While global investors are busily plucking daisy petals to decide between fear and #fomo, a (very) large elephant is crying out in pain in one corner of the globe. In a surreptitious move, #Softbank quietly rescheduled the release of their Financial Results for the entire 2023 fiscal year from the 9th to Monday 13th May. Unfortunately for them, someone was always watching…

It goes without saying that such a move from the company is objectively not #bullish, especially in today’s market where you can paint stones yellow in full view of everyone, and people will then be happy to pay #gold prices for them. In the past 24 hours, I couldn’t resist trying to figure out what could be happening in Softbank’s offices, so let’s take a peek at what we might expect on Monday (unless they postpone their results again).

First and foremost, we know that #Softbank is exposed to the #JPY depreciation, and they did not hedge their exposure in the right direction. The company itself couldn’t dodge having to reveal it.

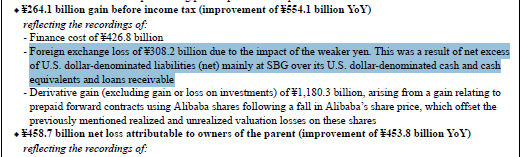

Q4-23 FX Loss

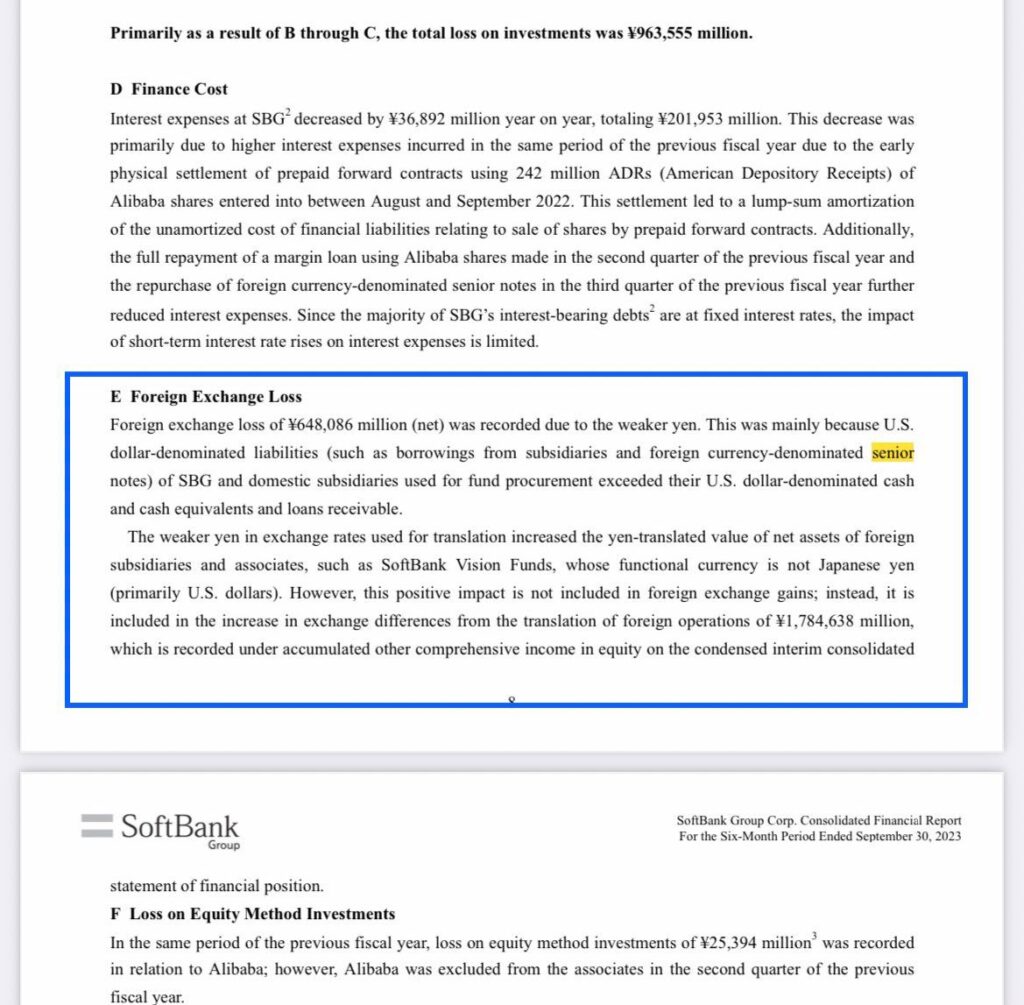

Q3-23 FX Loss

So let’s try to do some calculations here. In Q3-23, the #JPY depreciated by about 3.5% against the #USD, and #Softbank lost 648bn #JPY due to FX. In Q4-23, the #JPY APPRECIATED by roughly 3.6% against the #USD, but #Softbank still lost 308bn #JPY because of FX. Wait, what?! Hold on a minute, there’s something amiss here.

Let’s have a look at the amount of assets between the 2 quarters

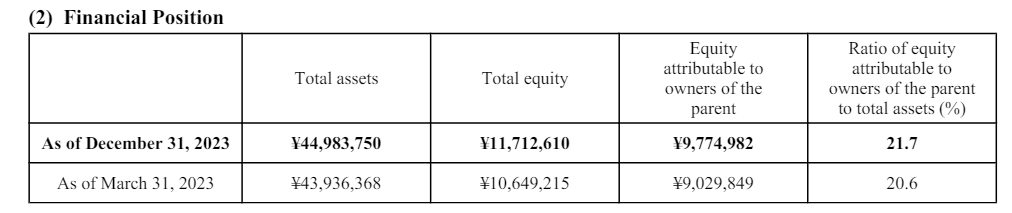

Q4-23

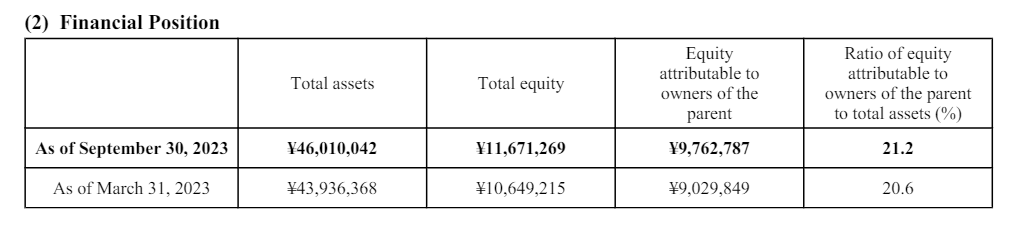

Q3-23

As you can see, the nominal value of #Softbank’s assets in #JPY decreased by about 2.3% QoQ, and considering the vast majority of #Softbank assets are in #USD, that makes sense. What doesn’t make sense is #Softbank losing money regardless of whether the #JPY goes up or down in value against the #USD. How could this be possible? One possible reason could be the currency mix of their liabilities, with those in #JPY increasing more than what the decrease in #USD ones can compensate (also because assets in #USD lose value at the same time).

Hold on, does this mean that #Softbank is losing money because of FX no matter what happens? Well.. that’s what the numbers are suggesting….

Now, considering that in Q1-24, the #JPY lost about 6.7% against the #USD, using the same type of proportions, #Softbank likely lost 1.25T #JPY due to FX or 8bn #USD. Wow, that’s significant.

No worries though, in Q1-24 #ARM gained 75% in one of the most spectacular gamma squeezes I can recall, which could have netted #Softbank a whopping ~50bn$ gain in the quarter. Can #Softbank record that as a gain and showcase Q1-24 blockbuster results? Of course, they cannot since they controlled approximately 90% of #ARM shares, and they are constrained to account for the equity value of those. There is a catch here… #Softbank can report a cash profit if they sold #ARM shares in Q1-24 and as of now, their latest 13-F has not been filed yet. This means there is a possibility that #Softbank started to dump #ARM shares as soon as the IPO lock expired on the 14th of March. Did they do it? As we can see from the chart, in the favorable window, they had volumes remained low and net volumes remained pretty much neutral, so it’s unlikely they sold (chart 1) unless, like they did with #Alibaba, they used prepaid forward derivatives. That is actually a possibility if you consider that heading into the April OPEX #ARM shares dumped hard on higher volumes and negative net selling (chart 2). Looking at the volumes, there is a chance #Softbank sold about 6.5% of its #ARM shares using derivatives, and that 8bn$ would have offset the FX losses we saw above. If I’m correct, #Softbank trimmed its #ARM stake to approximately 83.5%, and that will show up on Monday.

What could happen to #ARM shares if the news that #Softbank started selling hits the headlines? In the chart, you can see what happened to their infamous WeWork investment as a recent example.

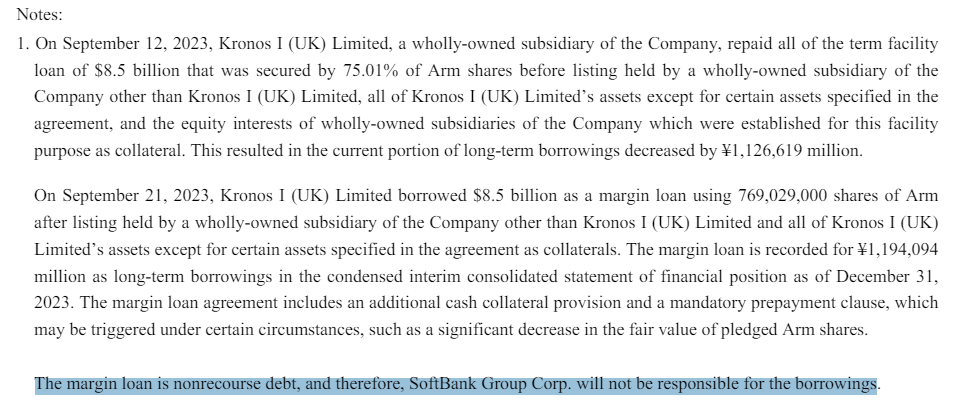

As you can see from the latest financial report, #Sofbank already pledged 75% of #ARM shares as collateral against an 8.5bn$ margin loan that was DOUBLED to 17bn$ in Q3-23. Furthermore, the loan is non-recourse, and as you can see, “Softbank will not be responsible for the borrowings”

Why do you think banks asked for such a large collateral against #ARM shares? Because they are not that naive, and even a monkey knows that a 1,100 P/E ratio is entirely unrealistic. A 100 P/E ratio would still be unrealistic, though, and at that level, banks would already be exposed to billions of losses on this margin loan position. Clearly, the value of ARM shares can collapse anytime if any bank decides to walk away from it, and if the market reacts very negatively to the news that #Softbank started selling, that can happen in the blink of an eye.

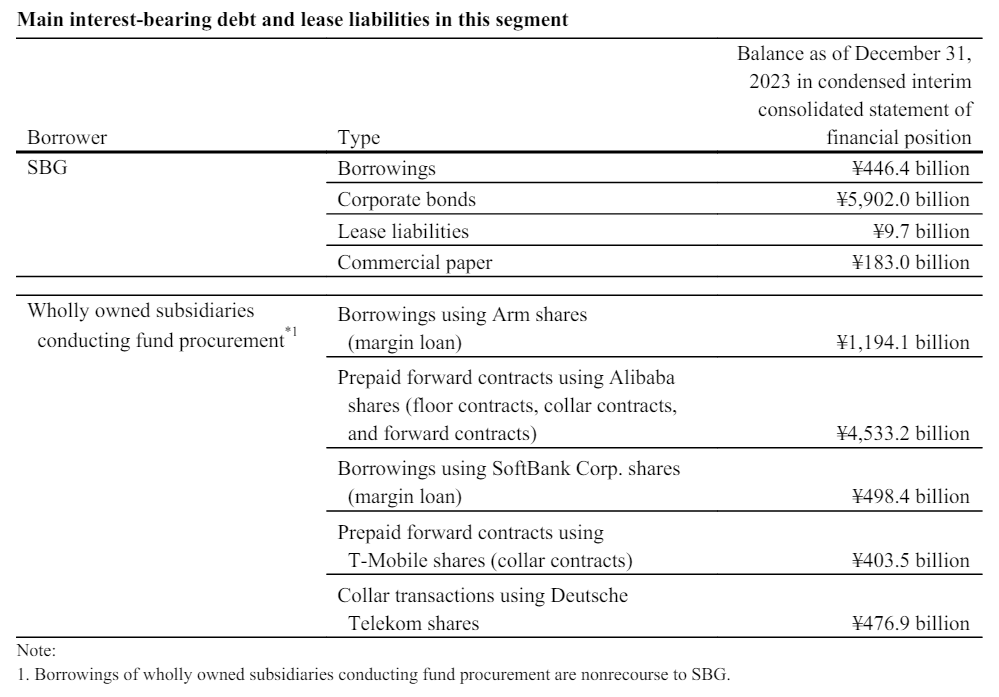

From the screenshot below, you can see that #Softbank leveraged itself to the hilt, posting everything banks could accept as collateral from its balance sheet.. including #Softbank shares! Yes, the exact thing FTX did…

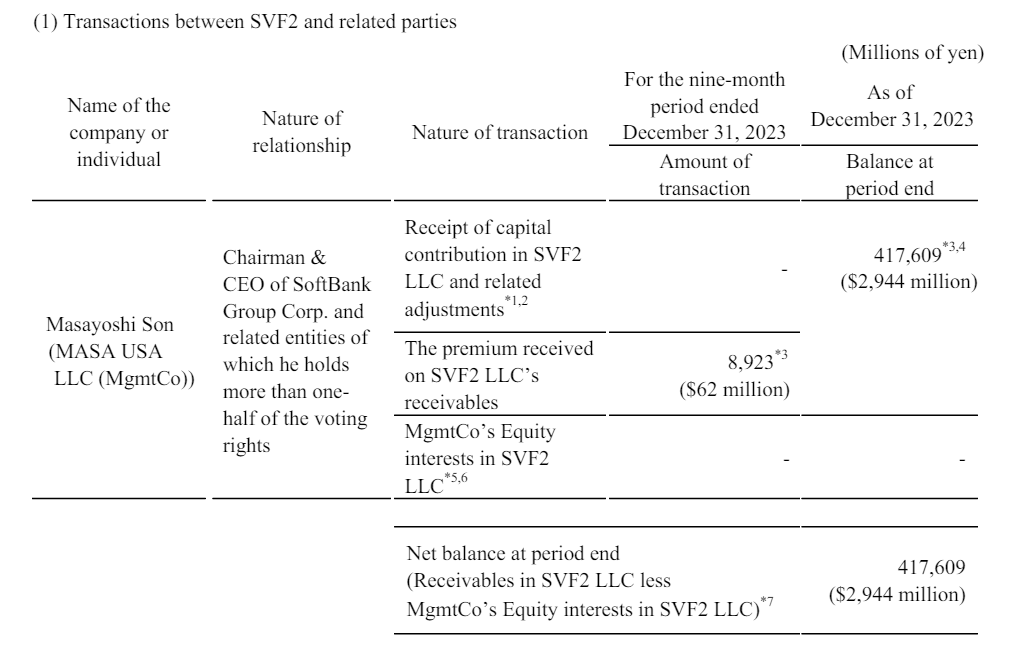

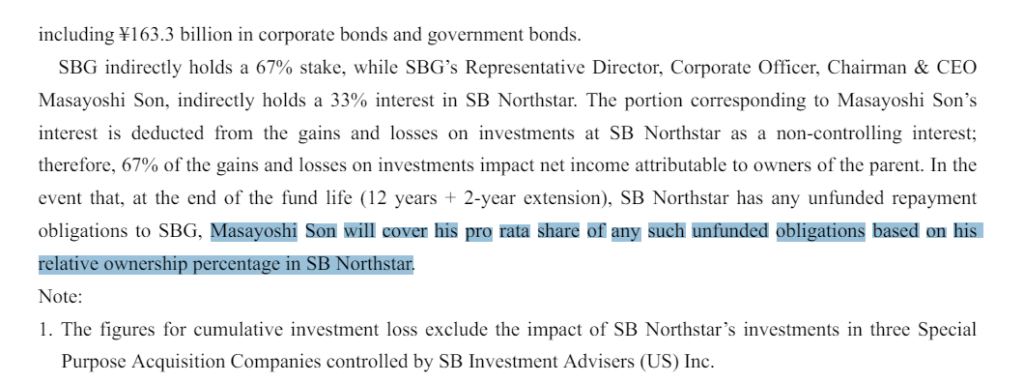

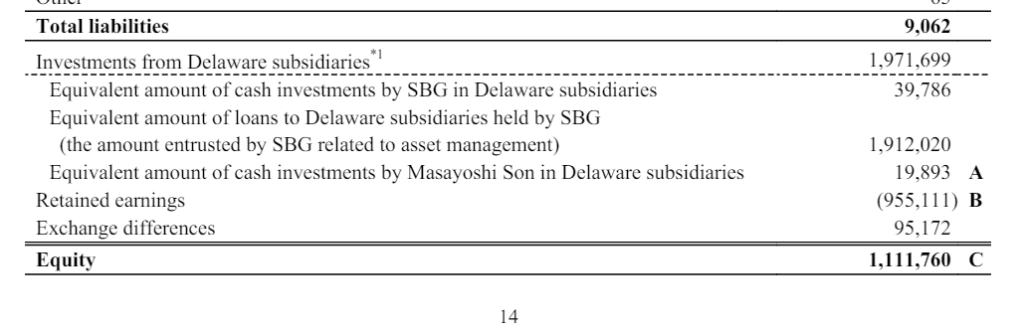

As if this wasn’t already bad enough, Masayoshi Son borrowed billions of dollars from Softbank PERSONALLY to invest in Vision Fund 2 (the one doing very poorly) and SB Northstar limited (Softbank’s internal Hedge Fund arm) providing as collateral… his #Softbank shares!

What are the chances banks are growing increasingly nervous about all this leverage in #Softbank? You tell me…

To conclude, why do you think the #BOJ is likely directly involved in the bailout of Softbank? Because they are the second largest shareholder after Masayoshi Son! Fun fact… the 3rd largest shareholder is none other than JP Morgan.

Keep your popcorn ready, folks, Monday might be a very fun day.

Excellent forensic analysis of their statements, filings and footnotes. Man do you know your corporate accounting. I learn so much from these posts..

Leverage cuts both ways and it sure looks like the Samurai sword is coming down on Son’s head this time. But his pledges aren’t even close to being enough, correct? Once this ball starts rolling the BOJ and JPM on down are on the hook big-time……Think they’re all talking this weekend?