Back in September last year in “IS THIS BLACKROCK’S MASTER PLAN FOR BITCOIN?” I described how the investment powerhouse BlackRock was laying the ground to make Bitcoin the golden goose and growth engine for its operations in the near future, considering how mature all other asset classes within the manager’s portfolio are. These were the key points I outlined at that time:

- Bitcoin’s potential for a big “gamma squeeze”

- Exponential growth in institutional Bitcoin and cryptocurrency derivatives market

- Demand shifts from stocks to Bitcoin and cryptocurrencies in the event of a sharp correction in stocks

- Exponential growth potential of the whole cryptocurrency asset class.

8 months later, the first two items of the list I outlined are now in place. On one side, BlackRock’s flagship ETF continues to accumulate Bitcoins, removing supply from the market, a trend followed by all other investment houses managing Bitcoin spot ETFs. On another side, more and more companies are gearing up to embrace Strategy’s (the former Microstrategy) “strategy” of raising money through debt, convertible debt, and eventually equity to buy Bitcoins in the open market and stash them in their own treasury. I already shared my considerations about Saylor’s strategy last year in “WHAT IF MICROSTRATEGY BECOMES TOO BIG TO FAIL?” and all I stated back then not only remains in place but clearly other people have figured out what he is up to and are now trying to jump on the same ship.

The third and fourth items I outlined in the original list did not materialize yet, and after several months, the reason is clearly Bitcoin becoming an asset class on its own, decoupled from the rest of the cryptocurrency market for one key reason: Bitcoin spot ETFs are removing Bitcoin supply from the crypto ecosystem, decreasing its “money velocity”.

Here I am going to try my best to simplify a very complex matter. When BlackRock purchases Bitcoins for its IBIT ETF, those are then removed from crypto exchanges and stored in a custodian “cold wallet”. Those who sold those Bitcoins to BlackRock receive cash and will have three alternatives: withdraw it, keep it on the exchanges as cash waiting for another opportunity, or reinvest it immediately. In the first case, not only has BlackRock removed Bitcoin supply, but cash will also leave the crypto ecosystem. In the second case, idle cash will remain part of the exchange balance sheet in the same way a deposit is part of a bank balance sheet. In the third case, the exchange will instead hold a new asset on behalf of the investor (since it’s rare for a retail investor to operate cold wallets with all the risk and technical difficulties associated or use an external custodian that comes with a pricey yearly fee).

Re-hypothecation is not only a cornerstone of traditional financial institutions but of crypto ones as well. Client assets stored on crypto exchanges, similar to assets stored with a bank, are not being kept idle on the books but re-hypothecated to make more profits. This activity of “lending” client assets to others has a similar consequence of increasing the money velocity in the crypto ecosystem similar to what happens in the traditional one. For example, if I buy one Bitcoin and I keep it on Coinbase, the exchange will show me one Bitcoin balance, but that is equivalent to one Bitcoin “credit” I have towards the crypto exchange. The exchange will take that Bitcoin and lend it out to a second customer who can decide to short it, to leverage it, or to use it as collateral to borrow.

Let’s assume my Bitcoin is used by customer number two to borrow money; a third customer will receive that Bitcoin from customer two as collateral and lend money against it. As you can see, thanks to re-hypothecation, the same Bitcoin generated a new balance of money in the crypto ecosystem. Monetary inflation increases the nominal prices of assets; consequently, if new money is being attracted into an ecosystem, its overall value is being inflated. Because Bitcoin ETFs are removing supply from the crypto ecosystem, the re-hypothecation flywheel loses steam and all other assets in the ecosystem will only marginally benefit from the inflow of cash from institutional asset managers or non-native crypto investors.

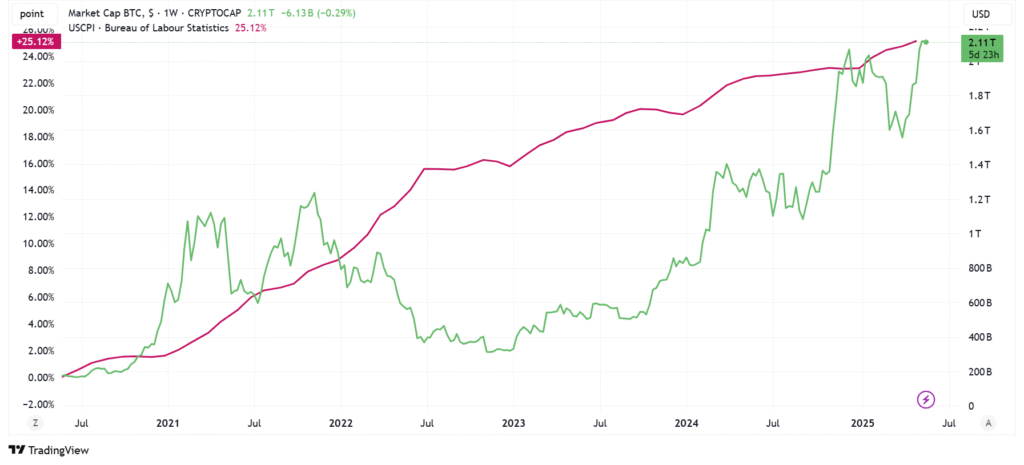

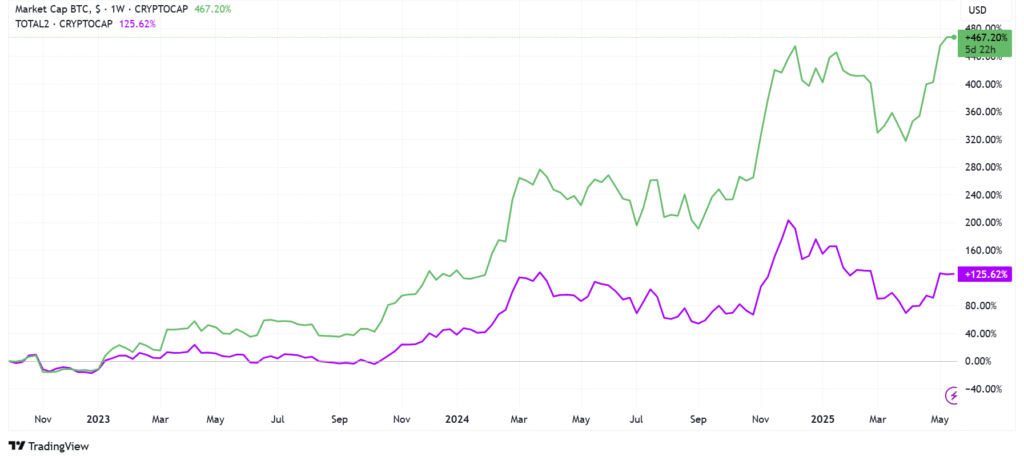

Because of this dynamic I just described, Bitcoin is effectively becoming more and more similar to Gold when it is being purchased in the open market to be stored in vaults. However, unlike gold, the traditional financial system is not allowed yet to re-hypothecate Bitcoin to other institutions and create a “paper market” because of regulatory constraints still in place, so the price of Bitcoin as of now remains mostly driven by the basic dynamics of supply and demand where on one side the supply of Bitcoin is limited and on the other the demand increases because institutional investors continue to see freshly printed money by central banks landing in their pockets. It should not surprise anyone anymore that Bitcoin is more and more correlated with inflation measures as you can see in the first chart below, while the rest of the crypto market is still mostly cut off from that after the on/off ramp rails and retail investors’ appetite fell apart in 2022 after the FTX shock as evident in the second chart I am presenting you.

At this point, I hope we all agree that Bitcoin deserves to be considered as an asset class on its own, so all considerations about “Bitcoin dominance” or all the various cycle indicators previously used to track the beginning of “altcoin seasons” or other market dynamics are becoming more and more obsolete simply because Bitcoin is slowly but irreversibly becoming a “traditional asset” embraced by the global financial system rather than the lead asset of a niche asset class like cryptocurrencies.

JustDario on X | JustDario on Instagram | JustDario on YouTube