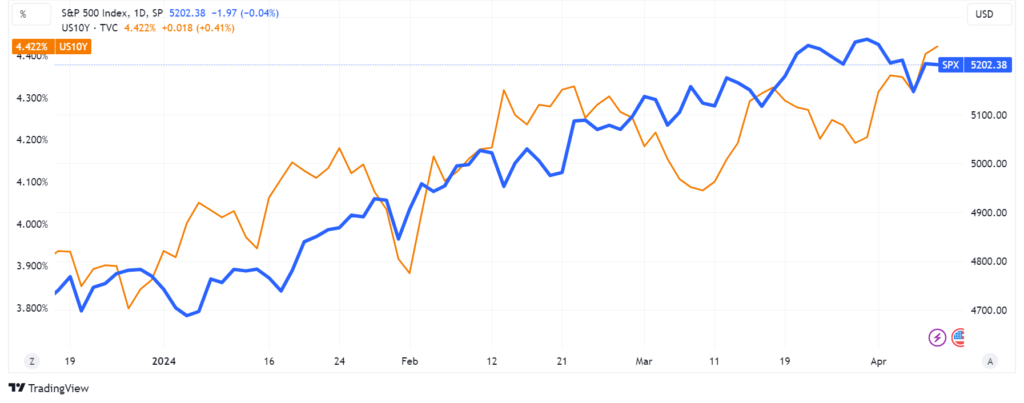

The discounted cash flow (DCF) valuation model is a fundamental tool used in finance to estimate the intrinsic value of a company based on its expected future cash flows. It is based on the “time value of money” — the basic law of finance (a dollar received in the future is worth less than a dollar received today). Now, when interest rates rise, the discount rate used in the DCF calculation increases, which in turn lowers the present value of future cash flows, potentially decreasing the overall valuation of the company. Conversely, when interest rates decrease, the discount rate decreases, leading to a higher present value of future cash flows and potentially increasing the company’s valuation, right? Well, apparently in the past 3 months, the rules have changed and this is not true anymore…

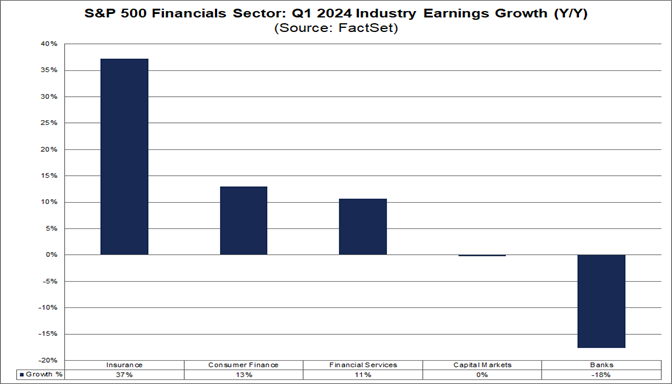

If you zoom in and focus on the banking sector #stocks, the disconnect between valuations and reality becomes even more acute. As reported by FactSet, for Q1-24 banks are expected to report a -18% YoY earnings growth.

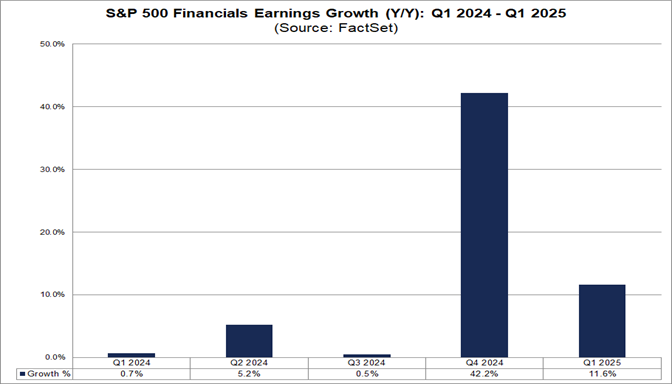

What about the financial sector as a whole? According to FactSet, it is expected to report a meager 0.7% YoY earnings growth.

As if this was not enough, we have already discussed many times how losses are piling up in banks’ “Hold to Maturity” (or as I like to call them “Hide Till Maturity”) books with the increase in interest rates impacting both their Government and Non-Government guaranteed exposures:

- THE GREAT PARADOX OF CRE LENDING: WHILE OWNERS ARE FREAKING OUT, BANKS ARE CHILLING

- 2024 THE YEAR WHEN “HIDE TILL MATURITY” ENDS

- WITHOUT THE FED BTFP, BANKS WILL NOW HAVE A HARDER TIME TO “HIDE TILL MATURITY” THEIR LOSSES

- IS THE #FED (PERHAPS WILLINGLY) STARTING A BANKING CRISIS TODAY?

- THE INCOMING GERMAN REAL ESTATE MAYHEM

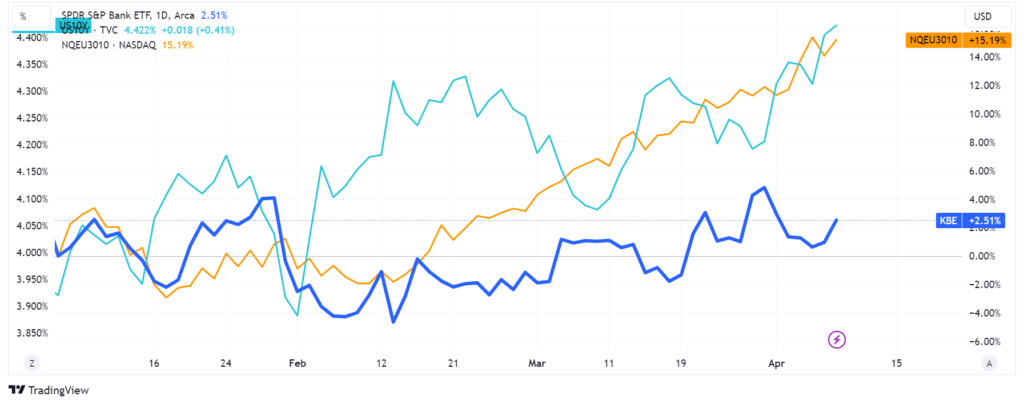

As the chart below shows, banks have been completely defying gravity in recent months, particularly European ones, even ignoring the fading of central banks’ rate cuts (wild) dreams everyone had in December 2023 and used to justify this nonsensical bullishness.

As if what I described so far was not enough, stocks are also ignoring the loudest warning you can find in a macro environment: gold and rates rising at the same time. What does this mean? Risk of monetary debasement (in-depth analysis: AFTER #BITCOIN DID IT, NOW #GOLD IS SOUNDING THE ALARM).

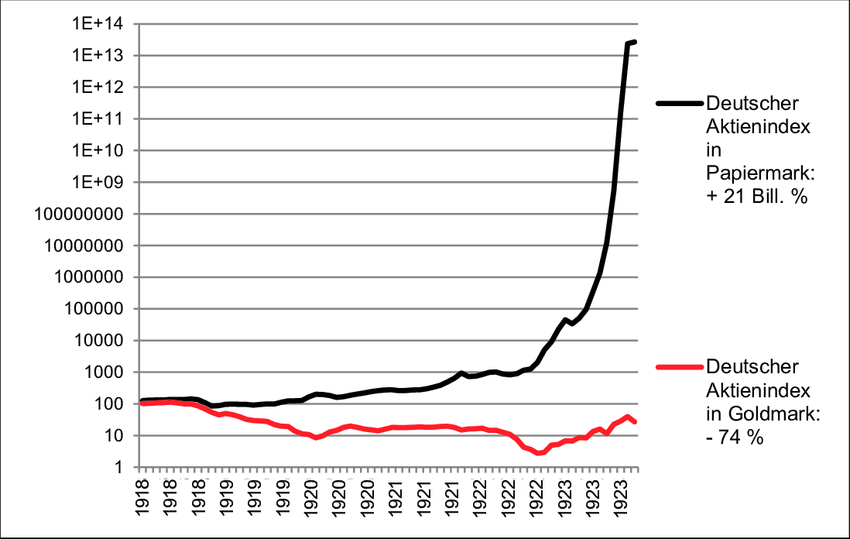

I keep hearing people talking about stocks’ melt-up here and there. Yes, it can happen if central banks do not stop printing money as if there is no tomorrow and monetizing the government’s drunken sailors’ out-of-control spending. However, I am not really sure that such a bullish scenario for your finances is a good thing, as the chart below shows.

Furthermore, if this type of scenario starts becoming realistic, would you expect the US Government to choose to keep the illusion of a booming stock market while losing its very lucrative and powerful role as the world’s reserve currency? I hardly think so, although nowadays nothing would surprise me anymore, considering the level of madness we are experiencing.