NVIDIA’s cooking of its financial earnings has reached a level of beauty and sophistication that the company should be awarded 3 Michelin stars and be featured in an episode of the popular Netflix series Chef’s Table. Get comfortable because this episode is going to be one with many “Woah!”

Singapore

Here is how NVIDIA describes its Singapore operations this time, adding another bit of disclaimer in an obvious attempt to show how the company is formally complying with all rules and regulations it is subject to, especially US export restrictions:

“Singapore represented 20% of the first quarter of fiscal year 2026 total revenue based upon customer billing location. Customers use Singapore to centralize invoicing while our products are almost always shipped elsewhere. Over 99% of controlled Data Center compute revenue billed to Singapore was for orders from U.S.-based customers“

Then the company also adds:

“Revenue from sales to customers outside of the United States accounted for 53% and 48% of total revenue for the first quarter of fiscal years 2026 and 2025, respectively”

For several quarters now, NVIDIA has stated and disclosed: “Revenue by geographic area is based upon the billing location of the customer. The end customer and shipping location may be different from our customer’s billing location.”

Alright, so let’s put all this together:

- US-based customers purchase $9bn worth of GPUs asking the company to be billed in Singapore but;

- Those GPUs aren’t shipped to the US; otherwise, they would require billing to a US entity to comply with US import rules;

Now let me add few more pieces to this puzzle in order to understand what’s going on here

Direct and Indirect customers “waltzer”

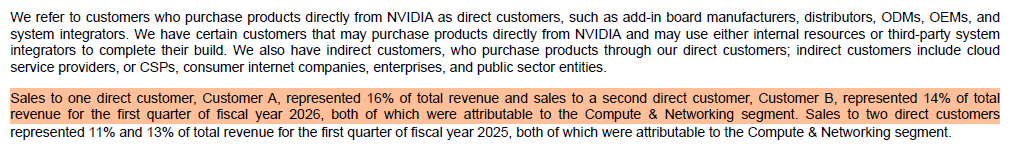

In a fresh disclaimer just added to this new 10-Q, the company states:

“Indirect customer revenue is an estimation based upon multiple factors including customer purchase order information, product specifications, internal sales data, and other sources. Actual indirect customer revenue may differ from our estimates. For the first quarter of fiscal year 2026, two indirect customers which primarily purchase our products through system integrators and distributors, including through Direct Customers A and B, are estimated to represent 10% or more of total revenue, attributable to the Compute & Networking segment”

Hold on a second, if two indirect customers are purchasing through customers A and B (more on these soon), then isn’t it fair to assume these two direct customers are GPU distributors and not end clients? Yes, it is. This is why we can safely assume the two largest NVIDIA clients that this quarter accounted for 30% of the total revenues aren’t any of Microsoft, Amazon, Google, or Meta.

There are not many names in the world that can tick all the boxes here besides: SMCI and Dell. Here is where things start to become funny, to say the least. Singapore government allegedly investigated the use of Singapore to divert GPUs to China in breach of US export controls and the case involved Dell and SMCI Singapore operations. However, instead of charging the companies, the Singapore government allegedly charged 3 men with defrauding Dell and SMCI: Singapore charges men with defrauding Dell, Super Micro. There is a very interesting thing in the Singapore case: “Singapore has said the servers made their way to Malaysia and Malaysia is investigating if its laws were breached.”

Hold on a second, who by their own admission is heavily investing in Malaysia and growing their business there? SMCI (source).

So basically, the Singapore government argued SMCI and Dell were defrauded, but then how come SMCI is scaling up operations in Malaysia exactly to handle the kind of dealings supposed to be in breach of US export rules? I will leave this question open even though in my opinion the answer is pretty logical.

By now it is obvious that among the “US Based customers” purchasing NVIDIA GPUs and having them billed in Singapore even if those are shipped elsewhere are Dell and SMCI. I cannot think of anyone else to add to the group but let’s assume they are not the only two (wink wink).

I know your brain is likely hurting already, but there is one more crucial element that just showed up in NVIDIA disclosures:

“We estimate that in the first quarter of fiscal year 2026, an AI research and deployment company contributed to a meaningful amount of our revenue, through one of the above indirect customers and through other indirect customers that provide cloud services”

There is only one company that fits this description and that company is OpenAI. Why?

- OpenAI purchased a small amount of GPUs directly; most of the infrastructure was built and operated by Microsoft as everyone by now knows;

- On top of that as I described in the article “WILL COREWEAVE MARK THE END OF INITIAL FRAUD OFFERINGS?“, Microsoft also leased external GPU capacity from CoreWeave where it accounted for 72% of this company’s revenues in the last quarter. Why was it doing that? Because it didn’t have enough capacity to serve OpenAI demand. How can we say so? Microsoft just cut its commitment to CoreWeave (Microsoft Withdraws from Cloud Deals with CoreWeave) but the very same has been promptly picked back up by OpenAI one week later (OpenAI concludes a strategic $11.9 billion deal with CoreWeave). Furthermore, OpenAI just expanded that agreement with CoreWeave (OpenAI signs new $4bn cloud deal with CoreWeave)

- Isn’t NVIDIA OpenAI’s investor and CoreWeave’s investor, supplier, and client as shown in the CoreWeave S-1 pre-IPO filings?

Yes, my dear reader, NVIDIA just admitted in its own disclosures that the company is round-tripping revenues and cash investments, and from that the company accounted for a “meaningful amount of revenues” as it itself says.

To conclude, not only is NVIDIA so obviously part of a scheme to circumvent US export rules even if it is taking all legal precautions to put itself at a safe distance, but now as per its own implicit admission, it is even round-tripping revenues as I have been warning about for years (articles archive).

JustDario on X | JustDario on Instagram | JustDario on YouTube