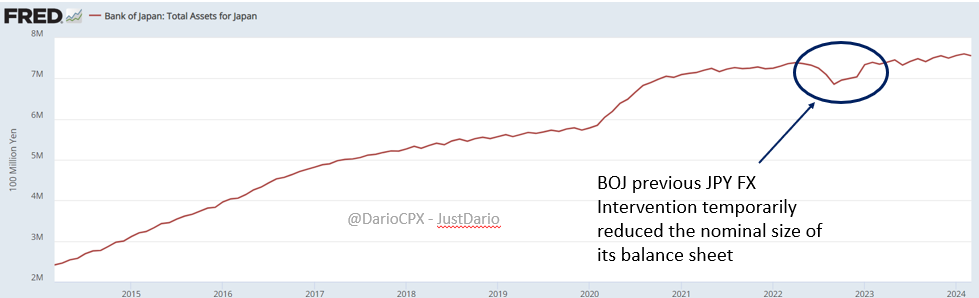

Yesterday, I got this interesting question that I believe the answer is worth sharing with everyone: why does the #BOJ balance sheet decrease when the #BOJ intervenes in the FX? And why doesn’t that mean there is less liquidity in the global system?

Understanding central banking accounting is the key to answering the first question.

When the #BOJ intervenes, this is what happens to the Asset side of their balance sheet (simplified):

1 – Sell US Treasuries – Receive #USD

2 – Receive #USD – Sell #USD

3 – Sell #USD – Buy #JPY

4 – Receive #JPY

Now, because the #BOJ is the one with the power of printing #JPY out of thin air, once these “re-enter” its balance sheet they are not eligible to be accounted for as assets since, strictly speaking, a currency is nothing more than a credit towards the central bank itself.

So, when does the #BOJ balance sheet resume increasing? When the #BOJ “uses” those #JPY they just purchased during the intervention to buy #JGB assets. #JGBs are credits towards the government, which is not the #BOJ (in theory 😉) so that asset is eligible to be accounted for in the #BOJ balance sheet that as a consequence will resume its growth.

I answered the second question in yesterday’s article “THIS LAST BURST OF QUANTITATIVE EASING WILL ACCELERATE THE OVERALL MONETARY IMPLOSION ALREADY UNFOLDING”, but perhaps I wasn’t clear enough and I apologize for that. Let me try again. 🙏🏻

When a central bank buys reserves in a foreign currency, that liquidity is still “virtually” part of the financial system (since it’s a credit of a central bank towards another central bank), but “practically” it is removed from circulation because central banks don’t “trade” or “repo” their reserves to make extra profits… with some exceptions (like the Swiss National Bank that is effectively run like a Hedge Fund).

As a consequence, when foreign reserves are being sold for foreign currency and that currency is then sold (hence is not part of the central bank reserves anymore), that currency resumes circulating in the global financial system “practically” increasing the liquidity in circulation because now this is again “available” to be traded/put to work. Visualizing this as a dam built up in the mountains can be helpful. In the upper part, the artificial water basin created by the dam is full while the flow of water downstream the dam is much smaller, however, the water as a whole is still there just in different places right? Now this is what happens when the dam gates are opened and water is being released downstream 😅

At this point, I hope it is easier to understand how a (temporary) decrease in the #JPY balance sheet is just a factor of “accounting” of the #BOJ as an entity and doesn’t mean there is less liquidity in the global system, quite the opposite. True, that there are fewer #JPY in circulation at the moment as a result of the intervention (hence a temporarily stronger #JPY rate against other currencies), but those #JPY have been replaced by a greater amount of #USD in the global system the #BOJ “dam” was previously held back.

Which type of #QE do you think is more effective to pump #stocks and global risk assets in general? The #USD one “sponsored” by the #FED (since they printed those #USD at the very beginning) or the #JPY one sponsored by the central bank of a country running a 260%+ debt to GDP? 🤷🏻♂️