Oil price is perhaps the most manipulated asset price right now after gold and silver managed to escape BIS trading desk claws lately. Let’s start from where we left this topic almost one year ago when the Biden administration successfully managed to crush the oil price through the floor all the way down to ~70$ and to defuse the risk of a price shock that was about to trigger considering the market situation at that time (on the 7th of October, the large-scale conflict between Hamas and Israel began). This is what I particularly highlighted in the last article I wrote before today:

“Look at the second chart from 2021, and please ask yourself this question: “how is it possible that while USOIL went up 64% since then, XLE went up 120% and all major US and EU oil companies are up 71-152%, but Saudi Aramco is only up 16.12%?”

“So what the hell is going on? Well, if by now it isn’t obvious that the US government weaponized the OOTT wholesale market to go after Saudi Arabia specifically to tame MBS geopolitical influence ambitions kneecapping his country’s revenue stream, then I am hopeless here”

That an incredible short squeeze in oil prices was brewing was already clear in July for those who dared to observe the market structure and traders’ positioning without wearing MSM or Wall Street beer goggles:

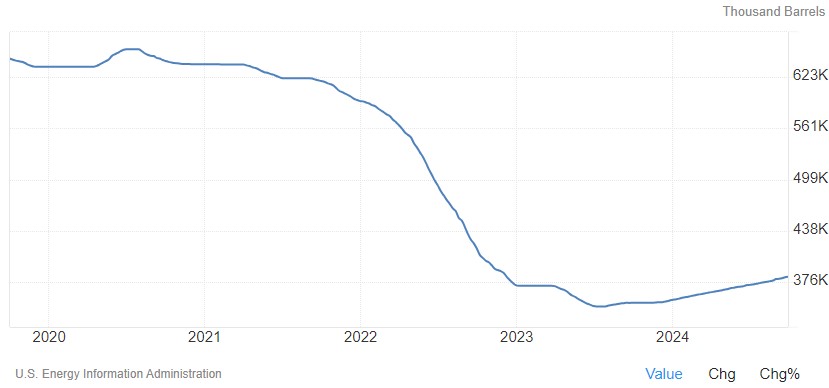

The scariest thing of all, now completely forgotten even if nothing changed in one year, was the current US administration actively unloading strategic petroleum reserves (SPR) in the market to cap oil prices not only without a realistic plan to refill them at all but up to an extreme where some SPR caverns were dried up completely (The first US oil SPR cavern is now dry).

Fast forward to today, after trading as low as ~66$, WTI prices are now up 10$ in a few weeks above 76$ with “experts” parading on CNBC trying to pull off mental acrobatics to justify why oil prices should remain low because of the weak economy but at the same time the economy is strong and markets pricing a “no landing” scenario is justified in particular after the FED said so despite cutting Fed Fund rates by 50bp (a move that one of these popular commentators even called “hawkish cut” to straighten up all these nonsense narratives MSM have to push).

Of course, everyone is blaming the current jump in oil prices on the risk of conflict escalation between Iran and Israel (Oil bets are most bullish in two years as Mideast tension flares) with the former threatening to close the Strait of Hormuz and the latter threatening to strike Iran’s oil production facilities even though these risks were already material one month ago when WTI prices were trading at ~66$. What everyone is ignoring are the inflationary pressures the FED reignited 3 weeks ago, something I promptly highlighted in “FED ACTION TODAY MARKS THE BEGINNING OF THE END OF THE FIAT MONETARY SYSTEM EXPERIMENT” the day the FED announced a 50 bps FF rates cut:

“First of all, and this should not come as a surprise to anyone, despite the 50bp cut, we are seeing 10-year yields increasing despite the FED being convinced inflation will be steadily coming down to their 2% long-term goal. Why? Because this action will obviously flare up inflation that, to all those who live in the real world, is much higher than the bogus data published by the US BLS”

Putting it all together we now have:

- Rising tensions in the Middle East

- Looser monetary conditions re-igniting inflation 1970s style

- US SPR at levels seen last time in 1983 and not capable of absorbing any exogenous shock in supply

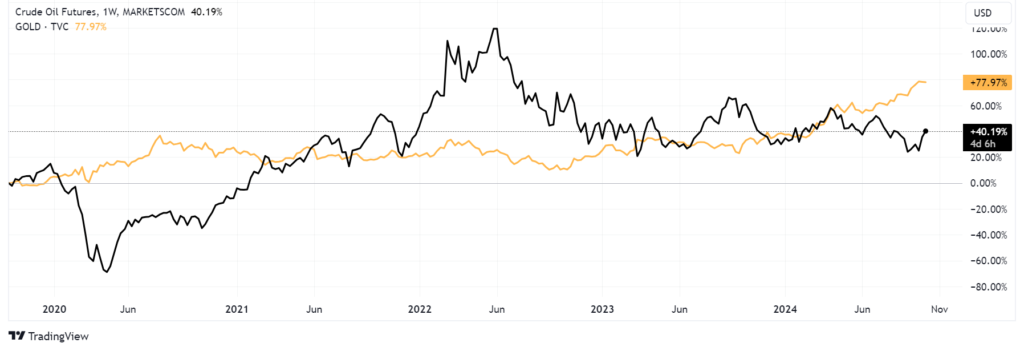

Hold on a second, isn’t the US now a net exporter of oil thanks to a boom in domestic production? Yes, it is, but the truth is that the US does not have the infrastructure to refine light sweet oil since most of its refineries were built to refine heavy and relatively high sulfur oil. So paradoxically, the oil that then goes into many US gas stations is refined abroad, significantly increasing production and transportation costs that are very sensitive to inflation starting from the one on oil price itself. The situation has been well known for years, but the current US administration has done nothing to address it in the past years, preferring to manipulate lower oil prices in the wholesale market as described above. If you consider gold as a good indicator of monetary inflation and compare it to oil prices in the past 5 years, you can quickly see how the current oil prices are currently ~30% below the inflation trend.

To conclude, Oil price equilibrium is currently ~30% higher than the current levels, and in such a market where momentum algorithms can quickly build up positions to follow a trend, there is a significant risk of seeing a rapid increase in prices exacerbated by geopolitical tensions and the fact that traders are fully aware the US administration has almost exhausted all its tools to control it. In all fairness though, the risk of a significant short squeeze in oil is lower today than one year ago when traders positioning in the market was far more extreme, both in terms of prices and volumes, and if this doesn’t change the risk of a significant spike in prices is currently limited.