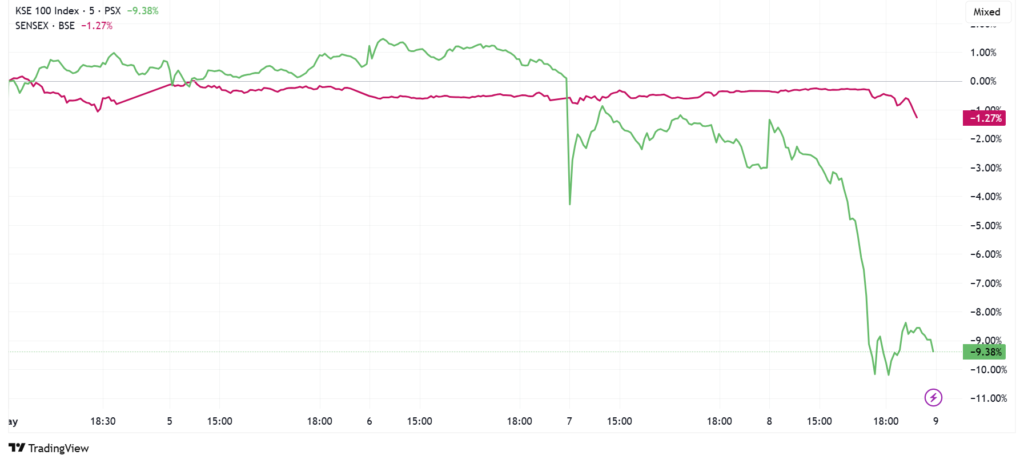

The comparison between India’s and Pakistan’s stock markets perfectly illustrates the current state of financial markets, not only in the region but across the world. Let’s start with the smaller picture, where we find two nuclear-armed countries bombing each other this week, yet only one country’s stock market “noticed” while the other didn’t. How come?

Comparing India and Pakistan’s stock markets is like comparing a Bollywood blockbuster to a low-budget indie film. Both have drama, but only one has the big money, bigger fanbase, and insane trading volumes. In recent years, India’s market has become a trillion-dollar party where foreign investors, hedge funds, and even your neighbor’s cousin trading options from their phone were all invited. Foreigners own about 20% of Indian stocks, and trading volumes are so high that India’s options market is now the largest in the world (yes, bigger than even the US), and not surprisingly, big US Hedge Funds are feasting all around it. Meanwhile, Pakistan’s market has remained incredibly small, ignored by big global players, and struggling with domestic crises, especially political ones, that keep scaring away foreign traders. India’s total market capitalization is 5 trillion USD equivalent, while Pakistan’s is just 50 billion USD. What about the respective countries’ GDP? India is roughly 10 times bigger than Pakistan in USD terms. What about the respective armies? India’s budget is 10 times larger than Pakistan’s, officially at ~72bn USD equivalent, but if we consider that Pakistan doesn’t have an Armed Navy force, then the gap between the two starts shrinking significantly. What about nuclear warheads? Here is where, according to the most recent data, the two countries are closer to each other with ~170 warheads each.

Now, objectively speaking, which country between India and Pakistan stands to lose more if the conflict escalates? Clearly India. Furthermore, do you expect companies like Apple and other major international ones to shift a good chunk of their supply chain to India from China because of tariffs, even in the case of an ongoing war with Pakistan?

Clearly, a correction in the Indian stock market would have been more than justified, maybe not that sharp (yet), but surely a cautious pullback “just in case”. However, so far India’s stocks haven’t given a damn about the eventual risks related to a conflict with Pakistan, and here is where we move from the smaller to the bigger picture, since in a similar way, global investors are completely ignoring the fallout of US tariffs on the major economies, starting with the US itself. Here we should definitely give credit to Donald and his administration for their so far effective game of smoke and mirrors that has “bamboozled” investors. While Secretary Bessent was spending so much time under TV studio lights that he was getting more and more tanned in each new interview where he continued to feed trading algorithms with bullish headlines about the strength of the US economy and how that and markets will greatly benefit from US government strategy of confused confusion, Secretary Lutnick was ironing out the very first trade deal of this campaign with the UK. Let’s not forget the UK had no reciprocal tariffs with the US and the US already had a commercial surplus with the UK. Furthermore, UK politicians have been desperately trying to sign a new trade agreement with the US since Brexit to counter-balance the fallout from leaving the EU. Doesn’t this objectively sound like rather low-hanging fruit? Yes, and also a pretty small one, since this deal will deliver a 5bn USD benefit to the US economy according to official estimates. The US is a 37 trillion USD economy. No need for further comments here. However, the PR effort was much, much greater than the real benefit to the US economy, which is risking empty shelves for many products all around the country by summer, and investors loved it, of course.

Investors are also loving the fact that conversations between the US and China will officially begin this upcoming weekend in Switzerland. Let me share with you what’s likely to be the outcome of this first round of talks, with headlines starting to hit the tape on Sunday evening US time (when US futures resume trading): on one side, the US administration will claim big progresses were made, while China’s government will instead reiterate after a few hours that all that was discussed during the talks was their firm request that the US has to drop all the new tariffs first and stop “bullying” China in order to set the proper environment for mutually beneficial trade negotiations to begin. In a nutshell, nothing will objectively come out of these first US-China talks, just as the first deal signed between the US and UK doesn’t move the needle whatsoever in the global scheme of things.

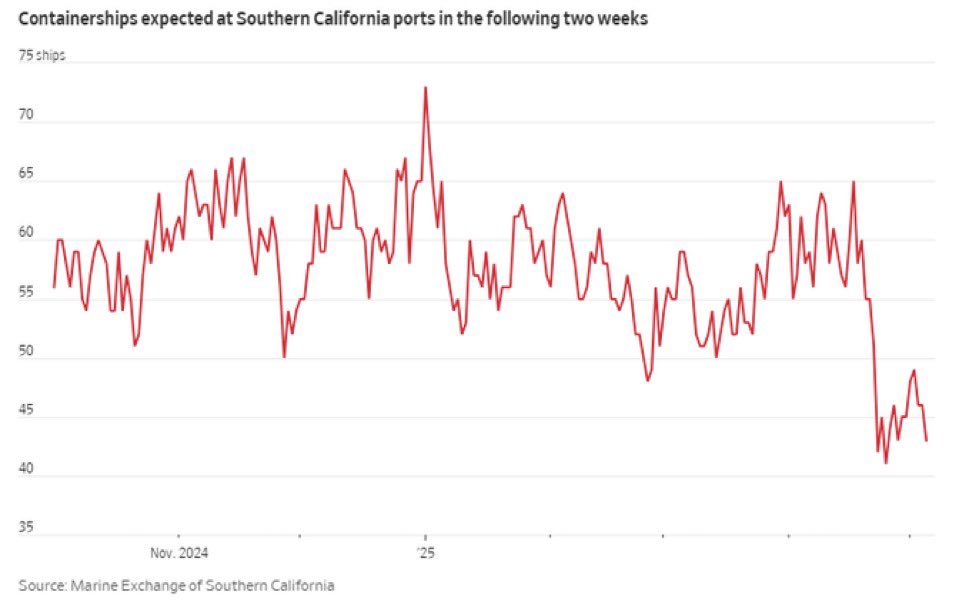

What is actually happening and should move the needle for stocks, especially US ones, is the collapse of shipments toward the US, particularly for imports coming from China. The chart below leaves little room for doubt.

There is also a detail many are ignoring: no new US customs duties were applied to any ship that was already sailing toward the US when the new tariff regime was announced on April 2nd and shortly after paused for 90 days for everyone but China. As a consequence, goods kept flowing into the US rather normally for about a month, with the last ships not subject to tariffs docking in California right now, but the trend is clear: ports in the Western US are set to experience a situation similar to the one they went through five years ago at the onset of COVID. Even at that time, the fallout took roughly a month to unfold since the ships already at sea were allowed to deliver and unload their cargo without many hurdles, but then after that, the real problems began. Do you remember what happened to stocks at the beginning of COVID? After a first reaction and recovery, the panic selling was epic when everyone realized how the risk and consequences for companies were greatly underestimated. History never repeats, but it rhymes, and here I am warning everyone again. Due to the inherent bullishness of this market environment, everyone has become so accustomed to, risks and their consequences are being greatly underestimated on every front. Personally, I believe markets might be able to ignore what’s going on until mid-June because more trade deals will likely come through, cheering everyone up, but at the same time, economic data will start souring significantly and people, especially in the US, will start feeling the effect of tariffs in their daily lives since there is only one deal that matters: the one between the US and China, because the latter is the one that directly and indirectly supplies most of the goods heading to the US, and Paul Tudor Jones is 100% correct in saying “stock market will hit new lows even if Trump cuts China tariffs to 50%“.

JustDario on X | JustDario on Instagram | JustDario on YouTube