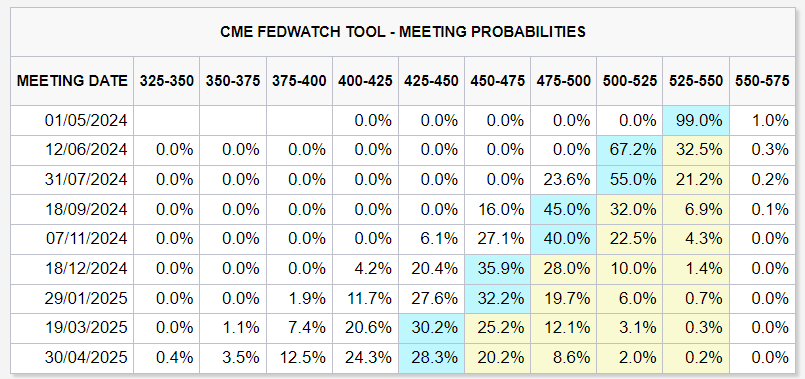

In December, people were literally salivating, dreaming of the flood of liquidity six #FED rate cuts would have delivered to the market in 2024. Fast forward 3 months into 2024, the expectations now are for 2 rate cuts and falling.

Was the expectation of six #FED FF rate cuts unrealistic? Of course, it was, and it wasn’t even that difficult to understand why, you just had to keep your eyes open: “THE REAL FIGHT AGAINST #INFLATION HAS NOT EVEN STARTED YET”

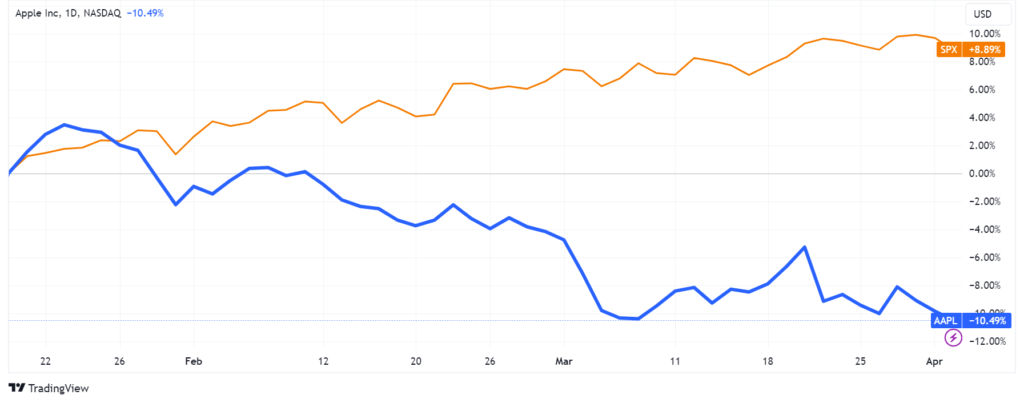

Let’s take another example, #Apple.

“Bank of America upgrades Apple, expects AI and Vision Pro to drive upside”. Yes, on the 18th of January, Bank of America raised Apple’s target price to 225$ based on bullish (unrealistic) expectations of Vision Pro sales. Were they alone? Of course not, every single Wall Street bank couldn’t resist the urge to please one of their ultra VIP fee-paying clients.

The current consensus recommendation on Apple? “Strong Buy” with an average target price of 202$.

Imagine all those people who blindly followed all those “strong buy” recommendations released around the 18th of January this year…

What about the almighty semiconductors sector? Well, even on that front, hallucinations are now giving way to reality. #Intel just restated not one, not two, but the past three years of “audited” financial statements showing to the world that, contrary to what everyone was dreaming, its foundry business was not doing so well. Quite the opposite, Intel’s chip-making unit made a 7bn$ operating loss hole in the company books!

The most ridiculous part of the event was the utmost bullishness of Intel’s press release (because of course, you need to do all you can to keep hallucinations alive).

Let’s move to another stock market darling, #Tesla.

Remember what people were saying over and over again in 2021 in order to convince themselves that Tesla’s 1 trillion valuation was more than justified compared to all other automakers? I do…

Of course, Tesla and Elon Musk are also Ultra VIP fee-paying clients to Wall Street banks, hence it should not come as a surprise that the street consensus on the stock is still “Buy” with an average price of 200$. However, contrary to the Apple example, here you start seeing some outliers that are not shy to recommend selling the stock and disclosing a very low target price. How is that possible? Just check how much business those brokers have been doing with Tesla or any other Elon Musk company in the past years.

Tesla’s deliveries declined by 8.5% in the first quarter to 386,810 vehicles from a year ago as per the last data just released, the first decline in over 4 years. What about all the other business segments that justified not considering Tesla a car company? Crickets…

2 months ago in THE PILE OF LIES USED TO RAISE THIS #STOCKS BULL MARKET UP TO THE SKY IS NOT WITHSTANDING GRAVITY ANYMORE I was already warning about the dangers of unrealistic expectations and how companies were so obviously feeding them with a growing amount of lies.

So many times I also warned about the extreme dangers posed by a market built upon a mountain of derivatives and systematic (dumb) algorithmic trading:

MR. MARKET HAS BEEN FULLY REPLACED BY MR. DERIVATIVES – OH MAMMA MIA!

DEAR ALL, IT WILL ALL END LIKE IN THE MOVIE “INDEPENDENCE DAY”

“WE HAVE NO ALTERNATIVE BUT TO RIDE STOCKS UNTIL THEY RUN”

THE #STOCKS HOUSE OF CARDS IS WOBBLING… AGAIN

Furthermore, the amount of insiders selling should have by itself been taken as a loud warning sign 2 months back: WHY ALL OF A SUDDEN ARE SO MANY HIGH PROFILE INSIDERS SELLING THEIR #STOCKS?

Be careful out there, this is a very dangerous market and now that the alarm bells are ringing so loudly from so many fronts (AFTER #BITCOIN DID IT, NOW #GOLD IS SOUNDING THE ALARM), ignoring them comes with such a high degree of danger that I am not sure it still justifies the risk/reward of remaining so fully invested in this market.

Never forget, if everyone stands on the same side of a boat, the risk of its suddenly capsizing is very high…