Have you ever watched the movie “Dumb and Dumber”? If you have not, you should. If that’s not your genre, at least do me a favor and watch this 41-second video clip here before reading this article.

“That’s as good as money sir, those are IOUs”, isn’t this sentence striking a chord inside you? Exactly, that’s what Central Banks and Governments have been force-feeding the public for decades now. Do you want to own a bunch of IOUs in your pockets that aren’t even worth the paper they are printed on? No one does, but many don’t realize that so why not take advantage of it?

Rule #1: Buy assets that “cannot be printed out of thin air”

Allow me to be provocative here. Do you think there is any “scarcity” of real estate in any developed country? Try to buy or rent an apartment anywhere and let me know how long it takes to find some alternatives in the area of your choice. There are even extreme situations like in Japan, where, despite 9 million homes being completely abandoned (Number of Vacant Homes in Japan Reaches Record 9 Million), new real estate developments keep being built. Why do you think that is the case? Because the moment this stops, not only do banks see an incredibly lucrative lending business evaporating, but all the debt piled up by real estate developers and “investors” suddenly defaults. In China, they know very well what this means.

As a matter of fact, Central Banks harnessed the power to print homes out of thin air for the joy of governments that love to promise a home to everyone. In reality, you are not getting a home, but a lifetime debt to repay that you won’t escape even if you decide to rent since in 99% of the cases you are paying someone else’s mortgage. Who’s the real winner here? Banks, of course:

1 – Real estate developers can continue servicing their debt

2 – Homeowners will pay interests for life, guaranteeing the principal with 100% of their assets until the last cent of the debt is paid.

The recent era of out-of-control money printed even created a monster no one imagined could ever materialize in the real world: Mortgages with Negative Amortization.

That’s right, in Canada, many people are set to pay their mortgages for their whole lifetime: “Bank of Canada’s Rogers Says Negative Amortization Mortgages Need ‘Close Look’”

What else can be printed out of thin air?

- Government Debt

- Any Corporate Debt

- Any ETF repackaging Government and/or Corporate Debt

- Any SPV that represents Debt Repackaging

- Commodity ETFs structured on derivative contracts

- Leveraged ETFs

- Fiat Currency

- Any good and service that comes with a form of debt attached (like leasing for used cars)

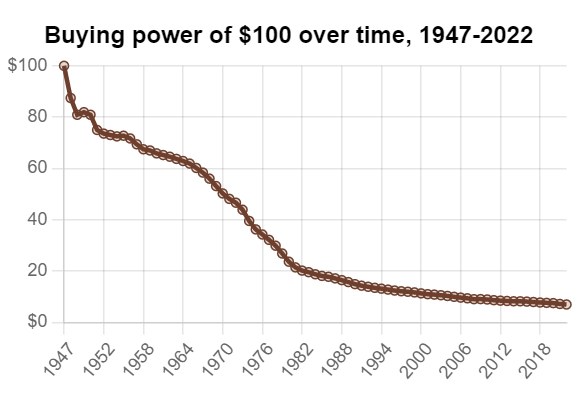

If you hold any of the above in any shape or form, that’s what your long-term purchasing power looks like.

So what kind of asset cannot be printed out of thin air? Anything that is scarce, physical, and does not come with any form of debt attached to it like physical gold (not paper gold ETFs be careful), silver, or Bitcoin.

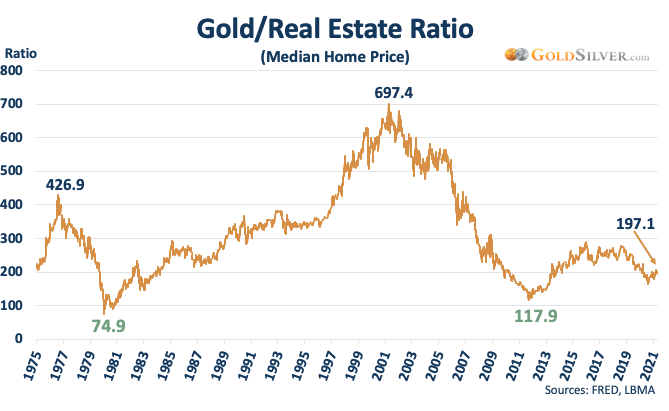

The chart below is the best representation of how gold preserved your purchasing power through the decades.

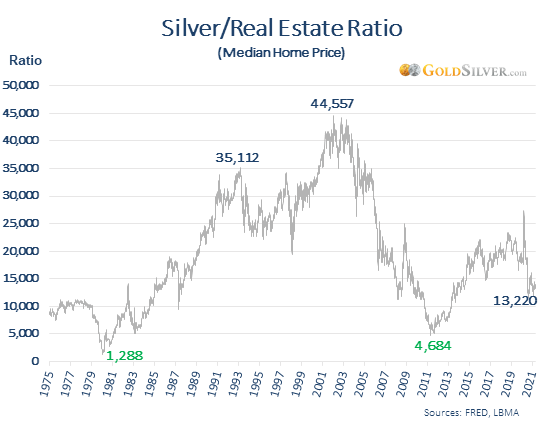

What about silver? Less efficient than gold, because of bigger supply available, but not too bad either.

I guess there is no point in charting the above ratio with regard to Bitcoin.

T-bills are the only form of government debt worth holding, why? You cannot go on in your daily life without paying fiat cash for goods and services and nowadays a short-term government liability is a far better trade-off compared to banks’ deposits that are not “cash” but a bank liability. This means that, in theory, if the bank goes bust your savings beyond the FDIC-insured amount are supposed to go bust too. Considering the FDIC only has assets to cover 1.17% of all deposits outstanding that looks pretty risky to me (and agencies in other countries aren’t in better shape either)

Rule #2: Buy assets that have “artificial” scarcity

Stocks are the king of this category, but not any type of stock. Should you buy companies that invest in the real economy and pay dividends from their (if profitable) operations? Of course not, and the reason is pretty straightforward: if the underlying economy is going bad, how do you expect them to perform well?

Companies that mastered the dark powers of financial engineering to the extreme are the best in this case, why?

1 – Never-ending stock buybacks simply decrease the number of shares outstanding so, all things being equal, they artificially inflate the price of a security.

2 – Big asset managers love these types of companies because, all things being equal, just holding shares increases the percentage of shareholding in the company while the price is being artificially goosed. These asset managers’ holdings, even if officially still part of the “float” in reality are not so the more asset managers of this type you find among a company shareholders group the higher the effective “scarcity” of the stock in the market (and consequently the more powerful the stock buybacks).

Apple is the best example of this to the point the whole company is effectively a big fixed-income hedge fund that happened to sell iPhones: “Apple Is a Hedge Fund That Makes Phones – WSJ”

Be careful though, everything has a limit and companies cannot buy back their way to the sky without making a real profit from their operations because, ultimately, they do need cash to buy back their own shares. Furthermore, the buybacks need to be greater than the shares they themselves are printing out of thin air to reward their management. This is why a company that exaggerates with buybacks might be a good short-term play, but in the long term the lack of (productive) CAPEX and R&D expenses will ultimately hurt the business, the revenues grow and ultimately the Free Cash Flow necessary to keep harnessing the dark powers of financial engineering even in the era of QE infinity.

Rule #3: Stay away from “hopes and dreams”

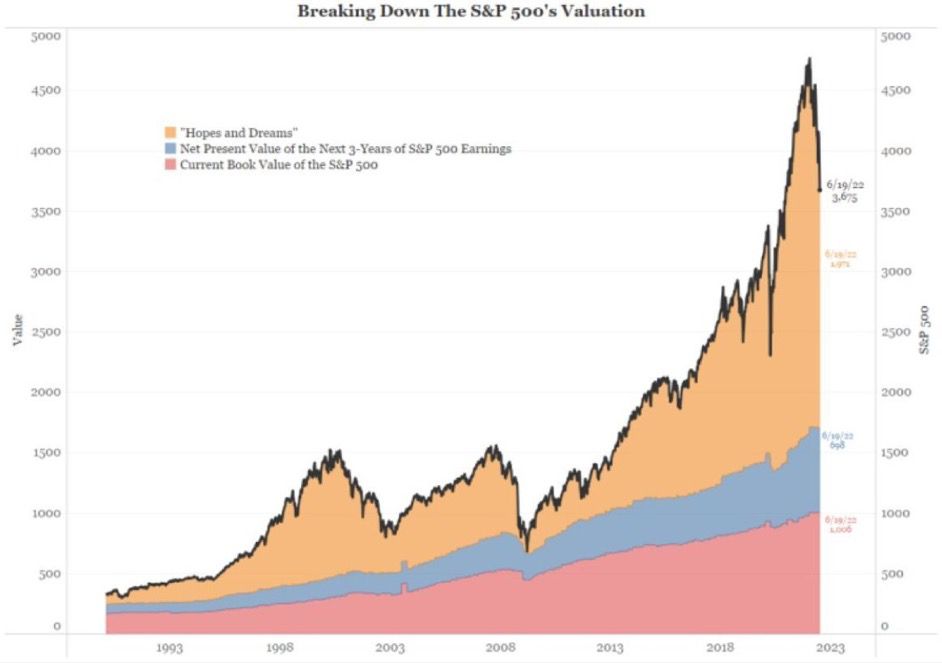

Investing in an exuberant stock market where “everything goes up” is one of the most difficult tasks because it is very easy to start pricing “hopes and dreams” and losing touch with the reality of each company business. The chart below I borrowed from @peruvian_bull is the best one I came across lately to picture how much stock prices in the US (and the same is happening in Europe and Japan) are being inflated by investors stampeding one on top of the other to buy stocks at valuations that are completely unrealistic.

Never forget, that a company’s total market cap is simply the total number of outstanding shares multiplied by the settlement price of the last trade. Yesterday’s NYSE “glitch” shows you what can hypothetically in the moment there are no willing buyers are left in the market 1929 style.

If you think “this time is different” because Central Banks and Governments got you covered I am afraid that is not the case since inflation and wealth inequality will bring society to the brink of forcing governments to change course if they do not want to risk social unrest (as happened over and over again through history)

Rule #4: “Stay away from frauds”

WeWork, Enron, and Wirecard are the best examples from the past, every single time both bulls and bears end up being hurt badly by frauds. The first category is on the way up, the second when it all implodes and because of the “recency bias” bulls will refrain from selling and get out before it is too late because they will simply refuse to acknowledge the fraud itself. How to spot a fraud? Believe me, if something is “too good to be true” in 100% of the cases it is indeed a fake.

I touched upon before what you should do to truly build long-term wealth in “IF YOU WANT TO BECOME RICH, THERE IS NO POINT IN TRYING TO TRADE A STOCK MARKET CRASH, BUT YOU SHOULD START PREPARING TO TAKE ADVANTAGE OF THE NEXT CYCLICAL BULL RUN THAT WILL COME AFTER” and based on the above rules I disclosed my “bearish” longs several times (post), I hope this article will help all of you to navigate these crazy times because money printing will not last forever and you better be positioned in a safe spot when that happens.