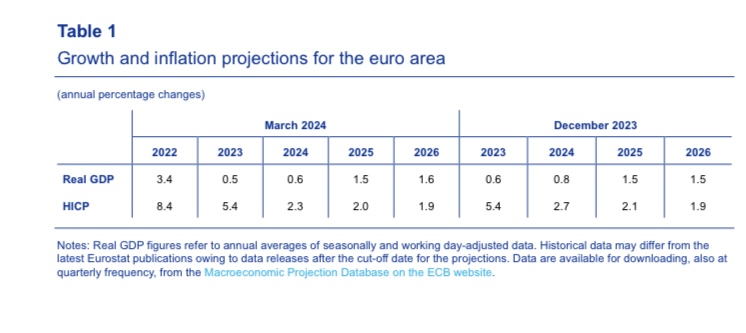

At the European Central Bank (#ECB), they are so adamant about cutting rates lately that they are barely sparing a single day to remind markets about it (The time is ripe to cut interest rates next week, European Central Bank’s Rehn says). But, why such a rush when, even according to the now completely manipulated official inflation statistics, every indicator the #ECB should follow is instead against such a move? The ECB’s excuse is that, according to its own research staff projections, #inflation is expected to return to 2% in 2025 and remain around that level going forward.

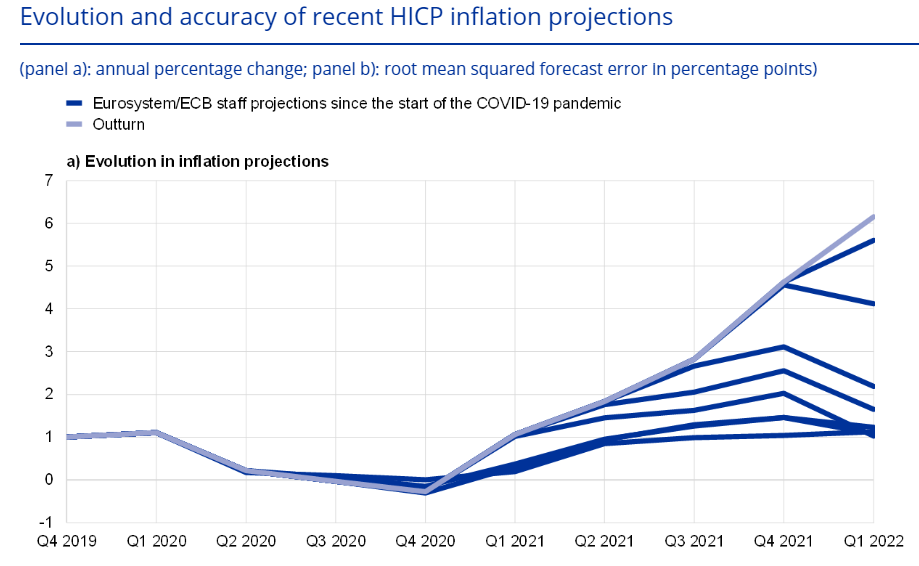

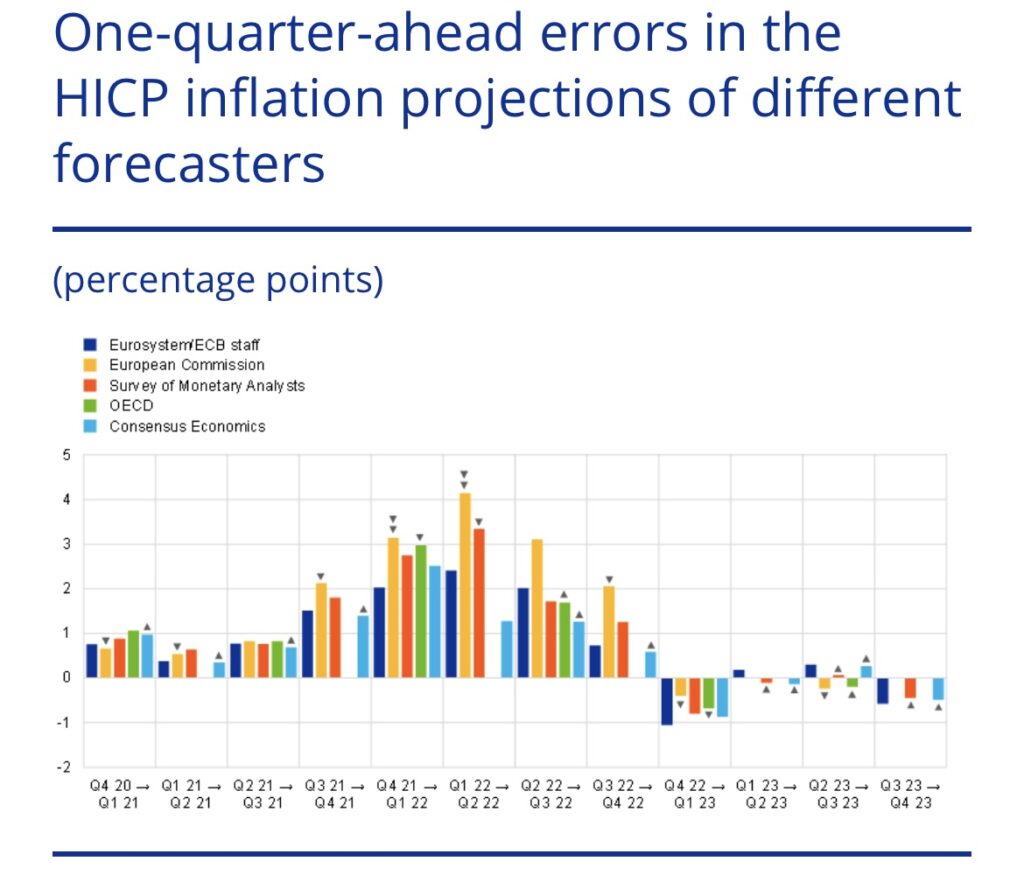

How accurate have ECB research staff projections been lately? As you can see in the chart below, which is part of an ECB’s own report they were forced to put out to fend off critics (Report: “What explains recent errors in the inflation projections of Eurosystem and ECB staff?”), the ECB staff did not do a good job lately.

Do you think that the ECB staff got any better in their forecasts after “understanding” what disrupted their models in 2022? According to the ECB, yes, and they are in good company (report: An update on the accuracy of recent Eurosystem/ECB staff projections for short-term inflation).

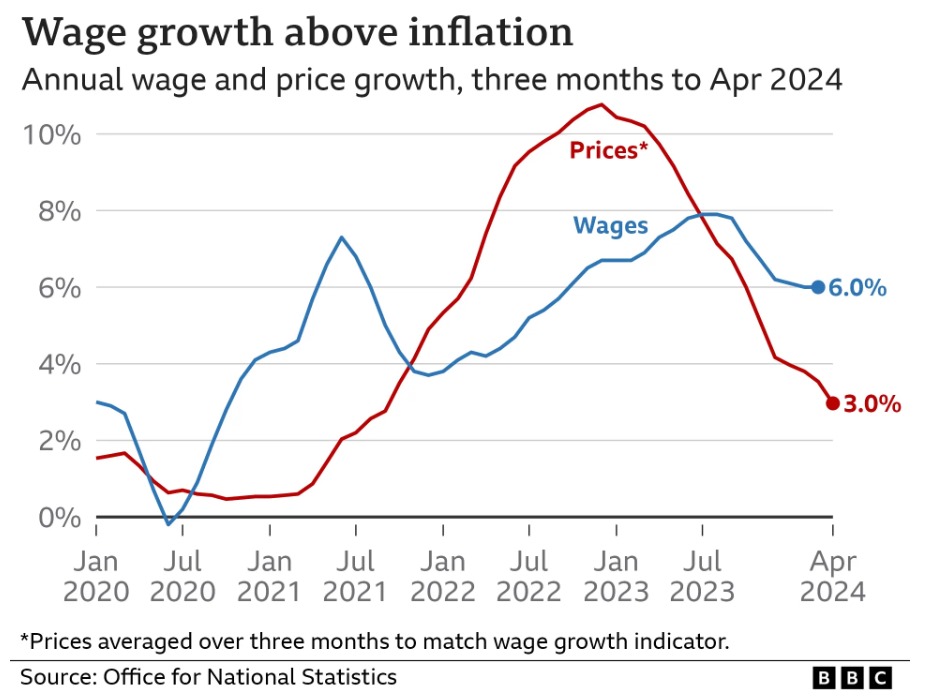

So, can we just relax and trust the ECB? Well, before we do that, please explain to me one thing. How can the ECB predict such a steady decrease in inflation towards 2% while at the same time their own forecasts for wage growth in the Euro area foresee a rate double that? (Report: Tracking euro area wages in exceptional times)

So, according to the ECB, European employers suddenly decided to become social benefactors and raise their employees’ salaries at a higher rate than inflation, making them wealthier. From a political perspective, this sounds beautiful, doesn’t it? Unfortunately, it is not what’s happening in reality since the real inflation rate in the Eurozone is much higher than 2% and even cats and dogs know it.

Don’t worry, the ECB isn’t alone in trying to sell this idiocy since the Bank of England is trying to feed the same narrative to the public in the UK. However, unfortunately for the BOE, inflation in the UK is so ridiculously higher than the one reported that the BOE had to back off in its attempts to “sell” a rate cut and the Prime Minister called for anticipated elections.

At this point, I am sure you want to know what’s the real reason behind such an ECB insistence on rate cuts while inflation (in the real world) keeps raging, financial market conditions are the loosest in decades, and the stock bubble remains resilient beyond any wild thought. The answer is, the ECB needs to back up the #FED in the effort to keep the stock market bubble standing until US elections in November.

Think about that, all the Bank of Japan ( #BOJ) did in the past 18 months went completely against the interest of its own country and people. They had a small window of opportunity to slam on the brakes and salvage the situation at the last minute, but instead, they decided to find any possible excuse to justify reckless JPY money printing, knowing a good chunk of that money left its borders to keep inflating asset prices abroad. Yes, the Nikkei managed to print new all-time highs after more than 3 decades in the process, but how many people celebrated that? Few…

Considering the BOE has been forced to back off due to the reason described above, the ECB remains the only Central Bank that can keep the music on even if that goes against the interest of its own people and in particular against its own Mission of preserving the value of the EUR.

If you think that the EUR won’t join the JPY bandwagon and start seeing its value evaporating as soon as the ECB resumes cutting rates, you are a fool. Who is going to benefit from a weaker EUR and a fresh flood of money printing? Not Europe, which is burdened by such an amount of zombie companies and unsustainable national debts and deficits that only an idiot would invest in an economy in such a condition and yet demanding uber inflated prices. Japan? China? Ah, let’s be serious. US? Of course.

However, who is going to pay for the bill of a weaker EUR? European taxpayers through higher taxes to cover ballooning deficits and surely with an even higher inflation rate in the future. Of course.

In 2021, the EUR had its first test run trading below 1 against the USD, and the situation had to be quickly salvaged by the Biden administration starting to drain SPR faster than water evaporates in the desert and export that to Europe to artificially lower oil and gas prices in the continent that was starting to see the white in the eyes of hyperinflation. What about today? Sorry, but it’s payback time, and the EUR now needs to sink to make sure the US bubble doesn’t burst before elections to make sure Biden still holds hope against Trump who, as everyone knows, isn’t even that fond of Europe in particular with regards to its free-riding of the NATO bandwagon.