So many people lately have been talking and writing a lot about the US Treasury “Buy Back” program officially started in May this year with the excuse of improving liquidity in the US Treasuries market (Debt buyback program set to improve liquidity, says US Treasury official). However, what many fail to realize is that the US Treasury has been actively meddling in the FED monetary policy for more than one year already, precisely since May 2023. What was happening exactly at that time? First Republic Bank was going bust (FDIC press release).

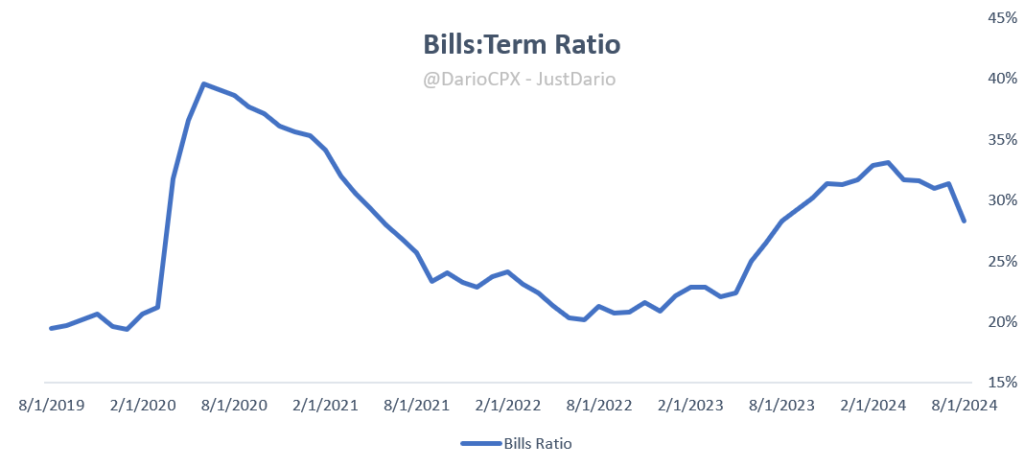

So what exactly did our dear Janet “Shroom” Yellen do? She started to significantly increase the proportion of US T-Bills issuances versus longer-dated Treasury Notes and Bonds. This action was blatantly against the law that restricts the US Treasury Department to finance the US Federal debt with a proportion of T-Bills no greater than ~20%, but as you can see in the first chart below, Janet completely ignored it (and no one, as far as I remember, challenged her).

This, combined with the, also illegal according to the law, BTFP facility set up by the FED, flooded both the banking system and the stock market with badly needed liquidity. Yes, this is effectively Quantitative Easing even if, officially, the FED was supposed to run a Quantitative Tightening policy and shrink its balance sheet. However, both the FED and the US Treasury reinjected liquidity in the market from both the front (BTFP) and the back door (T-Bills issuance spike).

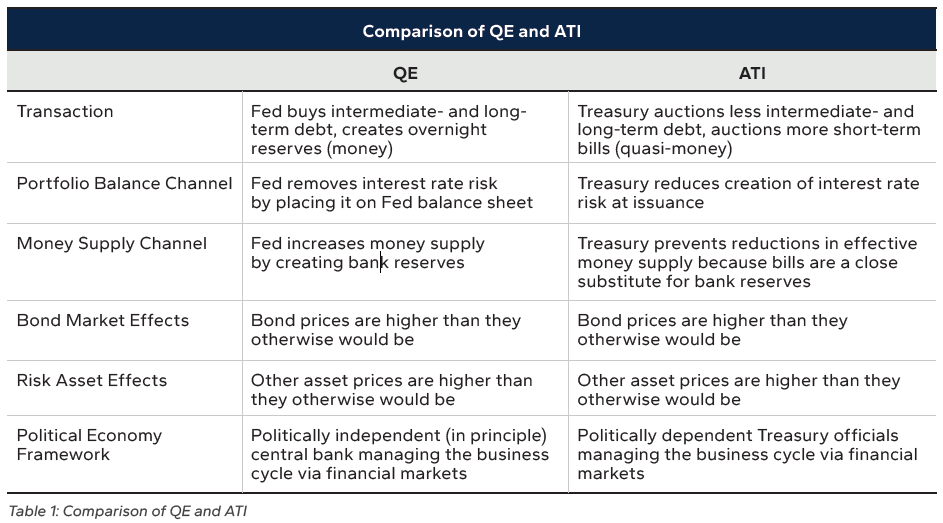

How significantly increasing the US T-Bills issuance compared to other forms of debt funding is a topic addressed thoroughly by Nouriel Roubini and Stephen Miran in “ATI: Activist Treasury Issuance and the Tug-of-War Over Monetary Policy”. If you don’t have time to read through the 32-page analysis, the below table helps to intuitively understand how ATI is a form of QE in disguise.

Furthermore, there is another important aspect to bear in mind I stressed so many times already to the point I lost count of the number of posts and Roubini-Miran did it too:

“Consider that when Treasury issues a security, it corresponds to a drawdown in bank reserves; someone sells a bank reserve to buy a Treasury bill or coupon. Because bills and reserves are close substitutes but coupons and cash are not, swapping bills for reserves causes a much smaller reduction in effective money supply than swapping coupons for reserves. Just as reserves can be used by banks to extend loans, bills can be leveraged in repo transactions to extend credit.”

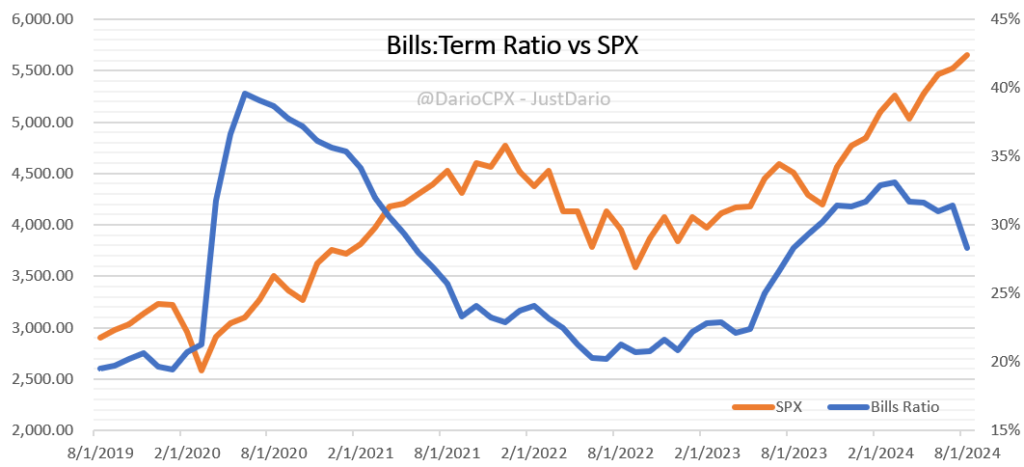

At this point, we can focus on how the US Treasury has been actively inflating the stock bubble. In order to do so, let’s put in the same chart the T-Bills ratio we already saw above and the SP&500.

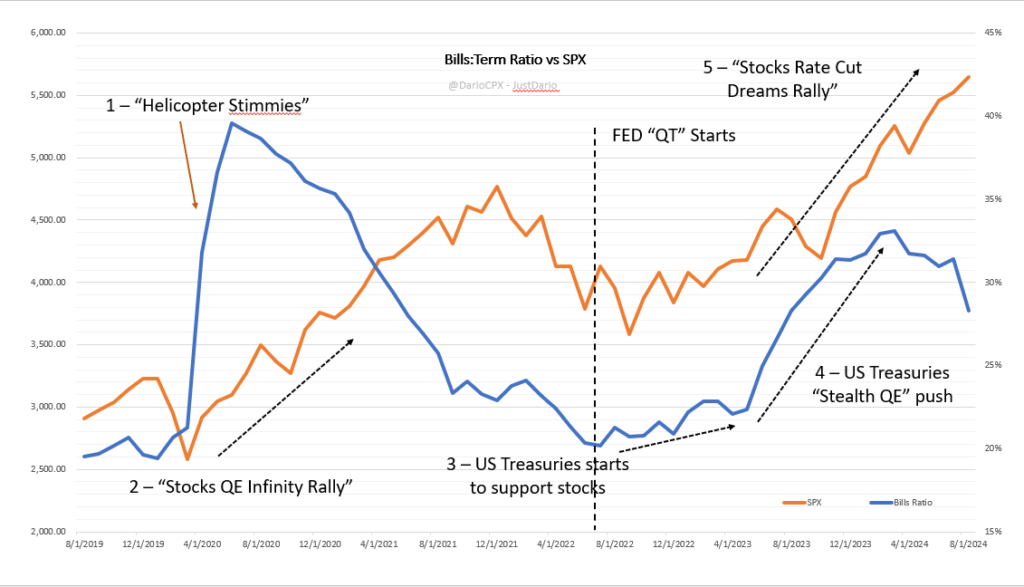

Do you notice anything? Let me guide you:

1 – When QE hits in 2020, the US Treasuries issue an absurd amount of T-Bills to fund the Covid stimulus package approved by the US Congress. As we discussed many times, this was the key moment that triggered the incredible stock rally, not when the FED delivered a series of emergency rate cuts. Why did the US Treasury issue such an incredible amount of T-Bills? Because in times of panic, everyone rushes into cash or cash equivalents, so there wasn’t market demand to absorb trillions of US Treasury Notes or Bonds. This is also explained well by Nouriel Roubini in the article “The US Treasury’s Backdoor Stimulus Is Hampering the Fed”:

“Such an excessive reliance on short-term debt is generally reserved for times of war or recession, when markets are fragile and financing needs spike.”

2 – The FED promptly monetizes all this epic amount of newly issued debt via the infamous “QE Infinity” and triggers a breakneck stampede into stocks and risky assets (because that was always the purpose of QE).

3 – However, the US Treasury by law could not finance such a large amount of Public Debt with T-Bills, so it started replacing the maturing ones with Treasury notes and bonds to re-establish the ~20% ratio.

4 – The exact moment the FED begins QT is when the US Treasury reaches the ~20% ratio. However, the stock market, which was already anticipating the end of QE infinity and suffering from less and less liquidity available in the system, also as a result of the fastest FED rate hike cycle ever, already started to roll over creating quite a bit of political headaches for the current US Administration.

5 – Due to an increasing scarcity of liquidity, the financial system starts shaking. Hence, it should not come as a surprise to anyone that at the exact moment QT started, the US Treasury started to resume its “stealth QE” by issuing a larger amount of T-bills.

6 – A few months later, the US Regional Banks and Credit Suisse crisis kicked in, prompting the FED to set up the illegal BTFP facility. Why illegal? Because in buying US Treasury Notes and Bonds from banks at par rather than at market value, the FED effectively injected capital right into the banking system, as I immediately flagged at that time. However, this was clearly not enough, and exactly at the moment when First Republic Bank went bust, the US Treasury Department started issuing an incredible amount of T-Bills again, effectively flooding the market with liquidity. Furthermore, at the same time, the market started to price more and more rate cuts incoming from the FED for 2024 as a result of the constant gaslighting delivered by Janet Yellen first and later on in October by the one and only Jerome Burns.

7 – What I just described, in coordination with other complicit Central Banks that never lost an occasion to flare up the money printer, like the BOJ, ignited another powerful rally in stocks with investors dreaming of rate cuts and resumption of QE in the near future.

You can visualize all I just described in the chart below.

The Achilles’ heel of what I just described was the pressure on yields, in particular long-term ones, to rise as a simple consequence of the constant growth in public debt. Such a rise in yields posed a significant risk to banks drowning deeper and deeper into “unrealized losses.” Despite all the central banks’ gang gimmick and jawboning, yields kept rising with the market also expecting less and less rate cuts from the FED that itself constantly reiterated rates would have remained “higher for longer.” How to blame them when even the politically adjusted inflation measures still remained well above their long-term 2% target? However, this started to force the foot off the pedal of the stock rally, with an increasing danger the bubble would pop before the US Presidential elections and undermine the re-election chances of the current US Administration. Here is when the US Treasury kicked off its “Buy Back Programme” experiment which is nothing more than yield curve control in disguise. It was never a mystery that the real goal was to defend the stock bubble at any cost (FED AND BOJ WILL DO EVERYTHING THEY CAN THIS WEEK TO SAVE THE STOCKS BUBBLE ONCE AGAIN), but the BOJ surprise rate hike, as a result of political pressures from the Japanese government dealing with a historic currency crisis, almost spoiled all US Treasury efforts. How did the BOJ correct its mistake? Again, printing a ton of JPY despite having just promised not to do it so the JPY carry trade forced unwinding could stop and a new flood of carry trades put back in place (today’s post). Other central banks like the BOE and the ECB helped out too of course (IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS) along with the GPIF (HOW COULD JAPAN RECOVER SO FAST FROM THE WORST CRASH SINCE 1987? THANKS TO ITS GPIF ANGEL).

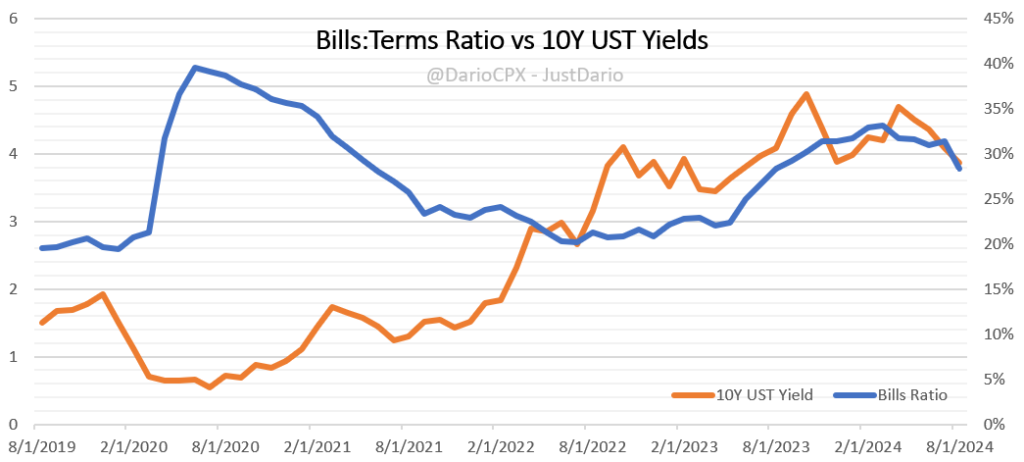

Then why am I arguing the US Treasury is running out of room to support the stock bubble and perhaps this is the reason why everyone is pushing the FED to cut rates even if that can be very dangerous in the current market condition? Please have a look at the chart below where we compare the T-Bills issuance ratio with the 10-year US Treasury yield.

As I mentioned at the very beginning of this article, the US Treasury is bound BY LAW to keep a ~20% funding ratio in T-Bills for the US Public Debt. Unless Janet Yellen wants to run into trouble, she has no choice but to start working to move towards that goal again. As a consequence, the ratio is already rolling over, and as a result, US yields are moving higher again. Furthermore, both the FED and the US Treasury are walking a very thin line, and in rescuing the BOJ from almost a complete implosion of its financial system, the DXY depreciated too much, clearly posing a risk to all the efforts of controlling inflation. As I flagged before, we were in the very same situation almost one year ago when as well the BOJ needed to be rescued. This is why, similar to what happened before, it is very dangerous for the FED to go ahead with delivering a rate cut for the market crybabies.

To conclude, it is no mystery that this stock market bubble is the poster child of many years of reckless monetary policies and government actions that all they achieved was to inflate valuations to nosebleed levels and create the biggest wealth gap ever experienced in modern history. Incredibly, the can has been successfully kicked down the road till now, but objectively from every front, all the central planners are running out of room to do so. This is why the ultimate reckoning with the market forces is getting closer and closer.