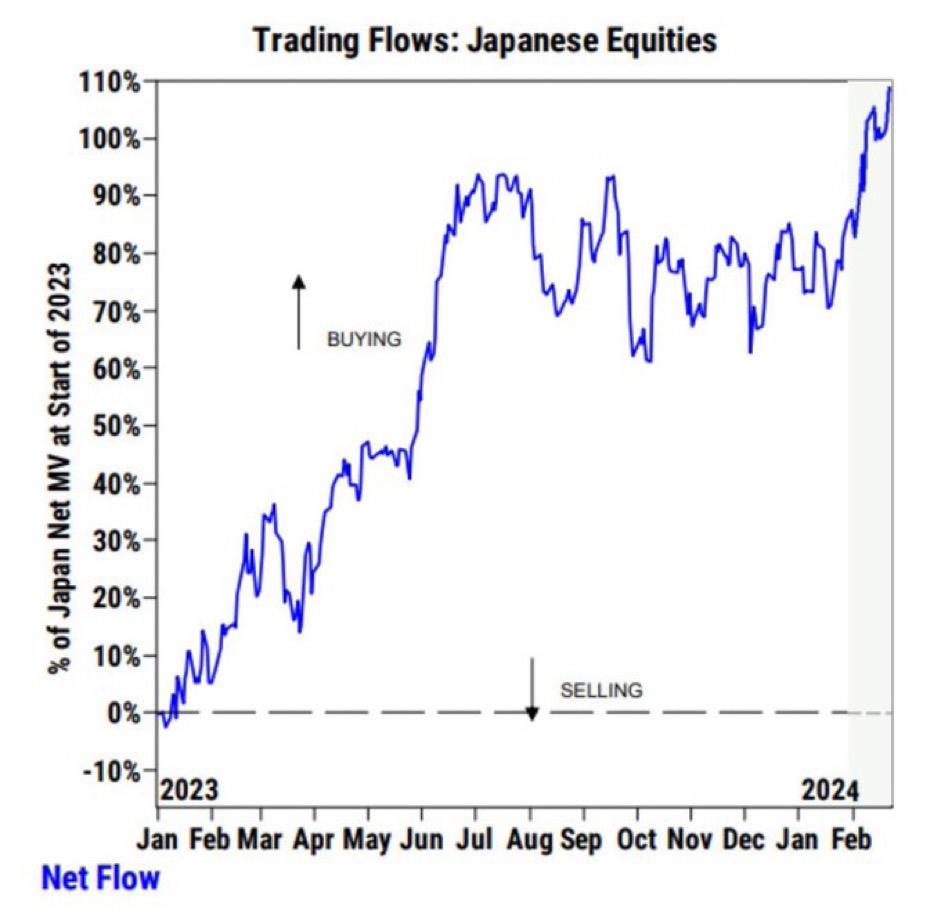

1 – Relentless inflow from foreign buyers, like #China and #US hedge funds, that seem like they cannot get enough from piling on #Japan #stocks at the very top.

This flow, buying $JPY to then buy local #stocks, is lately compensating for #BOJ money printing.

2 – The WRONG expectation that #BOJ ending the era of negative rates and perhaps even the Yield Curve Control (#YCC) will strengthen the currency. Why wrong? As I explained many times before, similar to what’s happening with #US and mindful of the fact that the #BOJ made it clear even at that point they won’t stop QE (because they cannot afford to do so with 254% Debt/GDP), increasing rates will simply increase the servicing cost of $JGB debt hence requiring even more $JPY to be printed to pay for it!

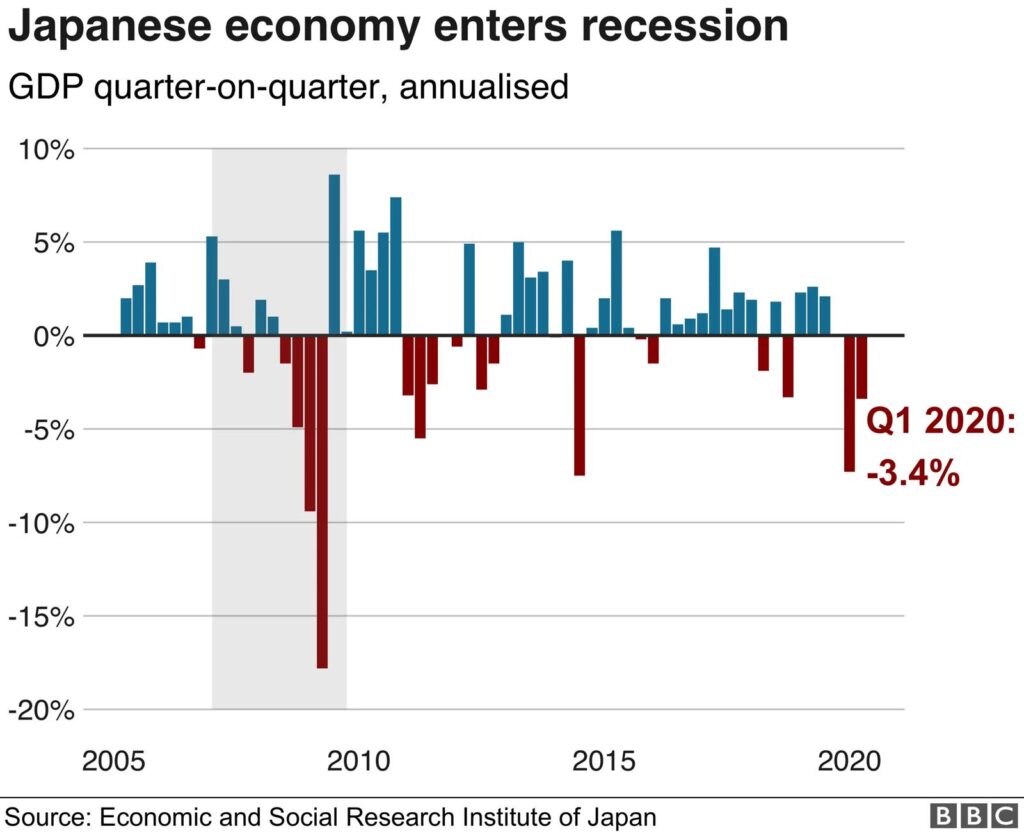

Secondly, why are #Nikkei #stocks worth much less than what is being priced at current nosebleed levels? Very easy answer: despite the endless money printing #Japan is already IN RECESSION and dealing with what is starting to become a runaway #inflation problem.

Translated: costs are increasing for companies while revenues are, as a matter of fact, decreasing on an aggregate basis 🙈. The media, of course, is minimizing this, talking about #stagflation while in reality the stage is set for what can potentially (and horribly) become an inflationary depression. Why? Because all those $JPY relentlessly printed in 3 decades truly only achieved to inflate asset bubbles abroad thanks to the $JPY carry trade that as I flagged so many times is a massive ticking time bomb (https://x.com/dariocpx/status/1691094524368404481?s=46&t=Hz7-qku8ZNVPw6L9nBJOZA ). What do you think is going to happen to that trade when the currency stops to be “money good”? It starts depreciating faster for the simple reason that it won’t have a strong commercial use to settle payments and all the financial leverage that comes out of the system will then come back in #Japan, throwing gasoline on the inflation bubble.

At this point, you would argue: “Isn’t the $JPY carry trade unwinding a strengthening factor for the currency?” This is a topic I touched upon as well before, and the answer is no. Why? Because of the derivatives used to hedge the carry trading that were set in place as a protection against $JPY appreciation. All those derivatives are not only now deeply underwater but “off balance sheet”, the reason why you still don’t see $JPY carry trades being unwound despite the cost to fund them significantly increased in the past year. Long story short, that leverage didn’t come down despite the $JPY depreciation effectively creating way more $JPY debt in the system than what official figures report! 🥶

As if this wasn’t enough, the #Japan government, currently facing a massive corruption scandal and rock-bottom popularity, is stepping on the stimmies gas in a desperate effort to regain popularity quickly before this year’s elections. Their target is to increase salaries while nothing is being done on the front of industrial productivity with the last bet on #AI (fiercely lobbied by #SoftBank) doomed to end miserably simply because it will always remain a marginal contributor to the GDP of a country of 250 million people, logically speaking. Ultimately this all leads to higher taxes, directly or in the form of inflation, with negligible benefits to the point the country is already in recession (and no one seems to be taking this massive problem into consideration).

Furthermore, the #Japan financial system is a zombie since the 80s bubble burst and never recovered from there. All banks, pensions, and insurances did to protect themselves was to invest their gains in foreign assets, often radioactive ☢ , at over-inflated prices starting from real estate often in the form of Loans portfolios and CLOs now on the verge to wreak havoc (again) on their balance sheet but the Aozora bank or Norinchukin bank being added to the #FED emergency repo facility (https://x.com/dariocpx/status/1736480360890843534?s=46&t=Hz7-qku8ZNVPw6L9nBJOZA) warning bells have been, of course, quickly dismissed.

The #BOJ had the chance to stop all this catastrophic turn of events from starting to snowball but of course, the political and social cost to do so would have been very high not only for #Japan but for all its allies that need the #BOJ printing press to keep rumbling to avoid the collapse of their own domestic financial bubbles (starting from #US). The end game is now inevitable and it will be a matter of when, not if.