Another great quarter for Microsoft that beat Wall Street analysts’ expectations comfortably (what a surprise), but once again the tides turned when the management started to provide guidance on future growth that came short of what investors were expecting, sending the stock price negative almost 4% during after-hours trading. However, while everyone was focusing on the headline numbers and singing “Kumbaya!” till Satya started to speak (what a party spoiler, he should borrow some pages from the Jensen playbook), nobody decided to take a tour beyond page 1 of the 10-Q released by Microsoft and really check if things are so truly hunky-dory. A few months ago things did not look so great (MICROSOFT REVENUES “ROUND TRIPPING” PONZI SCHEME IS NOW TOO BIG TO HIDE – THE TRUTH FROM THE CASH FLOWS), let’s go take a look if the revenues round-tripping Ponzi is in a better shape today.

🚩 Microsoft FAILED to collect cash for 17 billion USD of “Unearned Revenues” in Q3-24

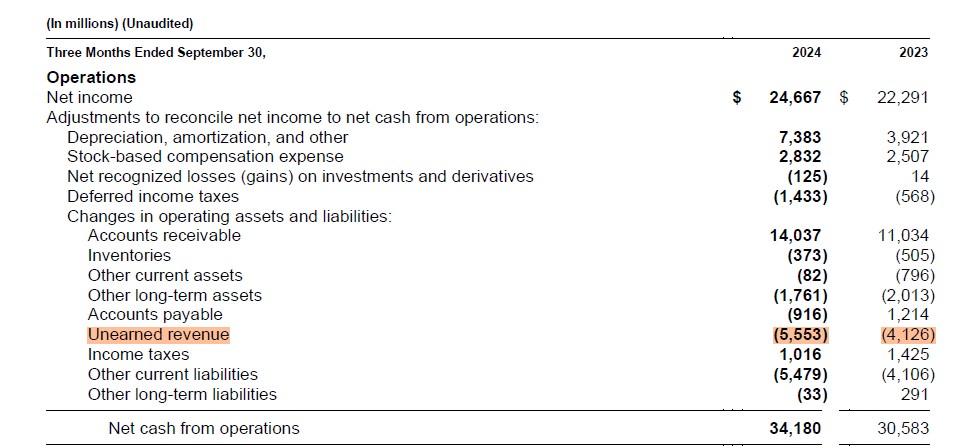

As you can see from the statement of cash flow below, Microsoft collected ~5.5bn USD of cash related to revenues it already recognized in previous quarters.

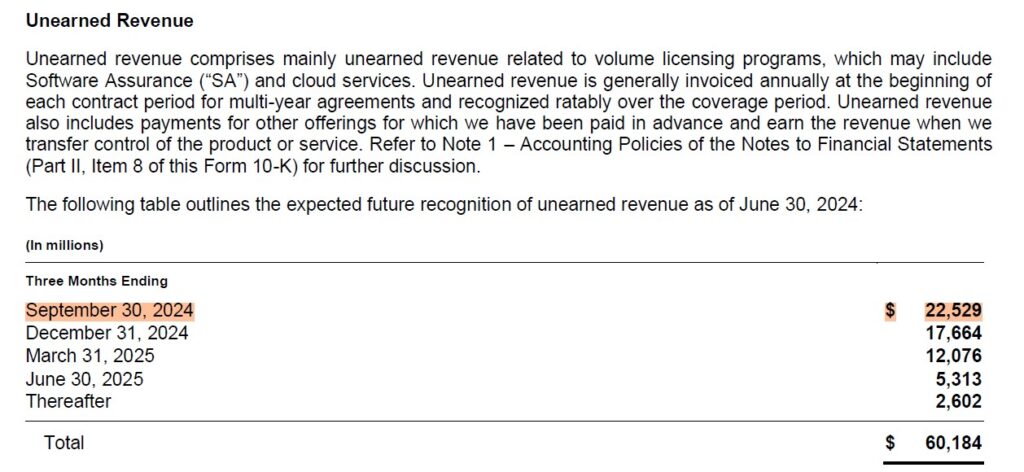

What’s wrong with it? As you can see in the table below from the previous quarter disclosing the details on the “Unearned Revenues” liabilities account, Microsoft should have collected ~22.5bn USD by the end of September 2024!

Yes, my dear reader, someone did not pay Microsoft 17bn USD and I have a strong gut feeling SMCI and OpenAI might have something to do with it considering OpenAI is the company revenues laundromat (THE SMOKING GUN THAT PROVES HOW OPENAI IS MICROSOFT’S REVENUES LAUNDROMAT). Maybe just a coincidence, but those ~5.5bn USD in cash Microsoft received are somewhat close to the full amount of cash OpenAI raised during its last fundraising round closed in Q3-24: OpenAI Raises $6.6 Billion in Funds at $157 Billion Value. Strange, isn’t it?

So how did Microsoft handle the hiccup? As you can see in the beautiful table below I prepared to make it easier to compare the unearned revenues account between the 2 quarters, Microsoft spread out those 17bn USD in several future quarters. The same table also shows how for this quarter Microsoft recognized one extra billion of unearned revenues. Hold on a second here, by how much did Microsoft beat Wall Street analyst revenue expectations this quarter? EXACTLY BY 1 BILLION USD (65.6bn$ vs 64.6bn$ Expected): Microsoft beats expectations with Q1 earnings driven by cloud. Yes, my dear reader, the company made up 1 billion USD of revenues it has not been paid for to nail a “beat”.

🚩 Big accounting changes for Microsoft in Q3-24 for Unearned Revenues

Yes, I am not done on this topic. As you can see underneath the table below, Microsoft made some changes in its accounting for unearned revenues

What did they change exactly? As you can see in the next table, more than 10bn USD of unearned revenues previously accounted to “Intelligent Cloud” (where Azure revenues are included) services have been shifted to “Productivity and Business Processes”

Why this trick? Thanks to lower Azure revenues the previous quarter, Microsoft showcased a 33% growth in Azure cloud services again “beating” Wall Street analyst expectations.

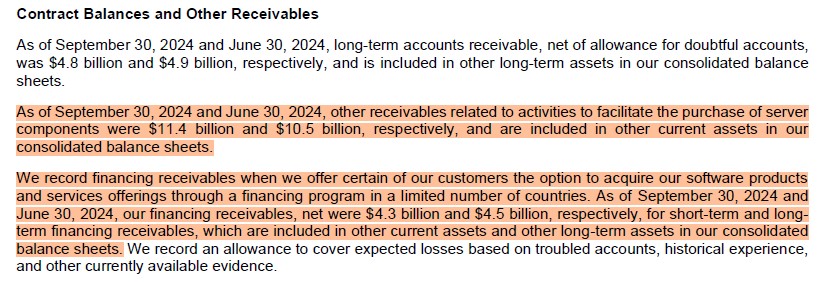

🚩 Most of Microsoft has been financing other companies to acquire server components and to buy its own services

What?! Yes, I bet this is what just popped into your mind because, in theory, Microsoft is the one supposed to build and run the servers, right? Apparently not, considering that out of ~26bn USD of “Other current assets” in Microsoft’s balance sheet, ~11.4bn USD are related to financing Microsoft gave to other companies to acquire server components as you can see in the first part highlighted below. Why do I have a strong gut feeling that this is related to Microsoft financing other companies to buy NVIDIA GPUs while Microsoft itself already buys the lion’s share of NVIDIA GPUs (especially Blackwell ones)?

As you can read in the second part highlighted, Microsoft lent ~4.3bn USD to customers to purchase its own products. Not a big deal, you might say. Well, here’s the thing: if my math is correct, there are ~10bn USD of Other Current Assets the company provides ZERO explanation about.

🚩 Microsoft’s start-ups shopping spree came to a halt, but the questionable valuation of its Goodwill remains

We know that 51bn$ of Goodwill in Microsoft’s balance sheet is related to the Activision Blizzard acquisition that was fully paid in cash, but what about the rest? As you can see from the math below from my last article 3 months ago, 43% of what is still accounted as Goodwill by Microsoft was acquired without paying a penny of cash (we know they like to use a lot of Azure credits) hence as a matter of fact Microsoft has been printing money out of thin air and including it in its accounts.

In its latest earnings release, Microsoft claims it spent:

- 44.4bn$ to purchase property and equipment (up from 28bn$ spent the year before)

- 69bn$ in companies acquisitions (up from 1.67bn$ the year before)

- 17.7bn$ in “purchase of investments” (down from 37.7bn$ the year before)

Microsoft’s Net Income for the past 12 months was 118.5bn$ meanwhile the net cash used in financing was negative 38bn$ (the lion’s share is dividends and stock buybacks).

Let’s do some easy math now: 132bn$ – 118.5bn$ + 38bn$ = 58bn$

Waaaait a second, how much did Microsoft Goodwill increase? ~52bn$

What about the increase in “fake revenues”? ~6bn$

Yes, dear readers, 43% of Microsoft’s buying spree was executed without the company paying a penny of cash.

As of the latest earnings, Microsoft’s “Goodwill” totals ~119bn$, and at this point the question is fair: if arguably they didn’t pay cash for it how much is this goodwill really worth?

JustDario on X | JustDario on Instagram | JustDario on YouTube