Dear reader, please accept my apologies, but today’s article is going to be quite short. Why? Because in its latest quarterly release HSBC disclosed pretty much nothing relevant to truly assess its balance sheet’s strength in the 71 pages made available to the public. However, even if you can clearly gauge the effort the bank made to convey the message they had a great Q3-24 in the financial results release, the devil as usual is in the details and a few of them are quite strange.

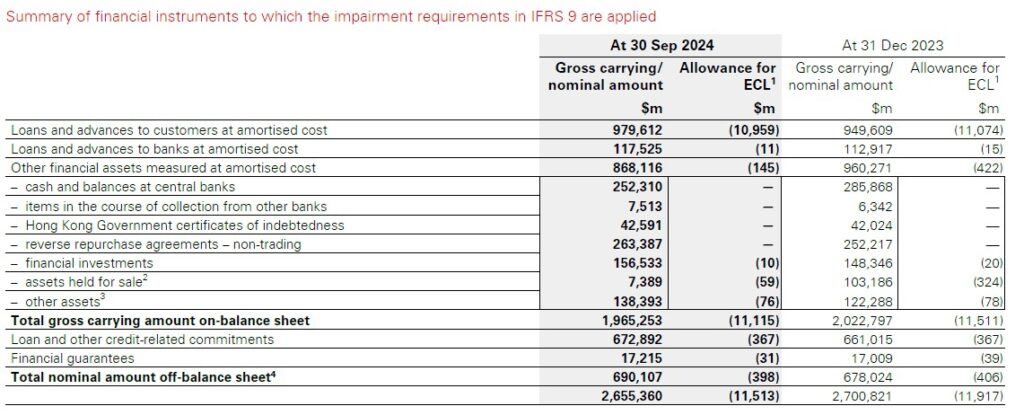

First of all, while many other banks, especially US-based ones, are disclosing billions of unrealized losses in their securities portfolios, HSBC claims that they have barely lost a penny in another quarter. As you can see below, HSBC set aside only 10 million USD as allowance for expected credit losses (ECL) against its total of 156.5 billion USD in financial investments.

How can they do so well? Because the bank sees no risk at all of not being able to hold those investments till maturity and to collect the principal invested in full. So why bother telling the market what’s the real shape of your books if the global economy is improving (according to their convenient assumptions) and the chances of liquidating those investments prior to maturity for their real market price is perceived as negligible?

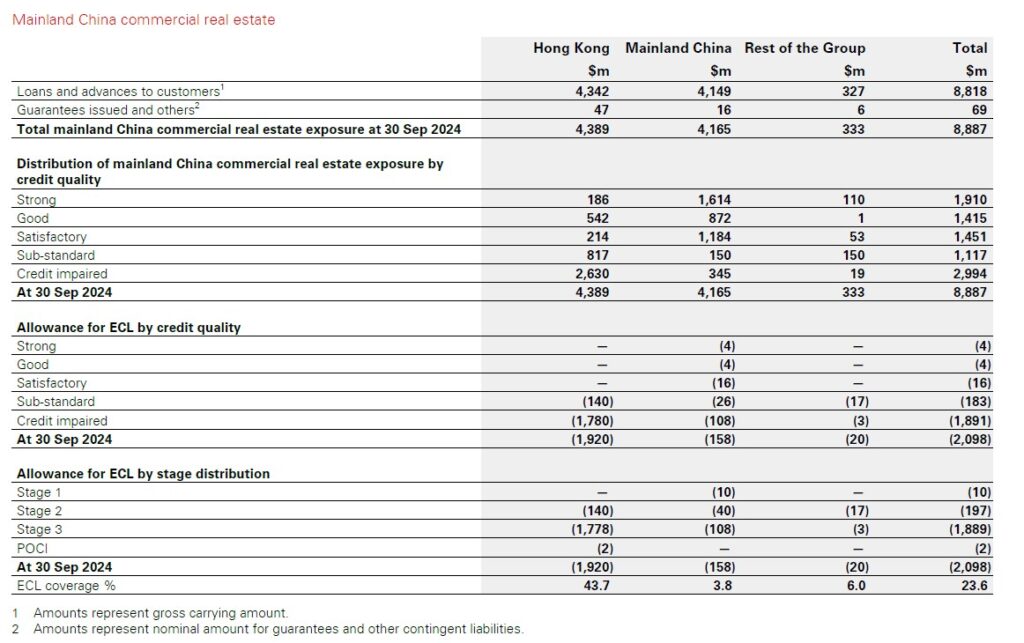

The second strange thing in HSBC numbers can be found on page 59 where despite MSM headlines of struggling economy in China and the government passing trillions of stimulus pretty much every other day now (of course, I am kidding), HSBC CRE loans in Mainland China apparently did not feel the pinch from any of that.

However, if you take a closer look at the numbers and compare Hong Kong CRE with Mainland China, something does not add up. How is it possible that considering the size of the two exposures is similar, half of HSBC’s exposure to Hong Kong CRE is “Credit Impaired” and the bank set aside almost 2 billion USD to cover ECL (~44% of the total exposure) while for the Mainland China portfolio the total allowance for ECL is a mere 3.8% of the total exposure? Furthermore, how is it possible that almost ~60% of the Hong Kong portfolio is credit impaired with the bank’s hopes to recover something out of it clearly low considering the amount of ECL, while the Mainland China credit impaired portfolio is only 8.2%? Isn’t the CRE situation in Hong Kong better than the one in Mainland China according to what filters in the MSM? As I said at the beginning, the numbers barely add up here.

Unfortunately, HSBC does not share any more detail about the rest of its portfolio in an attempt to make it look like everything is fine even if its previous CEO unexpectedly resigned the previous quarter even if at that time the numbers looked “great” (IS HSBC CEO “UNEXPECTEDLY” LEAVING BECAUSE THE BANK WON’T BE ABLE TO HIDE ITS PROBLEMS FOR MUCH LONGER?).

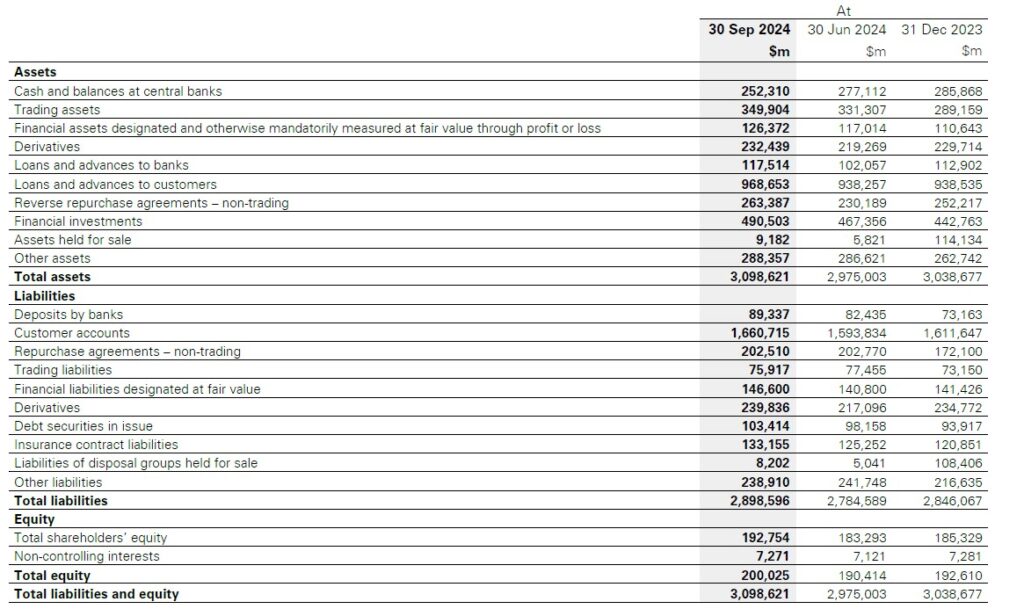

One last strange thing appeared in this HSBC financial report though. While rates were lower than previous quarters the bank saw its Net Interest Income shrinking significantly. What’s wrong with this? Well, the bank claims that occurred because HSBC funding costs INCREASED due to HIGHER interest rates.

Weird isn’t it? In particular when at the same time the bank claims their deposits increased by a whopping 67bn$ compared to the previous quarter. If we look closer at HSBC assets big figures though you can notice something strange again, all items increased in size compared to the previous quarter EXCEPT CASH in yet another sign that there is clearly more going on within HSBC books than the bank disclosed.

Again, apologies for not being able to dig out more at this stage, but unfortunately, we are living in a period when banks are allowed to “extend and pretend” until something breaks, and then regulators need to scramble to bail them out. I’m not saying this is the case for HSBC, but clearly, it feels like this bank has a lot to hide.

JustDario on X | JustDario on Instagram | JustDario on YouTube