Wow, what a great quarter and great 2024 for #Microsoft, every business (except devices) is growing its revenues and the sun couldn’t be brighter on Redmond, yada yada yada, high five high five. This was pretty much the summary of Microsoft earnings call.

Investors’ reaction after earnings release? Microsoft shares dumped 7.62% close to hitting 390$ a share. Why? Azure revenue growth fell 1% short of street expectations. According to the same MSM narrative that describes a world as realistic as Wonderland, then AMD earnings and Microsoft earnings call limited the damage with shares currently pricing around ~410$ in overnight trading.

Alright, now that we circled out the crap, let’s do some proper digging on Microsoft earnings, shall we?

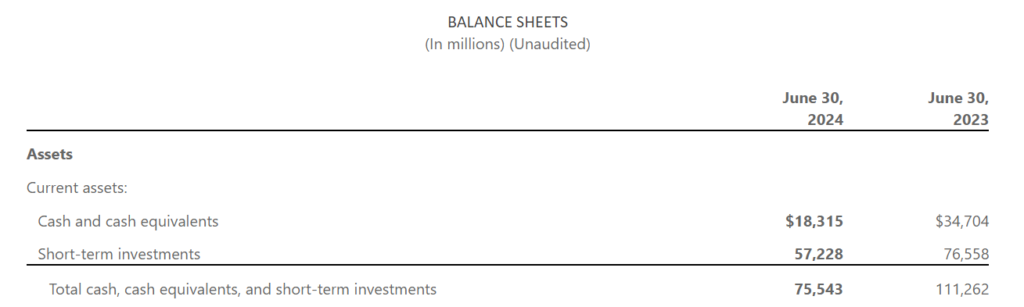

🚩 Microsoft Cash and Equivalents DECREASED ~32% in the past year

How many MSM headlines did you see highlighting this? Haven’t found any so far.

So how did Microsoft plug the 35.7bn$ of missing cash into its balance sheet? Goodwill increased 51.3bn$ in one year. Yes… the good old-fashioned holes fixer “Goodwill”

And how was that cash spent?

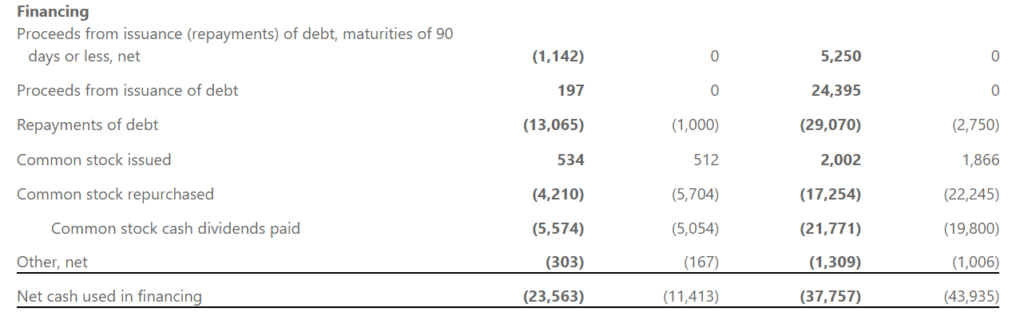

- 17bn$ in Stock buybacks

- 21bn$ in Dividends

Hold on a second, does this mean Microsoft revenue growth didn’t have any impact on cash from its operations? That’s correct.

🚩 Microsoft fake revenues increased ~6bn$ in one year.

No, “fake revenues” isn’t a typo but intentional let me be clear. What the hell am I talking about? “Short-Term unearned revenues” in Microsoft’s balance sheet currently total 57.5 bn$. Yes, Fifty-Seven point five billion.

What’s the definition of “Unearned Revenues”?

Money received by a company for a service or product that has yet to be provided or delivered

Well.. 57.5bn$ is a whole lot of money and it looks like Microsoft spends it as fast as it hits its bank account, doesn’t it? 🤭

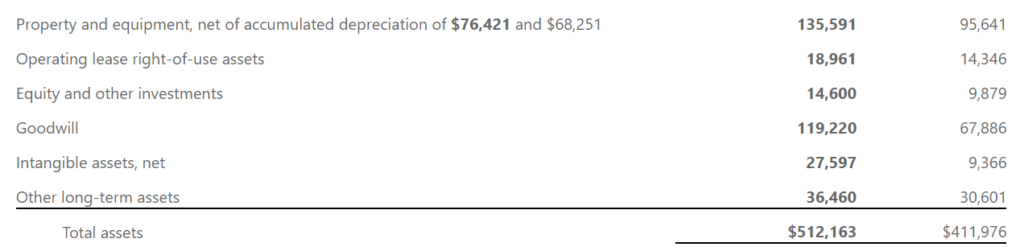

🚩 Microsoft 132bn$ buying spree in the past 12 months? Ahaha

In its latest earnings release, Microsoft claims it spent:

- 44.4bn$ to purchase property and equipment (up from 28bn$ spent the year before)

- 69bn$ in companies acquisitions (up from 1.67bn$ the year before)

- 17.7bn$ in “purchase of investments” (down from 37.7bn$ the year before)

Microsoft’s Net Income for the past 12 months was 118.5bn$ meanwhile the net cash used in financing was negative 38bn$ (the lion’s share is dividends and stock buybacks).

Let’s do some easy math now: 132bn$ – 118.5bn$ + 38bn$ = 58bn$

Waaaait a second, how much did Microsoft Goodwill increase? ~52bn$

What about the increase in “fake revenues”? ~6bn$

Yes, dear readers, 43% of Microsoft’s buying spree was executed without the company paying a penny of cash.

As of the latest earnings, Microsoft’s “Goodwill” totals ~119bn$, and at this point the question is fair: if arguably they didn’t pay cash for it how much is this goodwill really worth? Furthermore, what’s going to be the impact on revenues once the real value surfaces (for example when it will be clear #OpenAI is not worth ~80bn$)? I will leave these questions open for everyone to think about.