Super Micro Computer, Inc. (SMCI) is under the Nasdaq microscope again, and it’s not a pretty sight for the exchange. The company missed its 10-K filing deadline back in August and already filed an NT 10-Q form anticipating they won’t be able to file its 10-Q on time either. Now SMCI is scrambling to stay listed having already burned through one Nasdaq extension that expired on November 18. To make things worse, Ernst & Young (EY), its previous auditor, walked away in October, stating flatly that they didn’t want their name tied to SMCI’s financial statements.

Back in 2018, SMCI was delisted for failing to file audited reports and later got a slap from the SEC for accounting fraud. Despite being relisted in 2020, old habits seem to die hard and the Nasdaq is now weighing whether to give SMCI another lifeline or pull the plug. What are the factors Nasdaq should consider and the risks at stake?

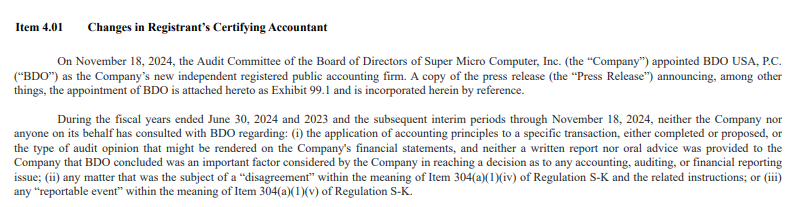

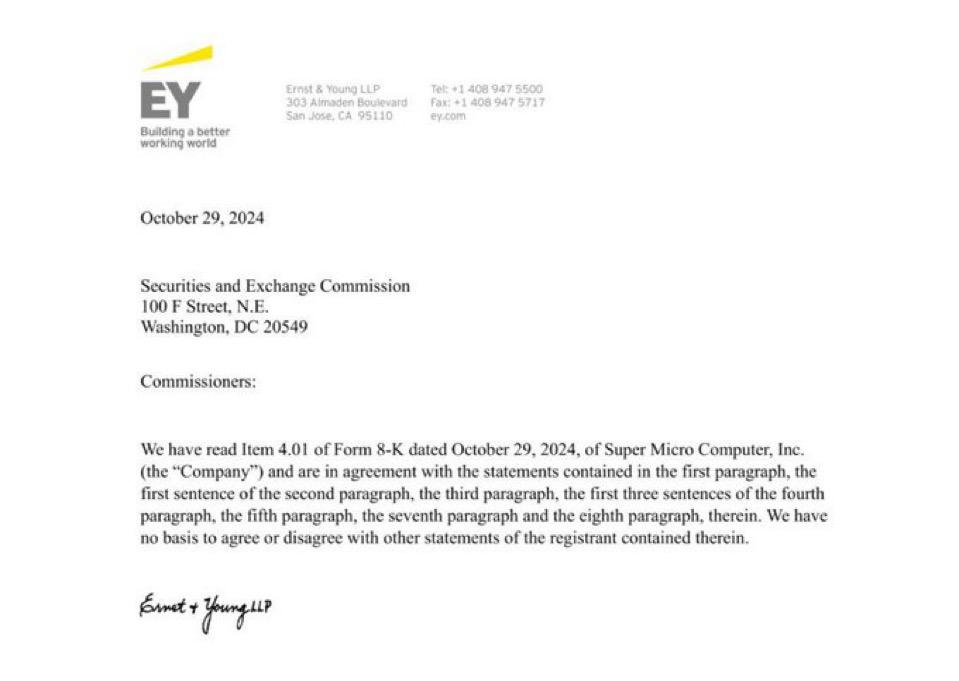

When a company doesn’t file its financial reports, it’s like showing up to a job interview with no résumé. SMCI not only missed filing its 10-K, but it also flagged delays for its 10-Q (quarterly report). These are critical documents for investors to assess a company’s health. EY’s resignation on October 29 was the cherry on top. The firm flatly said it didn’t want to be associated with SMCI’s numbers. That’s a bold—and rare—move for a top-tier auditor. SMCI’s quick switch to BDO as its new auditor is notable, but here’s the kicker: BDO wasn’t given any details about why EY left. SMCI says they’re working to comply with Nasdaq rules, but this level of opacity raises eyebrows as you can read in this extract of the 8-K NOT INCLUDED in the Press Release.

What is Nasdaq expected to consider?

1 – Consider the Company’s Track Record

Notably, this isn’t SMCI’s first rodeo. The company was delisted in 2018 for similar issues and was hit with SEC sanctions for fraud. Nasdaq relisted SMCI in 2020, but now the same problems are cropping up. Fool me once? Maybe. Fool me twice? This would look pretty bad on the exchange.

2 – Examine the EY cause for abrupt resignation

Auditors don’t just quit like this unless there’s serious cause for concern. EY’s refusal to back SMCI’s financials is a massive red flag. Even worse, SMCI hasn’t been transparent about why EY bailed to the point that EY wrote a letter to the SEC to even specify which parts of the SMCI press release they were in agreement with. It will be impossible for the exchange to turn a blind eye to this element.

3 – Assess Allegations of Mismanagement

All these public allegations supported by sources are summarized in my previous articles below:

- SMCI – THE NUCLEAR NOTHING BURGER THAT CAN EXPOSE NVIDIA SHENANIGANS [PART 2]

- SMCI – THE NUCLEAR NOTHING BURGER THAT CAN EXPOSE NVIDIA SHENANIGANS

- “HYPERSCALERS” OR “HYPERCHEATERS”? – ADDING HINDENBURG PIECE TO THE BIG PONZI PUZZLE WE HAVE BEEN PUTTING TOGETHER TILL NOW WHILE WAITING FOR NVIDIA EARNINGS

What are the risks for the Nasdaq exchange if they grant another extension to SMCI under the current circumstances?

1 – Reputation Damage

Nasdaq prides itself on being the gold standard of stock exchanges right? Listing a company with unresolved financial scandals tarnishes that image. Remember the Luckin Coffee Scandal or the most recent SunPower Corporation one? Nasdaq delisted them in 2020 after they admitted to fabricating sales data. If SMCI ends up pulling a similar stunt, Nasdaq’s credibility will take another serious hit.

2 – Loss of Investor Trust And Risk Of Losing Business To Competing Exchanges

Investors rely on Nasdaq to enforce strict compliance. If Nasdaq looks like it’s giving SMCI a free pass, confidence in other Nasdaq-listed companies could waver. And with SMCI operating in the high-stakes AI sector, even a whiff of impropriety could scare off tech investors.

3 – Legal and Financial Fallout

If SMCI’s issues morph into a full-blown fraud scandal, Nasdaq could face an investor lawsuit. The SEC and DOJ might also turn their spotlights on Nasdaq for failing to enforce its rules.

A notable example of investors suing a stock exchange for damages is the lawsuit following the listing and subsequent failure of Luckin Coffee on the Nasdaq. Investors argued that Nasdaq failed in its due diligence and oversight responsibilities by allowing the company to remain listed despite red flags. This case highlighted potential liability for exchanges when due diligence is inadequate, or compliance violations are overlooked (The Luckin Coffee Inc. Securities Fraud Class Action Litigation)

Nasdaq’s incoming decision on SMCI is about more than one company—it’s about setting the tone for corporate governance across its exchange. SMCI’s story is riddled with red flags, from its troubled history to EY’s dramatic exit and ongoing allegations of financial mismanagement.

Giving SMCI more time allowing a repeat offender to stay listed objectively far outweighs the potential benefits for the exchange while delisting SMCI would send a strong message: Nasdaq prioritizes integrity over convenience, protecting both investors and the exchange’s reputation in the long run.

JustDario on X | JustDario on Instagram | JustDario on YouTube