“Many observers maintained that the AMR and UAL option activity leading up to September 11 constitutes strong evidence that there had been trading on advance knowledge of the attacks”

In “Unusual Option Market Activity and the Terrorist Attacks of September 11, 2001” published in 2006, the author provided a very detailed analysis of how the trading activity on American Airlines and United Airlines stocks heading into the 9/11 terrorist attack was out of the ordinary, to say the least, in particular with regard to options positioning. However, in 2006 the case was already closed since the SEC published an investigative report in 2004 stating that no evidence of illegal trading activity was uncovered during their investigation: “No evidence of profiting from foreknowledge of 9/11 attacks found”. Remember, the SEC is the same agency that investigated Bernard Madoff and found no evidence of anything illegal too with its operation before it imploded in 2008. No need to provide more examples or further comments on this.

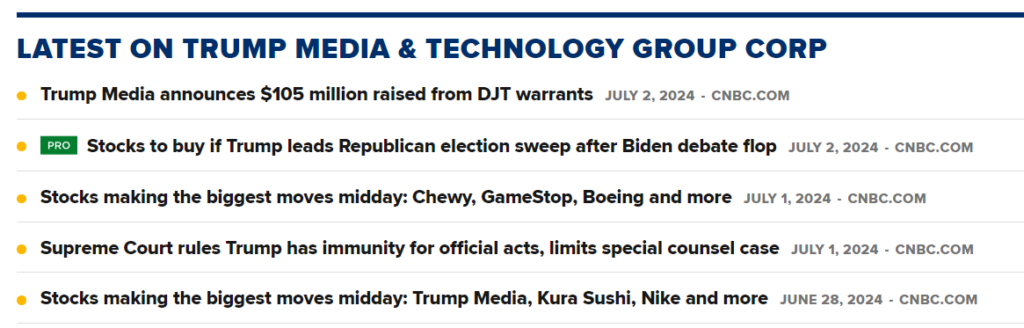

This weekend, the former president and current Republican presidential candidate Donald Trump was the target of a failed assassination attempt. A lot has been shared about this already and many criminal investigators are at work, but allow me to highlight again how in the past years (especially since mid-2023 onwards) any geopolitical event that could have resulted in a spike in risk-off sentiment in the market happened during weekends with enough time for investors to digest the news and any concern before trading resumed on Monday. Will this weekend’s events have any impact on the whole market? Personally speaking, I do not think so, but still, there might be some stocks or contracts that could help us understand if someone might have known something before the events, in particular #DJT.

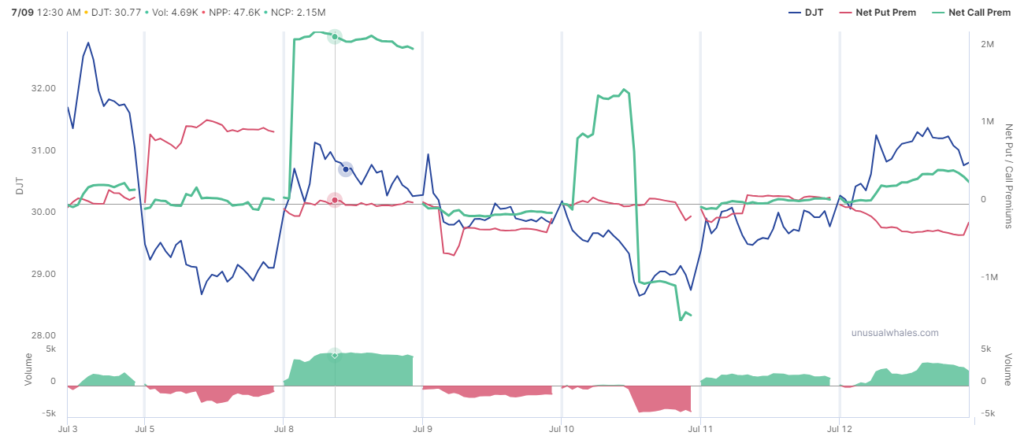

Options activity in DJT last week was particularly interesting. As you can see in the first chart showing options net flow for the past 7 trading sessions, you can easily notice a very large amount of call options were purchased on Monday right after the opening without any particular news on the company or Donald Trump to justify that prior to that.

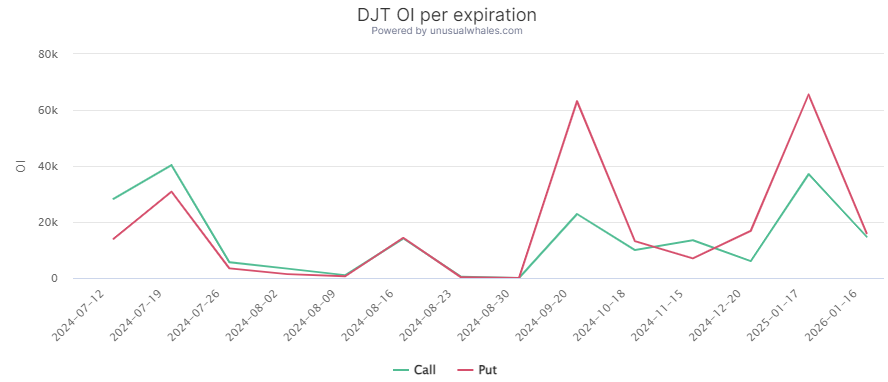

The large call options dump on Wednesday that marked the low of the week is quite in line with the bearishness of the market towards the stock (shorting call options is a trade to profit from a stock price decrease). After that, traders then kept accumulating call options on Thursday and Friday, however, it is easy (and convenient) to argue that was a consequence of the broad market reaction to US CPI data that benefitted small-cap stocks. One thing that clashes with this last statement though is the particular concentration of call option accumulation for very short-term strikes despite the market remaining heavily short-positioned on DJT for the longer term. Furthermore, the flow of longer-term strikes remained balanced.

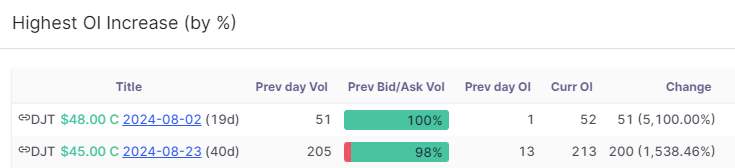

The last interesting thing of last Friday’s flow was the incredibly timely purchase of deep OTM Call options with $45 and $48 strikes and fairly close expiry.

While MSM is doing its best to erase any fear from the public ahead of Monday’s markets open, in particular, to avoid any dangerous VIX spike as I highlighted in this post, surely we can expect a rather big jump in DJT stock price after this weekend’s events. All those investors who piled in DJT call options and bullish trades surely will benefit from it and frankly, it is fair to wonder if they were just incredibly lucky or perhaps someone knew something.