A very important event occurred on May 6th, 2022, that many NVIDIA investors are unaware of: “SEC Charges NVIDIA Corporation with Inadequate Disclosures about Impact of Cryptomining“

Let’s examine what Nvidia did, shall we?

- In two of its Forms 10-Q for its fiscal year 2018, NVIDIA reported material growth in revenue within its gaming business. NVIDIA had information, however, that this increase in gaming sales was driven in significant part by cryptomining.

- The SEC’s order also finds that NVIDIA’s omissions of material information about the growth of its gaming business were misleading given that NVIDIA did make statements about how other parts of the company’s business were driven by demand for crypto, creating the impression that the company’s gaming business was not significantly affected by cryptomining

These words come directly from the SEC. As incredible as it sounds, Chief Kristina Littman stated: “NVIDIA’s disclosure failures deprived investors of critical information to evaluate the company’s business in a key market”.

Nvidia received merely a slap on the wrist from the SEC as a penalty, while investors suffered billions in losses and sued the company. Nvidia failed to convince the Supreme Court to dismiss the case: US Supreme Court dismisses Nvidia’s bid to avoid securities fraud suit.

Let’s summarize the situation before moving to the next part of the article. On one side, NVIDIA violated Section 17(a)(2) and (3) of the Securities Act of 1933 and the disclosure provisions of the Securities Exchange Act of 1934. On the other side, the company faces a class action lawsuit for securities fraud.

Looking at recent developments, here are the key events affecting NVIDIA in the first weeks of 2025:

- Nvidia faces revenue threat from new U.S. AI chip export curbs

- Nvidia’s Top Customers Face Delays From Glitchy AI Chip Racks

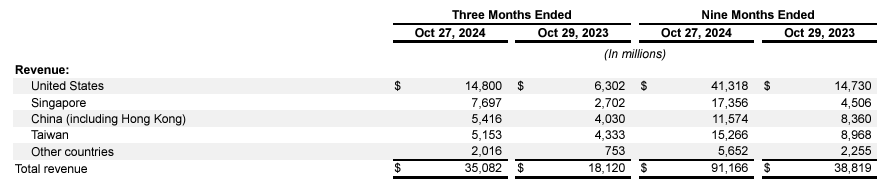

How significant is the threat from the first item alone? Let’s examine NVIDIA’s latest revenue disclosure by geography (where it’s now undeniable these geographies were used to circumvent previous US restrictions)

As evident, nearly 60% of NVIDIA’s revenues from last quarter are now directly affected by the new US restrictions, with virtually all previously exploited loopholes now closed. At a minimum, the company should disclose what portion of these revenues will be impacted. However, given their past disclosure practices, they’re likely to delay this information as long as possible. The impact must be substantial, otherwise the company wouldn’t have issued such a forceful statement: NVIDIA Statement on the Biden Administration’s Misguided ‘AI Diffusion’ Rule.

Moreover, the BlackWell issues are proving more complex than the company initially portrayed, with new information emerging regularly. Nomura Securities shared the following with its clients (source):

“Nomura Securities immediately issued a latest report naming Nvidia as a major cutter in TSMC due to the slowdown in demand for many products, and other CoWoS-S orders are as high as 80%, which is expected to cause TSMC’s revenue to decrease by 1% to 2%.

Nomura Semiconductor Industry Analyst Zheng Mingzong pointed out that the discontinuation of Nvidia’s Hopper platform chips, limited demand for the latest GB200A, and slow demand for GB300A are the reasons why Nvidia will significantly reduce its CoWoS-S bookings at TSMC and UMC in 2025. It is estimated that every year Reducing demand for 50,000 pieces of CoWoS-S will result in a 1% to 2% decrease in TSMC’s revenue”

Thus, Nvidia faces both a significant revenue cap and minimal chances of BlackWell entering mass production to meet this quarter’s delivery targets. Under current securities regulations, Nvidia must issue a profit warning unless it wants to risk another regulatory action – one that would be harder to weather than the 2018 incident, as it would constitute a repeat violation. This would also significantly weaken their position in the ongoing class action lawsuit regarding the 2018 events, adding more evidence of alleged misconduct.

This analysis doesn’t even consider the other issues we’ve previously discussed regarding questionable accounting practices by the company and its partners (archive).

In conclusion, with only two weeks remaining in Nvidia’s quarter, time is running out to avoid issuing a profit warning. This scenario becomes more likely with each passing day, and failure to act could trigger increased scrutiny of their accounting practices, potentially leading to more serious consequences as discrepancies in the numbers become harder to explain.

JustDario on X | JustDario on Instagram | JustDario on YouTube