In the first episode, we dived into $HSBC’s liquidity issues. Now, it’s time to peek into its lending books to close the circle on this (beyond messy) bank.

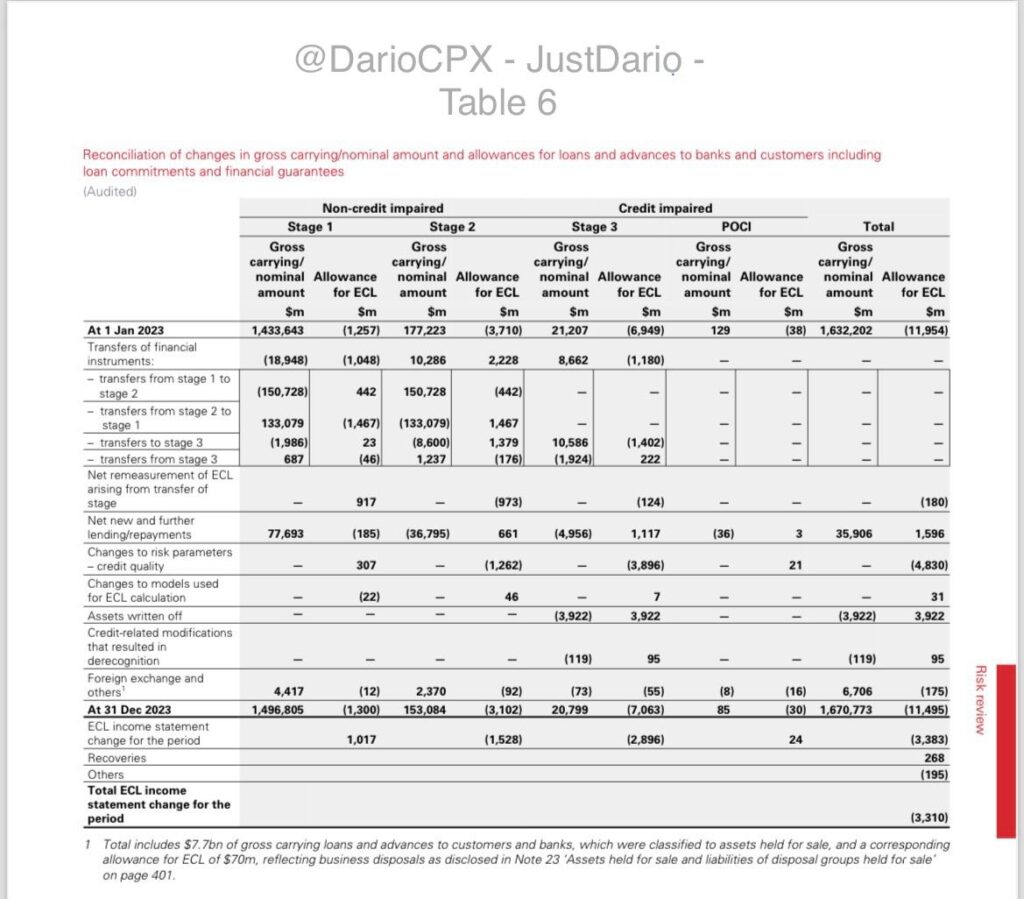

🚩 As hinted in my previous post, despite a market increase in total loan exposure (that, for the record, $HSBC mostly blames on FX moves) from 1,994bn$ to 2,022bn$, allowances for credit losses in $HSBC’s balance sheet DECREASED from 12bn$ to 11.5bn$

Furthermore, the impact on $HSBC’s balance sheet related to credit losses also decreased, from 3.6bn$ in 2022 to 3.45bn$ in 2023.

Basically, $HSBC wants us to believe that, while all other banks suffered from the weaker economic trend and increase in insolvencies in 2023 from 2022, they barely felt the pinch of it 🤡. Reminder: almost half of its business comes from #HongKong and #China, which aren’t doing that well as far as we know…

Let’s dive deeper now 🍿

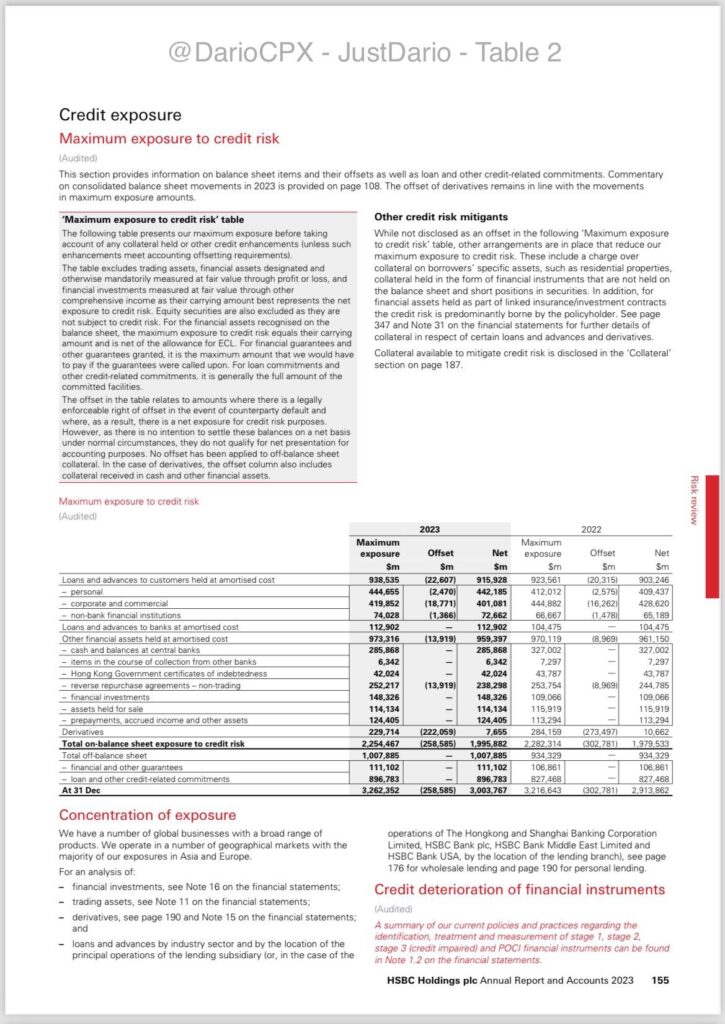

🚩 ~90% $HSBC CREDIT RISK EXPOSURE ISN’T BACKED BY ENFORCEABLE RIGHT TO ANY COLLATERAL

Well, I am afraid, but it isn’t me telling this to you, but $HSBC itself: “The following table presents our maximum exposure before taking into account any collateral held or other credit enhancements (unless such enhancements meet accounting offsetting requirements) […] The offset in the table relates to amounts where there is a legally enforceable right of offset in the event of counterparty default”.

All in all, the total NET credit risk exposure within $HSBC, combining both on-balance sheet and off-balance sheet items, INCREASED ~90bn$ to 3,003bn$ in 2023 while the bank, contrary to the rest of the street, saw a DECREASE in credit losses 🤡

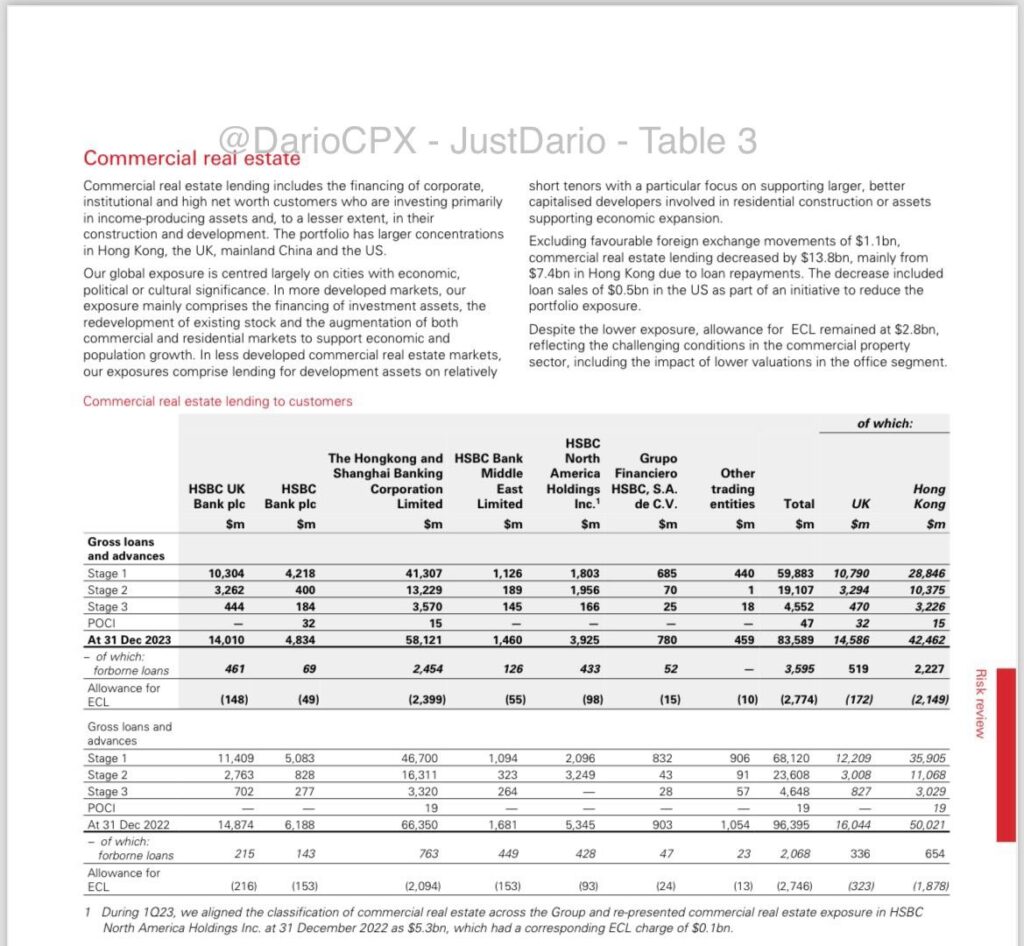

🚩 $HSBC COMMERCIAL REAL ESTATE TICKING TIME BOMB 💣

$HSBC’s #CRE exposure, as reported by the bank, stood at 83.6bn$ in 2023, down from 96.4bn$ in 2022. Wow, good job $HSBC for de-risking your exposure 👏🏻… ehmm… not so fast. As you can see below, the decrease was mainly due to 7.4bn$ of loan repayments in #HongKong. What about the bank’s effort to reduce their exposure? Their answer: “The decrease included loan sales of 0.5bn$ in the #US as part of an initiative to reduce the portfolio exposure” – That’s it?! 😳

As a matter of fact, despite #CRE imploding across the globe and those with good credit repaying (meaning there is a higher chance the loans left in the books are ☢), $HSBC DIDN’T MAKE ANY ADDITIONAL ALLOWANCE FOR #CRE LOSSES IN 2023 COMPARED TO 2022. 🤡

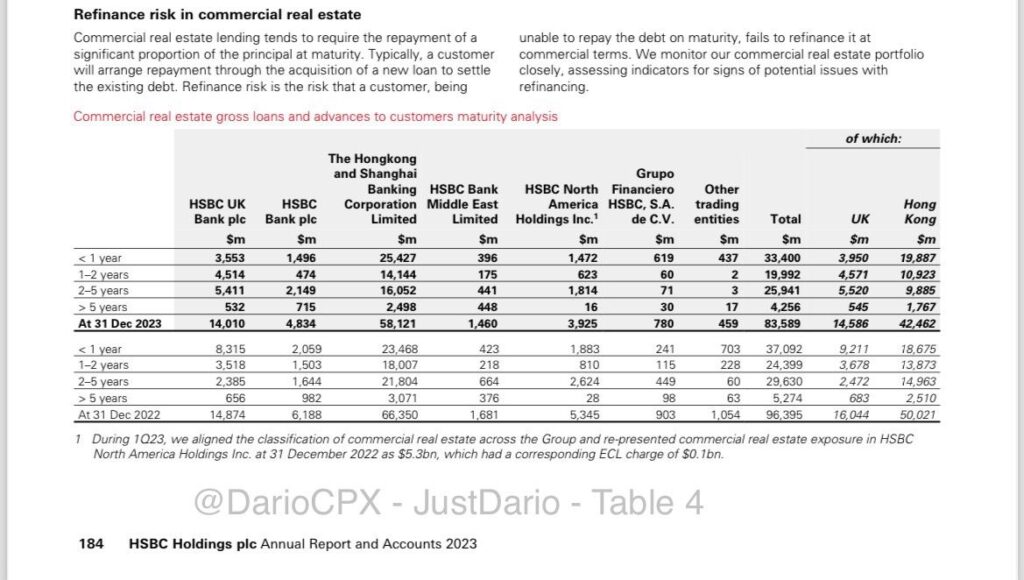

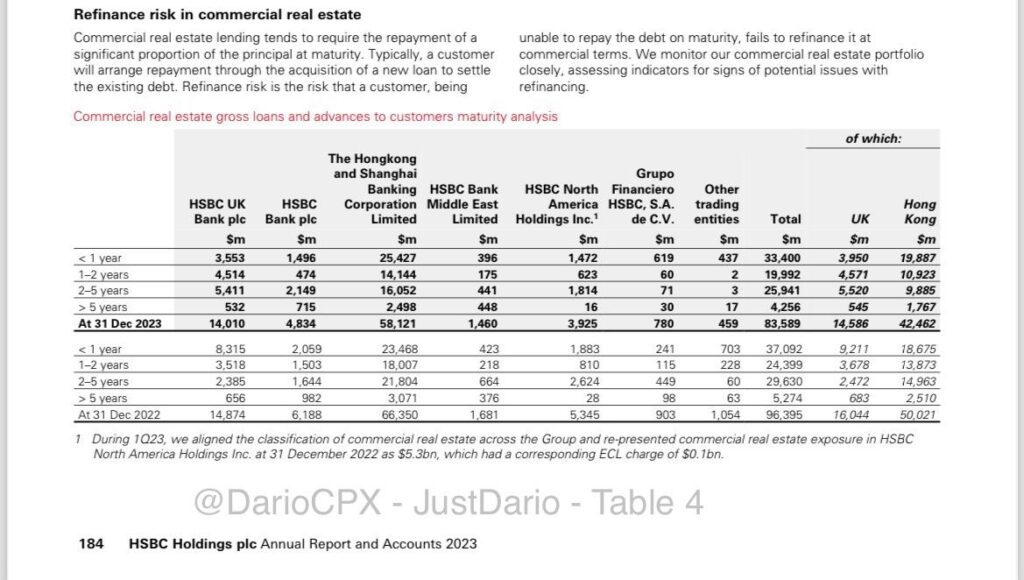

Do you think this is enough here? Nope, please have a look at the table below, which refers to #CRE refinancing risk. 🍿

🚩 As of December 2022, how many #CRE loans were expiring in less than 1 year? 37.1bn$ vs a total of 96.4bn$ #CRE loans.

🚩 As of December 2023, 33.4bn$ loans will expire in less than 1 year vs total loans decreasing to 83.6bn$.

🚩 In December 2022, the amount expected to expire in 2024 was 24.4bn$ vs 33.4bn$ in December 2023. What about 2025? In December 2022, #CRE loans expected to expire between 2025 and 2028 were 29.6bn$ vs 20bn$ reported to expire in 2025 as per December 2023 financials.

Putting all together, these were the #CRE repayments expected in December 2022:

2023: 37.1bn$

2024: 24.4bn$

2025: 20bn$ (as implied by 2023 financials)

The reduction in #CRE loans from 2022 to 2023 was 12.8bn$, right? That means of the 37.1bn$ due in 2023, 24.3bn$ were not paid and rolled into 2024, correct? Comparing 2023 and 2022 projections, we only see 9bn$ were rolled 1 Year forward into 2024, what about the remaining 15.3bn$? Looks like they managed to kick them further down the road beyond 2025! 🤡

So $HSBC saw 24.3bn$ in unpaid #CRE loans in 2023 and didn’t think it was necessary to increase the ECL provisions for the year compared to 2022?! Oh cmon 🤯

Do you think these tricks were only needed for #CRE troubles? Of course not!

🚩 $HSBC MASTER OF THE 3 CARDS GAME 🤡

Please have a look at the table here and focus on the balances at the end and at the beginning of 2023.

Changes are minimal, right? Now let’s zoom in:

🚩 Assets moved from Stage 1 risk to Stage 2: 41.2bn$

🚩 What about assets upgraded from Stage 1 to Stage 2 risk in 2023: 40.1bn$! 🤡

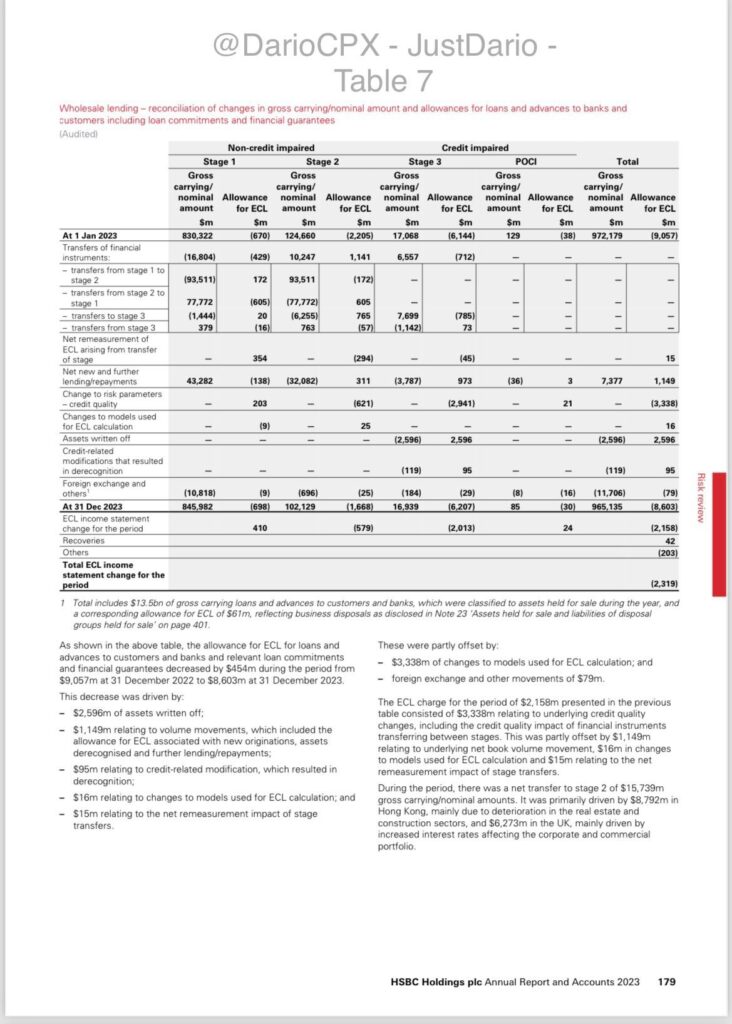

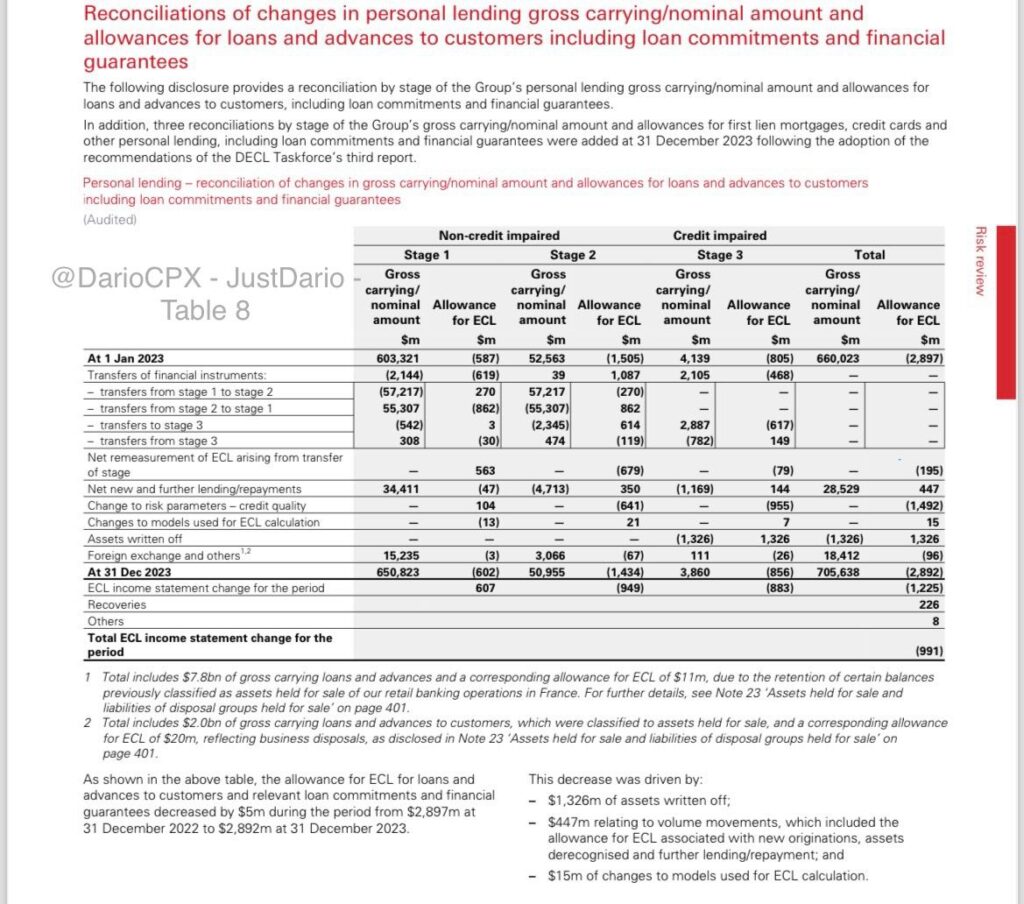

Do you think this is an isolated case? Please look at all the tables below that show the “reconciliations” within various classes of credit exposures. $HSBC did it across all its books!

If you sum all together across the financials, $HSBC has about 250bn$ of assets that significantly deteriorated in 2023 from 2022 but for whatever reason, they managed to U-turn and go back into the “good assets” books!

What are the chances $HSBC is insolvent and fighting a liquidity crisis? After reading my first (https://justdario.com/2024/02/what-are-the-chances-hsbc-is-insolvent-and-fighting-a-liquidity-crisis/)and second post, you tell me what you think 🤷🏻♂