It’s been some time since I first rang the alarm bell about the crisis unfolding in the Commercial Real Estate sector (#CRE) in the US. Banks’ risk departments were largely ignoring this crisis, an issue I highlighted in my previous post, ”The great paradox of CRE lending: while owners are freaking out, banks are chilling”.

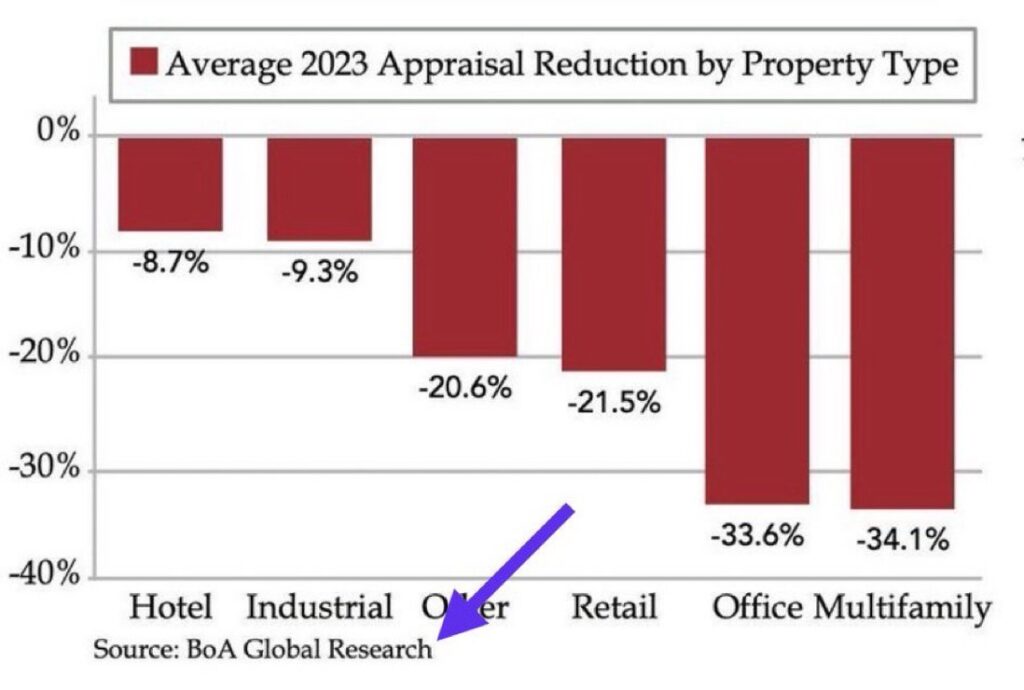

Just to give some specific examples: Bank of America’s accounting and risk departments were completely dismissing any risk (BANK OF AMERICA WENT “CRAZY” IN Q4). Yet, its own research department was publishing a chilling piece of research on the value of real estate properties in 2023.

In the last quarter, my personal favorite was #HSBC. Its financial report claimed a sharp improvement in China’s real estate sector, to the point that it was justified to REDUCE the reserves against potential losses (IS HSBC CEO “UNEXPECTEDLY” LEAVING BECAUSE THE BANK WON’T BE ABLE TO HIDE ITS PROBLEMS FOR MUCH LONGER?). Two weeks after HSBC claimed this, China’s real estate prices recorded the biggest decline EVER.

I want to make it clear, that every single bank out there is doing the same in some shape or form because the problem is global. It’s happening from the US to China, to Europe (THE INCOMING GERMAN REAL ESTATE MAYHEM).

Deutsche Bank (#DB) is the latest example of a bank pretending that everything is awesome in their financial statements, while a lot of what’s inside is burning or auto-combusting.

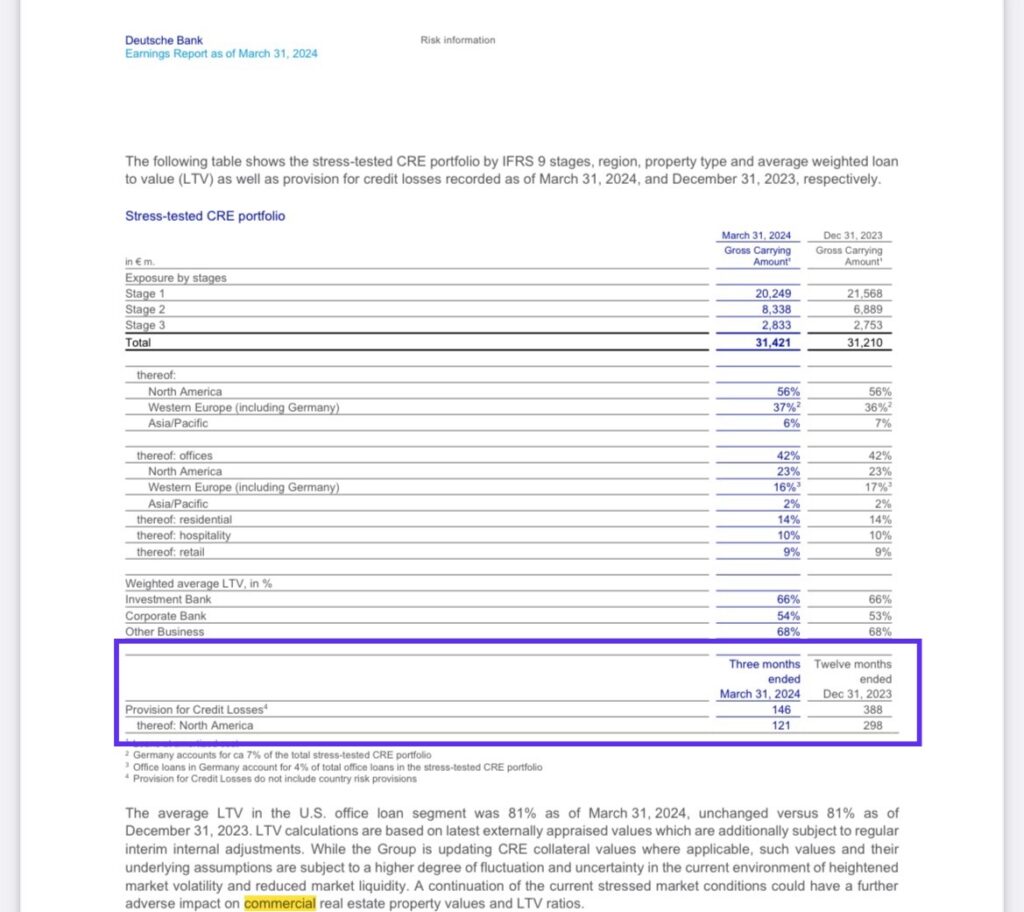

On the 25th of April 2024, we saw “Deutsche Bank expects fewer U.S. commercial real estate provisions in the second half”.

Then on the 5th of June 2024, we saw “TPG Buys Two Manhattan Office Buildings for Residential Conversion”.

- Guess who was the seller of this property? Deutsche Bank (through DWS, their asset management arm).

- How much did Deutsche Bank pay for these properties in 2014? ~500m$

- How much is TPG buying the property for? ~150m$

That’s right, Deutsche Bank is booking a ~350m$ LOSS on this transaction. What’s worse? This loss was TWICE the total amount of gross reserves for credit losses the bank allocated against its 31.5bn Euro Commercial Real Estate portfolio in their latest quarterly financials.

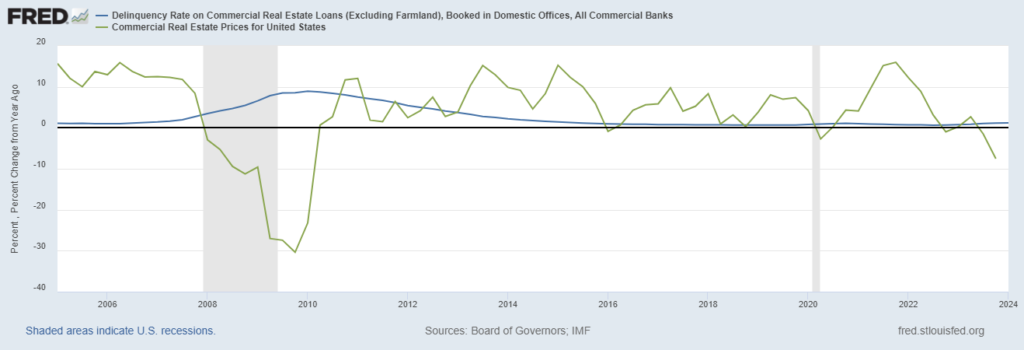

I hope the evidence is now sufficient to agree that banks are blatantly lying about the “Mark to Market” value they are assigning to their Commercial Real Estate assets. This is greatly reflected in the figures they do report every week to the regulator with “Delinquencies” at very low levels despite everything that’s happening. Moreover, now CRE prices’ sharp decline is inexorably surfacing in the official statistics as well.

By now, no one should be surprised anymore about the fact that official data are greatly misrepresenting the real state of the economy. Look no further than what the BLS has been doing for a while now with jobs (here) and inflation (here).

A name mostly unknown to the general public, Norinchukin Bank, might become the first big casualty of the unfolding mayhem in the Credit market. This could be triggered by the implosion of Commercial Real Estate asset values that we are already seeing (if it hasn’t happened already).

Personally, considering where #inflation, wealth inequality, and #stocks stand today, I don’t think they will be able to sell a massive trillion-dollar bank bailout to the public this time around. The best they can do is coordinate to kick the can down the road till after the US Elections in November this year, as discussed a few days ago in “HOW TO TAKE ADVANTAGE OF DUMB (CENTRAL BANKS) AND DUMBER (GOVERNMENTS)”.