ARM is both a joy and a problem for Softbank, why? On one side, the stock is Masa Son’s current jewel of the crown, but on the other, #Softbank owns 90% of it, precluding them from liquidating the investment and gathering badly needed cash to repay its mounting debt.

I addressed #ARM for the first time in August last year in “Is ARM The Canary In The $NVDA Coal Mine?” and then a second time in December when it became clear that the ARM IPO was “A PUMP & DUMP MASTERPIECE”

The ARM IPO lock-up period expired in March 2024, and in theory, Softbank could start selling its massive stake. However, they did not do it. Not because they did not want to, but because they could not do it without enough exit liquidity. As a matter of fact, ARM is such an obvious pump & dump scheme, as many orchestrated by Masa Son before, that neither the institutional investors crowd nor the retail one is falling for it even after his Nvidia buddy “surprised” the market by disclosing a stake in ARM a few months ago (”Nvidia discloses $147.3 million stake in Arm”). Why do I have a strong gut feeling that this hard-to-explain Nvidia “investment” was a move to trigger market #FOMO for ARM and hence serve abundant exit liquidity to Softbank on a silver plate? Anyhow, let’s move on.

The whole situation is becoming so grotesque that the divergence between ARM’s market value and its parent company reached asinine extremes (latest post below)

Now, how can a Softbank in desperate need of cash (”TALES OF A ROARING KITTY AND A TREMBLING SOFTBANK”) finally trigger #FOMO buying for ARM shares? There is only one option left for them: squeeze ARM into major indexes in order to trigger passive funds and ETF automatic buying that till now have been sitting on the sidelines (The Arm IPO is here, but many ETFs will not be buyers).

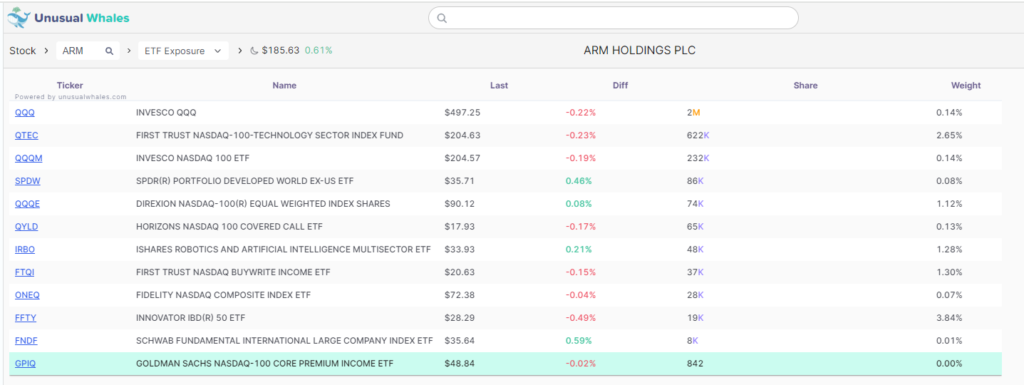

Finally, after months of relentless gamma squeezing, ARM managed to be included in the NASDAQ-100 index on the 24th of June (Arm Stock Joins Nasdaq 100, Replace Sirius XM), and right away the QQQ and similar ETFs started to buy ARM shares. However, as you can see in the screener below from unusualwhales.com, these purchases have been peanuts compared to the 930 million shares Softbank owns.

ARM is due to report results on the 31st of July, and you can rest assured the gamma squeezing will continue till and beyond that day no matter the results the company will publish (results I expect to be very embellished, to not always say “fake”, as usual) because the ultimate goal is to secure a spot in the S&P 500 and in all those indexes that will trigger an avalanche of ETFs buying into the shares regardless of its fundamentals. At that point, Softbank will be able to start the ARM cash-out till it can repay bank loans currently guaranteed by 75% of all ARM shares first and the giant pile of unsecured debt the big holding company carries on its shoulders.

As it happened for Alibaba, WeWork, Door Dash, and countless companies Softbank invested in the past that fell in disgrace after they were done dumping shares, do not expect a different fate from a company currently trading at ~1400 P/E, ~60 P/Sales, and ~40 P/Book ratios. Till then, feel free to tag along with Softbank’s scheme of goosing ARM shares as high as possible, although I wouldn’t risk putting any money near a Ponzi since 99% of both longs and shorts ultimately end up losing a good chunk of it (and this time isn’t going to be different).