Imagine you hold an asset of any type. At the moment, the asset XYZ is worth 1M$ according to the price quoted on the exchange. Now, what would be your instinctive reaction if you suddenly discovered that your asset XYZ is instead worth 100k$, but you can still go to the exchange and sell it for 1M$? Of course, you would rush back to the exchange faster than Usain Bolt at the Olympics.

Now, imagine a second person holds the very same asset XYZ and she knows you hold the same because once you bumped on the floor of the exchange trading it. What do you think will be this person’s instinctive reaction if she sees you running as fast as possible towards the exchange? At the minimum, she will wonder if anything is happening at the exchange, but reasonably she will wonder whether something happened to asset XYZ she holds too. At this point, she starts walking towards the exchange to figure out what’s going on.

In this example, you see the power of herd behavior at work, similar to when Forrest Gump suddenly decides to run across the US one day and people start following him knowing less and less information on why he was running, where he was going and how long he would have kept running.

Alright, now replace “asset XYZ” in my example with the $JPY. Wait, what?! Yes, let me present you some evidence on why $JPY is worth much less, much, much less, against $USD than everyone still realizes.

First of all, do you know how much Japan M2 (aka the total supply of $JPY in circulation) has grown since 2020? In case you do not, the answer is 200,000,000,000,000 $JPY to a total of 1,240,000,000,000,000 $JPY. Yep, that’s a lot of zeroes!

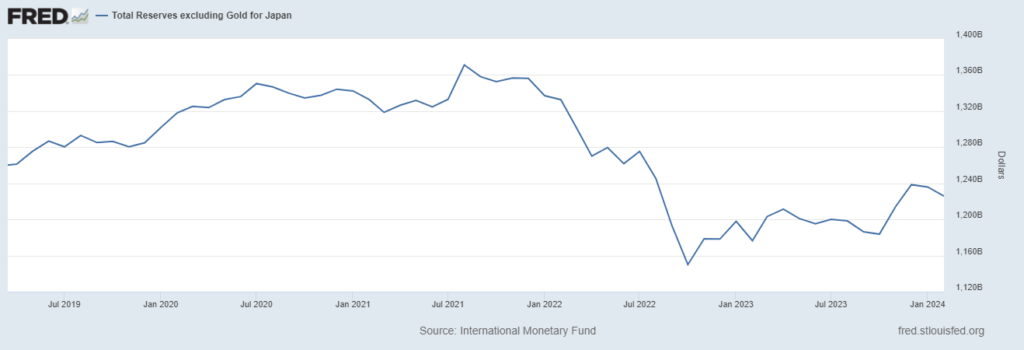

Secondly, do you know how much #Japan $USD reserves increased in the same period while #BOJ was running the $JPY printer as if the survival of the earth depended on that? Ehmm.. actually they didn’t increase but they decreased from 1.302T$ to 1.225T$ today…

Let’s put the two elements together, converting $JPY to $USD, to have a better idea of what happened. #Japan’s foreign reserves currently stand at 1,225,778,809,437 $USD against #Japan’s money supply having increased by 1,582,424,640,000 $USD equivalent since January 2020. Yes, I imagine the “WTF” popping up in your mind.

What is quite concerning is that the current total amount of foreign reserves #Japan holds is LOWER than the amount it held in November 2011 (1.262T$ at that time) meanwhile #Japan’s M2 increased from 807,000,000,000,000 $JPY to 1,240,000,000,000,000 $JPY in the same stretch of time. Yes, since 2011 Japan printed $JPY out of thin air twice as much as the amount of reserves.

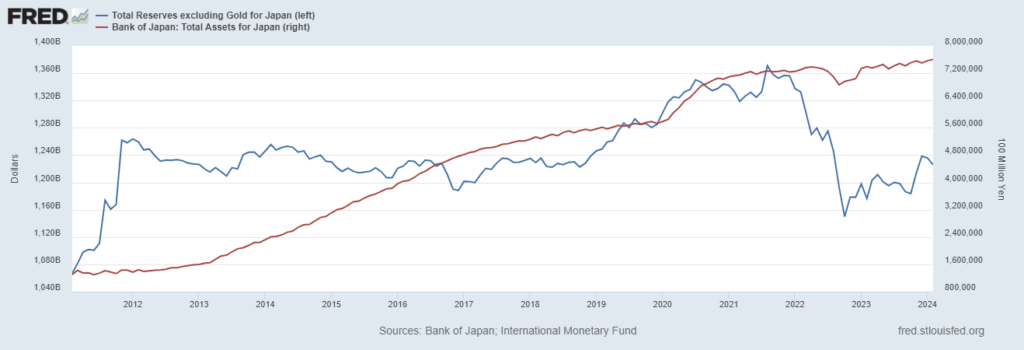

The #BOJ wasn’t only busy printing money out of thin air, but (following the example of other central banks) was committed to inflating its balance sheet above and beyond any reasonable limit. Precisely since 2011 to 2024, in $USD terms, $BOJ balance sheet increased 3.3 Times to 5T $USD (or 760,430B $JPY). Putting this into a better perspective, #FED balance sheet vs #US total #GDP is currently 26.84% while #BOJ balance sheet vs #Japan #GDP is 125%.

That’s right ladies and gentlemen, the #BOJ is bigger than the whole #Japan economy! Wait a second, does this mean that the #BOJ IS THE #JAPAN ECONOMY?! Yeah, surely in your brain again, “WTF”.

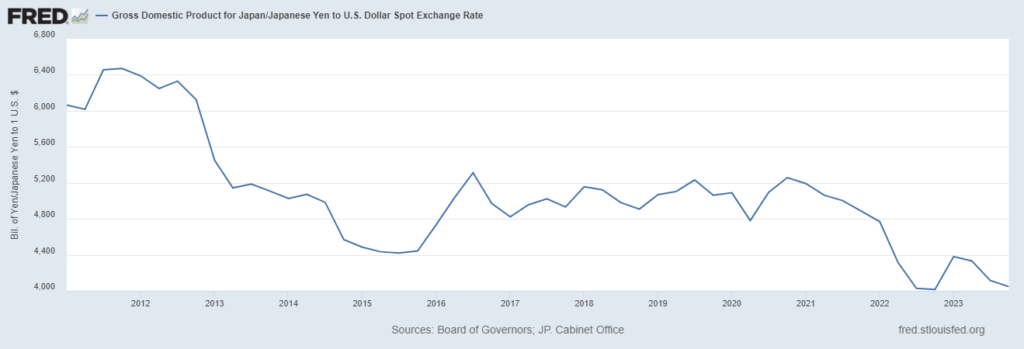

If you look at the #Japan GDP in $USD rather than $JPY you can see what’s going on.

At this point, I am sure that if you are one of those people holding $JPY or $JPY denominated assets are feeling already uncomfortable like the two characters in my example above.

To conclude, how much is the $JPY is really worth? (5T – 1.255T) / 1.255 = 298 $JPY vs $USD, because as we saw above #BOJ = #Japan. So after new all-time highs for the #Nikkei get prepared for new all-time lows for the $JPY vs $USD in the future.

I think is enough for today, have a nice weekend.

If you want to understand the impact this will have on the global economy please refer to my previous articles below where I addressed the topic extensively:

“Oops!… I did it again!” – #BOJ DANGEROUS SCHIZOPHRENIA

THE #BOJ DILEMMA – SAVE #JAPAN OR THE GLOBAL #STOCKS BUBBLE

$JPY CARRY TRADE – THE BIGGEST FINANCIAL TICKING TIME BOMB OF ALL?

SOMEONE SOMEWHERE HAS TO PAY A HIGH PRICE FOR THE BANK OF JAPAN’S INCOMPETENCE

GET READY FOR THE LAST BANK OF JAPAN “FREAK SHOW” OF 2023

JAPAN END GAME – A DEEPLY DEVALUED $JPY AND A WORTHLESS #NIKKEI