First of all, for those not familiar with it, let me quickly describe what is a minefield. Literally speaking a minefield is an area planted with explosive devices designed to deter or damage enemy forces, and it is primarily used as a defensive measure to control movement and protect strategic locations. By creating hazardous zones, minefields can prevent enemy advances, shield critical areas like borders, military installations, and supply routes, and force adversaries into predictable paths where they are more vulnerable to attack. However, while they serve as a cost-effective defense, minefields pose long-term dangers to civilians and can obstruct friendly forces as well, requiring significant time and effort to safely remove after a conflict.

From a political perspective, the concept of a “minefield” can be applied metaphorically to describe strategies that are designed to limit or control opponents’ actions, create obstacles, and protect key interests. Just as in military defense, political “minefields” are crafted to deter adversaries, like physical minefields, these political tactics are often set up in advance and remain passive until triggered by an action, slowing down momentum and forcing compromises. However, just as military minefields can have unintended consequences for friendly forces, political minefields can backfire, restricting flexibility or creating long-term complications that may damage the original party’s interests or reputation.

Here is an example of how the previous UK government run by Rishi Sunak effectively set up a trap in the UK government budget with the intent of undermining the incoming government of Keir Starmer:

- 4 March 2024: Budget day blow as analysis finds Tories squandered £125billion in 5 years

- 26 July 2024: Has Labour really found a bigger financial mess than it expected?

- 31 July 2024: UK Labour government discovers £22 billion ‘hole’ in public finances

- 21 September 2024: Keir Starmer now less popular than Rishi Sunak, poll suggests

Alright now that the concept of a minefield applied to politics and government tactics is clear, let’s take a look at how the Biden administration is being preparing a difficult economic ground to navigate for its rival Trump in case this one manages to win the US presidential elections in 3 weeks.

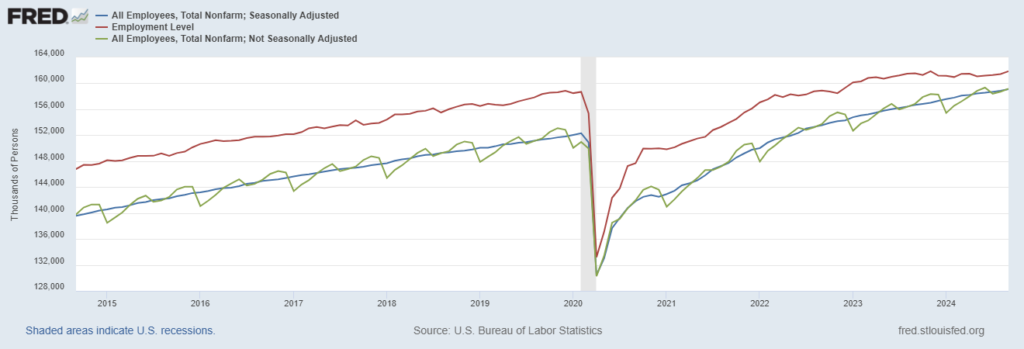

Mine #1 Location: the US jobs market

According to government agencies, the US economy added 7.8 million new payroll jobs over the past five years but it gained only 3.7 million new workers. How is this possible? In a nutshell, the BLS conducts 2 types of surveys, the household one and the company one where the first historically showed a larger number of people employed since it includes the likes of independent professionals and contractors that would not be included within companies’ payrolls. So this gap per se isn’t an issue since it is structural as you can see in the chart below

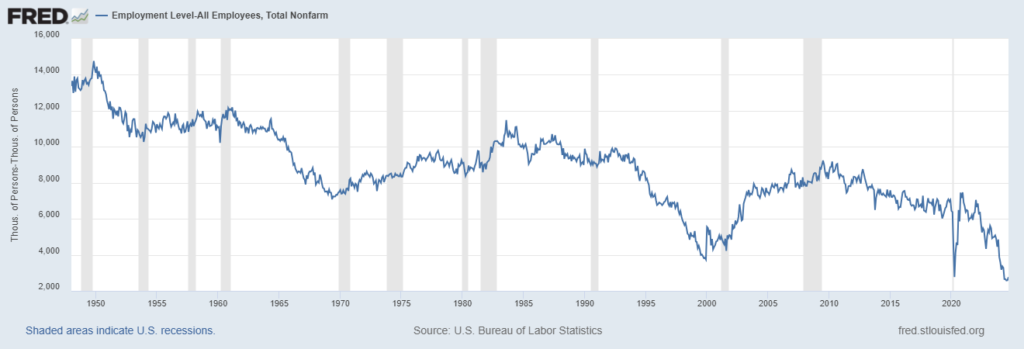

Now, please take a look at the chart of the difference between the 2 employment surveys.

Shocking isn’t it? There are 2 messages from this chart:

- The Non-Farm payroll number is overstated by a much larger number than the ~818k revision already announced by the BLS (Nonfarm payroll growth revised down by 818,000, Labor Department says) since this gap is structurally stable through economic cycles

- With the exception of the GFC when the job losses were mostly limited to the white-collar financial sector jobs, as you can notice a sharp decline in this gap always anticipated economic recessions. Right now the gap is at the SAME LEVEL of March 2020

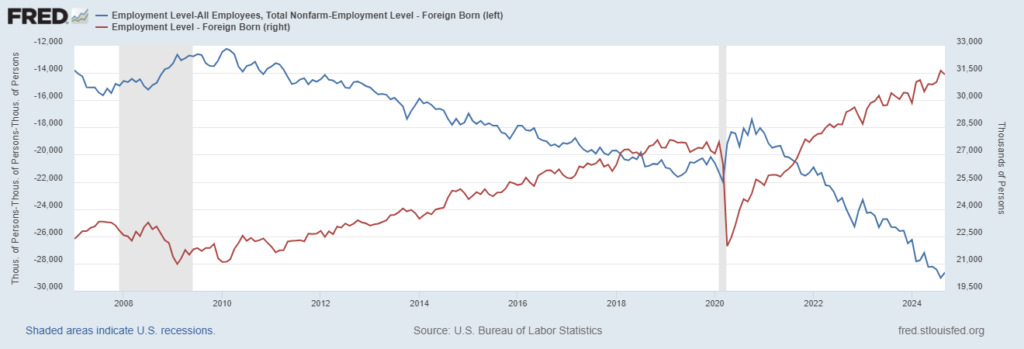

Let’s take a look at what happens to the gap if we deduct the immigrants employed in the US

As you can see the job market condition for US-born citizens is simply disastrous, deteriorating, and completely against the narrative pushed so far by the FED and other government agencies.

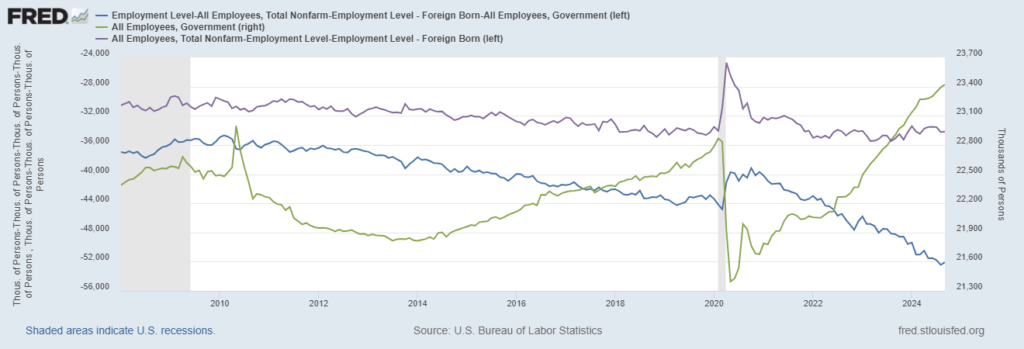

I am afraid I am not done. It is no mystery that during the Biden administration, the US government has been on an incredible hiring spree of public employees, the reason why the overall data on employment remained apparently resilient till now. Take a look at what happens if we include US public employees in the equation.

The private employment market for US-born citizens is effectively collapsing

Don’t ask me why no MSM media has been talking about this at all, but clearly, underneath the surface, the situation is simply dramatic and you can bet this mine will explode if Trump goes back into government and tries to rein in out of control government spending and stimmies that so far have been crucial for all the US-born citizens to withstand the current situation.

Mine #2 Location: Inflation

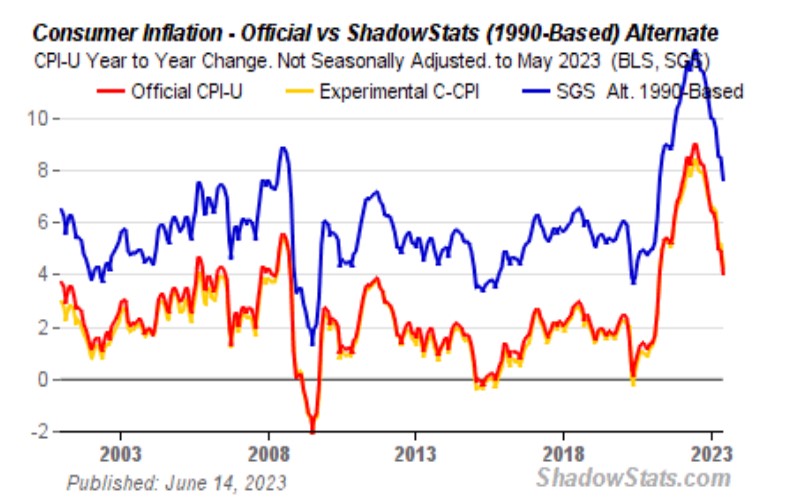

Shadowstats, which continues to calculate inflation based on the pre-1990s and more reliable methodology, consistently reported a ~4% gap between the official CPI inflation calculated by the BLS and the one effectively experienced by people in the real world. This means that the current level of inflation is ~6.5% and not the ~2.5% the FED loves to brag about.

As a matter of fact, real rates have never been positive (hence restrictive), not surprisingly the stock market bull run did not feel the pinch of the latest rate hike cycle at all so far. In this context of still loose monetary conditions, evident even to those paying little attention, the FED just cut rates 50bp and the government keeps accumulating debt at an eye-watering pace (~500bn$ in the last 2 weeks alone). That the FED repeated the same mistake of the 1970s is what the bond market has been clearly signaling with long-term rates going back up AFTER the FED cut rates.

I bet now you are wondering how is it possible that, considering the current level of real inflation in the US economy and the ballooning amount of debt, Treasury yields are not even higher. The answer is very simple, Janet Yellen has been manipulating them with the clear goal of keeping the stock market bubble in place till the US elections: HOW THE US TREASURY HAS BEEN ACTIVELY CONTRIBUTING TO INFLATE THE STOCK BUBBLE, BUT NOW IS RUNNING OUT OF ROOM TO DO SO

Imagine Trump winning the US elections taking office and resuming his strategy of applying steep tariffs to imports from foreign countries in the current situation, what do you think is going to be the outcome of that in the current environment? We just got the answer from Janet Yellen herself: US Treasury chief warns Trump’s proposed tariffs are ‘deeply misguided’

Mine #3 Location: The banking sector

Despite the ridiculously buoyant Q3 banks earning season so far, the FDIC reported in June the US banks alone are sitting on ~517bn$ of unrealized losses (There are 63 ‘problem banks’ and $517 billion in unrealized losses). That the US banking sector is in quite a bad shape, contrary to the narrative the MSM is relentlessly pushing, is proven by the fact that this weekend the FDIC just took over and liquidated another small lender: First National Bank Of Lindsay Closes, FDIC Takes Over Deposits. Needless to say, these things aren’t meant to happen in a strong economy and the situation is clearly hidden from the public also thanks to regulatory agencies’ support as I highlighted this week in TODAY “EVERYTHING WILL BE AWESOME” FOR BANK OF AMERICA.

Needless to say, especially with Jerome Burn in charge till May 2026 and notoriously an antagonist of Trump, this ticking time bomb can be allowed to burst if the current administration won’t be in charge anymore starting from January.

To conclude, the stage is set for a “perfect storm” to hit Donald Trump’s administration in case he will be re-elected in 3 weeks. As things stand now it is clearly impossible to rein in out-of-control deficit spending, and inflation and support an increasingly struggling banking sector without continuing the exact same policies the current US administration has been perpetrating in the past four years. China which, never forget, plays chess and not checkers, is already anticipating the storm and strengthening its banking system (A BIG BANK IS ON LIFE SUPPORT, CHINA KNOWS IT AND IS PREPARING TO WITHSTAND THE SHOCK – IS THIS BULLISH?). Furthermore, as per an analysis I did a few weeks ago, looking at market indicators apparently independent from all I said so far, it really looks like the stars are aligning for the bubble to bust in Q1-25 in what I believe is not a coincidence at all: HOW LONG WILL THIS BUBBLE LAST? IT LOOKS LIKE TILL Q1-2025. Clearly, if Donald Trump wins the election he is not going to have an easy life in handling all the mess he is going to inherit similar to what is happening to the Keir Starmer government in the UK.

JustDario on X | JustDario on Instagram