Every avalanche always starts with that last small drop of a snowflake that makes the whole pack of snow too heavy to stick on the mountain. Since the #FED and fellow Central Banks joined the BOJ in the great money-printing crusade to “save the world” from COVID-19 in March 2020, the incredible amount of liquidity that, like snow, started to fall on the mountain began to accumulate. However, #inflation started rising in the same way temperature slowly began to increase when the months went by from winter to spring.

The first stocks to melt down were the ones at the bottom of the mountain, like GSX Techedu, one of Archegos’ favorites. The temperature then kept rising, and the next casualty was the Chinese market, in particular Real Estate and Tech Giants (that are more like ants today), and the crypto one. Money printing wasn’t stopping though because Central Banks wanted to extend the Ski Season as long as possible despite the rising temperature that inexorably melted another chunk of the market: US regional banks and Credit Suisse.

Despite BLS and EuroStat agencies’ efforts to convince everyone the inflation temperature had stopped rising, nature was about to claim the first big casualty in October 2023: Japan. However, thanks to Jerome Burns’ (infamous) “phantom pivot”, another big flush of snow was shot towards the mountain, but it could only stick at the top: Mag7 names.

The concentration at the very top of the mountain can be clearly observed in the chart below

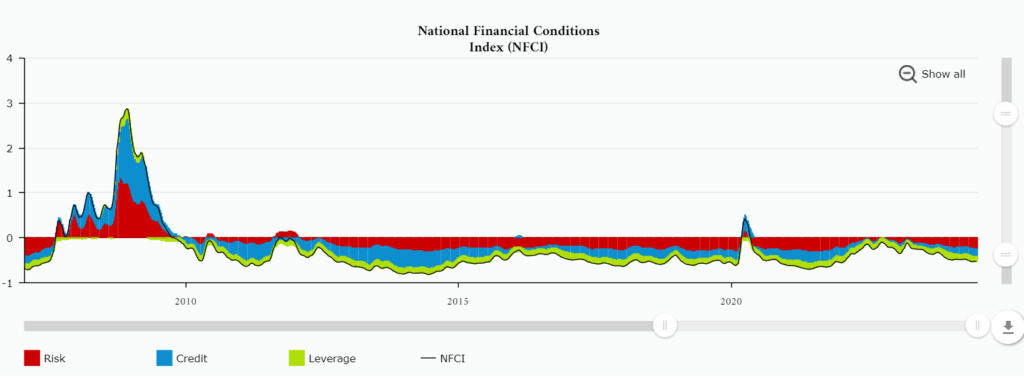

Did Central Banks stop printing liquidity? Of course not, and financial conditions became looser and looser, increasing the inflation temperature in the real economy despite BLS’ relentless effort to convince everyone of the opposite.

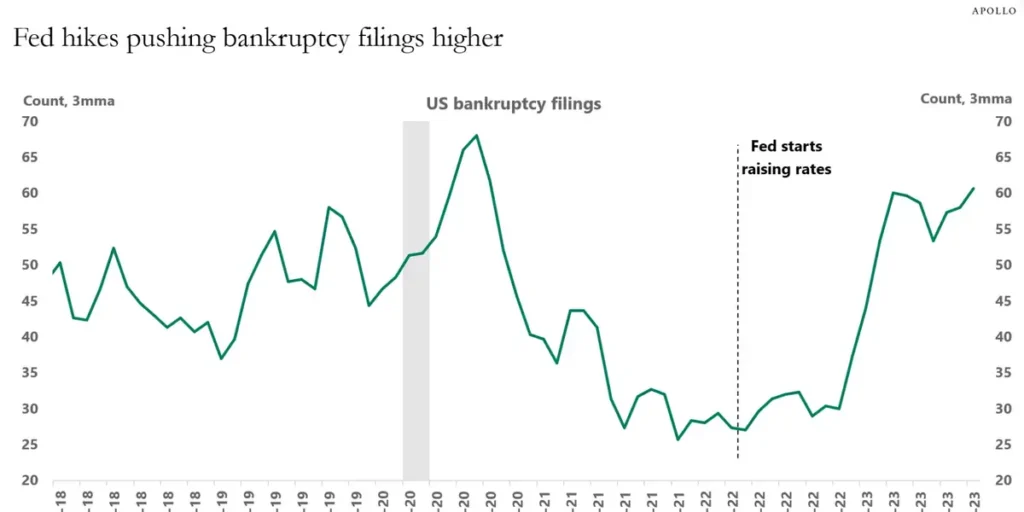

The record number of companies filing for bankruptcy across the globe is the best barometer to gauge the temperature of the overall system.

Fast forward to today, we are starting to see the first moves of the last, but very heavy, Mag7 snowpack sitting at the top of the mountain towards the bottom, with Small cap companies starting to see snow falling over them as a result of the avalanche beginning.

The fact that the last time small cap companies outperformed large caps was in October 1987 should have triggered the avalanche warnings, but those aren’t functioning too well when liquidity keeps covering their sensors.

We all know what happened in 1987; however, that kind of crash will be very difficult to repeat exactly in the same way today, mainly for 2 reasons:

- A circuit breaker system is in place

- The plunge protection team has been constantly on high alert to make sure the illusion of a bull market doesn’t break, revealing the true state of the economy.

Continuing on the same analogy of the avalanche, where do you think all that snow is going to move? Of course, from the top to the bottom of the mountain, with “everything else” that melted till today enjoying one last flush of liquidity.

However, the inflation temperature continues to rise. All that snow that will end up accumulating at the bottom of the mountain is ultimately going to melt down, revealing the true state of the economy. No money printing will be able to fix that since the inflation temperature will be so high that the snowflakes will melt immediately the moment they touch the ground.