The U.S. Treasury yield curve is one of the most important indicators in global financial markets, serving as a reflection of investors’ sentiment, economic outlook, and central bank policy. By plotting the yields of government bonds across different maturities, the yield curve provides insight into the direction of interest rates, inflation expectations, and economic growth prospects. It is not only a key gauge for policymakers and investors but also directly impacts the pricing of a wide range of assets, including corporate bonds, equities, and real estate. Movements in the yield curve can send powerful signals about the future state of the economy and have significant implications for the cost of debt, risk premiums, and asset valuations.

Key to understanding #1: Steepening vs. Flattening and Bear Shift vs. Bull Shift

The yield curve can change shape in different ways, each with unique implications for financial markets:

- Steepening occurs when the difference between long-term and short-term interest rates widens. This typically signals expectations of stronger future economic growth or rising inflation.

- Flattening happens when the spread between short-term and long-term yields narrows, often indicating weaker growth prospects or an approaching recession.

Additionally, yield curve movements can be categorized as bear shifts or bull shifts:

- Bear shifts refer to an overall rise in interest rates across maturities, often due to expectations of tighter monetary policy or higher inflation.

- Bull shifts, on the other hand, involve a general decline in yields, reflecting expectations of lower interest rates or economic slowdown.

These shifts can combine with steepening or flattening, resulting in four distinct yield curve movements:

- Bull steepening: Long-term rates fall less than short-term rates. This is often related to expectations of economic easing or stimulus.

- Bull flattening: Long-term rates drop faster than short-term rates. This tends to signal expectations of a dovish monetary policy, very often combined with near-term recession fears.

- Bear steepening: Short-term rates rise, but long-term rates increase at a faster pace, indicating higher inflation expectations.

- Bear flattening: Short-term rates rise faster than long-term rates, which could suggest aggressive central bank tightening.

Key to understanding #2: How do US Treasury yield curve movements impact companies’ cost of debt and valuations?

Yield curve shifts profoundly affect financial markets, particularly in terms of the cost of debt and company valuations. Increases in long-term interest rates (bear steepening or flattening) raise borrowing costs for businesses, impacting leveraged firms and sectors reliant on debt financing. When yields rise, the present value of future cash flows decreases, which in turn reduces company valuations under valuation methods like Discounted Cash Flow (DCF).

- Bull steepening, where long-term yields fall relative to short-term rates, can lower the cost of long-term borrowing and boost corporate valuations, particularly for growth-oriented companies.

- Bear steepening generally increases financing costs, especially for companies dependent on long-term debt, potentially dampening business investment and valuations.

- Bull flattening may be a sign of imminent rate cuts, which on one side could support equity valuations, but on the other side is often accompanied by concerns about economic weakness that undermine companies’ valuations.

- Bear flattening signals tighter monetary policy in the near term, increasing the cost of short-term debt while compressing valuations as higher rates lower future profit expectations.

Why is the US Treasury Yield curve currently screaming “Danger!”?

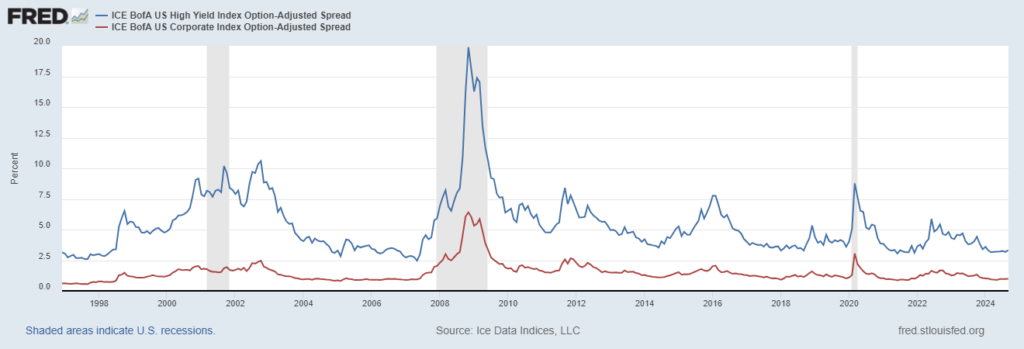

Even if the modern monetary policies embraced by central banks across the world, by some like the BOJ to the extreme, effectively translated into a “sterilized” bear flattening of the US yield curve with a nominally significantly higher cost of debt for companies, in reality, quantitative easing created such an abundance of liquidity that credit spreads have been compressed down to the floor, effectively resulting in an incredible oversupply of funding in financial markets. What I just described not only enabled a use of leverage never seen before but because the curve was inverted, the lower long-term rates effectively boosted companies’ valuations (especially “growth” ones), ultimately inflating one of the biggest stock market bubbles in history.

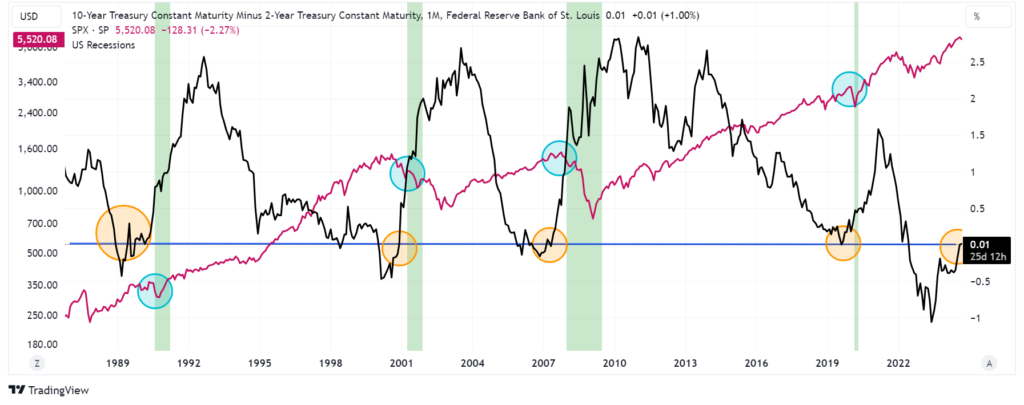

As a matter of fact, central banks led by the FED created an incredibly fertile ground for a stock market bubble to grow to the sky; as of late, they even worked tirelessly to make sure the very same did not pop-under their watch. As I previously highlighted in “FED AND BOJ WILL DO EVERYTHING THEY CAN THIS WEEK TO SAVE THE STOCKS BUBBLE ONCE AGAIN“, it was very clear what their real goal was lately: make sure the US yield curve did not invert. Unfortunately, even if they tried to kick the can down the road as long as they could, ultimately market forces prevailed because “it is never different this time”, and as of today, the very important spread between the 2-year US Treasury yield and the 10-year US Treasury yield is back to positive.

We just saw above that when a “bull flattening” of the yield curve occurs, it tends to anticipate an imminent FED rate cut, but at the same time, it also anticipates a weakening of the underlying economy. Today’s situation, though, is very special because central banks let the inflation genie out of the bottle and, despite the constant efforts by governments, central bankers, and MSM to make everyone believe inflation has been put under control, the reality is very different and the genie is still very free. As a consequence, a FED rate cut, combined with a very unique and fragile equilibrium in financial markets, can be particularly damaging this time (“IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS“) when this event by itself has already consistently been a harbinger of an incoming stock crash, as you can see from the chart below.

To conclude, the US Yield curve is screaming danger as loud as it can, as it always did, but yet again nobody is listening. Even more concerning is the fact that in the age of endless money printing and perpetual bailouts, people are now so convinced that central banks have gained such a degree of power to shape financial markets that they can rescue every stock trader in case of a downturn. All these people, however, are ignoring that this time the very same central banks are in need of a bailout themselves (“HOW CAN THE #FED BAILOUT BANKS WHEN THIS TIME IT NEEDS A BAILOUT ITSELF TO BEGIN WITH?”). Considering we are just resurfacing from the longest US yield curve inversion in history, the amount of debt has grown to biblical levels, and stock valuations have been inflated through the stratosphere because of the combined effect of abundant access to leverage and abuse of derivatives, it is objectively very hard for me to embrace the “soft landing” narrative mantra everyone keeps chanting. It is undeniable that the incoming market crash is going to be of historic proportions, and it will be very hard for governments to save their skins one more time through the wild monetization of deficit spending (“FINANCIAL MARKETS REACHED A SINGULARITY NO ONE WANTS TO DEAL WITH“). The best we can do is to run for the high ground before the tsunami hits and take shelter in all those reliable assets that will remain standing when the tides lower again; failure to do so can truly put many people in danger of facing financial ruin.

Buonasera,

scusa la franchezza, ma le definizioni che hai dato di bull steepening, bear steepening, bull flattening e bear flattening non mi sembrano come le ho studiate io o come le trovo in letteratura. Potresti darmi delucidazioni in merito?

Ciao, scusami penso di aver capito, facevo confusione tra steepener e stepening, quindi tra il movimento della curva e il suo risultato, giusto? Grazie e scusami ancora

Gentile Mario, si corretto le definizioni sono associate ai movimenti della curva. Per esempio fai attenzione che quando i tassi di interesse scendono e’ “bull” (perche’ il valore dei treasury sottostanti sale).