Emmanuel Macron’s decision to call snap elections in France after the disastrous results of his party in the latest European elections not only caught his fellow European leaders completely by surprise but also caught the ECB completely unprepared to deal with last week’s panic in French financial markets.

Beware, financial markets love two things: money printing and political stability. When they can get both, everything is awesome. However, similar to a body without a leg, if one of the two is missing it’s hard for financial markets to run.

In 3 weeks, France might find itself in the situation of having a President from one party that the population isn’t supporting anymore and a prime minister who is an expression of a parliament controlled by another party that holds views that are the complete opposite of Macron’s on pretty much every topic. Why does this situation pose a significant problem in terms of political stability? Because (in theory) it will be very hard for any legislation to be passed considering Macron and Marine Le Pen (France’s far-right party leader) can hardly agree on anything, especially on domestic policy.

The current situation has only happened 3 times in the recent history of France:

- 1986-1988:

- President: François Mitterrand (Socialist Party)

- Prime Minister: Jacques Chirac (Rally for the Republic, right-wing)

- 1993-1995:

- President: François Mitterrand (Socialist Party)

- Prime Minister: Édouard Balladur (Rally for the Republic, right-wing)

- 1997-2002:

- President: Jacques Chirac (Rally for the Republic, later Union for a Popular Movement, right-wing)

- Prime Minister: Lionel Jospin (Socialist Party, left-wing)

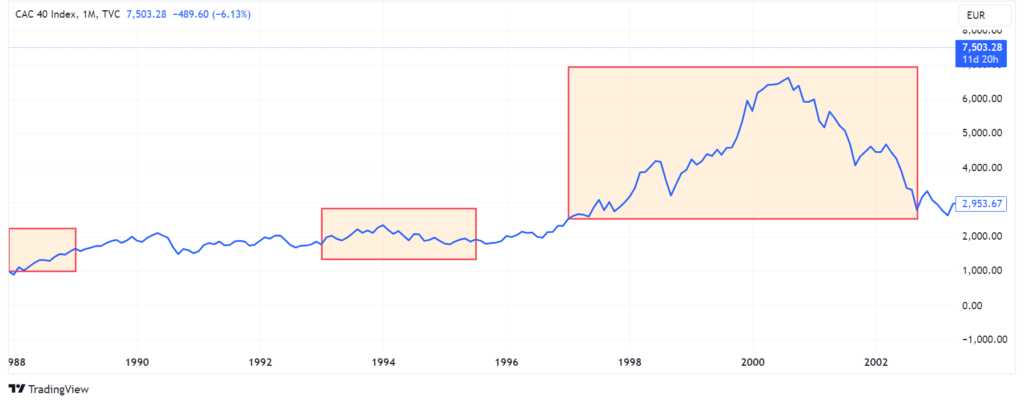

How did the French stock market perform during those times? As you can see from the chart below, the “cohabitation” ultimately never triggered a stock market crash of any sort.

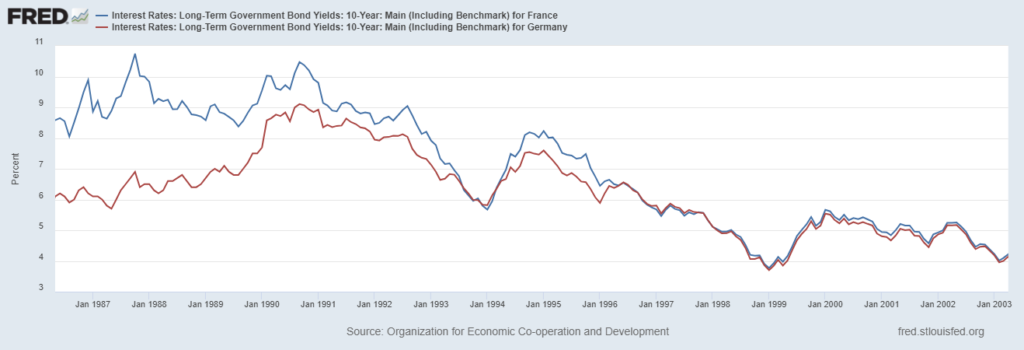

What about the government bond yield? As you can see from the second chart below, including both French and German government bonds 10 years yields, the “cohabitations” if anything only had a brief impact on the spread between the two.

Last week the French CAC40 lost 6% with even the ECB stepping in to try to calm markets according to MSM. Frankly, it was all so hilarious, even more so if you consider that in about a month France will host the Olympic Games, and no matter the party’s beliefs, no politician would risk bringing shame on its own country when the world’s spotlights are all over it. Not surprisingly, this news was published during the weekend: “France’s Le Pen says she won’t seek Macron’s resignation if far-right wins snap election”.

Personally speaking, I expect a rebound in French and European stocks this week with the MSM surely jumping on the “sigh of relief” narrative. Furthermore, the coming Wednesday US Markets holiday will surely impact liquidity already quite low across the board at the same time traders will be gearing up their books to squeeze as much profit as possible from their bullish options positions into the upcoming OPEX on Friday.