On October 30 2023, after the latest $HSBC financial report release, I took a deep dive into their numbers, highlighting how the bank was still “walking on waters” (Post below). Prior to that, I highlighted many things within their balance sheet that simply didn’t add up (TwitterX). Nevertheless, the stock continued its awkward uptrend even after this big news hit the tape: “$HSBC TOLD TO “BRACE” FOR 6.3bn£ LOSS” (TwitterX).

I had to look through this whole inconsistency, and below is what I found so far.

$HSBC’s bull run started on October 25, 2022, and it only had a small “blip” in Q1-23 when the banking system needed another #FED bailout.

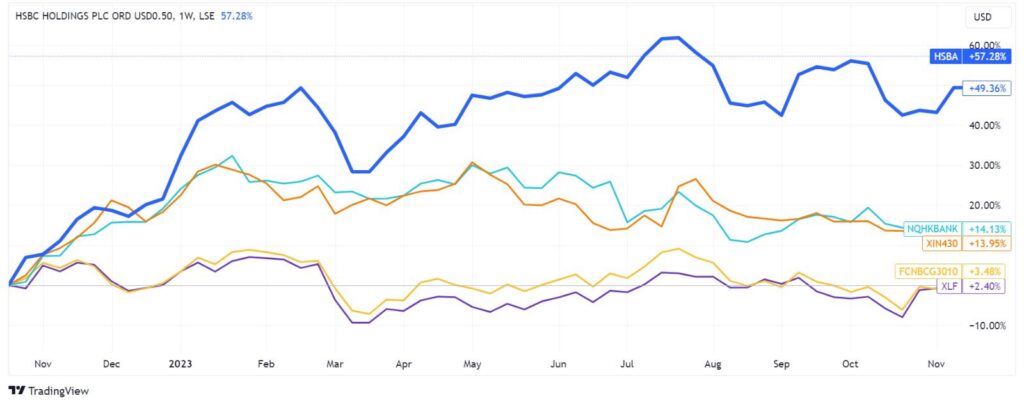

As you can see from Chart 1, starting from Oct 22, not only has $HSBC been outperforming the #HongKong $HSI and #China $CSI by a huge margin (despite 55% of the revenues and 70% of its profits coming from these 2 markets), but it has even outperformed both Asia and Western banking indexes big time too (Chart 2).

Did $HSBC blow out market expectations spectacularly on October 25, 2022? Quite the opposite, in fact that Tuesday the stock opened down 6% mostly for 3 reasons:

- $HSBC’s slump in profits to 3.1bn$ down from 5.4bn$ one year prior blamed on the sale of the HSBC French Unit

- $HSBC booking an “unexpected” 1.1bn$ provision for credit losses mainly on its China loans

- A leadership shake-up with Ewen Stevenson (famous for its heavy hand of cost-cutting) being replaced by Georges Elhedery as CFO

Even if on October 25th, the management categorically refused any call from its major shareholder, Ping An Insurance (with 8%), to spin-off $HSBC’s Asia business to release 35bn$ of value (according to them), they still reassured they would have refocused on their Asia main and only high-growth market despite all the troubles of the China real estate sector. Fast forward 1 year, the only thing $HSBC seems to be focusing on for real is still trimming down its balance sheet by selling underperforming units, with the latest being the sale of the Canadian unit (TwitterX).

It will be interesting to see whether they will book any extraordinary loss against this latest sale, and if yes, how much. $HSBC Q4-23 results are due on the 20th of February.

Despite being the major single shareholder, so far $HSBC hasn’t accommodated any of Ping A’s requests, and the difference in performance between the 2 companies is striking since Covid-19 bottom. The first one is up 43%, while the second is down 44% to the point Ping An is now worth less than $HSBC (Chart 3).

In December 2022, $HSBC firmly denied Beijing was behind Ping An’s request to break up the bank’s business by separating its Asian unit. This rang a bell in my head. What if this relentless bid underneath $HSBC #stocks is the result of Ping An secretly accumulating shares in a similar way Porsche did with $VW using derivatives in 2008?

Back to the title of this post, we can clearly rule out that behind this $HSBC great performance, there is a remarkable business turnaround story. In all fairness, the opposite is happening.

What about a secretly orchestrated takeover by Ping An? If Tom Cruise was Ping A chairman, perhaps this Mission Impossible would have had chances to succeed. However, being $HSBC (legally speaking) a UK bank, I see zero chances the FCA approves such a takeover. The last option on the table is a wisely orchestrated stock squeeze (perhaps by the new CFO in charge since October 2022), but if this is the case, the reality is going to catch up with the bank sooner or later when the mountain of loan losses in their books will be hard to hide (perhaps after Evergrande will be officially declared bankrupt on January 29) and this great pump will be followed by a spectacular dump.