“Is it possible for a bank to continue operating while being insolvent? The answer is yes, and Norinchukin Bank is the best example of it at the moment”. This was how I started my last article on Norinchukin Bank 3 months ago. This is why yesterday I wasn’t surprised at all when this breaking news hit the wires: “Norinchukin CEO Plans to Resign After Massive Bond Losses“

During the last quarter alone, Norinchukin Bank incurred a ~500bn JPY net income loss, bringing the total for the first quarters of this fiscal year to ~1.4trillion JPY, equivalent to ~9.2bn USD. Where do these losses come from? They come entirely from Norinchukin Bank’s securities portfolio, which shrank from ~38 trillion JPY to ~35.6 trillion JPY at the end of December 2024. From another perspective, this means that Norinchukin lost ~20% on a 2.4 trillion JPY face value of assets liquidated.

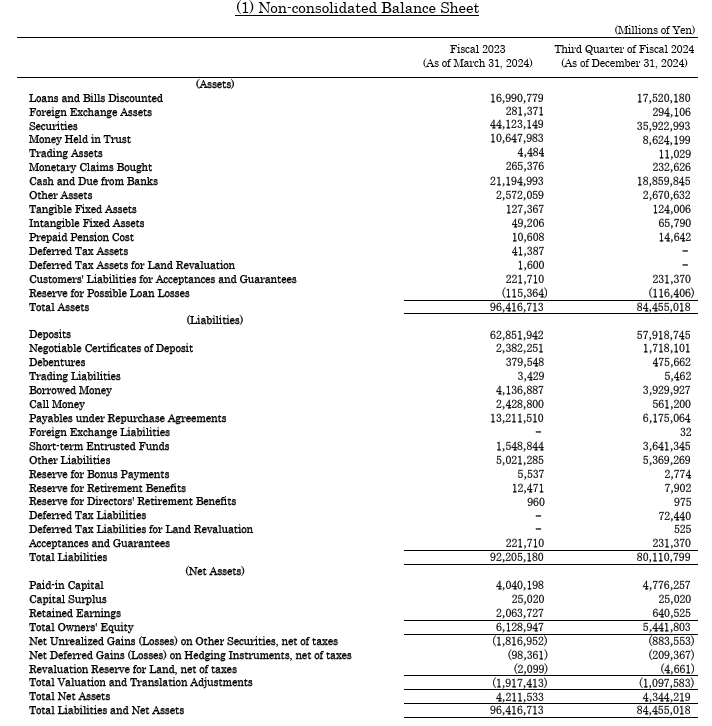

For those who are not familiar with how banks operate, please note that when a bank has to sell assets in a hurry to deal with a liquidity crisis (more on this shortly), the assets that have demand in the market aren’t the most toxic ones, but rather the highest quality ones like government bonds and guaranteed bonds. Now, if Norinchukin took such a huge loss on the best assets it could liquidate in the market, what do you expect is the Mark To Market value of the remaining securities left in its portfolio? This is why it’s a complete joke that the bank reports only ~900bn JPY of “unrealized losses” in its balance sheet as of the end of December 2024. Why is it a joke? As of the end of September 2024, Norinchukin Bank stated it only had ~800bn JPY of “unrealized losses”, then 3 months later it lost 500bn JPY and the amount of unrealized losses INCREASED to ~900bn JPY. This should make everyone seriously doubt any MTM figure the bank is putting out there, shouldn’t it? If we already apply the ~20% discount on the real price that the bank could fetch in the market to the ~35.6 trillion JPY of Securities left in its portfolio, the unrealized losses instead are ~7.12 trillion JPY. Considering that the bank only has ~4 trillion JPY of Net Assets left, it is becoming harder and harder for the Bank of Japan and the Japanese government to hide the fact that the second largest bank in the country is more and more insolvent and in desperate need of a bailout to stay in business.

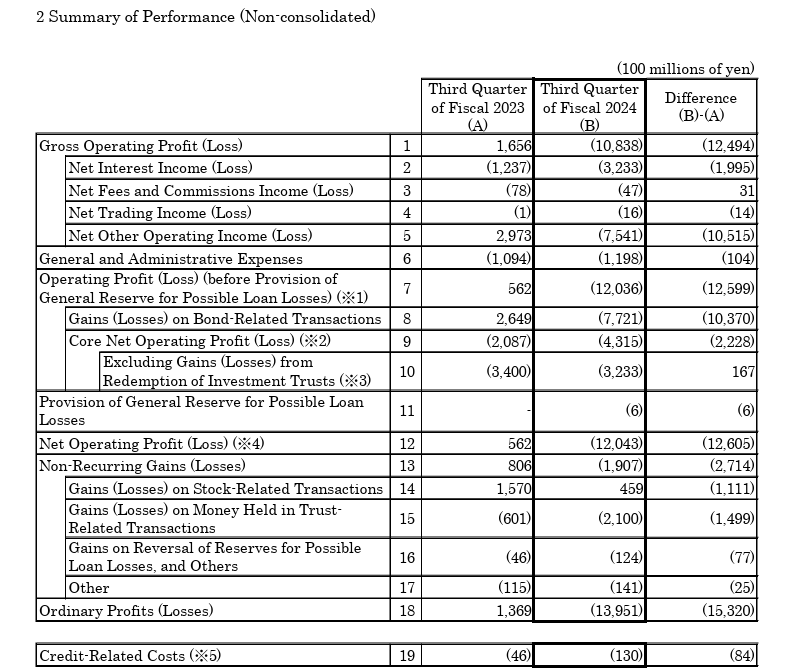

One thing that struck me the most in the latest Norinchukin Bank financial report is the table “Summary of Performance” which you can see below. Please take a look at the metrics for the third quarter of 2024. Do you notice anything incredible? Yes, my dear reader: EVERY SINGLE PERFORMANCE LINE IS NEGATIVE.

Personally, I have never seen something like this before, and if this doesn’t make it obvious how this very large bank is a sinking Titanic, I am not sure what further evidence is needed.

So why did Norinchukin sell all those securities in the last quarter and crystallize such a large amount of losses previously hidden in the hold-to-maturity books? Because the bank’s liquidity crisis is worsening:

- Deposits fell in one quarter from ~58.9 trillion JPY to 57.9 trillion JPY

- Repurchase Agreements (in Liabilities, hence money borrowed against collateral) fell in one quarter from ~9.3 trillion JPY to ~6.2 trillion JPY

Total = minus 4.1 trillion JPY

How did Norinchukin Bank fight the liquidity crisis besides selling securities in the market for which they could find a buyer?

- Cash and Due From Banks (Assets) fell from ~20.9 trillion JPY to ~18.9 trillion JPY

- Funding via Certificate Of Deposits increased from ~1.2 trillion JPY to ~1.7 trillion JPY

- “Other Liabilities” increased from ~4.6 trillion JPY to ~5.4 trillion JPY

The bank has been trying to raise capital since May last year (Japan’s Norinchukin Bank eyes raising $7.7bn in fresh capital), but as I flagged already at that time, whoever could read and properly analyze the books of the bank knew they were already insolvent and hiding a massive hole. Considering how much liquidity is being printed non-stop by central banks these days and how bullish stock markets are, if Norinchukin cannot raise capital in the best possible market conditions, then its fate is sealed and in the near future it is doomed to implode unless the government steps in with a massively expensive bailout. Failure to bail out this bank will have incredible repercussions in the global financial system, similar to those that would have occurred if Credit Suisse was let to collapse. The problem here is that governments will not be able to afford to bail out all these giant banks forever, and the scary thing is so many are in this very same situation and I won’t stop warning about it.

JustDario on X | JustDario on Instagram | JustDario on YouTube