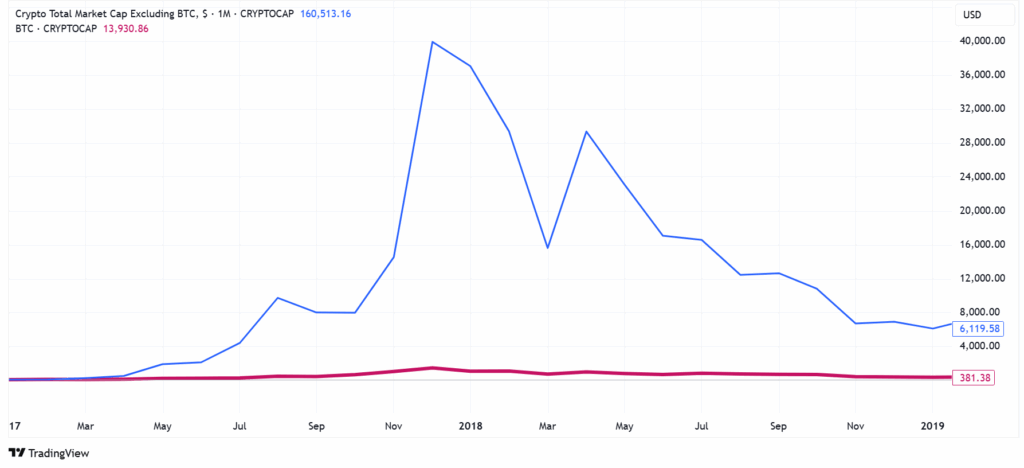

Altcoin season refers to a period in the cryptocurrency market when alternative cryptocurrencies (altcoins), any digital assets besides Bitcoin, significantly outperform Bitcoin in price appreciation and trading volume. This phase is characterized by a surge in capital flowing from Bitcoin into altcoins, leading to rapid, often exponential, gains across a broad range of altcoins. What does an altcoin season look like? In the first chart below, you can see what happened to Bitcoin’s total market cap from the beginning of 2017 to the end of 2018 compared to the rest of the market combined.

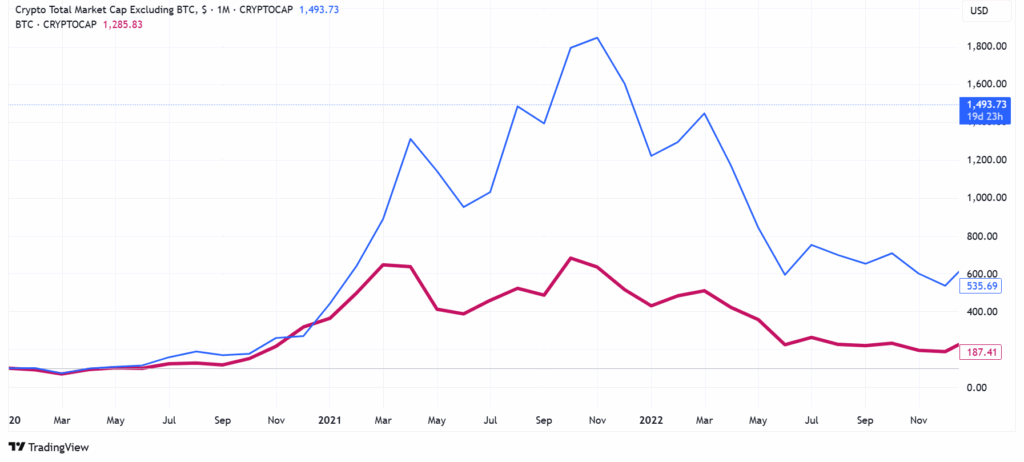

Shocking, isn’t it? At some point, all altcoins notched a gain of four hundred times in an incredibly short period. What about 2020 to 2022? The whole altcoin space at its peak notched a gain of fourteen times.

Beware though, these incredible numbers can be incredibly misleading. Why? Consider that at the beginning of 2017, the total Bitcoin market cap was only ~20bn USD and all the rest of crypto combined was less than 1bn USD, while during the COVID crash, Bitcoin’s market cap hit ~120bn USD lows with all the rest of the crypto market combined valued at ~60bn USD. If you compare these figures with the 3 trillion USD printed by the FED alone in 2020 to bail out markets, you can quickly realize how virtually irrelevant crypto was at that time in the global scheme of things. Did anything change 5 years later in this respect? Considering the whole crypto space is still worth less than Nvidia, I would argue that it did not.

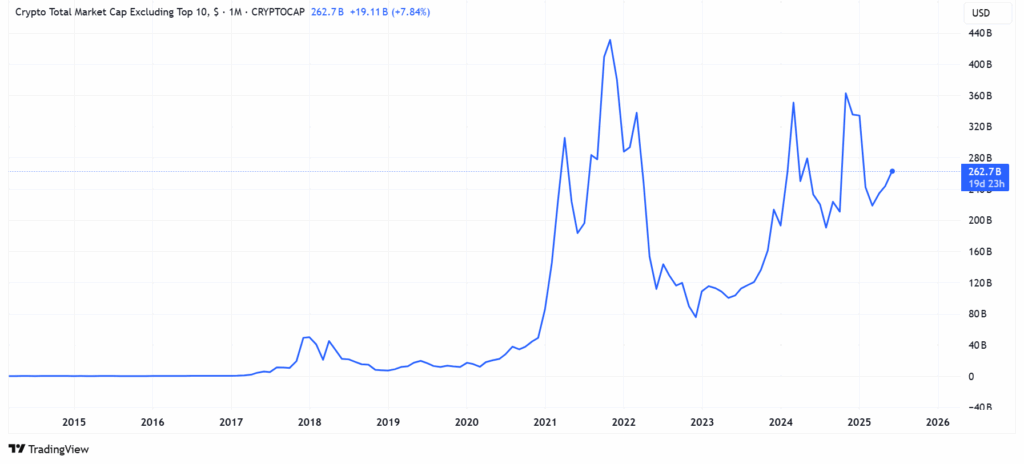

However, one thing is significantly different today compared to the past: traditional financial institutions are now effectively taking over Bitcoin as I explained in my article “WHY BITCOIN ISN’T JUST A CRYPTOCURRENCY ANYMORE BUT MORE AND MORE AN ASSET ON ITS OWN“. Not surprisingly, Bitcoin benefited from an incredible inflow of capital since spot ETFs went live and brought it beyond ~2 trillion USD market cap or twice as much as the rest of the crypto space. Another thing that is significantly different today compared to the past is the dominance of the top 10 largest cryptocurrencies compared to everything else, with the whole Web3 space going nowhere in the past 5 years and worth as a whole just a mere ~260bn USD.

There is another important element in this chart: objectively, the whole Web3 space only experienced a single brief massive bull run from 2020 to 2022.

Paradoxically, the whole Web3 space is significantly different today compared to years ago, with the vast majority of crypto revenues coming from projects that still do not make it into the top 10 cryptocurrencies by market cap. Just to give you an idea, the Ethereum blockchain currently earns ~23m USD worth of revenues every month while Uniswap, one of the first decentralized exchanges, earns five times that figure. Ethereum’s market cap today is ~300bn USD compared to ~5bn USD for Uniswap.

There is one last important element to consider: the total number of crypto tokens outside the TOP 10 grew exponentially in the past years while the total market cap didn’t: ~2000 in 2018 to ~8000 in 2020, then ~1,000,000 in 2022 and ~2,000,000 by the end of 2024. Beware these numbers only consider the active tokens, not all those scams that were launched and then rug-pulled to zero mostly thanks to projects like pump.fun enabling these sorts of bad things to spread like wildfire in the space.

Let’s put all the elements together now before moving forward with the analysis:

- Bitcoin is becoming more and more of a traditional financial institution’s playground

- The whole Web3 space, defined as crypto projects currently outside the top 10 by market capitalization, is currently worth the same as it was 5 years ago

- Web3 space revenues have grown significantly in the past 5 years and currently overshadow those of legacy mainstream blockchains

- Exponential growth in the total number of tokens without any change in the total valuation of the Web3 space

Back in December 2023 in “VALUE INVESTING ON CRYPTO BLOCKCHAIN PROJECTS” I outlined the following principles I actively apply to find investment opportunities in the crypto space, borrowing the framework from traditional finance (a framework now mostly forgotten in the era of endless money printing):

- Revenue sustainability and scalability

- Healthy tokenomics

- Transparency

- Compliance

- Defined product/service visions and constant innovation

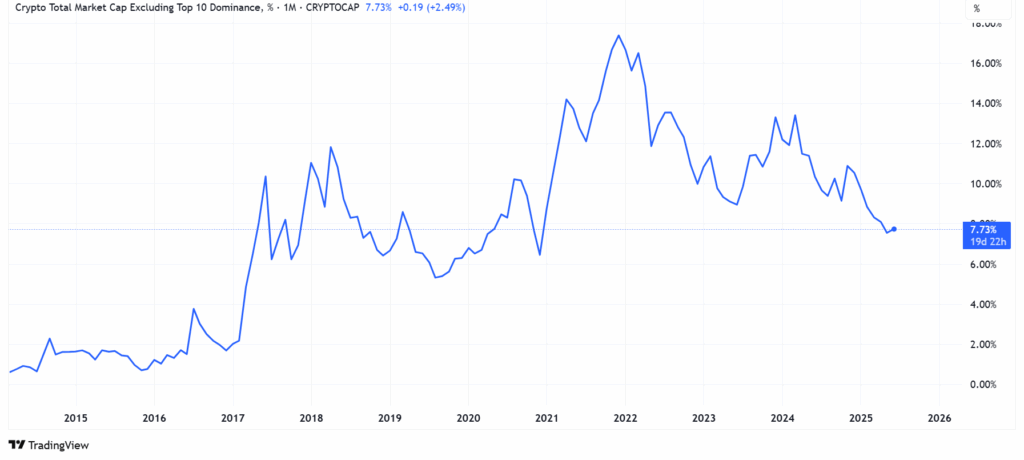

An altcoin season, broadly speaking, is defined as the period when Bitcoin underperforms the rest of the crypto space in market valuation growth. Today this definition needs to be refined in my opinion and shift the focus to the Web3 space instead, which at this point I believe we all agree is objectively due for a sharp repricing. What is going to be the trigger of this new trend? In my humble opinion, a defining moment for the whole crypto space is going to be the approval of the US GENIUS act that is going to regulate a critical element that drives the flow of money from the traditional world into the crypto space: stablecoins. Why are stablecoins important? That’s how real-world assets and currencies are represented in the crypto space on the premise that the stablecoin issuer holds in custody an amount of assets and currencies equal to or greater than the total amount of its stablecoins in circulation in order to maintain a 1:1 peg usually with the USD.

Just combine all the monetary inflation currently occurring with this new tool allowing it to spread into the crypto space, something that so far only happened in a very limited form due to all the frictions, bottlenecks, and regulatory roadblocks impairing unregulated stablecoins like USDT, with all the economics and rationale I outlined so far. The result is pointing towards a massive repricing of the Web3 space, isn’t it? Beware though, not the whole space is going to benefit from it but roughly ~1% because 99% of the tokens out there are empty ones without so-called “utility”.

How much upside are we talking about? At the moment, the dominance of the Web3 space is a mere ~7.70% compared to a ~17.5% peak reached in the last and only real bull run.

Only assuming a rotation into Web3 from the top 10 crypto without a change in market cap, we are talking about an increase from the current ~260bn USD to ~600bn USD. If we consider a new inflow of money, it will be reasonable to expect an increase to ~800bn USD at least, and this without taking into account a FOMO behavior triggering in the retail and institutional space for this asset class similar to what is driving stocks to asinine valuations today. If this happens, I cannot even quantify the potential growth in the space.

To conclude, while “despair” is clearly what is characterizing the Web3 space right now, all stars are aligning towards the formation of an epic bubble here. Perhaps the real last bubble that will be inflated in this completely insane economic cycle, giving the opportunity to build generational wealth before everything resets and falls apart across the board 1929 style.

JustDario on X | JustDario on Instagram | JustDario on YouTube