One month ago, when the LIBRA scandal broke out (“Argentina’s $4.6 Billion Crypto Scandal; Largest-Ever Crypto Theft“), I wrongly assumed that the era of “scam coins” and predatory “pump and dumps” was finally over, considering it was exposed how the whole meme coins casino was actually rigged in favor of a handful of players who consistently pocketed big wins. Since it appears that, with the exception of those who have been publicly exposed, bad actors and grifters are back in the game, I believe it will be useful for everyone to learn the rules I use to recognize and avoid pump and dumps in the crypto space (broadly speaking, not only with regard to memes).

Red Flag #1 – A newly launched token is immediately trending on DEX trading screeners

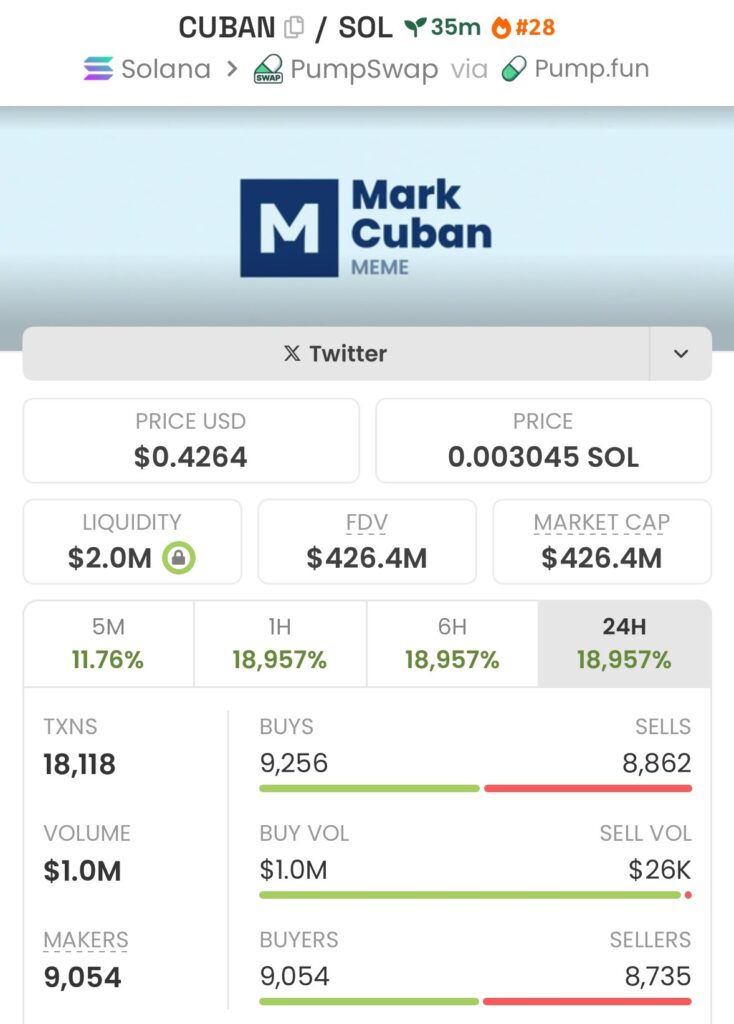

Take CUBAN as an example, which was launched under the false representation of being the “Official Mark Cuban” meme token. In less than 35 minutes since launch, this token was up 18,957% to a theoretical total market cap of ~426M USD, and as a result, it stood high among the “trending tokens” being picked up by various DEX screener platforms (because these tokens are never listed right away on centralized exchanges).

Red Flag #2 – Razor-thin liquidity and token supply in the DEX liquidity pools

How is it possible to send a newly minted token to hundreds of millions of USD in valuation in the blink of an eye? Very simple: buy most of the supply of tokens available in the decentralized exchange pool. As you can see in the table about CUBAN, 1M USD worth of buying volume was executed right away in 9,256 transactions compared to 8,862 of selling for a total of 26k USD. To understand how this brought the token to a staggering 400M+ USD valuation, it’s important to understand how DEX liquidity pools work and automatically calculate and broadcast the price of a token.

A decentralized exchange liquidity pool functions through a mechanism known as an Automated Market Maker (AMM), which replaces traditional order books with a mathematically driven system of pooled assets. At its core, the liquidity pool is a shared reserve of two tokens, such as CUBAN and SOL in our example, deposited by users called liquidity providers (LPs). These providers contribute equal values of both tokens to the pool, enabling decentralized trading. In return, they receive liquidity pool tokens that represent their proportional ownership of the pool. This system ensures continuous liquidity for traders, as the pool itself acts as a counterparty to every trade, eliminating the need for buyers and sellers to match orders directly.

The mechanics of price determination rely on a foundational mathematical formula, most commonly the constant product formula (x: y = k). Here, x and y represent the quantities of the two tokens in the pool, and k is a constant value that remains unchanged regardless of trading activity. The price of a token is derived dynamically from the ratio of these reserves. For instance, if a pool holds 100 SOL and 200,000 CUBAN, the initial price of SOL is calculated as the CUBAN reserve divided by the SOL reserve, yielding 2,000 CUBAN per SOL. This ratio shifts with every trade: when a trader buys SOL from the pool, the SOL reserve decreases while the CUBAN reserve increases, causing the price of SOL to rise incrementally. Conversely, selling SOL into the pool lowers its price. When the reserves become unbalanced, a phenomenon called slippage occurs, which grows with larger trades due to the curvature of the constant product curve. As a result, the greater the imbalance, the larger the price slippage, which is why it only took 1M USD worth of buying to send CUBAN price to a staggering 400M+ USD valuation, considering the initial supply of CUBAN and SOL in the DEX reserves was very limited. In essence, liquidity pools enable decentralized trading by algorithmically balancing supply and demand through token reserves. Prices adjust seamlessly with each transaction, ensuring liquidity but introducing trade-offs like slippage and impermanent loss (which occurs when the external market price of a token diverges from the pool’s ratio).

How does a scammer profit from this trade, then? By enticing FOMO traders or poorly written trading algorithms to buy the limited number of CUBAN left in the pool for a hyper-inflated price, hence supplying a large amount of SOL in the reserve pool. At this point, the trader who “pumped” the token then sells all the supply he holds, extracting as many SOL as possible from the reserve and crashing the CUBAN price as a consequence. You can see the final result in the chart below with the CUBAN now worth a total of 3K USD just 24 hours after its launch.

Red Flag #3 – No core team activity in support of the token

A crypto token should express the value of a project and the team pursuing it, at least in theory. This can be very straightforward with team identities disclosed or indirect when team members use social media pseudonyms to maintain their privacy while still performing actions like setting up and operating social media accounts or interacting with the community through various channels. When there is no sign of proactive commitment to build a project behind a token, that is a sign the token is potentially a pump and dump scam.

Let’s take our CUBAN case for example. If you go on the token page of a platform like Dexscreener and look for the social media accounts linked to the token, you can see there is a Twitter/X account set up. This is, of course, to give the impression that the real Mark Cuban is eventually behind this token launch – hence the reason why it is worth 400M+ USD and skyrocketing, right? If you click on that link, you can see it isn’t linked to Mark Cuban’s profile but to a single tweet from him that isn’t even related to the launch of CUBAN. Clearly, Mark Cuban had nothing to do with this scam.

I would like to share with you a more subtle example of another token that became very popular and wildly traded in the past week: ROUTINE. Here, there was a clear attempt to launch a pump and dump on the back of a viral “morning routine” video on social media, giving the false impression that Ashton Hall was supporting the launch. However, if you click on the social media links provided, all you get is being redirected to the single Twitter post of the video, and clicking on “website” you are just redirected to the web link of Ashton Hall’s TikTok profile instead of the direct profile on TikTok behind a proper “TikTok” direct button.

Red Flag #4 – Immediate off-the-chart social media hype

Continuing with the ROUTINE token example, it’s very easy to understand the significant social media hype from many accounts, many of which are obviously bots, bringing attention to the crypto meme by perpetuating the false impression that the launch was endorsed by Ashton Hall to trigger traders’ FOMO for the token. High social media hype for a token isn’t necessarily a red flag provided that the team behind the project is delivering results reflected in an increase in value of the token, and the hype usually tends to grow gradually, not right away.

Red Flag #5 – Supply concentration without a project team activity

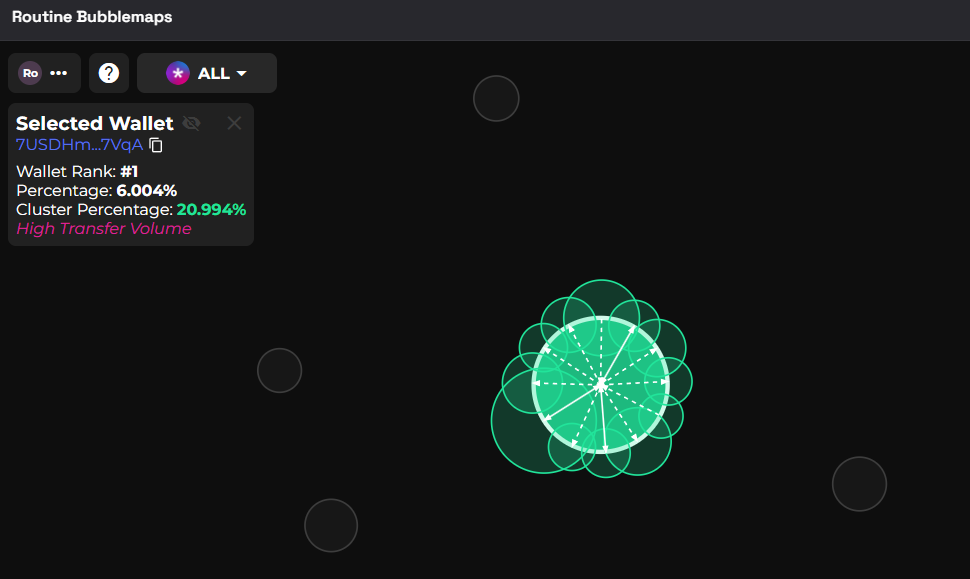

This red flag is more difficult to spot than in the previous example of the CUBAN token and usually tends to occur in more sophisticated pump and dump schemes like ROUTINE. As you can see from the Bubblemap here, a cluster of wallets linked to each other holds more than 20% of the whole supply of the token (and it has since the very beginning).

Clearly, here the intent was to give the impression this meme was a “fair launch,” meaning the supply was widespread through thousands of small holders, while the reality was very different, and all the top wallets are actually controlled by the same group/person. However, being this a more sophisticated scheme, the cluster did not dump all at once like in the case of CUBAN, but likely was used to constrain the supply while other “fresh wallets” (that cannot be linked to the cluster because no transactions exist among them) were created to “snipe” the supply at the very beginning (similar to what was exposed by the LIBRA scandal) to then dump this gradually when the social media hype started to fade. The ultimate result isn’t that much different from the CUBAN example, as you can see.

Supply concentration isn’t per se a red flag when there is a team working on the project behind the token, as usually the supply split is publicly disclosed in “tokenomics.” However, none of this was available in the ROUTINE example we just discussed.

Conclusion

As you already know, I am bullish on crypto in the long term, an asset class that, similar to the internet, will see a dramatic increase in value in the future, and as such, I have already written several articles trying to help spot the opportunities mindful of the history of the internet bubble:

- THE US CRYPTO RESERVE PLAN: WHAT IT MEANS FOR INVESTORS EVERYWHERE

- A CRYPTO UPDATE TO BEN GRAHAM’S “THE INTELLIGENT INVESTOR”

- IS THIS BLACKROCK’S MASTER PLAN FOR BITCOIN?

- WHY A BITCOIN ETF WILL REMOVE THE BARRIER BETWEEN CENTRAL BANKS’ MONEY PRINTING AND CRYPTO

- VALUE INVESTING ON CRYPTO BLOCKCHAIN PROJECTS

I hope that with today’s article I will also help you, my dear reader, to avoid the traps and losing money that can be instead deployed more profitably elsewhere.

JustDario on X | JustDario on Instagram | JustDario on YouTube