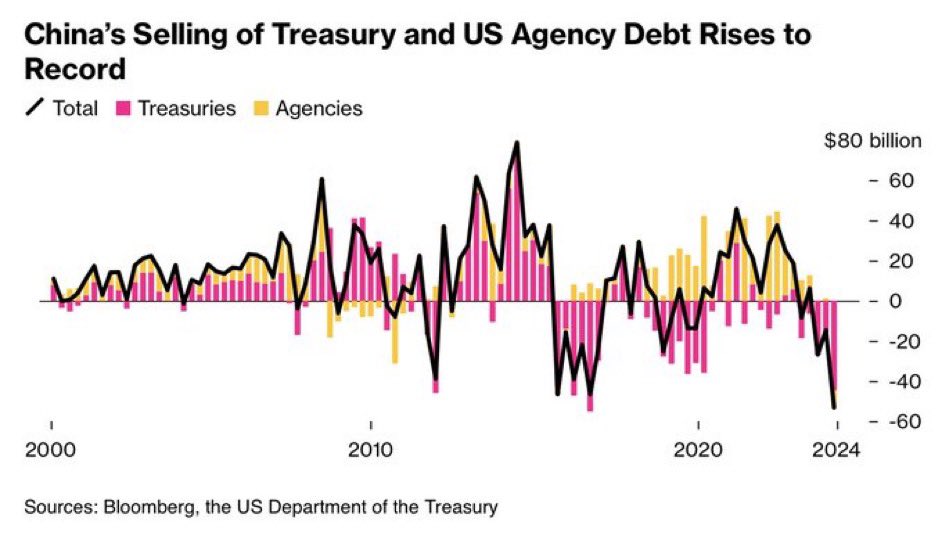

Yesterday, the news that #China PBOC sold its largest amount of US Treasury reserves ever was not a shock. It was expected to happen sooner or later considering the state of the relationship between the two countries lately. Nevertheless, it was big news.

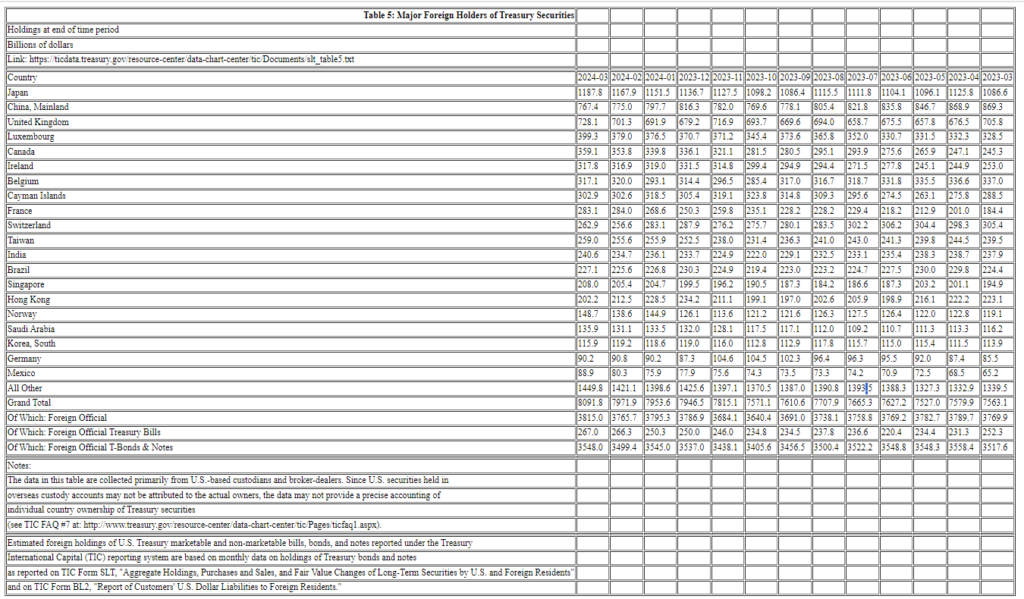

At this point, I started to dig deeper to see whether it is true that foreign countries in general are dumping US Treasuries for whatever reason is important to them (geopolitical, devaluation, domestic #USD shortage, and so on). Surprisingly, the total amount of US Treasuries held by foreigners, both public and private, overall remained somewhat stable lately as you can see from the latest update from the US Treasury Department.

True, some countries are trimming their holdings, particularly those not belonging to the US commercial allies group. But others are picking up what’s being sold, keeping the totals more or less stable.

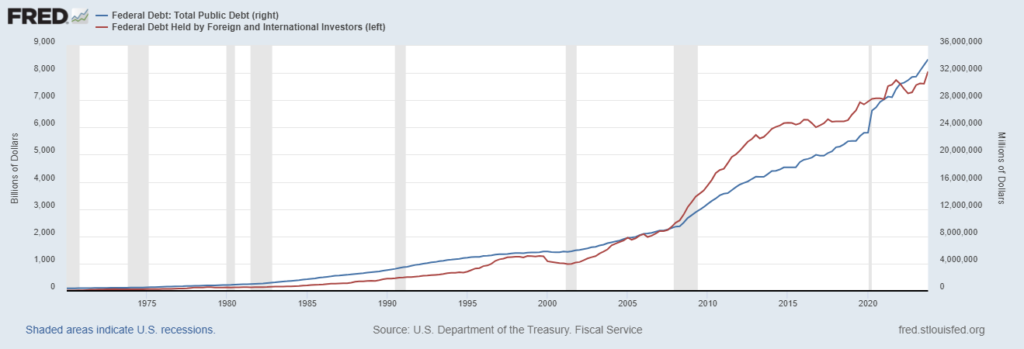

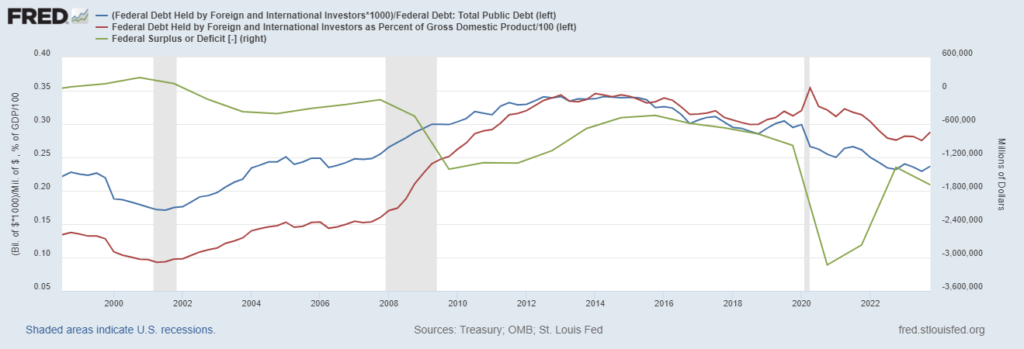

Furthermore, as you can see from the chart below, overall the amount of US Federal Debt held by foreigners kept growing over the years along with the growth of the US Federal Debt in general.

Then I guess there should not be any concern on this front, right? Not so fast.

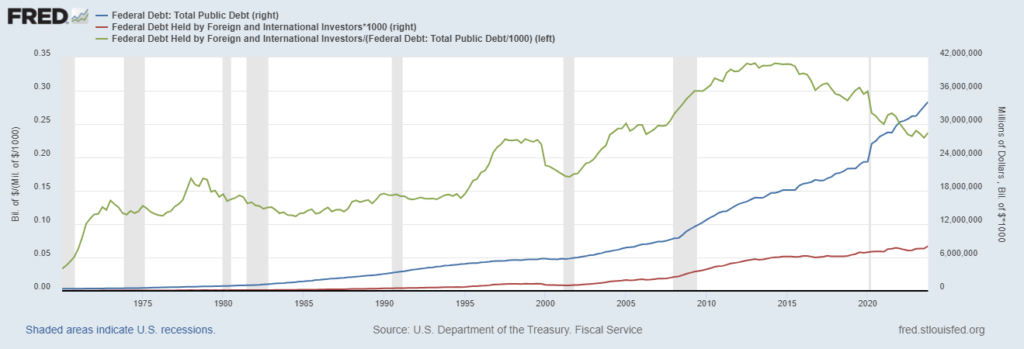

As you can see in this chart, foreign investors are struggling to keep pace with the ballooning US Debt and today overall they hold the same percentage of US Treasuries they did back in… 2005!

What’s the root cause of it? Not the growth of the US GDP faster than other foreign countries (overall), but the exploding US Deficit spending.

As a matter of fact, foreign countries are not in a position anymore to keep financing the US living above its means.

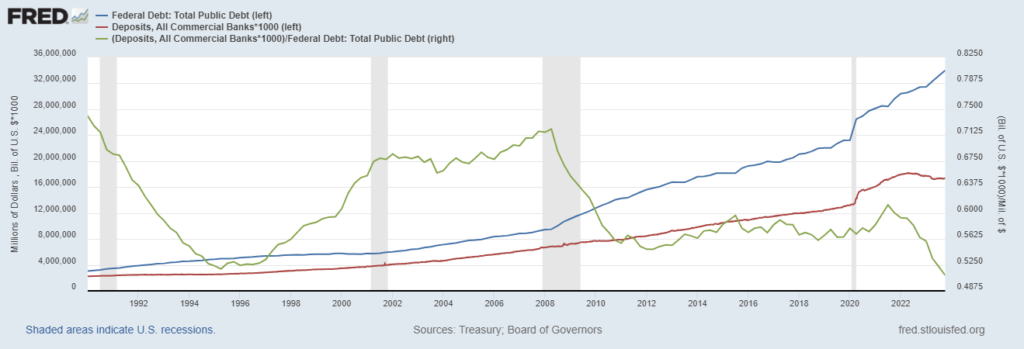

This means that despite her effort to sell US Treasuries during her trips abroad, Janet Yellen is now in a situation where only US Domestic buyers are the only ones she can turn to finance the Federal Deficit. This should not be a problem, right? If US depositors won’t willingly buy US Debt, banks will use their deposits to buy US Debt instead, making a good chunk of revenues in the process since they are paid 5% interest while most of them still pay 0-1% to current account deposits.

Unfortunately for Janet, #banks can pickpocket US people up to the limit allowed by the capital they hold unless… Capital requirements against US Treasury holdings will be scrapped as it temporarily happened during COVID. At this point, it should not come as a surprise anymore that banks are lobbying fiercely to have this requirement scrapped for a good while instead that should be increased to reflect the higher risk exposure carried by banks (”US bank capital overhaul proposal fatally flawed, top lobby groups say”). Hilarious, right?

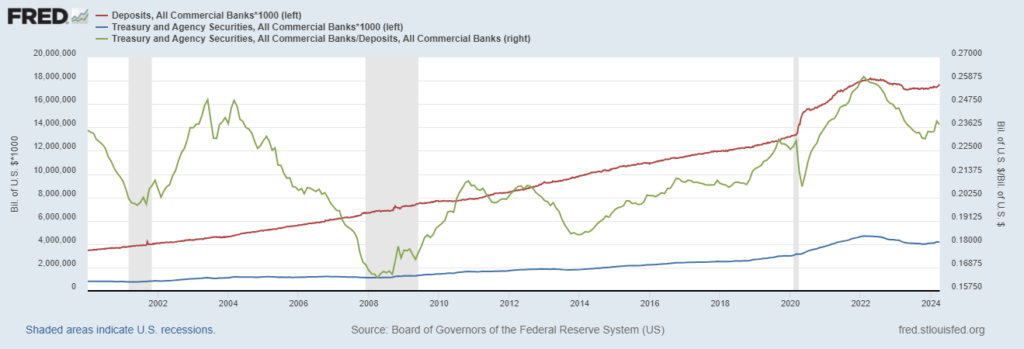

So, as you can see from the first chart below, even if US Deposits compared to total US Federal debt are now just ~50% of the total (a level below the bottom seen 30 years ago), if banks manage to scrap the capital requirements they will have quite a big room to buy US Treasuries using deposit money considering we are still quite far from the levels reached during the GFC crisis (chart 2)

Why then should the #FED cut rates? Because depositors are starting to demand higher interests for their money and shifting more and more to Time Deposits or Money Market funds, banks do need rate cuts to maintain their profitability margins while disincentivizing customers from moving their cash to more profitable alternatives.

Bottom line, willingly or unwillingly, US people will end up paying for their own country’s ballooning deficit while their fiat money purchasing power is evaporating because of inflation. Does not sound like a great deal to me…