The current market structure, though robust on the surface, maybe one of the most fragile in history. On one side, you have investors, both retail and professional, who tend to #FOMO into anything that rises (although professional investors call that the “momentum” strategy). On the other side, you have algorithms that appear complex and sophisticated but, in reality, run simplistic, iterative trading patterns on a loop, implementing strategies back-tested on a reality very different from today’s. Anyone who has spent serious time dealing with risk properly knows you always have to be ready to handle “unknown unknowns” at any time. However, risk management today is often delegated to emotions (”if trouble hits, I can just log in to my broker app and click the sell button”) or to predetermined thresholds (aka “stop losses”) that rely heavily on transmitting order-type scripts, which can easily flood the market and jam exchange systems if triggered simultaneously by a large enough number of them.

Do you think what I am talking about cannot happen? Think about the 1987 crash. Ok, today there are circuit breakers to handle that, you might argue. Well, what about 2010 when circuit breakers weren’t fast enough to beat high-frequency trading algorithms? [The 2010 ‘flash crash’: how it unfolded] . Do you think the market improved after that? Well, “Citi Fined €13 Million by Germany Over Fat-Finger Flash Crash”, or just a couple of months ago, “BlackRock World ETF Flash Crashes on Deutsche Boerse as Liquidity Vanishes”.

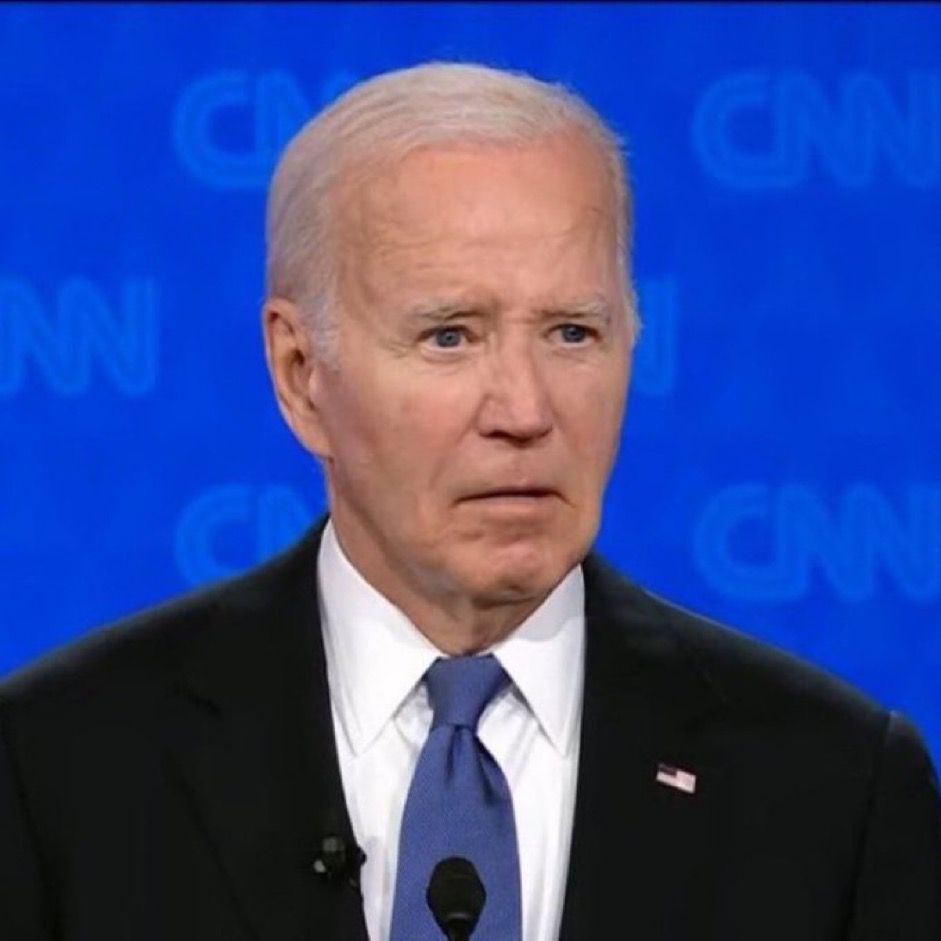

Alright, now that I have your attention, let’s brainstorm a bit on what can happen if an event like the incumbent US President giving up on his reelection campaign occurs a few months before the voting date.

- Scenario 1: Biden makes the September debate, and his performance is good enough to stand for election.

- Scenario 2: Biden drops out of the presidential election before the September debate.

- Scenario 3: Biden makes the September debate, but his performance is as grim as the first one, triggering a last-minute “switch” of the Democratic candidate.

Market Reaction in the First Scenario

If President Biden manages to withstand the September mandate and has a decent performance, it is fair to expect the current market status quo to remain. Objectively speaking, markets have already sailed through both 4 years of Trump and 4 years of Biden, so there should be little worry considering both administrations made most decisions with the primary goal of defending the market bubble at any cost. To be clear, I am not referring only to stocks but also to the credit, real estate, and commercial real estate markets.

Market Reaction in the Second Scenario

If Biden drops out of the presidential race early enough for the Democratic Party to make a considered decision on the best candidate to replace him, I expect the immediate market reaction to be one of stress. In particular, in these situations, those who tend to be more nervous are the fixed income traders, followed by the FX ones. Why? Because fixed income traders notoriously have less tolerance for uncertain environments since the rigid formulas they rely upon start going into tilt like a crazy flipper if they don’t have all the necessary inputs and forecasts due to the uncertain environment. After the initial emotional swings, market participants will quickly start to assess the various risk scenarios for each potential Biden replacement, and the fear triggered by uncertainty will quickly dissipate.

Market Reaction in the Third Scenario

One thing market participants of any kind do not like is chaos. A Democratic Party without an established candidate one month before the presidential election can cause serious damage. Why? Because it will be very hard to project future post-election scenarios, perform risk assessments based on the likelihood of one candidate or another winning, and then position accordingly. In this situation, with many “unknown unknowns,” the only sensible decision is to reduce risk and increase the cash buffer in the book to levels where the risk manager is comfortable that the portfolio can withstand a scenario of high volatility for a protracted time. As I mentioned before, very few people in this market adhere to sound risk management rules; this means they will react first. The second to react will be algorithms due to their high sensitivity to shifts in the market equilibrium and speed of execution, and they will certainly trim risk quickly, aligning with the developing “risk off” sentiment. The third to react will be the “momentum” traders, who will simply tag along the market direction, intensifying the selling with the potential risk of triggering a vicious circle of increasing sales due to the downward pressure on asset prices. The last to react will be the #FOMO traders, not because they did not perceive the increasing risk in the market like algorithms and momentum investors did, but because they are the slowest to execute transactions in the market. I know what you are thinking: if everyone starts selling, everything will quickly crash. Yes, there is definitely a risk of that happening, especially in a market standing on an unbelievable amount of leverage due to the enormous size of derivatives contracts traded nowadays. However, Jerome Powell’s mandate will end in May 2026, not November 2024. What do you expect the #FED to do if there is a serious risk of market implosion like the one during the COVID crash? They will quickly cut rates and flood the markets with liquidity to re-inflate asset prices at any cost, even if it means putting the last nail in the USD-based global currency system’s coffin.

To conclude, assuming near certainty for Scenario 1 to happen at this stage is a mistake. It is always better to be at least mentally prepared in advance for any scenario. Ultimately, if a stampede out of risk into cash occurs, you want to ensure you aren’t standing with your back to the crowd and being steamrolled by it.