Insurance isn’t really an area that I had much interest in, mostly because in the countries where I’ve lived, it has generally been a well-run and stable business. However, the recent Los Angeles wildfires prompted me to look into this sector in California more closely, and what I discovered is utterly shocking.

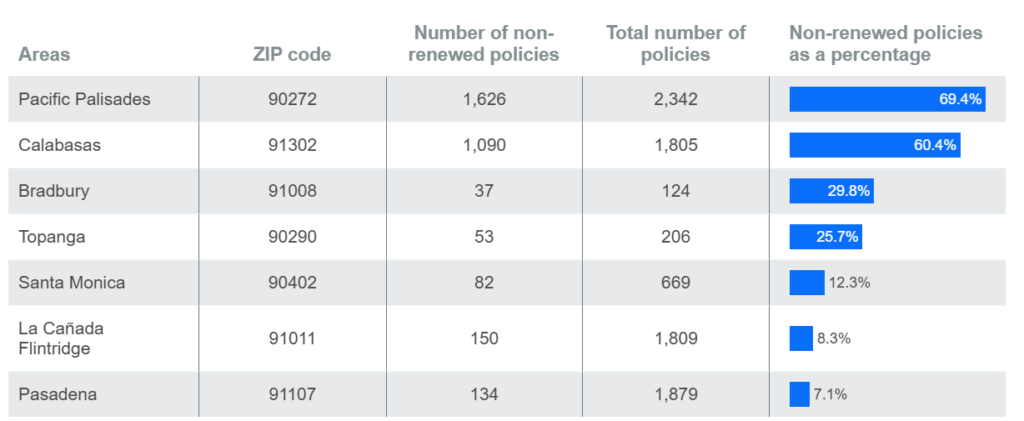

Let’s start with the first table where we can see the number of policies that were not renewed in LA in 2024 by State Farm

Frankly, I am no conspiracy theorist, but honestly speaking, what are the chances that State Farm walks away from renewing 70% of the insurance policies in an area that, a few months later, was totally wiped out by wildfires? Clearly, the inspectors figured out something that many overlooked: LA Palisades water reserves being effectively offline for months with no clear date for them to be back in full operation (State to probe why Pacific Palisades reservoir was offline, empty when firestorm exploded.) increased risks to an extent that they were not insurable.

Other insurance companies, even if more “relaxed” about it, were not totally blind to the risk either. Even though they did not pull out of the market, they increased their policy costs so much that the vast majority could not afford it and ended up switching to the only affordable alternative available: the California FAIR plan.

Now this is what a California FAIR plan covers (in theory):

Dwelling Fire Policy:

This policy offers protection against specific perils, including:

- Fire and Lightning

- Internal Explosion

- Smoke

Policyholders can opt for additional coverage at an extra cost, such as:

- Extended Coverage: Protects against windstorms, hail, explosions, riots, aircraft or vehicle damage, and volcanic eruptions.

- Vandalism and Malicious Mischief

It’s important to note that the FAIR Plan’s Dwelling Fire Policy is a named peril policy, meaning it covers only the specific causes of loss listed in the policy.

Optional Coverages:

To achieve more comprehensive protection, policyholders might consider:

- Difference in Conditions (DIC) Policy: Supplements the FAIR Plan by covering perils not included, such as theft, water damage, and liability.

- Comprehensive Premises Liability (CPL) Policy: Provides liability coverage, including for incidents like slip and fall lawsuits, and may also include medical payments to others.

Coverage Limits:

The FAIR Plan has established coverage limits to accommodate various property types:

- Residential Properties: Up to $3 million per location.

- Commercial Properties: Up to $20 million per location.

Among the relevant exclusions, we find arson not only when it’s a direct consequence of policyholder actions but also when it’s a direct consequence of “acts of war” or “civil unrest”. The latter is likely where lawyers are already gearing up to build their case, considering several arsonists have been arrested for starting fires with the intent of looting properties.

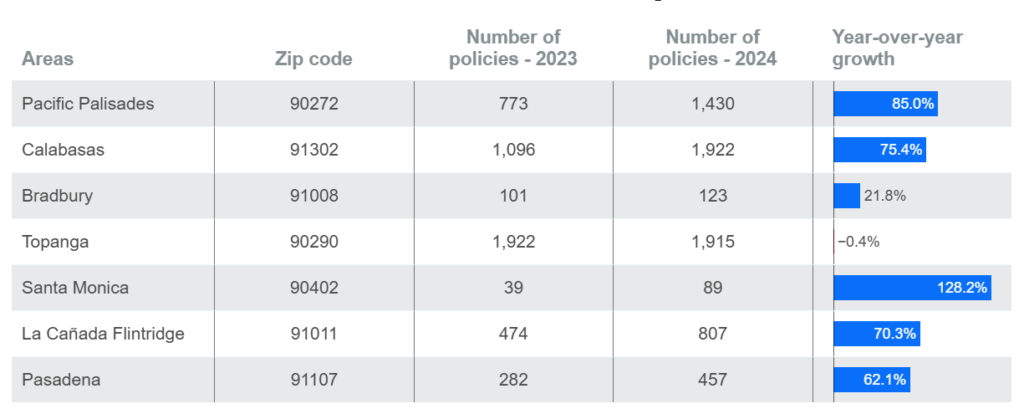

Let’s run some numbers, shall we? The median home listing price in Palisades as of December 2024 was $4,250,000, already far beyond the $3M coverage cap in the FAIR plan. However, the median home price reported in November was $3.3M, just slightly above the coverage cap. Good news then? Not so fast. Considering 1,430 homes in Palisades alone were under a CA FAIR plan and they were all pretty much destroyed, assuming the lawyers cannot prove the act of civil unrest and using the $3.3M median house price, the total damages in this area alone total ~$4.7B. Can the CA FAIR cover it? The answer is no.

As per the latest available figures, the CA FAIR plan only had ~$200M of capital surplus to cover damages for the whole of California, with only an additional $2.5B reinsured as a whole. CA FAIR instead underwrote $458B of risk, a shocking 63% increase from the year before and a massive red flag everyone but State Farm apparently ignored. As a matter of fact, Palisades’ damages alone wiped out the CA FAIR insurance scheme.

At this point, what can be expected next will be a fair assessment of the Private Insurers operating in California to cover the damages. However, it will not be an easy one this time, considering the objective public administration negligence in managing the water system meant to be in place to mitigate the risk of wildfires. The latest figures by AccuWeather put the total damages from current wildfires at an amount greater than $250B, and considering the fires are still raging, this figure is expected to continue increasing significantly, besides being already greater than the total capital surplus of all the private insurers operating in the state (State Farm California subsidiary only had a $1.3B capital surplus as of 2023).

The only solution here is a bailout of the whole California Insurance system, and there are not many alternatives to it, considering that banks and those who bought MBS backed by California mortgages will be hit by massive losses otherwise. The real question now is, can the US afford to bail out the whole California insurance system while already running a record deficit and needing to refinance $9.5 trillion of Treasuries due to mature in 2025 without the FED monetizing a big chunk of it? I bet many investors are already running the numbers and calculating the consequences on the economy, especially on inflation that was already reignited by the FED’s reckless rate cuts in 2024. At this point, it should not come as a surprise to see US Treasury yields continue to rise, and they will likely rise much more since I doubt the US Government will force investors to cash out stock gains to cover the shortfall, as they know it will bust the whole bubble with even worse consequences for the economy and the financial system, delaying the inevitable once again since all I am describing is going to add on top of the mounting problems banks are dealing with, especially in the commercial real estate sector.

JustDario on X | JustDario on Instagram | JustDario on YouTube