The past 24 hours have been an absolute display of ridicule that the human mind could not contemplate a few years ago, but the Quantitative Easing fairy dust apparently makes every dream come true. I believe this CNBC article is the best example of incoherence between markets and reality: “CPI report shows inflation easing in April, with consumer prices still rising 3.4% from a year ago”.

This is how the CNBC article begins “Inflation eased slightly in April, providing at least a bit of relief for consumers, while still holding above levels that would suggest a cut in interest rates is imminent.”

Hold on a second… what? Is there anything wrong with my understanding of English? Sorry, I am not a native speaker, or is that paragraph absolutely illogical?

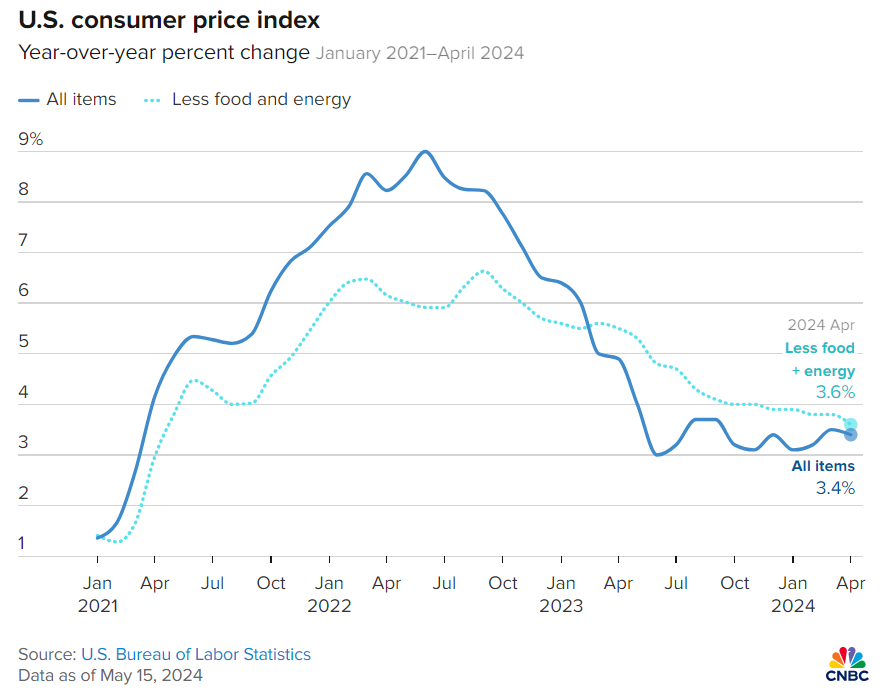

This is the chart CNBC, and every other (dishonest) mainstream media outlet loves to display to support the nonsense they write every month.

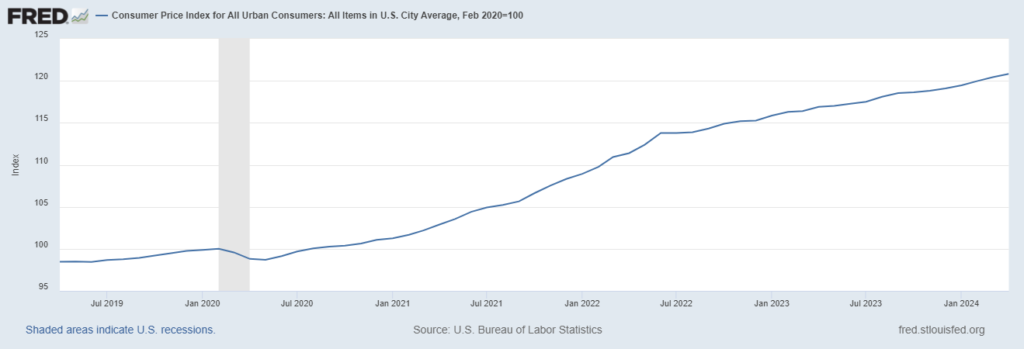

While every mainstream media outlet is very careful not to show the chart below that instead shows how, according to the seasonally politically adjusted official BLS data, prices in the US increased more than 20% since COVID.

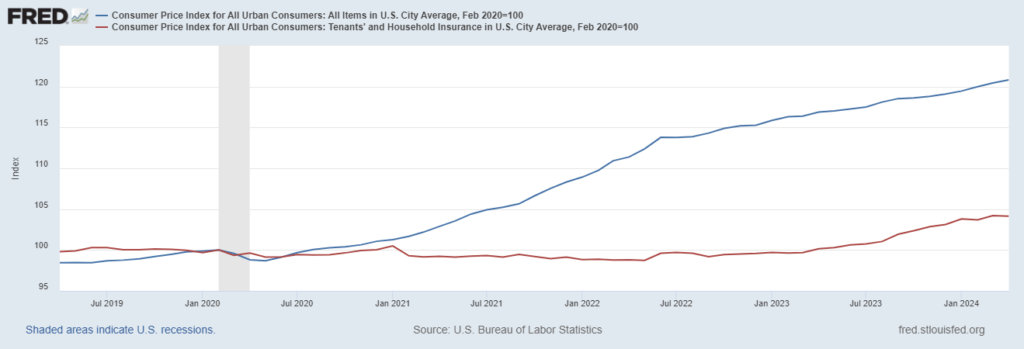

Anyone who goes to the supermarket every day, fills his car tank, pays his insurance, books a flight ticket, and so on, knows that prices have not increased 20% since COVID, but 40-50% in many cases. Sometimes they even doubled, and this does not even take into consideration shrinkflation. Think about that. This chart below is one of the best examples of how BLS official data are (intentionally) suppressing the real level of inflation the economy is experiencing. Yes, according to the BLS Insurance costs for US tenants and households increased less than 5% IN TOTAL since 2020.

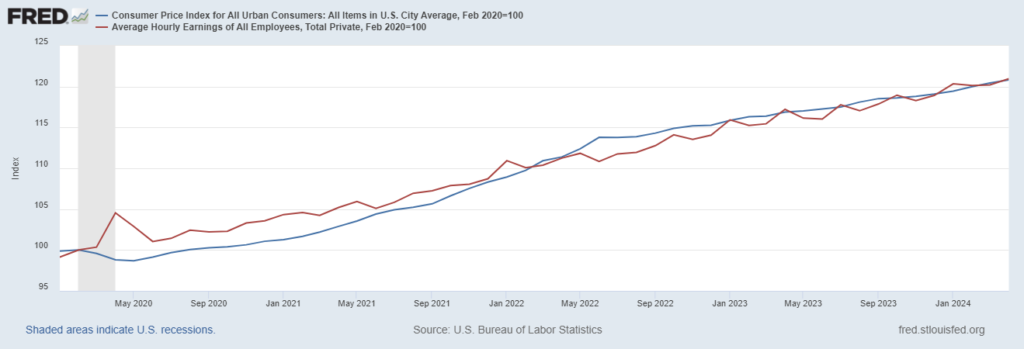

As if this wasn’t insulting enough to human intelligence, according to the BLS the average hourly earnings are keeping up with inflation pretty well…

Remember “INFLATION IS YOUR FAULT” because if you lived according to BLS principles (don’t eat, don’t travel, don’t go to work,…) you would have been doing great as their seasonally politically adjusted official data dictate.

After describing all of this I hope you now agree with my title choice for this article. Picture this: the top 1% in the US are the dancing pallbearers, the top 10% are the spectators enjoying the show and clapping at the performance while the remaining 90% are those lying in the coffin along with their “American Dream”.

The more life becomes miserable and unaffordable for most, the better the business for the 1% pallbearers because they keep having a good supply of coffins to dance with. Who is the one providing them with the music? The one and only Jerome Burns, of course.

Are rate cuts going to resuscitate the American dream and help the bottom 90% to stand and leave their coffins? Of course not, quite the opposite. All a rate cut would accomplish now would be to lower the chances people have to free themselves from being debt slaves. Lower rates and more liquidity in the market will allow people to access additional credit to repay the interest on their ballooning debt that NO, A FED RATE CUT WILL NOT CUT. I will not be surprised if in the future we will be reading an article titled “DEBT IS YOUR FAULT” where people will be blamed for recklessly borrowing. What about banks recklessly lending? Of course, they will never be blamed.