This incoming 15th of March will surely not hold a place in human history like the murder of Julius Caesar; however, the stage is set for what could turn out to be a hell of an eventful “Quadruple witching” #OPEX day.

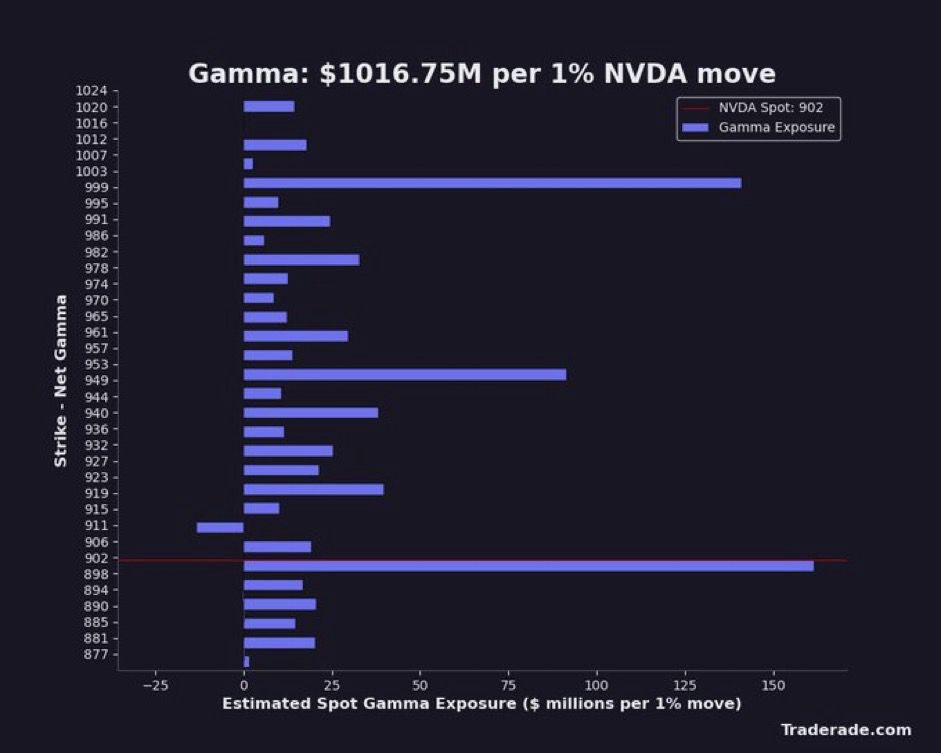

First of all, the darling of the current #stocks bubble, $NVDA, is in quite a tough spot. The stock closed the last session at $879.44, which, by itself, doesn’t look like a big deal considering $NVDA is now roughly flat compared to last week’s Friday close. However, if you compare this price with the overall gamma exposure built up by traders on $NVDA, you can immediately see things might turn seriously ugly for the stock.

Why so? Because of the time decay impact on option prices. Precisely when options are Out Of The Money, their price starts to collapse faster and faster the closer the contract is to expiry. What happens when an option loses value? Those who sold it, the Options Market Makers, will start unwinding their delta hedging positions. Translated, they will dump the underlying #stocks they purchased to cover their derivatives risk. Intuitively, considering where the $NVDA price stands now, the likelihood of a selling stampede is far from being remote.

If the above setup wasn’t bad enough, you should check out where the “Max Pain” for $NVDA options traders is going to be for the incoming #0DTE expiry: $770!

What is the “Max Pain”? It’s the price where most of the options expire Out Of The Money and consequently those who sold those options (Market Makers have the lion’s share) maximize their premium gains. While a 12.5% $NVDA price crash today will make many people unhappy, as I said yesterday in derivatives, when someone loses someone somewhere else gains, and in this case, a lot of Market Makers are set to pop champagne bottles in the weekend if $NVDA ends up having a very bad day.

Last Friday was already a pretty bad day for $NVDA, remember? The stock had almost a 12% intraday swing ending down 6%, leaving so many baffled (and many #0DTE gamblers bruised). After that happened, I wrote the intentionally provocative “$NVDA CAN CRASH 20% ON MONDAY AND NOBODY SHOULD BE SURPRISED ABOUT THAT” with the intention to open people’s eyes to the great risk posed by a sudden death of the speculative euphoria (paired with reckless manipulation, but this is something so obvious it’s pointless to say anything more about it) on $NVDA.

This is how I concluded the article last week: “After reading all I said so far, hopefully, you will agree with me that nobody should be surprised about Nvidia crashing 20% on Monday. If it doesn’t happen? The same words will remain valid for every single day thereafter because like it or not this event is a matter of when not if”. I wouldn’t change a single word today, all the same, is very well at play.

Let me be clear, I have no position on $NVDA and never had one, as a strict principle because 99% of those who ride a fraud, regardless if they do it short or long, will ultimately lose their money in the process.

Hence my purpose is to warn people like the gentleman here in the screenshot that to make $36k, he is more than willing to be exposed to a $54m loss.

Of course, this event has 0.0001% chance to happen since that will require $NVDA price to crash almost instantly to zero, however, the chances that $NVDA free falls by next Friday below $540 aren’t so remote at all. I seriously doubt this person has the funds to cover a loss that can quickly go in the millions, who will cover it then? Of course, his broker will not wait for $NVDA price to reach $540 but will surely liquidate that position long before that without additional collateral being provided by the investor. Be careful of what you are doing because many out there, perhaps unconsciously like this gentleman, are at risk of being wiped out and ruining their lives forever.