16 years have now passed since the GFC, the true last major financial markets crisis. Many people who started working at that time are now 35-40 years old and are at that stage of their lives when they start thinking about accumulating wealth for a comfortable retirement. Those who instead were 35-40 in 2008 are now facing the sunset of their active working career and, mindful of the time taken to recover the losses from the GFC crash, are now staying away from “playing” with the market fire. However, there is a problem for this category, and again it is a feature of every market cycle: while in their mind they feel “safe” investing in some indexed stock or bond funds, that feeling of “safety” makes them underestimate the real market risk embedded in their retirement account portfolios.

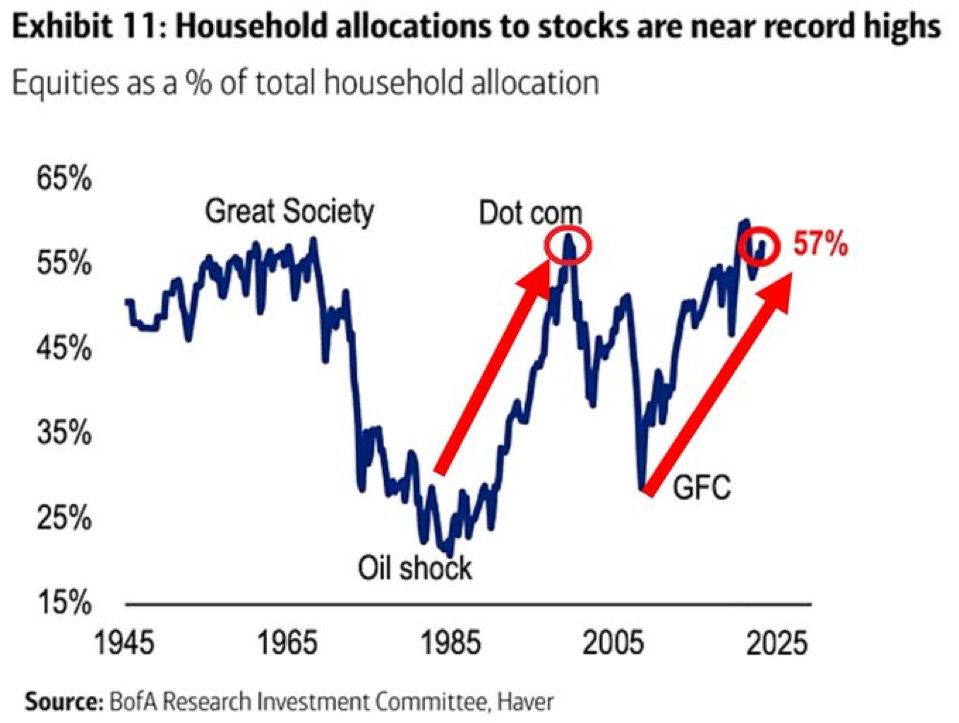

The market was already jittery in 2018 when the FED tried, and failed, to hike rates for the first time, creating a huge repo crisis in late 2019 (“September stress in dollar repo markets: passing or structural?“) that, if it wasn’t for the massive industry bailout delivered under the excuse of Covid, would have certainly resulted in another global financial crisis. Unfortunately, since March 2020, the problems for the global financial system started to compound while everyone thought they were instead being fixed by QE Infinity and extreme government debt monetization to fund “helicopter money” policies. Why was this particularly bad for people? Because those who in 2020 were 30-35 years old at that time built a blind trust in Central Banks’ “superpowers” to always be capable of saving markets, while those who were in their 50s and briefly saw their pensions evaporate built a blind trust in governments to always be ready to intervene to inflate back the value of their retirement accounts. These two combined led people to disproportionately keep their assets allocated to stocks instead of prudently shifting to government bonds even when these offered a better risk premium. Yet another warning sign of the current stage of the bubble along with others harder and harder to ignore (“THE US YIELD CURVE IS SCREAMING “DANGER!” AND ONCE AGAIN NOBODY IS LISTENING”).

The situation I am talking about isn’t only a feature of the US system but extends to other markets like Europe or Japan, even if these in theory have public pension systems in place. Why? Because due to rampant inflation, no one can maintain their lifestyle off a public pension that saw ridiculously low returns as a result of decades of ultra-low yields, the vast majority allocated their excess savings into risky assets.

The cycle between 2000 and 2008 is very misleading and effectively not part of a big economic cycle. Why? Because after the big dotcom crash, no one wanted to hear about stocks anymore, and the crowd flocked into “safe” real estate investments only to end up trapped in yet another financial bubble due to the system becoming hyper-financialized with instruments like CDOs creating fictitious demand on top of the real one already very high. As a matter of fact, major stock indexes like the S&P500 only briefly made new all-time highs in 2008 before crashing again due to banks’ collapse.

If we put all these together, it is not hard to picture that in reality, 2000-2024 was a single big economic cycle that is now approaching its sunset. Think about it, isn’t this something very similar to the years that anticipated the historic 1929 crash? Have a look at the Dow Jones chart (log scale) from that time.

Why did markets crash so hard in 1929? Because everyone, directly or indirectly (through their banks for example), was invested in the market, especially in stocks. Today we can see with the benefit of hindsight how the selling stampede was a disaster waiting to happen, but if you read the news at that time, very few saw it coming and prepared for it. One of the few who did was Joseph Kennedy, who not only was the one who later created the SEC exactly to prevent a 1929 from happening again but also became extremely rich. How did he do that? He sold the stocks when he recognized the mania wasn’t sustainable and then bought them back in the aftermath of the crash when no one wanted to hear about them anymore.

Why do you think those who have lived through many market cycles like Warren Buffett are then stashing as much cash as possible as fast as possible? Exactly because of what I just described. The key to building real wealth is to avoid the sharp drawdowns in markets; as long as you do that, you are assured of becoming incredibly rich. Simple, but yet the opposite of what everyone does every single time, jumping onto the speculative mania of the moment (options trading being the more incredible one of our times).

I will be 36 years old in a few days, and believe me, it wasn’t easy to resist market temptation till now. Yes, I could have made so much more money for myself, but at what risk? Furthermore, wouldn’t it be stupid to spend so much time researching and analyzing things to then fall into the mania trap? I am very bullish on the future in the sense that I am mindful of the fact that if I accumulate cash (~40% of my assets) and safer assets (~40% of my portfolio) now, I will be one of the very few able to cherry-pick stocks and assets at distressed valuations when no one will be willing to hear about them anymore like it happened to our parents and grandparents before us.

Those who don’t learn from history are bound to repeat the same mistakes, and this lesson from history isn’t very difficult to follow, but still, at every cycle, it is easily forgotten. Are we going to see another 1929 again? I truly hope not, believe me, but surely we are going to experience a severe market crash in the near future, and while every time people say things like “if you invested 10,000 USD in this company you would have made tens of millions now,” how many do you really know that did it? Almost no one and the reason is they lost so much money in the crash at every stage (at the beginning or through the bear market rallies in between) to the point they didn’t have much money available to be a buyer when it was time to do so. Personally, I want to be one of those who invested 10,000 USD at the very bottom, maybe the only chance in my lifetime, and I hope you dear reader will be one as well.