Here we are with another episode of the NVIDIA saga when I thought we already brought to light all that was possible, but I was wrong. One important thing to highlight is that in its latest 10-Q NVIDIA did quite a good deal of “cleaning”. What am I referring to? Please go check all that I highlighted 3 months ago in “THE DARK CORNERS OF NVIDIA 10-Q REVEAL THE EXTENT OF THE NVIDIA FRAUD” and compare it with the latest report just released. Do you notice anything? Yes, all the “dark corners” we found out before disappeared. You are welcome, Jensen.

Before sharing with you my latest findings and yet another proof that NVIDIA engineered a sophisticated method to fabricate revenues, let me deliver some tasty appetizers still from the latest 10-Q.

🚩 Appetizer 1: Half of NVIDIA revenues, a 3 trillion company, come from only 5 companies.

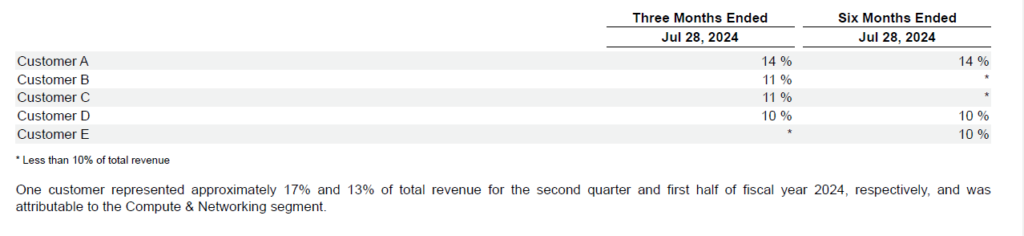

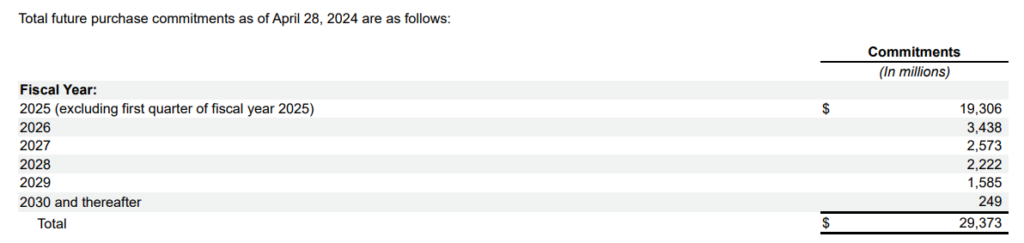

I could not believe my eyes when I saw the below table appearing in the latest 10-Q in the same way I could not believe no one across MSM or social media stumbled into it before me considering the head start between NVIDIA releasing earnings and myself waking up.

The table is pretty self-explanatory, isn’t it? However please have a look at what NVIDIA itself writes underneath the table: “One customer represented approximately 17% and 13% of total revenue for the second quarter and first half of fiscal year 2024, respectively, and was attributable to the Compute & Networking segment”. Is it only me or is there no customer in the table attached to 17% of the revenues? Does that mean that among its large customers, one of them is so desperate to buy GPUs that has also to rely on indirect channels or is it just a typo? Who knows, but surely weird.

It is no mystery that Microsoft is NVIDIA’s largest customer and round-tripping buddy (”MELLANOX, THE CORNERSTONE OF NVIDIA-MICROSOFT REVENUES ROUND-TRIPPING SCHEME”) as well as it is no mystery anymore that its 3rd largest customer SMCI (”NVIDIA’s Third-Largest Customer – Super Micro Computer (SMCI) – Withholds 10-K Filing Just A Day After A Short Research Report”), that now we know for sure accounted for 10% of the firm total revenues in the last quarter, is as well a scam on its own (“HYPERSCALERS” OR “HYPERCHEATERS”?).

Fair question now, if 5 companies alone represent more than 50% of the revenues of NVIDIA how come the company can showcase a 78% profit margin on its sales? Do these very large companies have no bargaining power whatsoever? Of course, they do as we are about to see, but the company is aware of the risk as well and they make no mystery about it.

🚩 Appetizer 2: As a “kickback” to its largest customers NVIDIA keeps buying servers usage

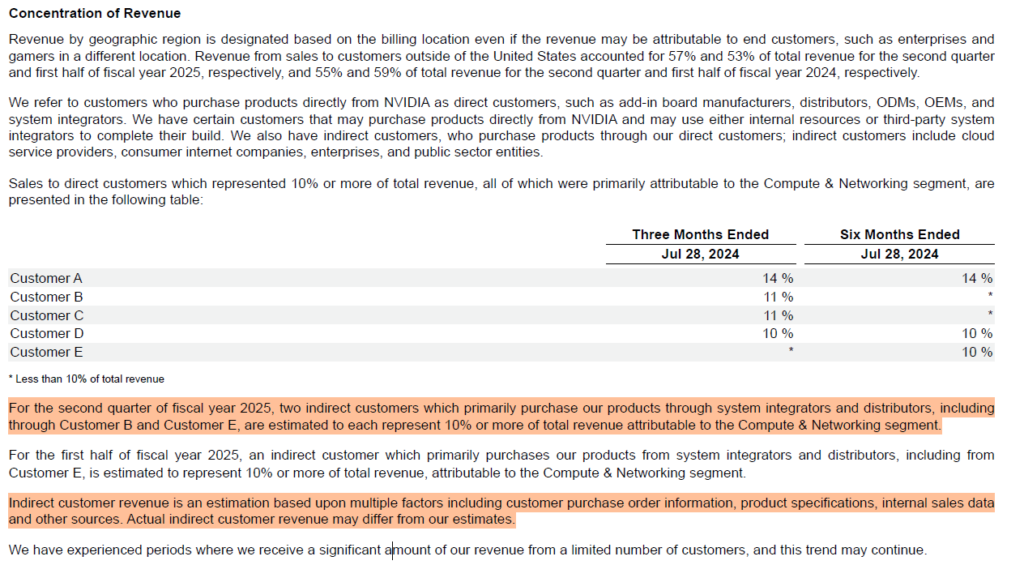

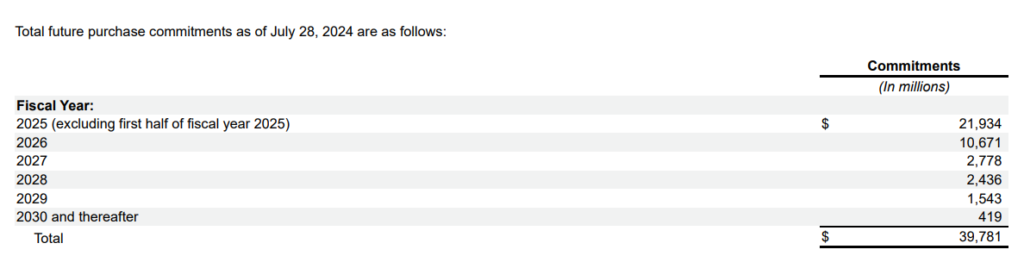

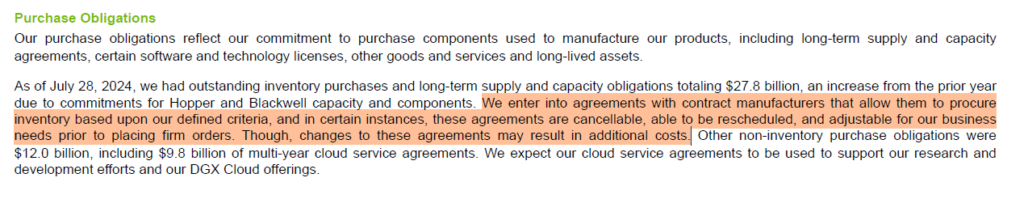

As you can see from the two tables below, from Q1 to Q2 NVIDIA purchase obligations increased by 10 billion USD in the last quarter.

NVIDIA Purchase obligations in Q2

NVIDIA Purchase obligations in Q1

How does NVIDIA justify this very large amount of future commitments? 27.8bn$ are orders for future Hopper and Blackwell GPUs (that as the company highlights can be easily canceled), but 12bn$ are “non-inventory purchase obligations” among which 9.8bn$ are multi-year cloud service agreements (a 1bn$ increase from the previous quarter).

Putting together this element and the fact that NVIDIA largest customers are also large cloud service providers, isn’t it odd that the company providing them the critical infrastructure to deliver their services is buying the very same from them rather than building a cloud server on its own? Revenues round-tripping at their best here.

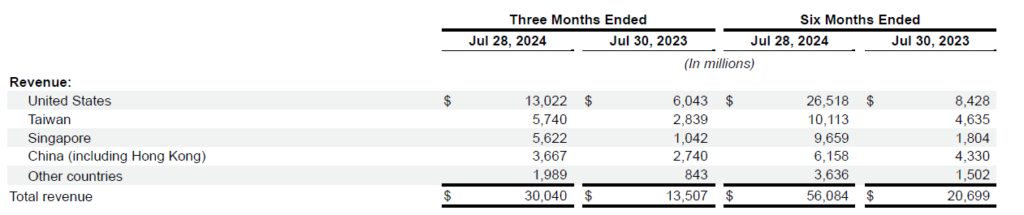

🚩 Appetizer 3: Decreasing revenues in the US are compensated with revenue growth in China, Singapore, and Taiwan.

In order to visualize what’s happening here properly we need to put again next to each other the tables from the two latest reports because NVIDIA, wisely, avoided doing so.

NVIDIA Revenues split Q2

NVIDIA Revenues split Q1

So what do we have here:

- Revenues from the US decreased by 474m$ from Q1 to Q2

- Revenues from Taiwan increased by ~1.4bn$

- Revenues from Singapore increased by ~1.6bn$

- Revenues from China (including Hong Kong) increased by ~1.1bn$

This is what we know from the previous 10-Q and removed from the latest one, “Revenue by geographic areas is based upon the billing location of the customer. The end customer and shipping location may be different from our customer’s billing location. For example, most of the shipments associated with Singapore revenue went to either the United States or Taiwan in the first quarter of fiscal year 2025. Shipments to Singapore were insignificant.” Clearly NVIDIA company in Singapore is a shell company set up to hide the true end location of the final customer. Why does NVIDIA need that? Wink wink.

The same applies to Taiwan which structurally is a country where NVIDIA cannot sell billions and billions of GPUs every quarter. Wink wink.

What about China? How come NVIDIA managed to increase revenues from there despite US sanctions, strong local competition and delays of the less powerful GPU NVIDIA is developing to comply with US sanctions? Wink wink.

We cannot say with certainty that NVIDIA sales in the US reached a plateau because as the company itself tells us, for whatever reason we are not supposed to know, sales billed in Singapore are in reality diverted to either the US or Taiwan, but that decrease in direct sales is a loud warning the US market might have either already reached saturation or NVIDIA competitors are gaining market share.

Alright, it is now time for the main course, let’s dig into it!

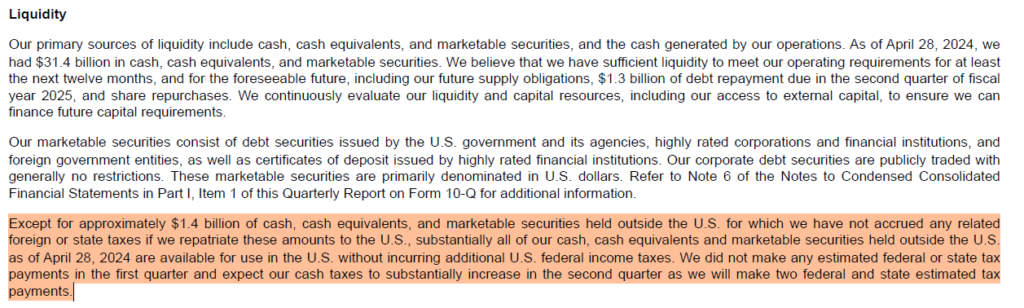

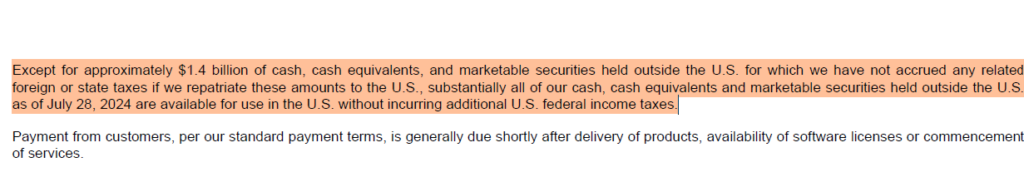

🚩 Main: Employing a trick as old as time, in order to avoid attracting any scrutiny on its revenues from the US government or its regulatory agencies, NVIDIA, contrary to all other mega-cap companies like Apple, is paying all its taxes in the US.

This is the very first odd item I stumbled upon, despite most of its revenues and its suppliers being outside the US, NVIDIA always repatriates all its cash in the US and what’s left outside apparently is not supposed to be subject to US federal taxation. Furthermore, the tiny 1.4bn$ amount of cash and equivalents kept abroad did not change by a penny from Q1 to Q2. Strange isn’t it?

NVIDIA cash held outside US in Q1

NVIDIA cash held outside US in Q2

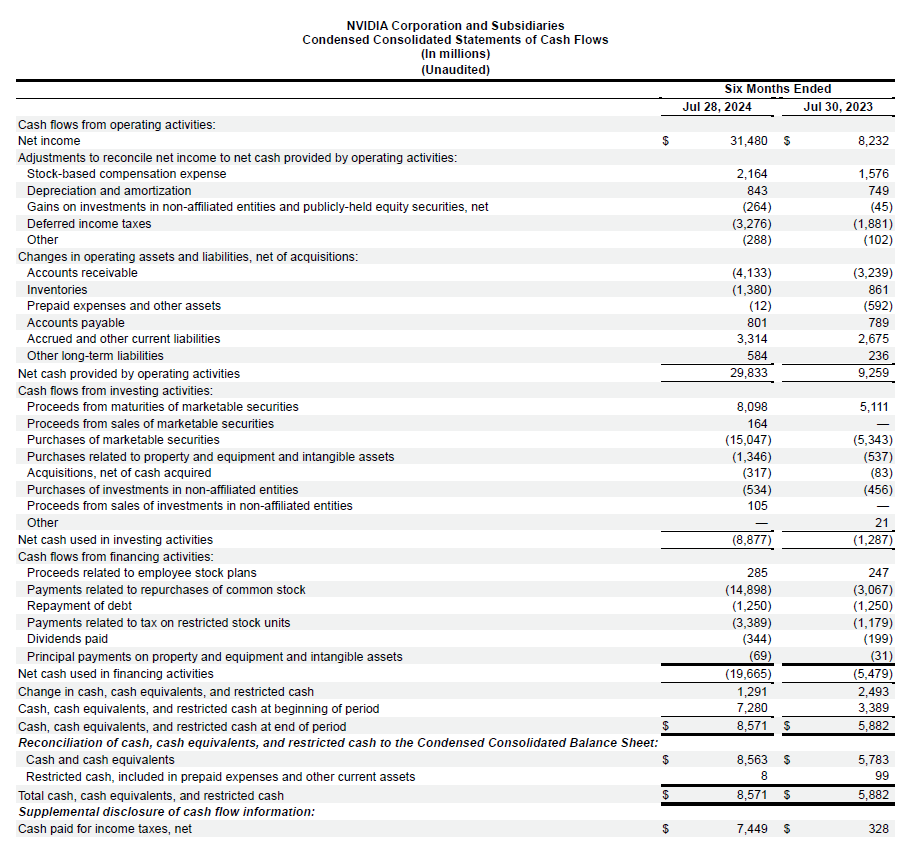

Alright then let’s have a look at NVIDIA taxes that according to the company stood at 2.6bn$ in Q2 out of a 19.2bn$ Income Before Taxes. That is ~13.5%. If we look at the bottom of NVIDIA’s cash-flow statement though we can notice a strange “Supplemental disclosure of cash flow information” that states the company paid a net of ~7.5bn$ in income taxes without saying where those have been paid from across all the items of the statement and placing that right underneath the total sum of cash and equivalents. Does that mean the company did not include that item in cash and equivalents so the total is much lower or are those taxes sprinkled within other items? Maybe NVIDIA will help us with the specific disclosures later on.

Here is the disclosure in Note 5 and no, as you can see, the company does not help to answer our question above

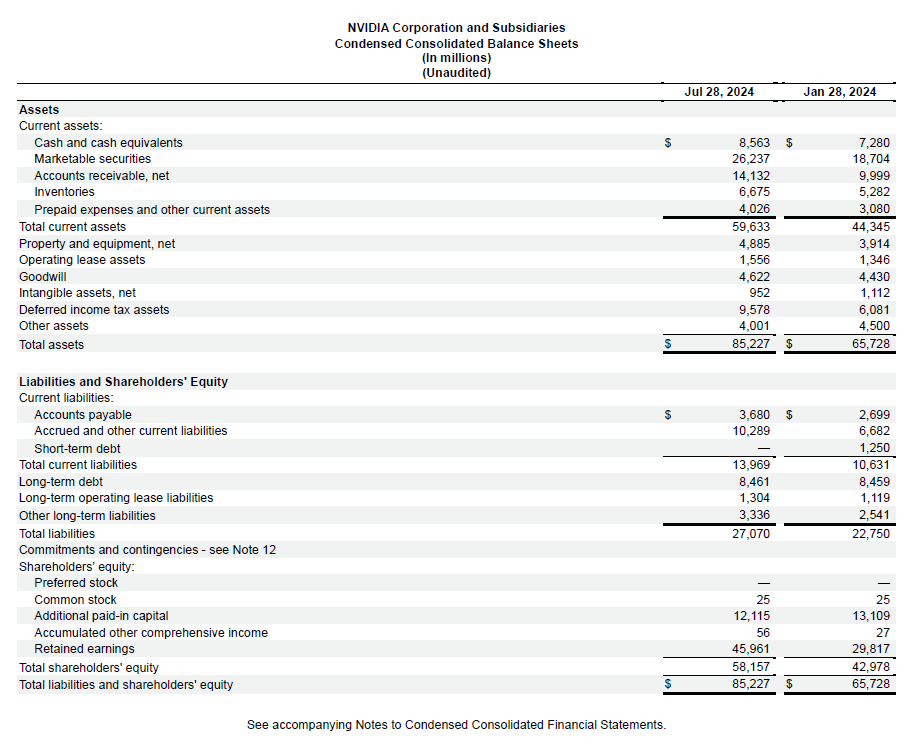

However there is something strange in NVIDIA Balance sheet

Have you noticed it? Let me help, if you check in the Assets side we can find “Deferred Income Tax Assets” totaling ~9.5bn$ in the last quarter. Yes, on the Assets side, that means is cash the company is supposed to receive back from Uncle Sam (because paid in advance). Hold on, why would a company pay more taxes than those it is supposed to?

Imagine you are booking “revenues” that are in reality future orders not yet delivered and/or paid, that means you will still have to pay taxes on them. Wait, what happens if those orders are then canceled as the company itself makes clear it can happen? Then you will have to go back in the previous quarters, write off those non-materialized revenues, and at that point, you can claim previously paid taxes back from Uncle Sam. On the other side, if those orders are then delivered and cashed in, NVIDIA will simply make an accounting transfer from Deferred Income Tax Assets into Cash and Equivalent without pay any more taxes or book any Deferred Tax in its liabilities. Smart isn’t it? Of course, NVIDIA does not provide any disclosure whatsoever about the nature of those deferred income tax assets.

As a comparison to help your understanding you can see how Microsoft instead handles the same issues as we saw in “MICROSOFT REVENUES “ROUND TRIPPING” PONZI SCHEME IS NOW TOO BIG TO HIDE – THE TRUTH FROM THE CASH FLOWS”

The company correctly reported (an astonishingly high) 57.5bn$ of “unearned revenues” among its short-term liabilities. Perhaps because, differently from NVIDIA, they were less adamant to pay taxes on those before cashing them in.

Let’s apply some easy algebra now. If NVIDIA’s average tax rate is ~13.5% and Deferred Income Tax Assets” are “9.5bn$ does not that imply that NVIDIA reported as “revenues” an amount equivalent to ~70.4bn$ of what are in reality unearned revenues? Strangely an amount that covers the one reported by Microsoft, its revenues round-tripping buddy. Wink wink.

Of course, what’s the incentive for the US Government and regulators to look into NVIDIA books to make sure they don’t miss out on their share of their revenues if the company diligently pays even more than what is due to them?

Now the question is fair, how much is the through operating cash flow of NVIDIA operations? How is it possible that the company repatriates all that huge amount of cash they are supposed to make abroad when it will be non-beneficial to them from a tax perspective? To answer this question we should go behind the numbers the company discloses to the public and check what’s truly going on there, but unfortunately, that is something only government investigators can do.