“Why are central banks cutting rates while yields are going up? How is this possible?” This is the question many people are asking themselves at the moment. Surprisingly, those experiencing the highest degree of confusion and bewilderment appear to be institutional investors rather than retail investors. The reason is that almost nobody in the institutional investor space dared to question Central Banks’ “superpowers” to control markets and direct them as they pleased. After all, “don’t fight the FED” has been one of the most lucrative and safe investment strategies for quite some time, especially for stock investors, particularly after 2008 – with perhaps one exception: banks accumulating long-term assets in 2020 after they assumed that the FED’s promise to keep rates “low for longer” meant “low forever”.

Several months ago in “IF THE FED CUTS RATES, THE DAMAGES WILL BE FAR GREATER THAN THE BENEFITS“, written one month before the FED started to cut rates, I highlighted the following risk everyone on Wall Street and beyond was overlooking:

“if the FED cuts rates, there is the ultimate risk of triggering an inversion of the US yield curve back to upward sloping. As I described in “FED AND BOJ WILL DO EVERYTHING THEY CAN THIS WEEK TO SAVE THE STOCKS BUBBLE ONCE AGAIN,” if that happens, it will be hard for the global financial house of cards to remain standing as it has happened every single time in the past”

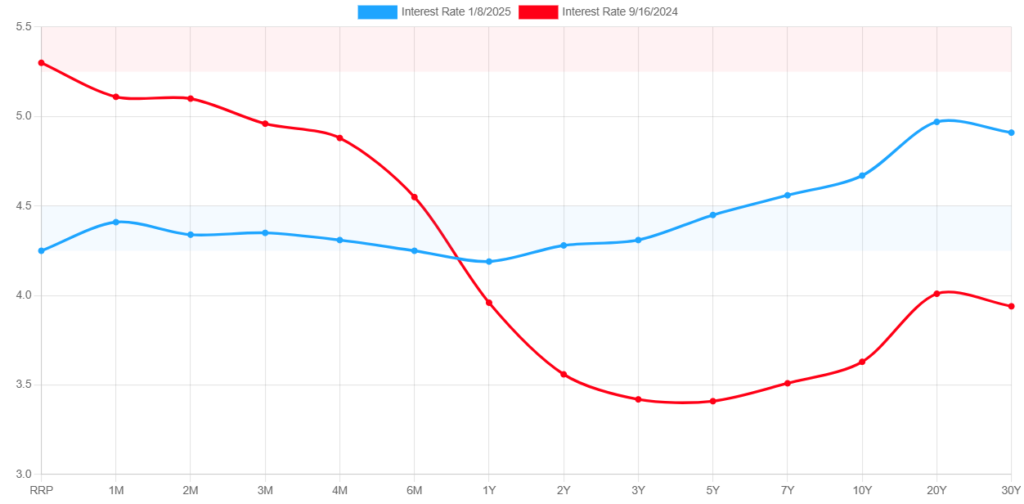

The FED proceeded with cutting rates, despite ultra-loose financial conditions already in place continuing to feed stock market euphoria and real-world inflation. However, it also triggered a sharp inversion of the yield curve into a “bear steepening” in an unexpected way: long-term rates started to rise while short-term rates fell (contrary to the street’s expectation that long-term rates would fall at a slower pace compared to short-term ones).

Never make the mistake of looking at things in isolation, as that’s not how the global financial system works in reality, while academics still fail to recognize this (perhaps because their theories would become too complex for the Nobel prize committee to understand and evaluate). As I highlighted in this post here, while the FED, the ECB, and the BOE were preparing to start cutting rates because they knew their respective financial systems could not withstand the pressure much longer due to trillions of debt coming due for refinancing in 2025, the BOJ was already losing control of its own interest rate curve.

Why was this an element that central banks should have considered more carefully? Because of its impact on one of the largest derivative instruments traded in the world, cross-currency swaps, which are rarely mentioned on social media.

A cross-currency swap is a financial contract between two parties to exchange principal and interest payments in different currencies for a set period. For example, one party might agree to pay fixed interest in JPY while receiving floating interest in USD, along with exchanging the principal amounts at the start and end of the contract. When interest rates and foreign exchange (FX) rates move from stable to highly volatile, the value of the swap and its associated cash flows become harder to predict. Volatile FX rates increase the risk of large swings in the value of exchanged principal and interest payments. Similarly, volatile interest rates can significantly affect the relative cost or benefit of fixed versus floating payments, potentially leading to higher risks and costs for both parties involved in the swap.

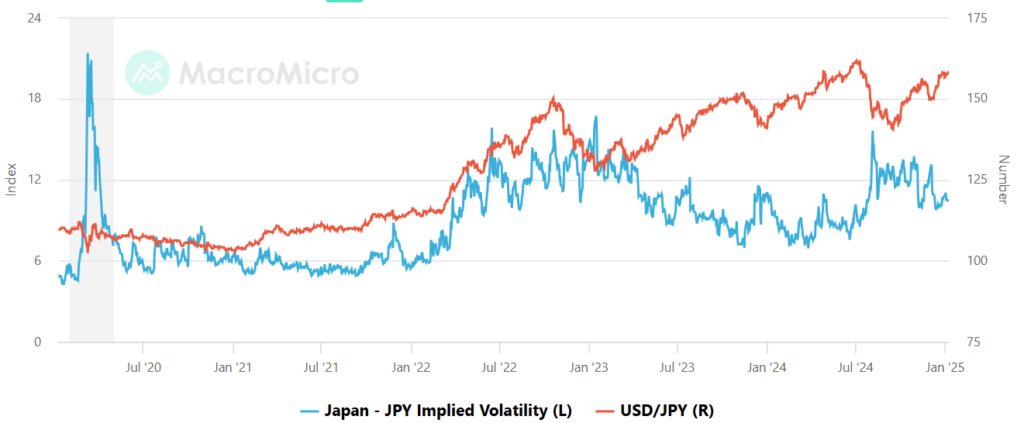

Take a look at the chart below comparing JPY Implied volatility with the USD/JPY exchange rate. Do you notice anything curious that happened in the recent past? Let me help you:

- A massive spike in JPY volatility in 2020 required Central Banks to step in with a massive rescue of the global financial system when, in theory, banks were supposed to be flush with cash and high-quality assets

- A steady increase in JPY volatility culminated in January 2023 with the US regional banks crisis

- Another spike in JPY volatility culminated with the events of the 5th of August when Japan experienced its own “Black Monday” and US stocks avoided a similar fate only because the market began demanding an emergency FED cut. Everyone assumed the FED would step in to bail out everyone once again, ultimately becoming a self-fulfilling prophecy with algorithms buying stocks even though the FED ultimately took no action.

At present, JPY volatility remains elevated, but not yet at dangerous levels, since the market believes the BOJ is in a position to hike interest rates to strengthen its currency. However, as I have warned many times, the BOJ has fallen into a trap from which they cannot escape without sacrificing either markets or Japan’s economy, with no way to avoid a sharp depreciation in the JPY in the long term: A PEEK INTO THE FUTURE: USD/JPY ROAD TO 300.

As you may now understand, trillions of USD equivalent of JPY carry trade are living on borrowed time because the “hedging” of leverage accumulated by the global financial system in the form of cross-currency swaps is under increasing pressure on both the FX and interest rates fronts, which are now both moving against those who borrowed money in JPY to invest in foreign assets. Furthermore, because of the bear steepening in interest rates occurring as described above, the value of those foreign assets is decreasing rapidly, effectively trapping many financial institutions that are now unable to unwind their leverage without incurring massive losses.

Are central banks in a position to bail out everyone once again? Unfortunately, that is not the case because literally every single one of them is running on a capital deficit (HOW CAN THE FED BAILOUT BANKS WHEN THIS TIME IT NEEDS A BAILOUT ITSELF TO BEGIN WITH?) while their countries are in no position to recapitalize them since they are running steep government deficits themselves. Yes, dear reader, both central banks and governments are now insolvent, but it will take some time before the market starts to figure this out – which is why I said the central bank “king” is more and more “naked”.

JustDario on X | JustDario on Instagram | JustDario on YouTube