Every time I look at a new release of public, politically, seasonally adjusted data, I struggle not to smile (often, not to laugh lately). Things must be so bad this time that 7 months away from US elections, despite adjustments beyond the limits of human creativity, we’re getting this type of MSM headline after the Q1-24 US #GDP data release: “Q1 US GDP shows surprise slowing and uncomfortable inflation”

I wonder how many will feel even more surprised after I show you that the US economy has been in a recession for (at least) almost 3 years already.

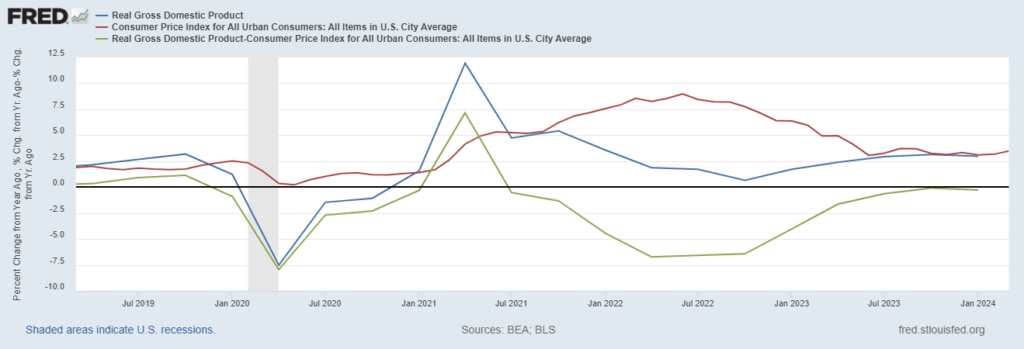

An essential thing to always bear in mind is that US GDP Data releases are adjusted to net out #inflation, the laughable one from public data. What is the real level of inflation? Two to three times higher than what is officially reported and no, not according to Dario (THE REAL FIGHT AGAINST #INFLATION HAS NOT EVEN STARTED YET), neither to ShadowStats nor to the New York Times (”Inflation Is Higher Than the Numbers Say”), but according to the people that go to the grocery store every week, fill their gas tanks, pay their bills every month, and from time to time purchase something on Amazon or at their local mall: “Real Inflation Is Higher Than Reported. One Shopper Has Proof”

Take the official data on inflation growth, double it to remain “conservative”, and deduct it from the US “Real” GDP published by the BLS (aka Bureau for Lame Statistics)… Ta Daaa! The US has been in a recession since 2021.

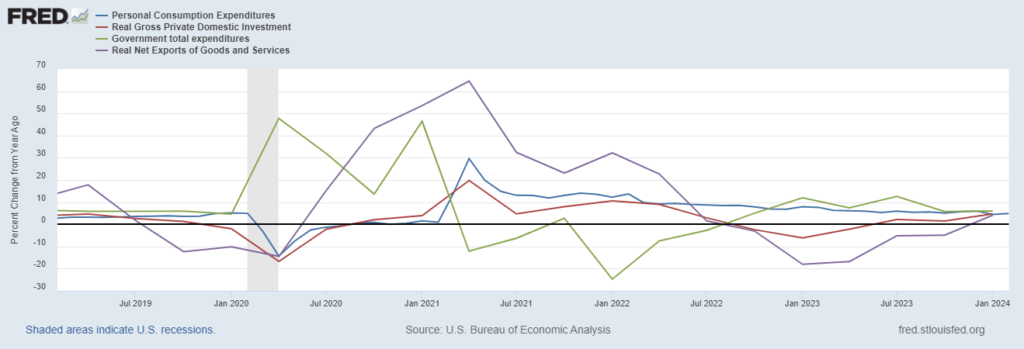

As if this isn’t already shocking enough, although not as shocking as the fact MSM is totally silent about this, let’s have a look at how GDP is calculated:

GDP = C + I + G + NX

C = Personal Consumption Expenditures

I = Investments

G = Government Spending

NX = Exports – Imports

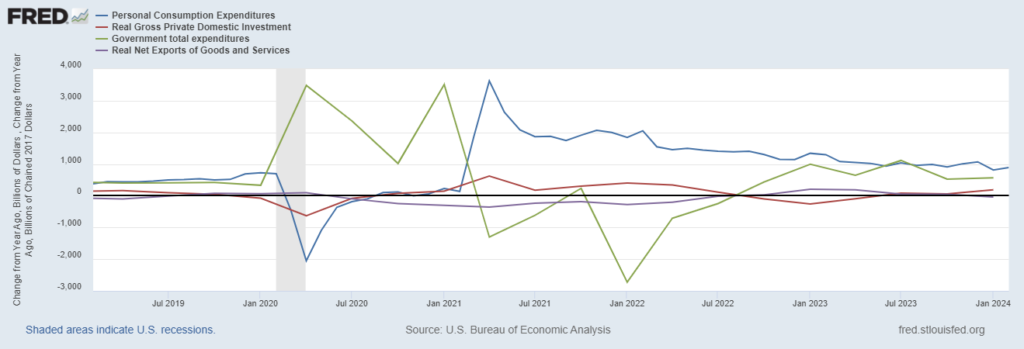

Which item do you think grew the most in terms of % of annual change and absolute change in billions of USD? It should not come as a surprise the answer is PCE and G.

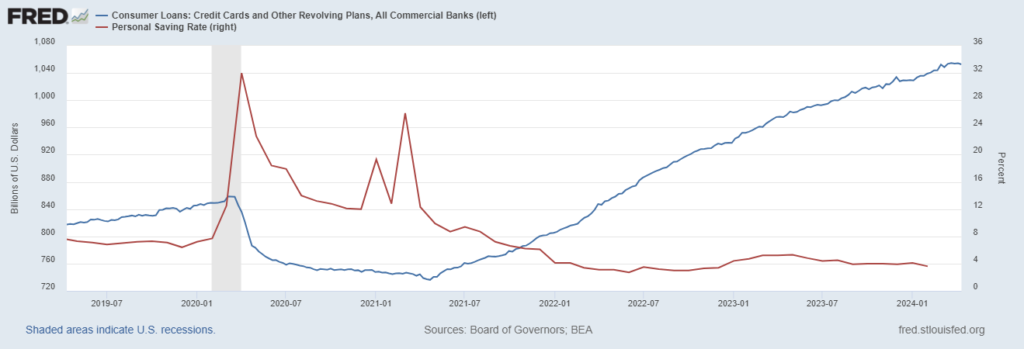

How could consumers keep up with inflation without any improvement to their personal savings rate? Easy, credit cards.

How could the US government keep spending at an astounding rate while running a widening deficit? Easy, US debt has been monetized by Central Banks globally (not only by the #FED) since the USD is, still, a reserve currency so a % of every unit of fiat currency printed out of thin air across the world always ends up buying US government bonds.

Without endless money printing across the world, US “Real” GDP would have already been in a recession for many years, even without factoring in the real inflation rate taxpayers have to deal with in their lives.

What is the end game of all of this? Fiat currency monetary debasement is currently translating into a faster and faster erosion of purchasing power due to the basic law of demand and supply (limited goods and services against a continuously growing fiat currency monetary base).

I wonder why people are still surprised by the fact that #gold, #silver, #bitcoin, and a whole range of #commodities keep increasing in value against fiat currencies. Isn’t it obvious now?

This is what I warned about 3 months ago: TRADERS AND (ZOMBIE) COMPANIES NOW PRAYING #INFLATION IS NOT COMING BACK. Now that #inflation is growing back again (with vengeance) you start seeing the impact on the economy and soon you will see the impact on the global financial system.