Many investors and traders aren’t enjoying this weekend after what happened on Friday following the US NFP release. The immediate market reaction was, as usual, positive, with trading algorithms flooding US futures with bids while dumping volatility hedging, simultaneously crushing the VIX almost vertically from ~22.3 to ~19.

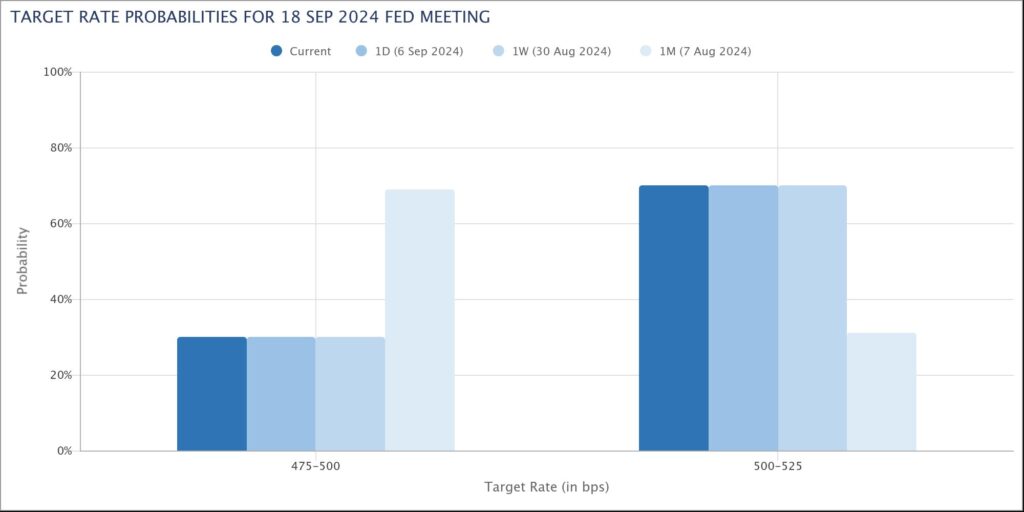

However, the market didn’t continue to celebrate the “bad news” as it had before under the completely stupid assumption that data showing a deteriorating economy would increase the chances of seeing the Fed reopening the liquidity floodgates sooner rather than later. Why? Because as soon as real trading began, the probability of a 25bp rate cut in the next FED meeting remained greater than the 50bp one traders were hoping for last week.

This spooked trading algorithms that have been wired to be bullish to the prospect of a more dovish monetary policy and to instead react bearishly if future expectations shift towards the prospect of tighter than expected financial conditions. As a result, after a first moment of “confusion” that I flagged in this post (link), automatic selling orders didn’t take long to flip the overall momentum to negative with risk hedging quickly being put in place again and the VIX closing the week at 22.38.

How is it possible that despite the bad data, interest rate futures didn’t price higher chances of a 50bp cut in Fed fund rates? Because the BOJ clearly intervened in the market to weaken the JPY in a move that was planned to coincide with the US NFP release, using an important macro data release event as a cover, as they have done many times before. The chart of USD-JPY is crystal clear about this. After a first spike to 144 (obviously planned) and then a light-speed (and mind-blowing) crash to 142 because trading algorithms were wired to price in higher chances of a 50bp rate cut from the FED, BOJ traders quickly jumped in to buy JGB futures and weaken the JPY back to ~143.75 in order to stop the JPY carry trade unwinding already ongoing since Monday and especially hitting semiconductor stocks, as we discussed on several occasions. Unfortunately, the plan didn’t work out as expected because of trading algorithms’ automatic risk-off selling, and the JPY Carry Trade unwinding reignited, pushing USD-JPY back to the ~142.3 low level of the week. Why is this level extremely important? As you can see from the next chart, this is the bottom hit during the crash of August 5th.

Unlike August 5th, however, Japan stocks are currently trading at a much higher level compared to a month ago, with the Nikkei at ~36,400 (almost 20% higher). How did the Nikkei manage to perform so well despite what happened to the FX rate? Because of the BOJ and GPIF combined efforts (“HOW COULD JAPAN RECOVER SO FAST FROM THE WORST CRASH SINCE 1987? THANKS TO ITS GPIF ANGEL“) and the support of other central banks.

For sure, the upcoming Monday open in Japan is going to be very tough, with Nikkei futures already pricing a drop of more than ~1,000 points. Why is there a risk of another “Black Monday” unfolding? Because, as I highlighted in “IN JAPAN IT WILL BE A MESSY MONDAY, BUT NOT A BLACK ONE (YET)” before, the lower Japan index goes, the higher the automatic selling from structured products and structured derivative strategies put in place during the incredible rally in Japan stocks that began last year. As you can see from the chart below, ~36,000 is exactly the level when one month ago the market started to free fall, and considering there has been little change in the structured strategies in place, it is fair to expect the same level is still very critical.

Now the question is: do BOJ and GPIF still have the same amount of flexibility to print JPY and buy stocks to avoid another collapse as happened not long ago? I am not sure. Unlike August 5th, when US and European stocks were selling off after Japan stocks did earlier in the day, this time we are in the opposite situation. As a consequence, the GPIF, which is set to keep a 50:50 allocation between foreign and domestic stocks, not only has much less buying power but paradoxically is supposed to be selling Japan stocks and buying foreign stocks. However, rates are currently lower than one month ago, meaning that in theory GPIF, which overall is bound to a 50:50 allocation between stocks and bonds, has room to sell bonds and use that liquidity to bid stocks. Will GPIF bid strongly enough to counter the selling expected from the automated de-risking of systematic strategy? I’m sorry, but this is impossible to quantify; logically, it should be lower and can only strengthen if the US stock futures open isn’t going to be weak. In case on US Sunday night we see US stock futures continue puking, then the chances of seeing another “Black Monday” in Japan will effectively increase, and only a massive BOJ intervention in the markets to buy JGBs, push yields lower, and weaken the JPY can support GPIF efforts to bid domestic stocks.

Using logic again, with the FED expected to cut rates by only 25bp and likely be done with it because they will trigger a flare-up in inflation that will undermine US stocks ahead of US elections, a scenario also predicted by the US yield curve (“THE US YIELD CURVE IS SCREAMING “DANGER!” AND ONCE AGAIN NOBODY IS LISTENING“), the BOJ might find itself dealing with a horrible scenario of a quick devaluation of the JPY (due to all the JPY being printed since August 5th) and a fall in value of Japan stocks resulting from broad selling pressure in the market triggered by a strong risk-off momentum, this time caused by US stocks.

To conclude, I don’t think we will see a “Black Monday” that soon again, but what I warned about a while ago in “JAPAN END GAME – A DEEPLY DEVALUED $JPY AND A WORTHLESS NIKKEI” is becoming the scenario with higher and higher chances of unfolding.