“Higher stock prices will boost consumer wealth and help increase confidence, which can also spur spending. Increased spending will lead to higher incomes and profits that, in a virtuous circle, will further support economic expansion.” This is how on the 5th of November 2010 the almighty Ben Bernanke himself was justifying #FED printing money out of thin air (“Aiding the Economy: What the Fed Did and Why“). In 2013, when it was already clear things weren’t really going as Bernanke presented them 3 years before and all you could see were only stocks going up with little to no “trickle-down” effect into the economy, then “Bernanke Admits To Congress: We Are Printing Money, Just Not Literally”.

More than 10 years down the road, the negative effects of Quantitative Easing are now clear to everyone, even to stones:

- Inflation: #QE led to higher inflation because too much money chases too few goods, eroding purchasing power.

- Asset Bubbles: Excess liquidity leads to asset bubbles in markets such as real estate, stocks, or bonds, which can burst and ultimately cause economic turmoil.

- Income Inequality: QE disproportionately benefits those who own financial assets, widening the gap between the rich and the poor.

- Diminished Returns: Over time, the effectiveness of QE diminishes, requiring larger and larger purchases to achieve the same economic effect.

- Distorted Market Signals: By artificially keeping interest rates subdued, QE distorts the true cost of borrowing and risk, ultimately leading to inefficient investment decisions.

- Increased Public Debt: QE mainly involves the purchase of government bonds, encouraging higher government borrowing, larger deficit spending, and ultimately increased public debt levels.

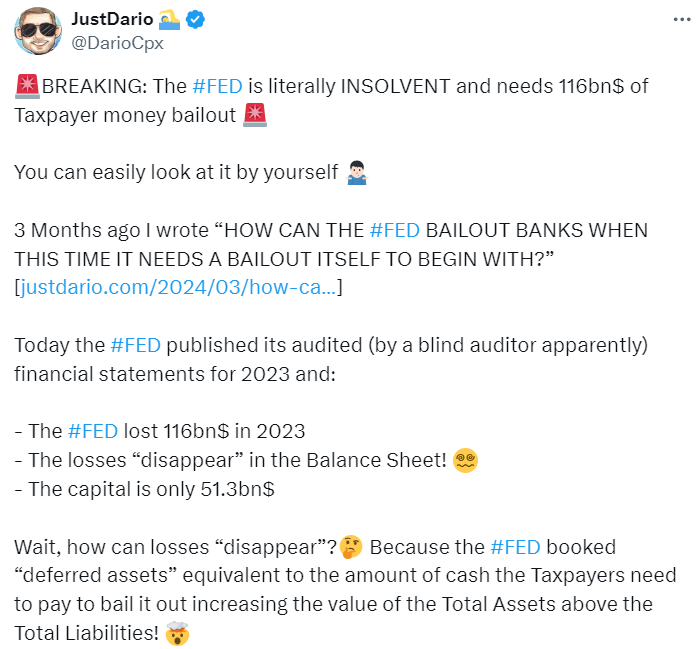

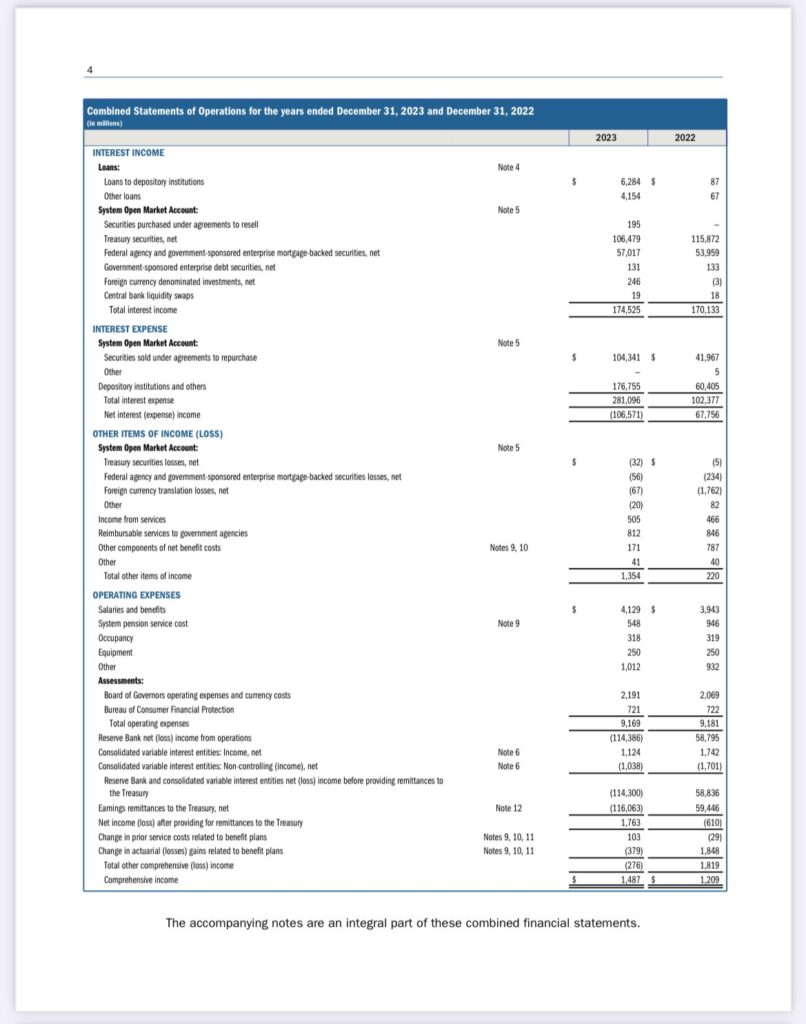

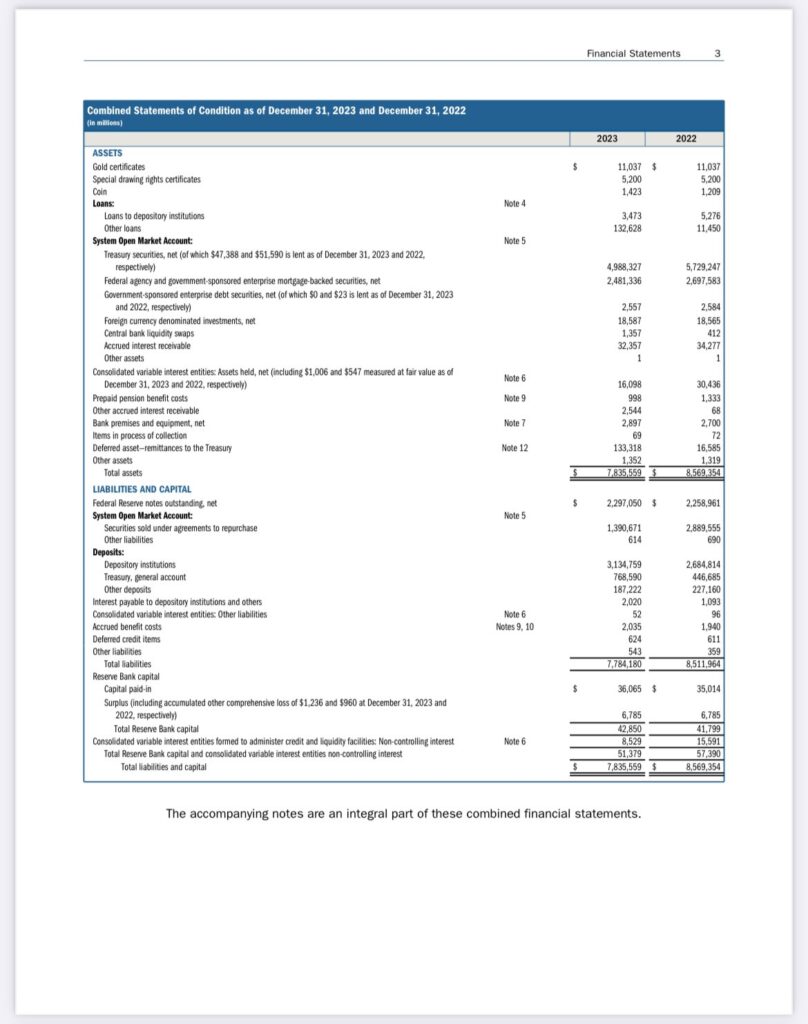

- Central Bank Balance Sheet Risks: The central bank’s balance sheet can become loaded with assets that may be difficult to unwind without disrupting financial markets. If you have not read it yet, I suggest you take a few minutes to read “HOW CAN THE #FED BAILOUT BANKS WHEN THIS TIME IT NEEDS A BAILOUT ITSELF TO BEGIN WITH?”

- Financial Instability: Prolonged QE leads to financial instability, in particular, due to over-leveraging and increased risk-taking by investors.

Ehi Dario, didn’t you get the news that most of the major central banks stopped QE a while ago? Yes, I did, but I am afraid QE was not stopped but simply disguised, as you can see in the two examples below:

- Rather than inflating their assets balances, central banks instead pushed their capital (that sits on the liabilities side) deep into the negative. How can they then keep their balance sheets “balanced”? Very simple, as I explained in the post below several months ago that focuses on the #FED (but SNB, ECB, and Co. are all doing the same), Central Banks book a “deferred assets” credit towards governments and that also compensates the operational losses in the income statement and voila’.

- The US Treasury has been delivering ~800bn$ of “Stealth QE” in the past 12 months, as explained very well in the paper “ATI: Activist Treasury Issuance and the Tug-of-War Over Monetary Policy”

However, China broke out of the pack a long time ago after figuring out the significant long-term dangers for social stability, economic growth, and social well-being posed by quantitative easing. Paradoxically, China shifted to a “capitalistic” approach to the market, where the private sector is supposed to not only enjoy profits during the good times but also bear losses in the bad times. Meanwhile, on the other side of the globe, we are still seeing profits being kept private while losses are then dumped onto the public which is forced to pick up the bill of endless and more and more expensive bailouts. What a paradox right?

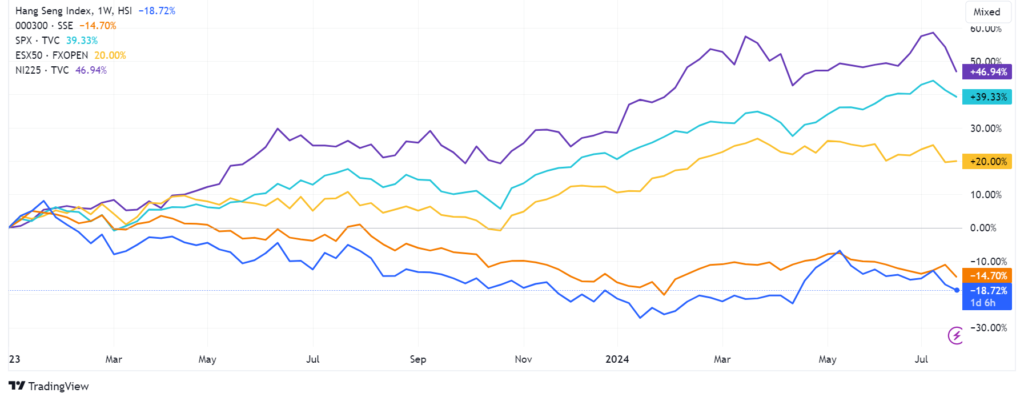

The great shift in policy is crystal clear if you observe the performance of China’s stock indexes compared to those of other major economies.

I already wrote many months ago in “A MESSAGE FROM #CHINA : DEBT DETOXING IS GOING TO BE LONG, PAINFUL AND NEEDED NOT TO RISK THE ECONOMY DIES OF OVERDOSE AT SOME POINT” how the country embarked on a profound restructuring of its system, shifting away from what ended up being an increasingly problematic “western” approach to drive the economy growth and development, shifting to a healthier and more sustainable in the long term.

Now the real question is, who is going to be the next major economy that will abandon QE? In my humble opinion, I believe the US is next in line because its debt growth is very close to catching the escape velocity and starting to go parabolic. What if the FED cuts rates? The cost of debt isn’t the real problem here; the big problem is the ballooning deficit spending that keeps adding up piles of debt on top of each other with no plan in sight to repay any of it in the future. Perhaps because cutting the deficit spending will push the economy into a very painful recession no government running for re-election every 4 years wants to take the risk for. However, the moment will come when the pain inflicted on the population by inflation and wealth inequality will start impacting voting intentions significantly, leaving the administration with no choice but to start addressing the problem. Once the US manages to put itself back on a strong and sustainable economic footing, then a big “Marshall Plan” to help the #BOE, #ECB, the #BOJ, and other “allied” central banks will likely be prepared by the FED since all these I mentioned do not have the strength to ensure their economies only endure an economic recession rather than a traumatic and long depression.

A little ironic that a place considered less free market is actually trying to let the market function. Perhaps also drawing some inspiration from other countries’ “lost decades”.

Elsewhere, a generation of policymakers has only known kicking the can down the road and taking the easy way out. Or blindly adhering to ideology of “trickle down wealth effects”. No course correction until it’s forced upon you.

Sadly in the short term, I await further shenanigans and new acronyms for money printing and rescuing the chosen few stocks.