If foreign countries and companies are going to have less USD going forward, who is going to buy US debt? These past few days, I have been paying close attention to the narratives and dynamics developing around the tariffs war topic, but somehow nobody has brought attention to the crucial question of who will buy US Treasuries going forward. As I explained in several articles before, the US administration acted on the wrong assumption that foreign companies and countries were taking advantage of the US by extracting large profits from its economy, without realizing that US companies and agents were the ones reaping very fat margins but not repatriating those profits back into the US economy and paying their fair share of taxes. However, what many still fail to grasp is that all these USD flowing abroad were actually coming back within the US system, reinvested mostly in US government debt.

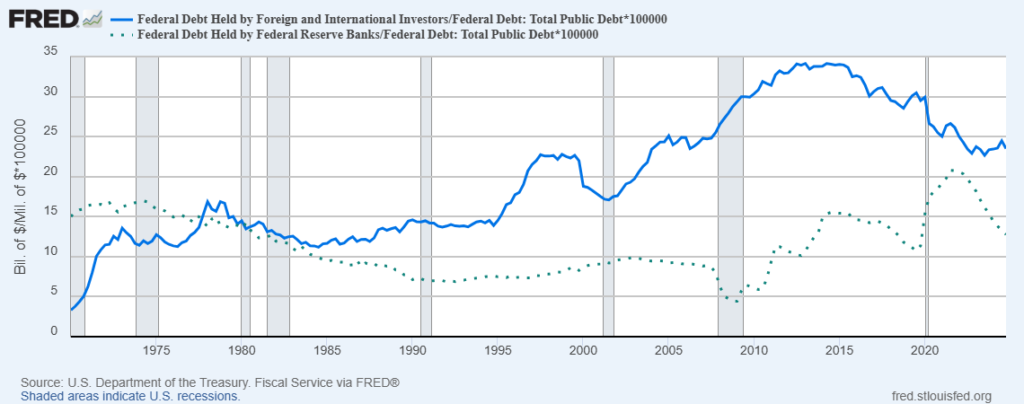

As I explained in my latest podcast “THE TARIFFS CALM BEFORE THE ECONOMIC CHAOS,” the impact of this new US Tariffs system on the global economy is having similar consequences to the damage created by the COVID crisis when the worldwide supply chain came close to a halt. However, what many fail to recognize is that prior to COVID, the US was already heading towards a debt crisis since the FED was not doing QE and foreign trade was not generating enough USD currency to be reinvested back into US government debt. This put the US government in the precarious situation of relying on its domestic banks to keep accumulating US debt in their balance sheets. All I am describing is evident in the chart below, which shows the amount of US government debt held internationally and the amount held by the federal reserve system. As you can see, once COVID hit, the FED had to step in with QE infinity to monetize US debt and fill that gap.

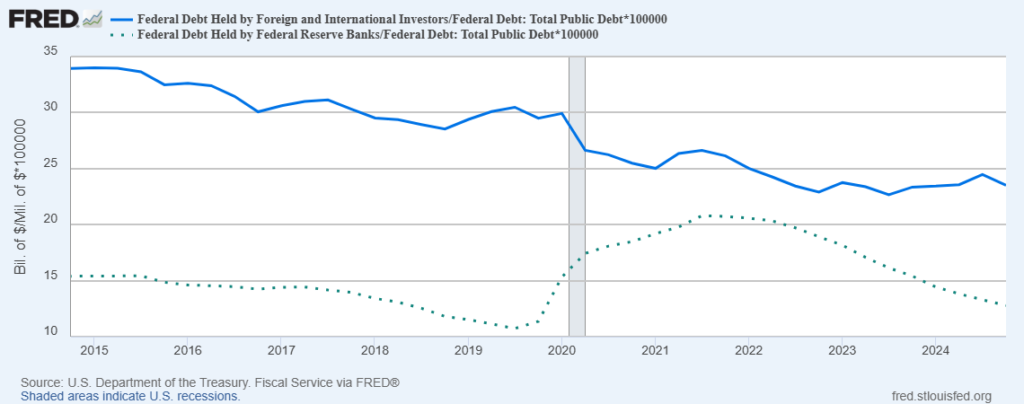

Now let’s zoom in. As you can see in this second chart, the pre-2020 dynamic we just analyzed is very similar to the one that has been anticipating the current US tariff wars. Considering that the impact the economy is going to experience will be similar to the COVID crisis, with less USD flowing to foreign holders available for US investment, matched with less profit for US domestic companies and investors who themselves were reinvesting a good chunk back into US government debt, there is clearly not much alternative left than the Federal Reserve resuming QE to monetize the chunk of US debt that will suddenly be left without willing bidders. This is especially true since, unlike in 2019, US Banks are now dealing with capital constraints and cannot step in anymore.

How fast will the US approach a debt crisis? This year the US Treasury has to refinance ~9.5 trillion USD of expiring debt, out of which ~6 trillion is debt with original maturity of less than one year. As a matter of fact, T-Bills are the type of US government debt preferred by corporates, both domestic and foreign, to park their assets. Now, if all corporates are going to have less cash on hand going forward, who is going to bid on trillions of T-Bills? This is why there is no escape for the FED that, as I already warned about weeks ago in my weekly podcast “HOW THE FED FELL INTO A CHECKMATE TRAP,” is already going to be forced to bail out the banking system for a second time in a few years in a situation that developed even before tariff wars began.

It’s all coming down to an epic showdown between the FED and the US administration, with the former sooner rather than later going to face very difficult decisions – and no, cutting Fed funds rates won’t be a long-term fix. Hold on a second. If all I have described is going to happen, will the consequence be a sharp devaluation of the USD? Not really, and the reason is that economies like Europe and Japan are in an even worse situation than the US. Hence, on a relative basis, the amount of QE needed by ECB and BOJ to fend off their own financial system and government debt crisis is going to be even larger. Who stands to gain significantly in all of this is, needless to say, China, which already began strengthening its own financial and government system in 2022, with the whole world not realizing that it took steps to make its economy independent from QE bailouts long ago, as I described last year in the article “CHINA HAS BEEN THE FIRST ONE TO ABANDON THE QE ABERRATION, WHO IS GOING TO BE NEXT?“.

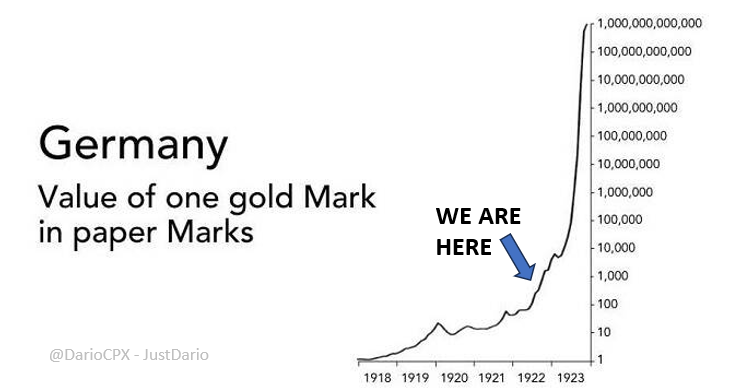

Surely with all this monetary inflation in the pipeline, it should not come as a surprise anymore that hard assets with limited supply like Gold continue to see their value in fiat currency increasing. Something that will continue, which is why this chart that I shared a few months ago is more realistic than anyone believes

JustDario on X | JustDario on Instagram | JustDario on YouTube