On the 29th of April, something very special happened, yet many did not grasp the importance of the event. Even if that day was a public holiday in Japan, hence there was no real liquidity in the US Treasuries (both spot and related derivatives) market overnight hours as usual, the #BOJ decided to intervene in the market as soon as the USD/JPY FX rate crossed the psychological 160 mark. However, pay attention to the chart, the #BOJ did not intervene immediately but after several hours. Guess why? Because with the treasuries spot traders on holiday and no one that could stay late in the office in the US to pick up their orders (it was a Sunday night), the BOJ could not promptly fetch USD for an outright intervention in the FX market: Sell USD securities to get hold of #USD and then buy #JPY. So what did the BOJ do? The only alternative available to them to trade at that time was the Over-The-Counter (OTC) FX Derivatives market which is mainly covered by international brokers between Hong Kong and Singapore.

- At 1 pm Tokyo time on the 29th of April, when public officials officially resumed working after the customary lunch break (not a joke, it’s a pretty strict rule in Japan), a big jolt hit the JPY that was quickly pushed back down to 155.

- Then a second smaller jolt struck at 4 pm right at the end of official business hours when the FX rose above 157, sending the JPY again back to 155.

- A third intervention happened later that day during US trading hours, this time clearly a “conventional” one since you could observe how the spot rate started to grind downward right before the slam (a sign USDs were fetched in the market and FX dealers started to front-run the trade this time), and JPY was slammed down again to 155.

Now, please compare the change in Japan reserves between March and April, hence isolating very clearly the 29th of April intervention.

- International Reserves/Foreign Currency Liquidity (as of the end of April 2024),

- International Reserves/Foreign Currency Liquidity (as of the end of March 2024)

Here is what you can notice:

- Official reserves are down $11.6bn, where a $16bn drop in “Securities” has been compensated by the rise in value in pretty much all other items. Bear in mind those securities are mostly US Treasuries and Bills.

- Securities lent or on Repo increased by ~ $1bn

- Swaps increased by ~ $0.5bn

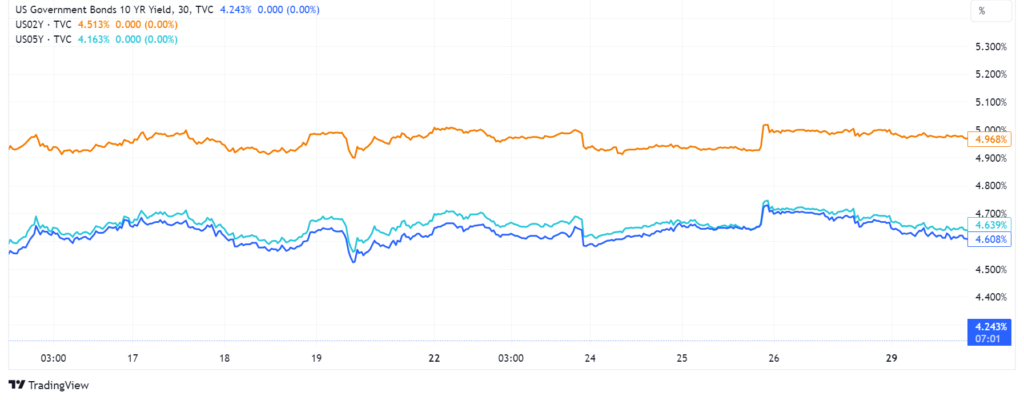

Bearing all these 3 points in mind, now let’s have a look at the US Treasuries market from the 15th to the 30th of April

What do you notice? Yes, there was no particular move in the market and as you can see from the chart below the USD/JPY started to go parabolic exactly at 11:30 am Tokyo time on the 26th of April exactly when the BOJ released its 26th April MPM statement. Clearly:

- The BOJ was caught totally on the wrong foot triggering an opposite market reaction than what they expected

- The BOJ did not expect any need to intervene in the FX market right into the upcoming long Japan holiday (when usually the JPY FX trading remains “quiet”)

Putting it all together, I hope it is now clear that there was no way for the BOJ to sell securities to fetch USD and intervene on the 29th of April when they did intervene the first 2 times. So there was no other way to intervene than in the derivatives market opening transactions that then have been settled later in the day when there was liquidity to eventually sell and settle the securities without disrupting the US Treasuries market.

Technically speaking:

- The increase in the “Swap” amount is likely a hedge on the amount of US Treasuries the BOJ planned to sell (so they hedged the interest rate risk to avoid a big shift in principal value)

- The first and second interventions in the market happened with FX Forwards since the BOJ, being in Japan on holiday and Sunday in the US, could not physically fetch the USD to sell in the open market.

At this point, it is very important to understand the dynamics of the FX forward market and how that impacts the Spot FX rate.

Foreign exchange (FX) forward contracts are derivatives that allow market participants to lock in an exchange rate today for a currency transaction that will occur at a future date. When a client enters into an FX forward contract to sell USD and buy JPY in the future, several dynamics come into play in both the forward and spot FX markets. Here’s an explanation of these dynamics and how brokers hedge the associated risks, which can influence the spot market.

1. Mechanics of the FX Forward Contract

FX Forward Contract Details:

- BOJ’s Position: The client agrees to sell USD and buy JPY at a predetermined future date and exchange rate (forward rate).

- Broker/Dealer’s Position: The broker or dealer takes the opposite side of the transaction, agreeing to buy USD and sell JPY at the forward rate.

2. Broker’s Hedging Strategy

To mitigate the risk of the forward contract, the broker typically engages in a process known as “hedging.” The broker may use several hedging techniques, such as:

A. Spot Market Transactions:

- To hedge the forward contract, the broker may immediately enter the spot market to buy USD and sell JPY. This creates a position that offsets the forward contract.

- By doing this, the broker secures the JPY required for future delivery, effectively locking in the cost of obtaining JPY today.

B. Currency Swaps:

- Another method is using a currency swap, where the broker enters into a swap agreement to exchange currencies today and then reverses the transaction at the forward contract’s maturity.

- This swap involves simultaneous spot and forward transactions, aligning the broker’s positions to mitigate risk.

3. Impact on the Spot Market

The broker’s hedging activity, especially when it involves significant amounts like in the case of BOJ interventions, can influence the spot FX market:

A. Increased Demand and Supply:

- Increased JPY Demand: When the broker buys JPY in the spot market to hedge the forward contract, the demand for JPY increases, which can push the spot price of JPY higher.

- Increased USD Supply: Simultaneously, the broker sells USD in the spot market, increasing the supply of USD, which can push the spot price of USD lower.

B. Market Liquidity and Volatility:

- Liquidity: Large hedging transactions can impact market liquidity. If the broker’s transaction is substantial relative to the market’s normal trading volume, it can cause noticeable price movements.

- Volatility: The immediate impact of these transactions can increase short-term volatility in the spot market as the prices adjust to the new levels of supply and demand.

4. BOJ Base Case Scenario on the 29th of April

To illustrate, suppose the BOJ enters into an FX forward contract to sell $10 billion USD and buy JPY at a future date:

- Forward Rate Agreement: BOJ and broker agree on a forward rate of, say, 160 JPY/USD for a six-month contract.

- Spot Market Hedge:

The broker immediately buys JPY and sells USD in the spot market to hedge this forward contract. Assuming the current spot rate is 155 JPY/USD:

- The broker needs to buy approximately 1.55 trillion JPY in the spot market.

- This increased demand for JPY can drive up the spot rate, causing the JPY to appreciate against the USD.

- Conversely, the increased supply of USD can cause the USD to depreciate against the JPY.

Suppose you put the above base case scenario in a completely illiquid market because of the holiday in Japan, Sunday night in the US, and the “urgency” of brokers to immediately cover their risk. In that case, it is very easy to understand how those sharp JPY moves happened.

At this point, we can discuss why this is a dangerous strategy being pursued by the BOJ.

- As we discussed many times, the main goal of the BOJ here is to trigger hedge fund stop losses (”Hedge funds slash short yen bets by most in more than a decade”) when the market is illiquid in order to achieve larger JPY moves than what their transaction alone would cause.

- However, as I explained for the first time in “WHY A HISTORICAL $JPY CURRENCY CRISIS IS AT THE DOORSTEP OF #JAPAN” the #BOJ is actually depleting its reserves while structurally weakening its reserves balance implying a higher USD/JPY equilibrium FX rate. So effectively what they are doing is trading short-term “relief” for a much larger “pain” in the future. This is also the reason why the USD/JPY weakens faster and faster with every intervention.

- If the USD/JPY FX rate moves quickly up while the FX Forwards are still open, then the “slingshot” effect in the market can be potentially brutal due to brokers quickly rebalancing their positions.

Example of Broker Hedge Adjustment:

- Initial Hedge:

- The broker buys 1.55 trillion JPY at 155 JPY/USD in the spot market to hedge a $10 billion forward contract.

- Market Movement:

- The spot rate moves to 165 JPY/USD.

- The initial hedge is now less effective because the broker’s JPY position is worth less in USD terms.

- Adjustment:

- The broker must sell some of their JPY holdings and buy USD at the new rate to rebalance the hedge. (in our example 1 trillion JPY)

- The broker might also buy a call option on USD/JPY to protect against further depreciation.

As you can quickly understand, that will create selling pressure on the JPY that can quickly “snowball” because of the illiquidity in the market and the speed Hedge Funds can react with HFT algorithms to re-establish their positions just stopped out.

To conclude, what the BOJ is doing is not only completely pointless because it does not address the structural problems its decades of reckless monetary policy created, but potentially can end up accelerating the demise of JPY to a point where it can quickly go out of control and start wrecking the very fragile balance of the trillions of $ of JPY carry trades in the global financial system with consequences very hard to imagine.