By this time, the news of $NYCB closing should have already hit the tape. However, REGARDLESS OF WHETHER THIS NEWS IS POSITIVE OR NEGATIVE, the price of this #stock is MATHEMATICALLY going to crash by 40-50%.

Wait, why mathematically? Let me explain.

Scenario 1 – A $1bn rescue package for $NYCB arranged from a group of vultures is signed.

In this scenario, the current shareholders, to be clear, those who are buying the shares listed on the #NYSE at ~$3.4 right now, are going to face a steep 50% dilution immediately in the best-case scenario. Yes, I said BEST case scenario. The reason is that the vultures aren’t just buying common shares in $NYCB but:

- common shares

- preferred shares with a 1:1,000 conversion ratio into common shares

- Warrants for 70% of the deal value at a $2.5 strike

So, current shareholders face ~50% dilution right away and potentially up to 90% in certain scenarios (we will be able to calculate better when all the exact details of the deal are available).

Scenario 2 – The $NYCB rescue fails, and the bank is left with no other options.

Reasonably speaking, what do you think is going to happen to a bank that got to a point of being so desperate that it agreed to sit at a table, arranged by Jefferies, negotiate with a group of aggressive hedge funds that clearly aren’t in for an “Industrial” investment that can turn the bank around and then fails to catch this last available lifeboat? Of course, it’s not going to remain in operation anymore as it is today. Now, at this point, what do you think the share price of $NYCB is going to be? Exactly, zero or close to zero.

At this point, I believe we all agree that the $NYCB price is certainly set for a steep slump that can happen at any time, right?

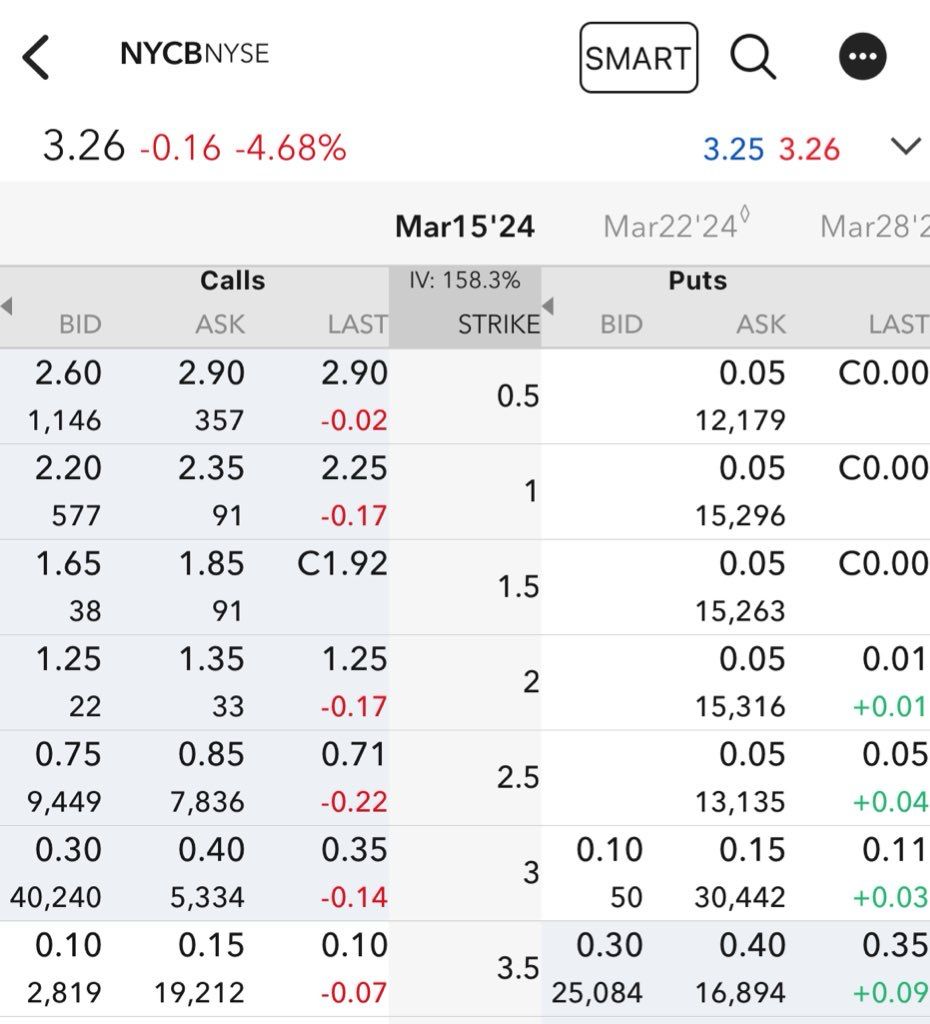

Ok good, kindly please have a look at the following screenshot I took around the US #stocks cash opening time and showing $NYCB options pricing for 18 March expiry on Interactive Brokers. It’s not even necessary to disturb Black-Scholes-Merton to immediately see with the naked eye that the put option prices are wrong.

Let’s take the $3 strike puts offered at $0.15 for example. At that price, the implied probability they would trade ITM is about 25%. Imagine you take a bet, because that’s what options are, probabilistically speaking, and you know the payout is going to be $1.5. How do we get this number? Quite simple, $3 strike price minus $1.5 since there is where $NYCB is going to trade in any case in both scenarios above. So what the market should be pricing is the probability of the “uncertain” state of the bank to end by Friday.

What are the chances we will see news on $NYCB by Friday? Close to 100%, right? If this is the case and in any situation, the outcome is the same for the price, then options are blatantly mispriced, and they should be quoting close to ~$1.5 in price.

Here is what I think could be happening here:

1 – The Market Makers’ algorithm is simply wrong. Believe me, this happens more often than you think and some people in the industry famously make a living arbitraging against them.

2 – The Market Maker is in desperate need of cash and willing to short put options no matter what to raise it and cover its holes.

In the first case, the market maker should likely wake up after I post this article and adjust its pricing. But if we are in the second case, then we should all be seriously concerned. Why? Because that’s exactly what a Ponzi scheme is all about, and you will get to a point where the market makers won’t be able to raise cash anymore to pay off liabilities accumulated elsewhere.

I am leaving this here for today, but I can tell you that I already found so many instances like this one, although far less obvious to catch. Obviously, there is something wrong here, and if any one of you is willing to contribute in the comments or join forces, I am more than happy to accept the help! 🙏🏻

POST UPDATE: After publishing $NYCB announced the closing on the 1bn$ deals with the hedge funds

If all shares issued will be converted current $NYCB common shareholders will own 39.6% of the company on a fully diluted basis

– 76.6m common shares only bought at 2$

– 192,062 Series B preferred #stocks with 1:000 conversion ratio to common

– 256,307 Series C preferred #stocks with a 1:1000 conversion to common

– Warrants to purchase 315m shares of common stock at 2.5$ with 7 years expiry

As if this wasn’t already enough, the newly issued common shares will be immediately tradable

Full details on the transaction below, link to the press release: https://ir.mynycb.com/news-and-events/news-releases/press-release-details/2024/NEW-YORK-COMMUNITY-BANCORP-INC.-CLOSES-OVER-1-BILLION-EQUITY-INVESTMENT-STRENGTHENING-BALANCE-SHEET-AND-LIQUIDITY-POSITION/default.aspx