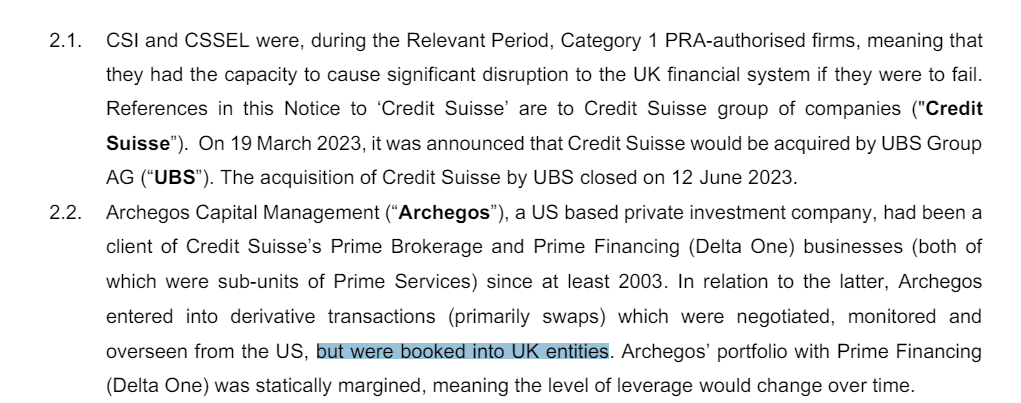

If you are a Prime Broker dealing with a US client involved in “questionable” trading activities in the US, how are you going to deal with that to keep doing business while staying at a safe distance from the US watchdog? Easy, you carry on the business from a different country. This is exactly how Credit Suisse dealt with Archegos, as you can see in the first exhibit from the “Final notice from PRA to Credit Suisse” where PRA is the UK “Prudential Regulation Authority” here.

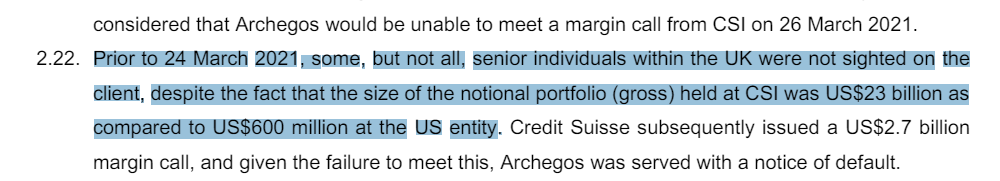

As you can see in the next Exhibit, only 600 million dollars of the Archegos portfolio in Credit Suisse was booked into the US entity, while 23 billion dollars were in “Credit Suisse International”, the UK one. However, there is a juicier part in this exhibit: “some, but not all, senior individuals within the UK were not sighted on the client”. Shocking, isn’t it?

Now let’s have a look at the various steps Credit Suisse took to help its prized client.

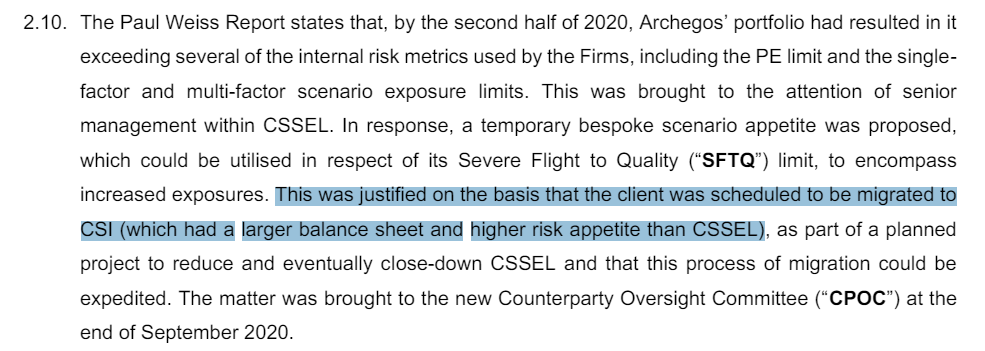

Step 1 – Move the positions to an entity with more capital.

Originally, Archegos trades were booked in Credit Suisse Securities (Europe) Ltd (CSSEL), but then they became too large and too under-collateralized to be carried by that entity, so it was decided to “migrate” Archegos position to Credit Suisse International (CSI), an entity with much more capital, in the second half of 2020.

Step 2 – Attach a very low-risk profile to Archegos.

Credit Suisse risk management agreed to assign risk margins to Archegos just slightly below “AAA” sovereign entities and above the average of other clients in CSI, even if in the second quarter of 2020 there were loud warnings about Archegos trades being in distress.

How did that compare to terms offered to Archegos by other Prime Brokers? Not surprisingly, CSI ones were very favorable.

Archegos and Credit Suisse were so cozy that, even if Archegos portfolio positions started to change in 2020 and become riskier, the bank still allowed its client to enter into Total Return Swap (TRS) transactions that would have required minimal Initial Margin requirements.

Step 3 – Don’t mark to market the positions.

Yes, CSI was applying a “Static Margin” to the Archegos portfolio, meaning that even if market prices moved substantially against those positions, they were not promptly issuing margin calls to cover for the negative value in derivatives transactions. Consequently, instead of issuing a 1.5 billion dollar margin call to Archegos in March 2021, CSI asked for 250 million dollars (and Archegos ignored them).

Step 4 – Allow the client to roll in the future the loss-making positions.

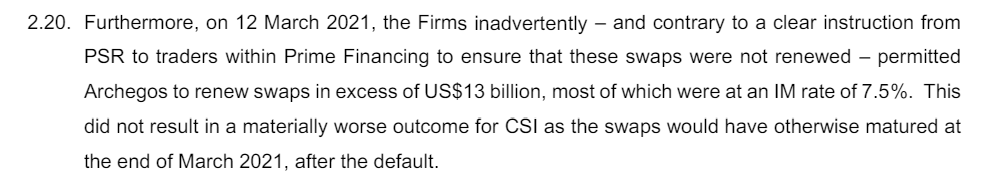

This is a part of the document I find very funny; apparently, on the 12th of March 2021, Credit Suisse “inadvertently” allowed Archegos to extend 13 billion dollars of swaps that would have otherwise matured by the end of March 2021.

As if this wasn’t enough, the UK’s PRA claims, “This did not result in a materially worse outcome for CSI as the swaps would have otherwise matured at the end of March 2021, after the default”. Hold on a second here, didn’t Archegos default on the 26th of March 2021?! The answer is “Yes,” and it’s even written a paragraph later in the same Notice.

At this point, I believe there is no more doubt to what extent Credit Suisse went to accommodate its prized, high-fee-generating client.

Ok, now let’s move to the next part and focus on Credit Suisse’s underreporting losses.

On the 19th of February 2021, CSI started to panic a little bit (euphemism), and the risk managers now began to push for applying “dynamic margining”, meaning margins on the mark-to-market value of Archegos positions.

“if adopted, these terms would have yielded an average margin of 16.74%, leading to approximately US$1.27 billion of additional IM. This would, however, have been less than half the US$3 billion figure which PSR knew had been calculated as the amount of additional IM needed if the relevant dynamic margining rules had applied.”

Guess what? No decision was taken till the 8th of March, despite the “urgency” of the situation. I wish this was a joke, but no, this is what was decided at that meeting: “The actions arising from the meeting were for the client to be transitioned to dynamic margining in the near future or for the client to post an additional US$250 million in margin by 15 March 2021.”

Yes, my dear readers, instead of asking for 3 billion dollars, they asked for 250 million.

The losses were there, though, right? So, what did Credit Suisse’s risk management do? “In the weeks that followed, rather than obtaining further margin from Archegos, PSR and CRM posted US$2.4 billion of variation margin (“VM”), being a release of margin in excess of that required as agreed between Archegos and Credit Suisse, to the client.”

Exactly, Credit Suisse started to directly shoulder Archegos losses.

While all the above was happening, on the 12th of March 2021, Credit Suisse “inadvertently allowed Archegos to extend 13 billion dollars of swaps that would have otherwise matured by the end of March 2021” as we saw above.

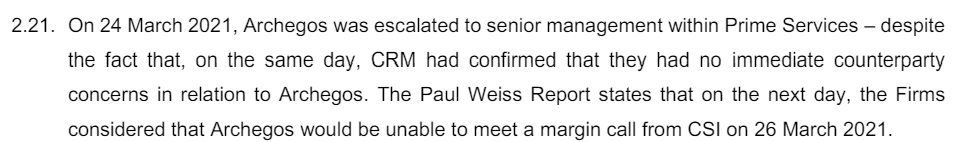

On the 24th of March, 2 days before Archegos’s spectacular implosion, Credit Suisse finally issued a 2.7 billion dollar margin call that, as we know, was ignored.

What did the Prime Brokers counterpart of Archegos do before all the events started to become of the public domain? As reported by the Financial Times “Archegos banks discussed co-operation to head off selling frenzy”. Was the regulator being informed of anything that was happening? Nope.

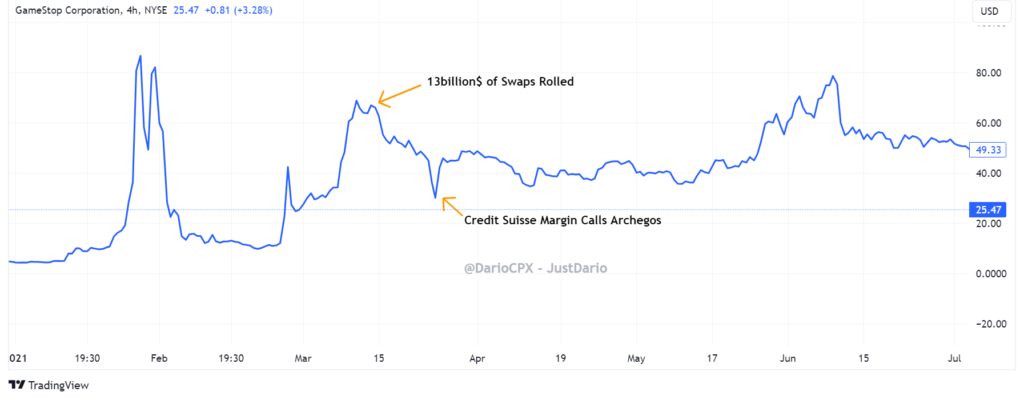

Today we know that Prime Brokers’ liquidation of Archegos positions was totally chaotic and that Credit Suisse was the slowest one to move. Now tell me, how is it possible that Credit Suisse only reported 5.5 billion in losses out of a 26 billion dollar portfolio of highly exotic and illiquid derivatives when the underlying stocks like Viacom, Paramount, or GSX linked to those derivatives crashed 50%+ in 2 days? Did Archegos’s short position offset that? As we saw above, in 2020 Archegos was carrying short positions not offsetting its long ones, so no. Very likely Archegos’s short positions significantly increased the amount of losses, being shorts potentially uncapped by definition. Now have a look at this chart here; do you notice anything weird after reading all I wrote so far? Let me help you.

- The 12th of March 2021 is when Credit Suisse “inadvertently allowed Archegos to extend 13 billion dollars of swaps that would have otherwise matured by the end of March 2021″, as we saw above”. When did GME stock price peak and start to crash for the second time? The 12th of March 2021… what a coincidence.

- On the 24th of March 2021, Credit Suisse issued margin calls to Archegos without receiving any collateral. Again, coincidentally, at the very same moment, GME price resumed to go up.

Was Archegos short GME like many other hedge funds at that time? We have no public documents to confirm that (yet), but what are the chances that the unfolding of events between Archegos and Credit Suisse coincide so well with the price action of a very specific stock among thousands of listed ones?

Were Archegos’s competitors, aware of the short positions, starting to step on the gas and buy GME stocks to short squeeze Archegos’s Prime Broker as soon as it was clear Archegos did not have assets to cover its margin calls? Again, another coincidence.

Two years later, Credit Suisse went bust, apparently due to a bank run and not because it was insolvent, and its liquidity crisis simply allowed that to surface… Then how to explain why Credit Suisse clients started to ask for their deposits back if the bank was in reality in good shape and meeting all its regulatory capital requirements? What were they worried about? Ah, who knows, but I kind of have a gut feeling those 13 billion dollars in swaps “inadvertently” extended in the future have something to do with that.