Last week, the European Central Bank (#ECB) didn’t make a policy mistake. As we discussed in “AFTER JAPAN, NOW IT’S EUROPE’S TURN TO SACRIFICE ITSELF TO KEEP THE US MARKET BUBBLE ALIVE UNTIL THE ELECTIONS”, they simply acted to serve the US Federal Reserve (#FED) interests.

The market now expects the ECB to cut rates at least 2 more times before the end of the year. Unfortunately, traders’ expectations might be right this time. Why?

- Central Banks know that financial markets cannot withstand real liquidity tightening without imploding (especially banks)

- FED, #BOJ have no room whatsoever to cut rates. The BOE has been “politically handcuffed” and other smaller ones already did their part (Bank of Canada and Swiss National Bank cuts, for example)

- The ECB, among all central banks, still has room to loosen monetary conditions because the real #inflation level in Europe isn’t as atrocious as that in the US or Japan.

- The ECB will now be under even more political pressure to deliver a shot of adrenaline to the economy given the electoral catastrophe that just hit Macron and Scholz.

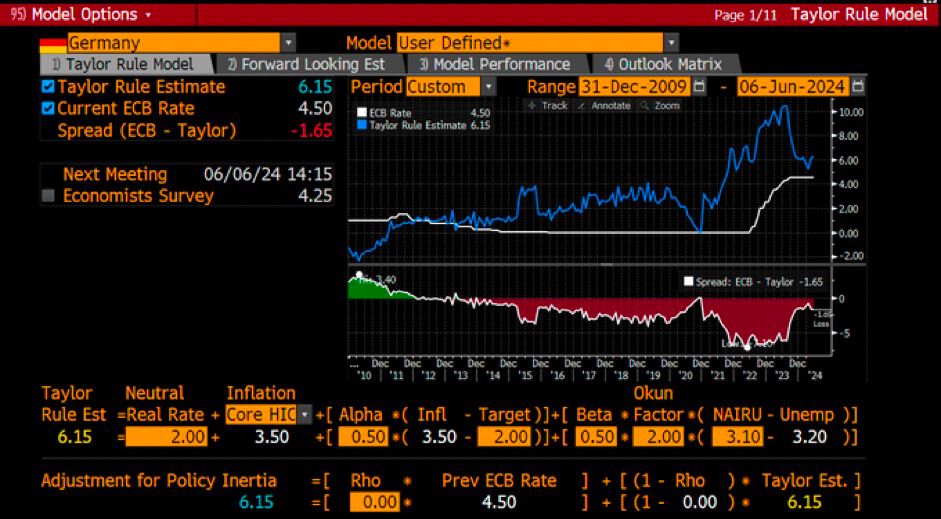

It is now pretty clear that the ECB will continue to cut rates while they should be increasing them instead (to 6.15% according to the Taylor rule). But as a matter of fact, no one cares about the health and stability of economies in the long term anymore. Perhaps if elections were held every 20 years rather than 4-5 years on average, the story would be different.

Alright, now that we have no doubts anymore that the ECB will continue to (illogically) cut rates, let’s see what’s going to happen to the #EUR that currently trades at 1.073 against the #USD.

1 – The ECB has a good chance to succeed in lowering the yields in the short-term part of the curve, but the longer the duration, the lower their grip (by definition), particularly in the absence of a full-fledged QE.

Lower short-term rates will make funding in EUR attractive again, not only for European companies but also for foreign ones, particularly those in the US currently being choked by much higher rates. As a consequence, you should expect foreign companies to issue more debt in EUR and then sell that to refinance other outstanding liabilities mainly in USD. So, the EUR will be sold for USD.

2 – Cutting rates will surely reignite #inflation on the continent, particularly heading towards the winter with the cyclical spike in heating and electricity bills. Higher inflation expectations will put pressure on medium to long-term rates to rise, increasing losses in the books of all those financial institutions that piled up on ultra-long-duration debt during ZIRP years. I expect Japanese insurance companies and pension funds to be the ones feeling the biggest heat here to the point they will be forced to sell at a loss and close their carry trades. The EUR they receive from selling European government bonds will inevitably be dumped in the market since other assets in EUR, like #stocks, aren’t that attractive compared to alternatives listed in other regions.

3 – European citizens on their own will be pushed to seek alternatives to protect the purchasing power of their savings. Do you expect them to keep holding onto EUR and receive miserable returns? Of course not. You cannot imagine how many people I am in touch with in Europe who have asked me this question lately and my answer was always the same: either you diversify in precious metals or look for non-EUR denominated securities. US T-bills do represent an attractive safe haven for them too, objectively.

In the same way, we are seeing so many similarities with the early 2000s years all across markets, the same is happening for the currency space to some degree and at that time, EUR sunk below 0.85.

This is how the situation was described at that time by the Guardian when the EUR was still trading above 1 (like today): “The malaise of the euro against the dollar is a result of unexpected economic decline in Europe, economic strength in the US, and squabbling between politicians and central bankers. Germany’s economy, the largest in Europe, has taken a sudden turn for the worse, and is now shrinking. Overall, the Euroland economy is growing just one seventh as fast as that of the US. At the same time, the credibility of the European Central Bank has been undermined by senior German politicians publicly pressing for rate cuts.” – Full Article Here

History doesn’t repeat, but it rhymes, and in this case, it is rhyming quite loudly considering those words can pretty much fit what is happening today. The stage is being set for the EUR to revisit 0.85 again. When that moment is reached, the ball will be in the FED’s court, and if still at that time they have no room to cut rates, it is fair to expect the EUR to go down to much lower levels, opening the risk of a “Eurotragedy” like the one Ashoka Modi predicted in his famous book published 6 years ago.