Two months ago, in FINANCIAL MARKETS REACHED A “SINGULARITY” NO ONE WANTS TO DEAL WITH, I tried to highlight how legacy economic theories—built on assumptions that never fully materialized decades ago—are now ineffective in today’s economic context. In that article, I emphasized five key points:

- The FED cannot cut rates to save stocks.

- GDP growth is no longer driven by economic prosperity but by increasing public debt.

- Stock valuations are no longer linked to the strength of underlying economies and societies.

- Debt is no longer a problem for borrowers but for lenders.

- Derivatives are no longer tools for transferring risk but means to pursue it.

Today, @thesiriusreport posted one of the best tweets on macroeconomics I’ve seen in a long time:

“According to Western experts, deflation in China is a death sentence for their economy.

However, if you produce real things and prices are lower, rather than shuffling worthless bits of electronic paper and calling it economic growth, then your population will have more disposable income, which will help stimulate more economic growth. Cheaper goods and services mean you can buy more of them.

Cheaper asset prices in the world of worthless electronic paper is a disaster, because you have asset impairment, and your balance sheet is wrecked. Bankruptcy and default beckon because our entire economy and financial system depend on rising asset prices to create the illusion of economic prosperity.

The simplistic Western mindset also believes that lower prices (deflation) equate to lower demand, and higher prices (inflation) equate to higher demand. Have they learned nothing about the causes of recent inflation in the West?

What about when deflation is caused by access to cheaper energy and raw materials, which is good for an economy? Or improvements in productivity, which are also good for an economy? Or trading in local currencies, which is good for the economy, etc.?

Deflation is bad for zombie economies and financial systems, which depend on debt-fueled, fictitious asset bubbles.

Ultimately, a healthy economy depends on the profitability/margins you make, not on the price you sell your goods and services at. So we always come back to the mythical aggregate GDP as a barometer of economic strength, which, of course, is utter nonsense.”

Let me explain why every single sentence above is spot on in highlighting what is going wrong with the “modern” approach to economics now so popular among central planners in the Western world.

1. “If you produce real things and prices are lower, rather than shuffling worthless bits of electronic paper and calling it economic growth, then your population will have more disposable income, which will help stimulate more economic growth. Cheaper goods and services mean you can buy more of them.”

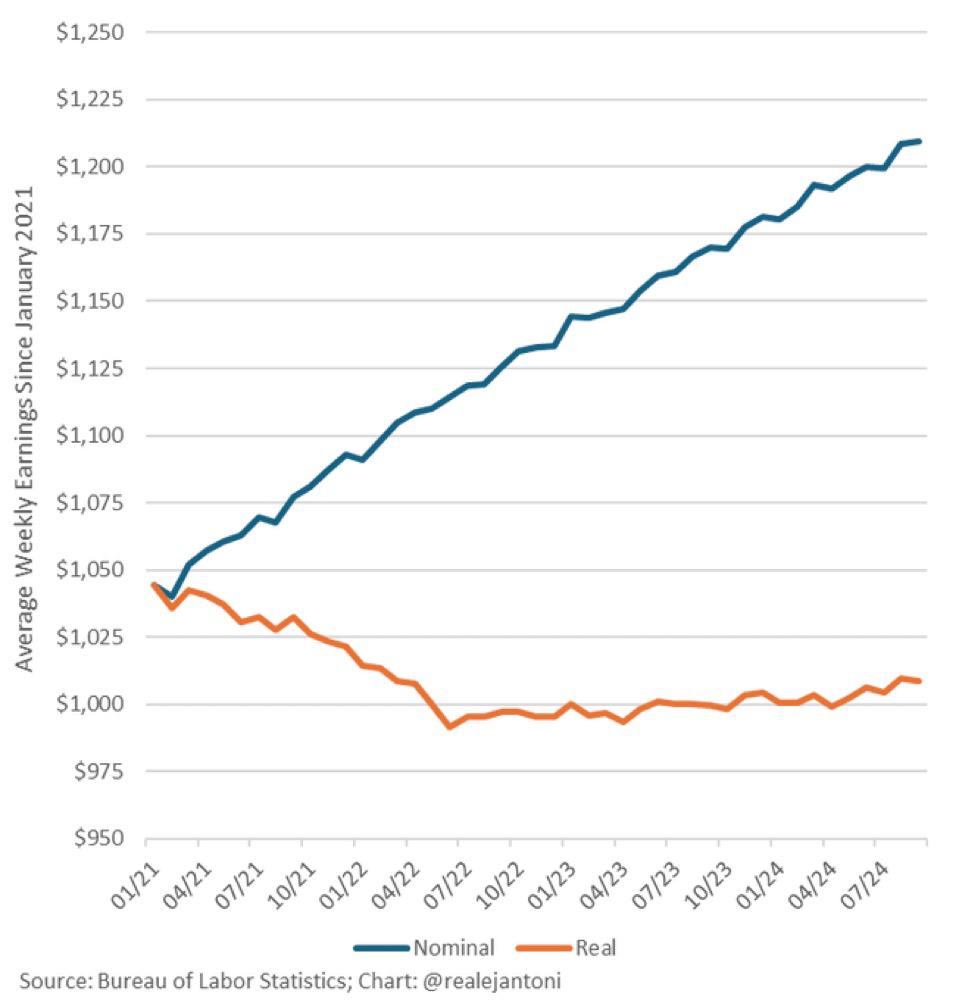

In reality, the constant pursuit of inflation—set to an arbitrary 2% goal in the US and Europe—is simply a way to transfer wealth from the majority of the population, who do not own financial assets, to the minority who do. Christine Lagarde even admitted this in her last interview with The Daily Show (video), though she shifted the blame onto workers, claiming they hadn’t negotiated adequate salary increases for decades to match the rising cost of living caused by inflation.

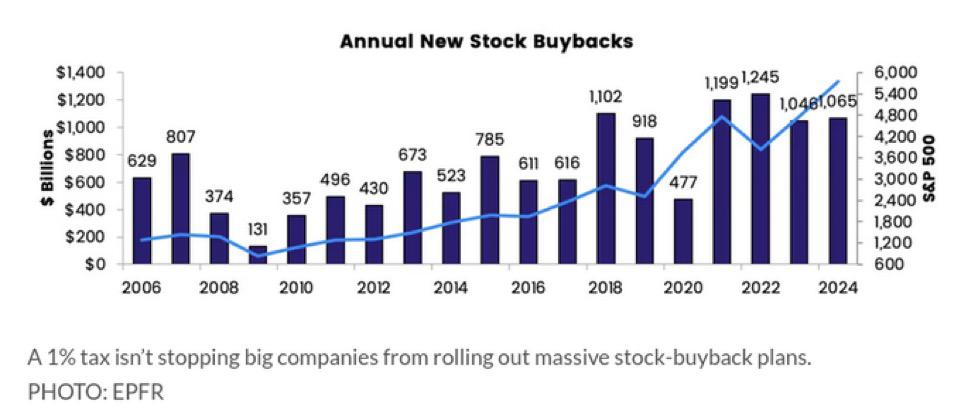

Endless QE (Quantitative Easing) and monetary interventions aimed at inflating asset prices under the guise of a “trickle-down effect” have had the opposite outcome: they created the greatest wealth inequality in modern history. This happened because those who owned financial assets were unwilling to share their wealth with the broader population. Instead, we saw the explosion of share buybacks, which funneled excess profits back into financial markets rather than redistributing them through lower prices or higher wages. As of today, share buybacks are on track to break the 2022 1.2T USD record and if you sum all buybacks executed since 2020 you can easily see how pretty much all FED QE since then has been indeed mostly used for this purpose with little to no “trickle down” effect in the real economy (and just a fraction of the total QE since 2008 effectively made its way into the economy since re-injected into stocks via buybacks)

China was the first major economy to recognize the long-term societal damage caused by endless QE. As a country that lifted most of its population out of poverty, it couldn’t afford to risk driving them back into it, which is essentially what’s happening in the US, Europe, and Japan. (See CHINA HAS BEEN THE FIRST ONE TO ABANDON THE QE ABERRATION, WHO IS GOING TO BE NEXT?).

2. “Cheaper asset prices in the world of worthless electronic paper is a disaster, because you have asset impairment, and your balance sheet is wrecked. Bankruptcy and default beckon because our entire economy and financial system depend on rising asset prices to create the illusion of economic prosperity.”

We’ve discussed this extensively. A perfect example is the current state of the global financial system. US banks, for instance, still carry more than half a trillion dollars in unrealized losses, according to FDIC data, despite a $1 trillion windfall from the FED during the last rate hike cycle (Fed’s high-rates era handed $1tn windfall to US banks). Here’s how things have worked so far:

- The FED printed trillions of dollars and gave it to banks to lend into the economy (or so they said).

- Instead of lending to support the entire economy, banks extended more credit to zombie borrowers who would otherwise have defaulted on debt accumulated during ZIRP (zero interest rate policy) years. Why? Because writing off bad loans forces banks to recognize losses, and if those losses are too great, banks can quickly become insolvent.

- Since lending wasn’t reaching the struggling parts of the economy, the government started distributing trillions in unfunded stimulus, which central banks monetized by purchasing government debt. This money ended up in banks, which saw a massive inflow of deposits. Rather than lending this excess cash, banks returned it to the FED, earning interest while keeping customer deposit rates at zero. Wasn’t this money the FED originally printed out of thin air? Exactly.

- You might expect banks to use these profits to clean up their balance sheets, but instead, they distributed profits through dividends and stock buybacks, paradoxically approved by the FED itself.

Like it or not, this is the sad reality. My first article of 2024 was titled 2024: THE YEAR WHEN “HOLD TILL MATURITY” ENDS. We’re now in the last quarter of 2024, and despite the evident problems in the economy, real estate, and commercial real estate sectors, banks are still pretending everything is fine, with the FED’s full support. (FED ACTION TODAY MARKS THE BEGINNING OF THE END OF THE FIAT MONETARY SYSTEM EXPERIMENT).

3. “The simplistic Western mindset also believes that lower prices (deflation) equate to lower demand and higher prices (inflation) equate to higher demand. Have they learned nothing about the causes of recent inflation in the West?”

Inflation is a monetary phenomenon, plain and simple. When too much money chases a limited supply of goods and services, prices inevitably rise. But there’s another factor economic planners overlook: shadow banking.

Why is shadow banking important? Because money isn’t created when central banks print it; it’s created when banks lend. Shadow lenders—private credit, insurance companies, pension funds, buy-now-pay-later providers—fall outside FED supervision, but they still increase the money supply by lending hundreds of billions. Is anyone tracking this? No. This is why measures used to track money supply are technically flawed. Despite the BLS’s best efforts to obscure it, the chronically high inflation is obvious to everyone.

Once again, China has recognized the dangers of shadow banking and is moving to regulate it (see China tightens leash on non-bank payment firms), while in the US and Europe, there’s only silence.

4. “Deflation is bad for zombie economies and financial systems dependent on debt-fueled fictitious asset bubbles.”

Japan is the perfect example of this. Both the BOJ (Bank of Japan) and the Japanese government know this risk well, which is why they have no choice but to continue printing money. When they tried to slow down, their zombie financial system had a seizure, as we saw in August. (THE LONGER THE BOJ TAKES TO CUT RATES BACK TO ZERO, THE GREATER THE DAMAGE TO JAPAN’S BANKING SYSTEM). What’s the endgame for Japan? USD/JPY ROAD TO 300.

5. “Ultimately, a healthy economy depends on the profitability/margins you make, not on the price you sell your goods and services at. So we always come back to the mythical aggregate GDP as a barometer of economic strength, which, of course, is utter nonsense.”

This ties back to my original article, where I explained that GDP, especially in Western economies, is now merely a measure of government spending growth rather than true economic growth. In a world with seemingly no limit to deficit spending, central banks help monetize government debt. This results in nominal GDP growth, which is misleadingly presented as real economic growth thanks to understated inflation figures. But the lived reality for the population—growing poorer—tells a very different story, just take a look at the chart below