Currently, Nvidia is the company with the highest market capitalization in the world. Sorry, I won’t call it “the most valuable” because price and value are two different things, and it would be an intellectual insult to refer to it as such.

There are pros and cons to becoming such a big name. On one side, it can attract a lot of support, but on the other side, it can also attract a lot of scrutiny. When I started bringing the spotlight on Nvidia more than one year ago (full archive), only myself and a bunch of “Twitter Randos” (as they called us at that time: Wall Street analyst defends Nvidia from ‘Twitter randos’ spreading bearish conspiracy theory) dared to raise questions on Nvidia numbers and mind-blowing management projections for the future. One year later, the “Twitter Randos” are not alone anymore, and so many social media accounts have come forward raising more than legitimate questions about Nvidia’s business and numbers, highlighting all the incongruences and dark sides no one cared about so much before. As a consequence, as a form of respect, I am not going to bring up anything that is already available on social media and claim any credit for that since those who did the work faster than I deserve it. What I am going to do in this article is step up the analysis of Nvidia financials one notch, but I promise I will do my best to keep it simple to understand. Please bear in mind several of the tables I am going to share are a comparison between the latest and the previous 10-Q where the red lines and text in red represent the amendments the company made in the new quarter.

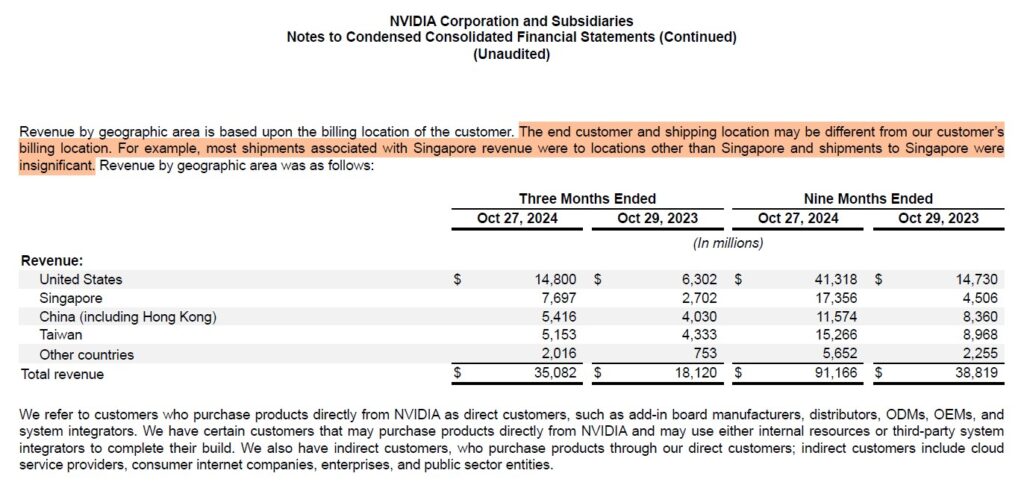

🚩 Why does Nvidia hide the geography of a growing amount of its revenues?

I already brought this up before, but since I did not see anyone still highlighting this matter, I will do it again. This is how Nvidia describes its revenues attached to Singapore:

“Most shipments associated with Singapore revenue were to locations other than Singapore and shipments to Singapore were insignificant”

So according to the company, almost 8 billion USD of revenues in the last quarter, 22% of the total and the largest chunk outside the US market, were sent to an undisclosed location. One year ago, this amount was ~2.7 billion USD and ~15% of the total. Isn’t it a fair question to ask where these revenues are really being generated from? Furthermore, if there is nothing wrong with the end destination, what’s the point of hiding the end location and being more transparent with the investors’ community? It doesn’t take an accounting genius to figure out there is something wrong going on here.

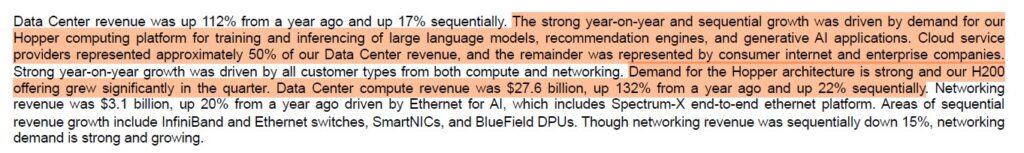

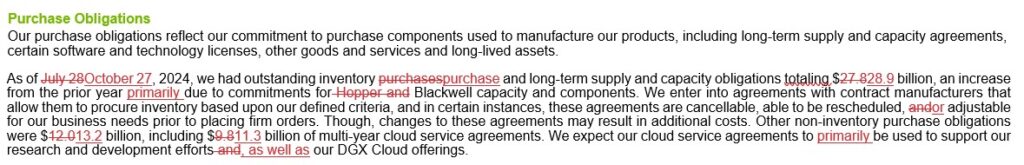

🚩 “Strong demand” for Hopper but no increase in future purchase obligations for Hopper?

As you can read in the paragraph below Nvidia claims “Demand for the Hopper architecture is strong and our H200 offering grew significantly in the quarter” and that Hopper (not BlackWell) has been the driver of Nvidia’s spectacular growth so far.

I wonder how it is possible that the company claims strong demand for Hopper but then its clients aren’t placing purchasing orders for it. Strange, isn’t it? As you can see from the table below, Nvidia even struck out the reference to “Hopper” in the purchase obligations section.

Does this have anything to do with the Mark To Market assumptions based on subjective management estimates to evaluate the value of Hopper inventories? Of course it does, but clearly, here we have a pretty big contradiction and I wonder if NVIDIA auditor PwC will close an eye on it.

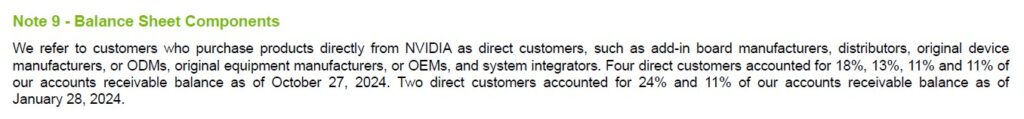

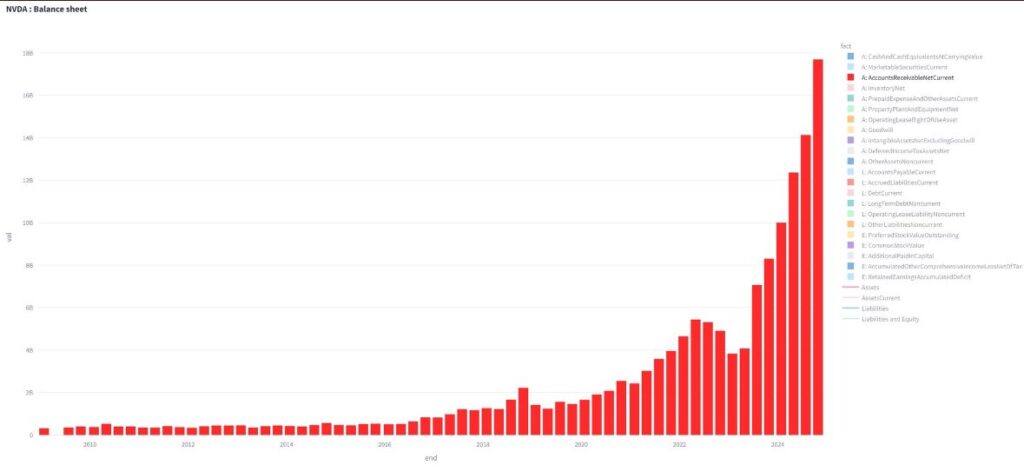

🚩 Unusual Account Receivables concentration

It is very well known now that the majority of NVIDIA revenues come from a handful of customers, notoriously Microsoft, META, and SMCI, however, what I did not see anyone highlighting is a similar concentration in Account Receivables too.

53% of the account receivables are against four direct customers only (who knows about the “indirect” ones), and considering this amount keeps growing significantly (chart credit to @1CoastalJournal), it’s very hard to push back that feeling these customers aren’t paying the bills, but NVIDIA keeps delivering products to them, isn’t it?

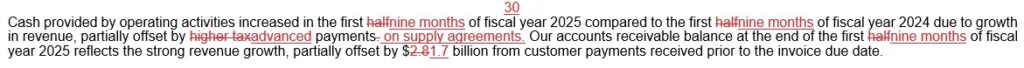

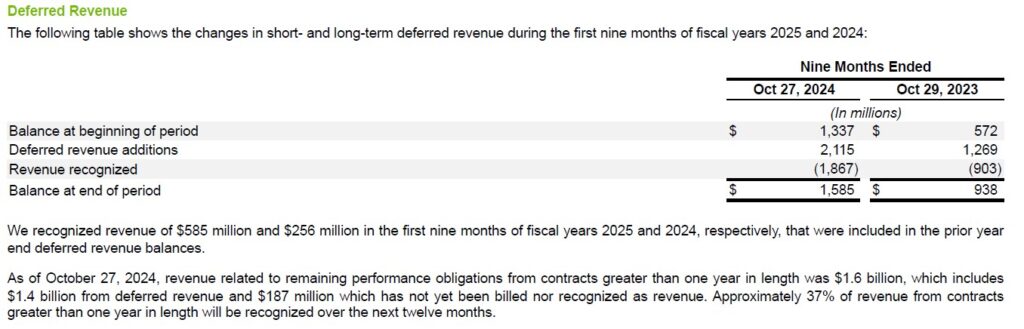

🚩 NVIDIA invoices paid in advance and booked as revenues in the current quarter

While there are clients piling up bills with Nvidia, there are also clients that are so eager to pay them even before an invoice is issued to them. Crazy, isn’t it? Apparently not.

As you can see, it is something that happens every quarter. Hold on a second, by how much did Nvidia “beat” Wall Street revenues consensus this quarter? ~2bn$. How much is the amount of these advance payments booked as revenues in the current quarter? ~1.7bn$. Where is the rest of the “beat” coming from? From “Deferred Revenues” the company already disclosed LAST YEAR.

Dear reader, hopefully, you will agree with me that this revenue “beat” was totally fabricated (like the previous ones)

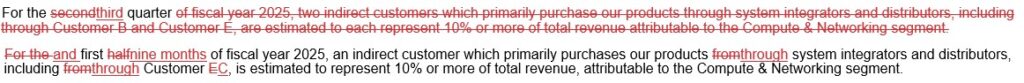

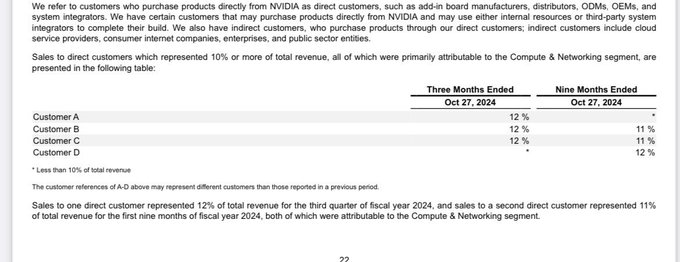

🚩 From two “indirect” customers to one

As you can read below, in the previous quarter Nvidia had two “indirect” customers that represented more than 10% of the revenues each. This was a red flag I highlighted already at that time and very unusual for such large customers not to deal directly with the company and prefer to go through a “middleman,” isn’t it? This quarter only one “indirect” customer is left and it is fair to wonder whether SMCI troubles had anything to do with it considering part of the company business was notoriously to play the middle man.

Furthermore, how did NVIDIA fill the void left open by the fallout with this “indirect customer”? Perhaps they started to deal with it directly considering a brand new “Customer A” filled the spot for the exact amount.

How can we assume “Customer A” is a new one? As you can see below there are two elements pointing at that:

- Customer A was not a significant direct customer before

- The company sneaked a very subtle disclaimer with a smaller font under the table: “The customer references of A-D above may represent different customers from those represented in previous periods”

The fair question here is: why wasn’t NVIDIA directly dealing with this customer before to begin with? It looks like another big red flag to me.

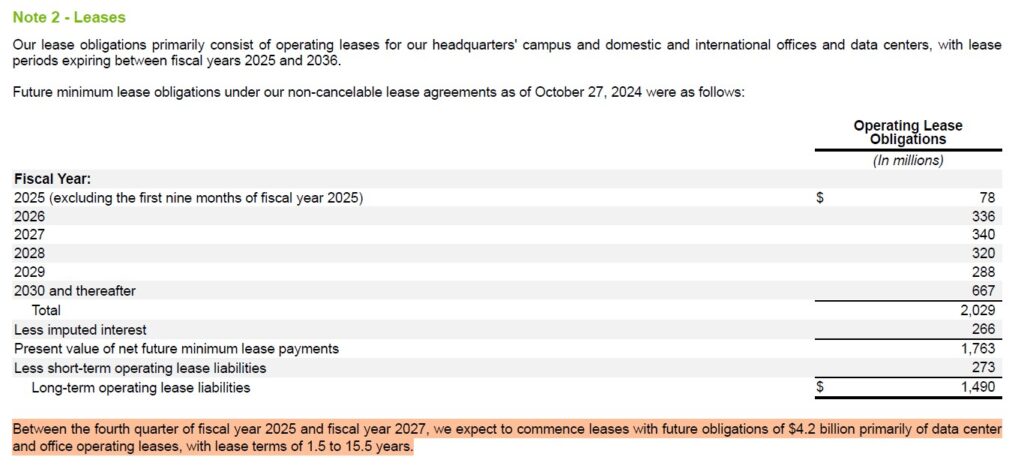

🚩 Are future lease costs kept off-balance sheet to boost the Net Income?

As you can easily observe in the table below, NVIDIA reported a net total of ~1.5 billion USD of future lease obligations, however as you can read in the highlighted part, they instead disclose their future lease obligations until 2030 are 4.2 billion USD. Somehow 2.7 billion USD of future lease liabilities disappeared from NVIDIA’s balance sheet and no one noticed. What happens when a lower number of liabilities is being reported? The equity portion increases to compensate. By how much did NVIDIA Net Income increase compared to the previous quarter? Coincidentally 2.7 billion USD, crazy isn’t it?

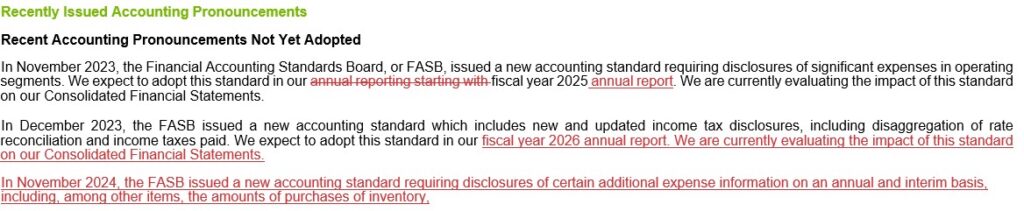

🚩 Are higher operating costs expected next quarter due to Nvidia waiting more than one year to apply the new accounting standards?

I believe the language below is quite self-explanatory, isn’t it? As you can read, Nvidia delayed the disclosure of significant expenses in its operating segments for more than one year since the new FASB rule was in place. Furthermore, this month a new FASB rule has been issued to increase company disclosures about additional expenses, in particular with regards to inventory purchases. No worries though, I do not expect NVIDIA to be so adamant about applying it right away starting from the next quarter that coincides with its annual report subject to audit.

I believe it’s more than enough today considering the amount of material I dropped. I wish you all a nice weekend.

JustDario on X | JustDario on Instagram | JustDario on YouTube